Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.77 USD

−90.37 M USD

676.83 M USD

102.17 M

About Sweetgreen, Inc.

Sector

Industry

CEO

Jonathan Neman

Website

Headquarters

Los Angeles

Founded

2006

FIGI

BBG005NTTSP9

Sweetgreen, Inc. owns and operates a chain of salad restaurants. It offers drinks, sides, local bowls, salads, plates, and warm bowls. The company was founded by Nicolas Jammet, Jonathan Neman, and Nathaniel E. Ru in November 2006 and is headquartered in Los Angeles, CA.

Related stocks

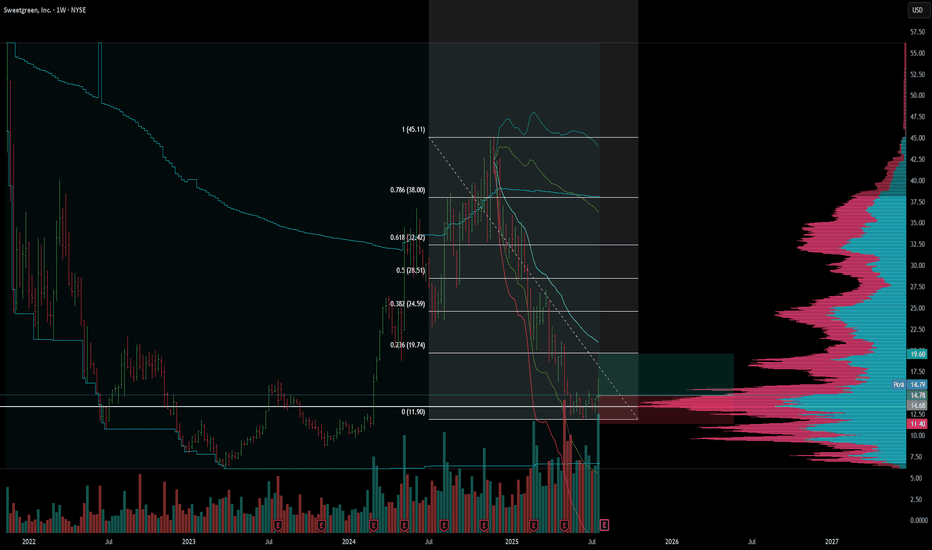

SG Approaching a Potential Trend ShiftPotential trend flip on the SweetGreen Chart for the first time since December 2024. I use a default doubled cloud on the daily timeframe 18/52/104/26. I find this to be superior to the default cloud on both backtesting and forward testing over the past decade on any chart.

Ideal bullish entry con

From Greens to GreenbacksSweetgreen (NYSE: SG) recently gapped up after clearing the $13 level, showing renewed momentum and strong market interest . Technical setup points to a key breakout above $16.58, paving the way toward the $27.15 resistance—a setup offering a solid risk‑reward profile with a stop‑loss at $2.78.

Wal

SG – Bearish Setup in PlaySG – Bearish Setup in Play

Took a bearish position on SG, targeting $10.00 by next monthly expiration. Pattern looks heavy — lower highs, weak bounces, and no real support until the $10 zone.

🔹 Position: Put option

🔹 Expiration: Monthly

🔹 Risk: Max loss

🔹 Target: $10.00

No need to overthink this

$SG - LONGNYSE:SG is approaching a key monthly control level following a sharp decline. I’ve started a front-side entry and plan to scale in further if price moves lower toward the back-side level.

Entries & Targets:

**First Entry: $13

Target 1 (T1): Daily supply zone around $15

Target 2 (T2): ~$16.50

Tar

SG – 1H Short Trade Setup!📌

🔹 Asset: Sweetgreen, Inc. (SG)

🔹 Timeframe: 1-Hour Chart

🔹 Setup Type: Descending Trendline & Bearish Breakdown Short Trade

📌 Trade Plan (Short Position)

✅ Entry Zone: Below $21.83 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $23.13 (Break of Resistance & Trendline)

🎯 Take Profit Targets

📌

Sweetgreen, Inc. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sweetgreen, Inc.

- Support & Resistance | Wedge Structure

- Double Top | Target Invalid

- Wave 1 | 12345 | Support Long Set Up

Active Sessions On Relevant Range & Elemented Probabil

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where SG is featured.

Frequently Asked Questions

The current price of SG is 11.93 USD — it has decreased by −7.38% in the past 24 hours. Watch Sweetgreen, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Sweetgreen, Inc. stocks are traded under the ticker SG.

SG stock has fallen by −18.23% compared to the previous week, the month change is a −19.55% fall, over the last year Sweetgreen, Inc. has showed a −57.53% decrease.

We've gathered analysts' opinions on Sweetgreen, Inc. future price: according to them, SG price has a max estimate of 29.00 USD and a min estimate of 15.00 USD. Watch SG chart and read a more detailed Sweetgreen, Inc. stock forecast: see what analysts think of Sweetgreen, Inc. and suggest that you do with its stocks.

SG stock is 8.78% volatile and has beta coefficient of 1.82. Track Sweetgreen, Inc. stock price on the chart and check out the list of the most volatile stocks — is Sweetgreen, Inc. there?

Today Sweetgreen, Inc. has the market capitalization of 1.52 B, it has decreased by −4.67% over the last week.

Yes, you can track Sweetgreen, Inc. financials in yearly and quarterly reports right on TradingView.

Sweetgreen, Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

SG earnings for the last quarter are −0.21 USD per share, whereas the estimation was −0.20 USD resulting in a −3.43% surprise. The estimated earnings for the next quarter are −0.10 USD per share. See more details about Sweetgreen, Inc. earnings.

Sweetgreen, Inc. revenue for the last quarter amounts to 166.30 M USD, despite the estimated figure of 165.09 M USD. In the next quarter, revenue is expected to reach 191.73 M USD.

SG net income for the last quarter is −25.04 M USD, while the quarter before that showed −29.03 M USD of net income which accounts for 13.75% change. Track more Sweetgreen, Inc. financial stats to get the full picture.

No, SG doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 1, 2025, the company has 6.41 K employees. See our rating of the largest employees — is Sweetgreen, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Sweetgreen, Inc. EBITDA is −17.32 M USD, and current EBITDA margin is −2.51%. See more stats in Sweetgreen, Inc. financial statements.

Like other stocks, SG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Sweetgreen, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Sweetgreen, Inc. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Sweetgreen, Inc. stock shows the sell signal. See more of Sweetgreen, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.