RMD trade ideas

RMD consolidating to a pivot point on low volumeThere are a few things going on here that I think make RMD a breakout candidate.

The stock is trading above its' 50 day moving average and around the 20 day moving average. A breakout should pull it well above the 20 day.

The correction here was shallow, maybe even a bit too shallow at 8.7%. The base is also shallow and has just two tiers. The first tier narrows the price action to a range of $5.41 ($2.5% of the high of the tier). The next tier widens the price action a bit to 3%.

It may consolidate a bit more before it breaks out but its' currently trading in a very narrow range with volume below the 50 day average. Today the volume has fallen even further. As I write this it's below 50% of the 50 day average and there's just over an hour of trading left in the day.

If this breaks to the upside I'll need to see solid volume coming along with it. I see some evidence of institutional accumulation

but not a heck of a lot.

If I do take a position I'll go in for 25% of a full position and see how it performs.

ResMed (RMD): ASX down more than 4%ResMed (RMD): ASX down more than 4%

Share prices have taken a massive fall and now approaching 78.60 Fibonacci retracement level, which is around 24.59/23.80, a critical point that could see prices bounce back and head back up. The ideal buying situation is to wait for prices to get back into the price channel at 25.88.

My automated support and resistance indicator generated the support and resistance level on the chart, highlighting past, current, and predicting future levels.

The Indicator will be released to the public soon, let me know if you want to be the first lot to get your hand on this brilliant Indicator.

Stock to watch and potential Buy setup in $RMD Resmed. Resmed looking good using the Heikin Ashi candles.

Technical Indicators such as TD Sequential, MACD, RSI, and the Squeeze are showing positive signals for further upside and potential breakout.

Why?

The pulse signal (red dots) on the squeeze indicator is telling us a big move is coming. While the MACD indicator is about to cross and provide a buy signal.

If we do go down, the two moving averages (20 and 50) will likely act as support.

I have added this stock to my watchlist.

Long RMD ( ASX) - Turtle Soup plus one

This is a variation of ' Turtle Soup' strategy by Larry Connors, from the book' Street Smarts'

The difference is entering one day after signal in direction of anticipated trade instead of the same day.

See notes on Linked idea ' Short WPL' which already booked a profit as a day trade.

RMD..... 176 and up?I have been eagerly watching this one.

ResMed develops, manufactures, distributes, and markets medical devices and cloud-based software solutions that diagnose, treat, and manage respiratory disorders comprising sleep disordered breathing, chronic obstructive pulmonary disease, neuromuscular disease, and other chronic diseases. The company operates through two segments, Sleep and Respiratory Care, and Software as a Service (SaaS).

Considering that respiratory is currently a MASSIVE issue, I believe there is a lot of LONG-TERM benefit to be taken from this. UNFORTUNATELY, it will be on the back of individuals who are currently coming off the ICU respirators related to COVID. Definitely a long-term play, as well as good for some nice quick pops (lows 3.16 $116; highs 2/10 $176)

I am loving this thing for its beautiful trend line, and the fact that currently the company is performing very well relative to S&P and DOW.

Look for previous resistance at 173 and 176 for breakouts.

Good luck.

Buy RESMED [NYSE: $RMD] | 5.8.2020 | Eric ChoeMy name is Eric Choe.

I am a professional trader with over 7 years of equities and cryptocurrency experience.

I've worked at an energy trading company, a Fortune 500 company, and one of the top management consulting firms in the world.

I left my high-paying salary as a management consultant in early 2018 for a career in investing and trading.

I've been a full-time equities trader ever since.

I give detailed analysis on TradingView.

Over the past 7 years, I've dedicated my time and effort to helping others learn about the financial markets.

All my ideas are for education purposes. There is a high-degree of risks involving leverage trading. Trade at your own risk. This is not financial advice

ResMed Mian supplier of Respiratory Equipment

Company profile

ResMed, Inc. engages in the development, manufacturing, distribution, and marketing of medical equipment and software solutions. The company operates through the following segments: Sleep and Respiratory Care, and SaaS. The Sleep and Respiratory Care segment engages in the sleep and respiratory disorders sector of the medical device industry. The SaaS segment engages in the supply of business management software as a service to out-of-hospital health providers. Its product portfolio includes devices, diagnostic products, mask systems, headgear and other accessories, and dental devices. The company was founded by Peter C. Farrell in June 1989 and is headquartered in San Diego, CA.

ResMed Inc top Respiratory supplier. ResMed, Inc. engages in the development, manufacturing, distribution, and marketing of medical equipment and software solutions. The company operates through the following segments: Sleep and Respiratory Care, and SaaS. The Sleep and Respiratory Care segment engages in the sleep and respiratory disorders sector of the medical device industry. The SaaS segment engages in the supply of business management software as a service to out-of-hospital health providers. Its product portfolio includes devices, diagnostic products, mask systems, headgear and other accessories, and dental devices. The company was founded by Peter C. Farrell in June 1989 and is headquartered in San Diego, CA.

