Seadrill (SDRL) AnalysisCompany Overview:

Seadrill provides offshore contract drilling services for the oil and natural gas industry. The company achieved a record day rate of $545,000 for a one-well contract in Q1 2024, the highest in the current cycle, significantly boosting its Q2 earnings outlook.

Key Highlights:

CEO Simon Johnson: Emphasized a strong start to the year with safe, efficient operations, high day rates, and capital returns to shareholders.

Competitive Fleet: Seadrill's fleet and strong balance sheet are expected to sustain durable earnings and capital returns as the cycle progresses.

Order Backlog: Approximately $2.8 billion, including $108 million in new contracts since February.

New Contracts: $32 million contract in South Korea for the drillship West Capella and an $86 million six-month extension in the U.S. Gulf of Mexico for the drillship West Neptune.

Investment Outlook:

Bullish Outlook: We are bullish on NYSE:SDRL above the $47.00-$48.00 range.

Upside Potential: With an upside target set at $78.00-$80.00, investors should consider Seadrill's strong performance, high day rates, and substantial order backlog as key drivers for potential stock appreciation.

📈🌊 Monitor Seadrill for promising investment opportunities! #SDRL #OffshoreDrilling 🛢️🚀

SDRL trade ideas

SDRL an oil services and support company LONGSDRL is a Scandavania / UK-based company supporting offshore oil drilling projects. On the

daily chart I have drawn a green support trendline and a red resistance trendline from the

higher weekly timeframe. Fundamentally- it has had two consecutive earnings beats. Per

Tradingview, the average analyst has a price of $45 as a target and technically it rates

Strong Buy. On the chart, SDRL is sitting at the confluence of convergence of moving averages

with the POC line of the volume profile and inside a symmetrical triangle which could

be considered as demonstrative of consolidation and volatility compression and sometimes

called a Bollinger Band squeeze.

I will take this long trade targeting the line just below the supply zone of the Luxalgo indicator

and setting a stop loss at the bottom of the high-volume area also marked on the chart

SDRL could be a takeover target with the buyer being any number of Big Oil companies

Should such occur share prices would escalate far beyond any current expectations.

$SDRL Seadrill found key support Seadrill Ltd. engages in the provision of offshore drilling services to the oil and gas industry. It operates through the following segments: Floaters, Jack-up rigs, and Other. The Floaters segment encompasses drilling, completion, and maintenance of offshore exploration and production wells. the Jack-up Rigs segment includes drilling contracts relate to jack-up rigs for operations in harsh and benign environments in shallow water. The Other segment represents management services to third parties and related parties. The company was founded on May 10, 2005 and is headquartered in Hamilton, Bermuda.

$SDRL BULLISH TREND BREAK FOR SEADRILL Seadrill Ltd. is an offshore drilling contractor providing offshore drilling services to the oil and gas industry. Its primary business is the ownership and operation of drillships, semi-submersible rigs, jack-up rigs, tender rigs for operations in shallow, mid, deep, and ultra deep-water areas, and in benign and harsh environments. It operates through the following segments: Floaters, Jack-up Rigs, and Tender Rigs. The Floaters segment offer services encompassing drilling, completion, and maintenance of offshore exploration and production wells. The Jack-up Rigs segment offers drilling services, completion and maintenance of offshore exploration and production wells. The drilling contracts relate to jack-up rigs for operations in harsh and benign environments. The Tender Rigs segment operates self-erecting tender barges and semi-submersible tender rigs, which are used for production drilling and well maintenance in Southeast Asia and West Africa. The company was founded on May 10, 2005 and is headquartered in Hamilton, Bermuda.

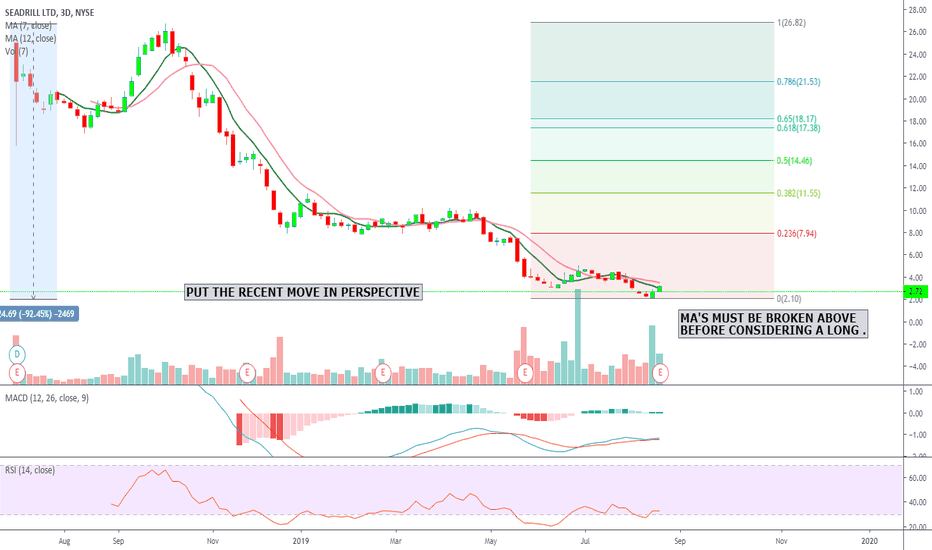

$SDRL Seadrill not in buy zone yet. Recent moves in Seadrill should not be taken with to much optimism, any recovery has a long way to go, so need to be jumping in it yet. We await a cross on the 3day and 1 week 7&12ma's to confirm a bias on the long side in confluence with sustained volume.

EARNINGS CALL TRANSCRIPT

The improvements in forward pricing and utilization are leading indicators that the recovery is progressing, and we expect that floater fixtures made in 2018 mark the low point in this cycle. Similarly, we see improving trends in the premium jack-up market with marketed utilization above 80% and rates trending toward $80,000 to $100,000 per day range, driven by increased activity in the Middle East. There remains a significant bifurcation between premium and standard jack-up units, and we expect a preference for premium units to continue and result in further attrition of standard jack-up.

During the second quarter, we added approximately $160 million in backlog related to the following contracts. In Angola, we extended the West Gemini, keeping her busy into August. Following this extension, she will undertake her SPF before returning to Angola in Q4 to perform nine well contract with three options. Total contract value for the firm portion of this contract is approximately $84 million. We have a great track record of operating in Angola and hope to expand our operational footprint here through our Sonadrill JV. Equinor exercised three options in the West Hercules in Norway keeping her busy through Q1 2020. Following the options Equinor have access to the West Hercules through a continuous optionality mechanism, which could keep her busy through 2020.

SDRL-Take ProfitsFor those that followed me in SDRL. Close final positions and take profits at gains of greater than 100%. Prepare to rentry at .20-.24 and hold for a long term gain.

You can also short with puts to (.50 puts)

This is a good trade to follow and for review read my prior to analysis for long term positions. This is better than crypto because it is oil, oil, oil with a top ten company in the sector.

Sea DrillSea Drill is in final stages of a restructure. Its one of the worlds largest drillers and has 13 new units under construction right now with another 5 units available for offshore operations now.

What do you think????? Buy or not to buy?

Hmmm....this will be interesting to learn the opinions of others!

Get deep on this!!!!!

Sea Drill (SDRL)-Long TermThis chart represents one of the top 10 Ocean Oil Drillers in the world. They are in bankruptcy and preparing final plans for the reorg.

This play reminds me of Delta after the 9-11 attack and their bankruptcy reorg.

This is a pure speculation play with a potential for a great reward.

t1 is 29.50 for as long as it takes.

My plan is to acquire 1500 shares prompt for a long term hold. (hodl)

SDRL # Price marked up from previous low breakdown failure(less volume are interested to the breakdown).

# Mark up is supported by volume spike showing interest.

# RSI higher high. MACD lines up below 0, histogram converge.

# News: Restructuring plan.

Condition:

1. If price gaps up high at pre-market or market open, I will cancel the orders and wait for a gap up pullback on 1min/5min timeframe with good R:R ratio to get in again.

2. If my entry is triggered with weakness or potential trapped, I will watch the move for the next 30min and get out of the trade if strong selling occurs. Hold the S1 position if weak selling follows through.

3. If no sign of strength and weakness on both sides, my order will remain.

4. If further weak selling is coming, I will find a better LWP for entry.

5. If strong selling follows, orders will be cancelled and reassessment is needed.

SDRLI HAVE BEEN HONESTLY CALLING THIS COMPANY FOR AVAILIBLE JOBS TO SEE WHATS GOING ON . BECAUSE IF THEY ARE HIRING IT'S SOMETHING. LAST WEEK THEY ANNOUNCED THAT THEY HAVE A PLAN TO FIX EVERYTHING THEY WILL NEVER LET THIS COMPANY GO EASILY BECAUSE IT'S WORTH ALOT THOSE MACHINES ARE VERY EXPENSIVE THIS IS A BASIC THOUGHT WHICH I BELEIVE OTHER THAN THIS STOCK YOU WOULDNT BE ABLE TO MAKE MILLIONS WITH ONLY 10 GRAND THANKS!!!! BUY 1000$ WORTH SHARE AND WAIT ONE DAY IT COULD BE 20 GRAND

9.1.17 | SDRL | Possible Short on this Penny StockSDRL

(Code-Name_Virtue)

I am sorry Folks I do not have any more time today to narrate this analysis. If you are having difficulty tracking along please send me a P.M. or better yet leave a comment so that it may help others who may have a similar disposition.

(Keymaker)

Speculation may be seen in the Short Position drawing on the chart. A 1:2 Risk:Reward.

SDRL - Fallen angel pattern long from $0.55 up to $0.87SDRL forming a very nice fallen angel pattern with moneyflow divergence. It has broken out the moving averages with huge volume.

We think it has good upside potential from here.

* Trade Criteria *

Date First Found- July 25, 2017

Pattern/Why- Fallen angel pattern

Entry Target Criteria- Break of $0.55

Exit Target Criteria- 1st Target $0.64, 2nd Target $0.87

Stop Loss Criteria- $0.48

Please check back for Trade updates. (Note: Trade update is little delayed here.)

Option PlayI like this level going into earnings on SDRL.. We bounced pretty hard at this level in the past and this stock can't go much lower. I'm playing the March 17th calls but you can do the weekly's also. You can buy the stocks but you have to be aware of the gap down. With options you can just buy your risk level.

CoCo indicators day trading example (SDRL)Click on the 1 minute chart below in the comments!.

During a big run down, CoCoBars nibbled a couple times around 10:10.

Around 10:40 is when it hits on all cylinders, you got CoCoVol showing a large jump in independent volume, CoCoBars showing dark green independent price moves up and the CoCo Trend colors at the bottom turning from red to green.

At 11:26 is when selling pressure returns with the three increasingly red CoCoBars. This run would have taken in around +9%.

Keep in mind what the CoCo indicators do... they ISOLATE & IDENTIFY price and volume changes independent from the market.

Good trading!

Brian Hershey