BE REALLY CAREFUL, RALLIES WILL LIKELY BE SOLD.

BEST ADVICE IS TO RELAX AND WAIT FOR THIS EXTREME VOLATILITY TO PASS, VERY SMART AND

EXPERIENCED TRADERS HAVE BEEN STRUGGLING.

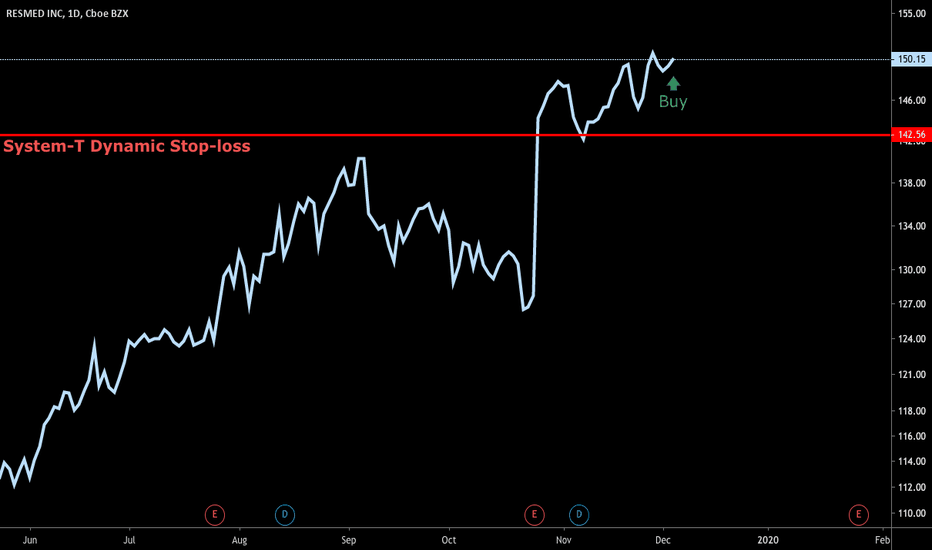

RMDSystem T Performances: Annual Compound Profit 40%, Win Rate 55%, Risk/Reward Ratio 1:2, 20 Years of Backtesting Data, Over 100 Markets.

* Click Like and Follow to Support My Work!

---

Hi Traders,

I'd like to introduce the System T, a computerized trading system that analyzed and backtested the 20 years history data of over 100 markets.

This post is my sharing of how I think about systematic trading and the signals generated by the System T.

(This is my opinion only, NOT the financial advice.)

I think that for the system to open a trade and manage risk, it only needs a buy signal & a stop-loss signal clearly on the chart.

Once the system finds a good trend, it will ride it as long as possible. The stop-loss will be adjusted accordingly to the new price movement.

(Remember to follow this trade idea and follow my profile to get updates about the stop-loss adjustment and sell signal based on the latest price and market conditions daily.)

System T performances above will give you an idea of how it performs in the last 20 years.

Notice that this result was achieved only if I strictly followed the rule: "Only and Always Buy & Sell based on the System Signals".

Don't sell when there is no sell signal as we all want to follow the good trends til the end like everything in life does. \(^-^)/

Also, my system is extremely diversified through over 100 markets so that it only risks less than -1% of the total capital per trade.

Thank you and good luck!

---

DISCLAIMER:

I am NOT a financial advisor, and nothing I say is meant to be a recommendation to buy or sell any financial instrument.

My views are general in nature and I am not giving financial advice. You should not take my opinion as financial advice. This is my opinion only.

Do your own due diligence, and take 100% responsibility for your financial decisions.

Trading and investing are risky! Don't invest money you can't afford to lose, because many traders and investors lose money. There are no guarantees or certainties in trading.

- Content is for education purposes only, not investment advice.

- Trading involves a high degree of risk.

- We’re not investment or trading advisers.

- Nothing we say is a recommendation to buy or sell anything.

- There are no guarantees or certainties in trading.

- Many traders lose money. Don’t trade with money you can’t afford to lose.

ResMed keeps rolling higher.COMPANY PROFILE

ResMed, Inc. engages in the development, manufacturing, distribution, and marketing of medical equipment and software solutions. The company operates through the following segments: Sleep and Respiratory Care, and SaaS. The Sleep and Respiratory Care segment engages in the sleep and respiratory disorders sector of the medical device industry. The SaaS segment engages in the supply of business management software as a service to out-of-hospital health providers. Its product portfolio includes devices, diagnostic products, mask systems, headgear and other accessories, and dental devices. The company was founded by Peter C. Farrell in June 1989 and is headquartered in San Diego, CA.