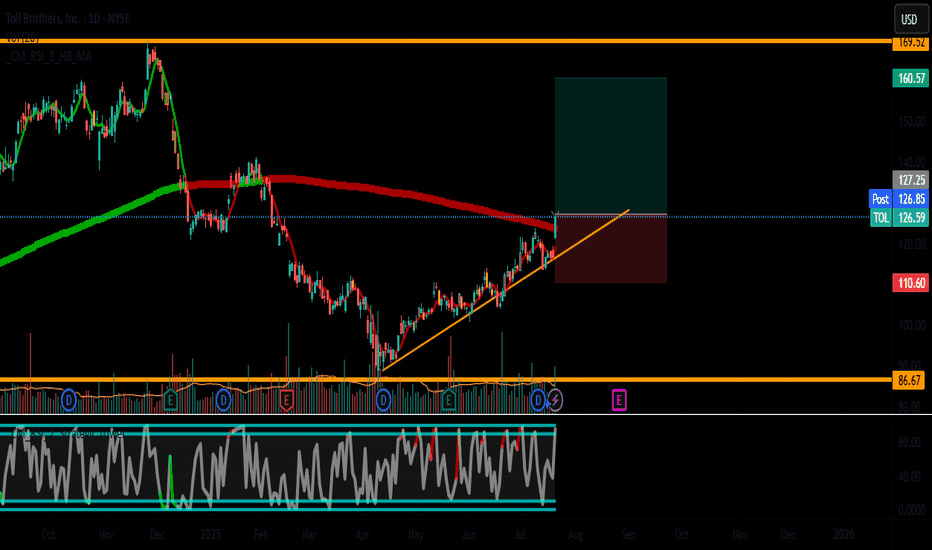

TOL (Toll Brothers) – Bullish Continuation Play🚀 Trade Idea: TOL (Toll Brothers) – Bullish Continuation Play

Entry: $127 | Stop Loss: $110.60 | Take Profit: $160.57

Risk/Reward Ratio: ~1:3

📈 Technical Setup

Trend:

Daily: Strong uptrend, higher highs & higher lows.

4H/1H: Bullish momentum with SMA(20) > SMA(50).

Key Levels:

Support: $121 (r

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.60 USD

1.57 B USD

10.85 B USD

97.50 M

About Toll Brothers, Inc.

Sector

Industry

CEO

Douglas C. Yearley

Website

Headquarters

Fort Washington

Founded

1967

FIGI

BBG000BVHBM1

Toll Brothers, Inc. engages in the design, building, marketing, and arranging of financing for detached and attached homes in residential communities. It operates through the following geographical segments: North Region, Mid-Atlantic Region, South Region, Mountain Region, and Pacific Region. The company was founded by Robert I. Toll, and Bruce E. Toll in May 1967 and is headquartered in Fort Washington, PA.

Related stocks

Trading Analysis for Toll Brothers**Current Price:** $101.06

**Direction:** **LONG**

**LONG Targets:**

- **T1 = $103.25**

- **T2 = $106.10**

**Stop Levels:**

- **S1 = $99.00**

- **S2 = $97.50**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and

TOL (Toll Brothers, Inc.) TA & Trade Idea

Short-term Outlook (1–4 Weeks):

• Analysis: Oversold stochastic oscillator showing bullish crossover potential. Price approaching strong historical support near $90–$95. Candlesticks indicate seller exhaustion.

• Trade Direction: Long

• Confidence Score : 75% (Bullish reversal likely)

Medium

Has the TOL been paid?As trading view states, Toll Brothers, Inc. engages in the design, building, marketing, and arranging of financing for detached and attached homes in residential communities. The technicals are neutral and the analysis's naively have given this company a buy rating.

However, among the real estate c

TOLL Brothers #TOL new high vs US single family home priceHomemakers are making money over fist.

Does this confirm that the housing bull market will continue.

It seems like it doesn't it

This ratio highlights the housing bottom in the 90's

this Ratio also topped out in 2005 before the housing bubble popped

#Roaring20's

TOLToll Brothers is a company which designs, builds, markets, sells, and arranges financing for residential and commercial properties in the United States. In 2020, the company was the fifth largest home builder in the United States, based on homebuilding revenue. The company is ranked 411th on the For

Toll Brothers Inc. ($TOL) AnalysisSector: Consumer Cyclical - Residential Construction | Country: USA

Company Overview:

Toll Brothers Inc., a key player in the consumer cyclical sector, specifically residential construction, holds a significant position in shaping the real estate landscape in the United States. Known for its inn

High Mortgage Rates Taking a Toll in the Housing MarketComments on Quantitative Analysis Sector Comparison

Homebuilder sentiment dropped to a five-month low in September as higher rates push prospective buyers out of the market

Revenues from land sales are little.

Comments on Business

Continuous hike in interest rates and high-cost environ

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TOL6094657

Toll Brothers Finance Corp. 5.6% 15-JUN-2035Yield to maturity

5.40%

Maturity date

Jun 15, 2035

TOL4464594

Toll Brothers Finance Corp. 4.875% 15-MAR-2027Yield to maturity

4.50%

Maturity date

Mar 15, 2027

TOL4587598

Toll Brothers Finance Corp. 4.35% 15-FEB-2028Yield to maturity

4.49%

Maturity date

Feb 15, 2028

TOL4882307

Toll Brothers Finance Corp. 3.8% 01-NOV-2029Yield to maturity

4.46%

Maturity date

Nov 1, 2029

See all TOL bonds

Frequently Asked Questions

The current price of TOL is 121.91 USD — it has increased by 3.00% in the past 24 hours. Watch Toll Brothers, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Toll Brothers, Inc. stocks are traded under the ticker TOL.

TOL stock has fallen by −1.12% compared to the previous week, the month change is a 2.70% rise, over the last year Toll Brothers, Inc. has showed a −15.31% decrease.

We've gathered analysts' opinions on Toll Brothers, Inc. future price: according to them, TOL price has a max estimate of 183.00 USD and a min estimate of 92.00 USD. Watch TOL chart and read a more detailed Toll Brothers, Inc. stock forecast: see what analysts think of Toll Brothers, Inc. and suggest that you do with its stocks.

TOL stock is 4.10% volatile and has beta coefficient of 0.98. Track Toll Brothers, Inc. stock price on the chart and check out the list of the most volatile stocks — is Toll Brothers, Inc. there?

Today Toll Brothers, Inc. has the market capitalization of 11.97 B, it has decreased by −4.80% over the last week.

Yes, you can track Toll Brothers, Inc. financials in yearly and quarterly reports right on TradingView.

Toll Brothers, Inc. is going to release the next earnings report on Aug 26, 2025. Keep track of upcoming events with our Earnings Calendar.

TOL earnings for the last quarter are 3.50 USD per share, whereas the estimation was 2.81 USD resulting in a 24.44% surprise. The estimated earnings for the next quarter are 3.60 USD per share. See more details about Toll Brothers, Inc. earnings.

Toll Brothers, Inc. revenue for the last quarter amounts to 2.74 B USD, despite the estimated figure of 2.48 B USD. In the next quarter, revenue is expected to reach 2.85 B USD.

TOL net income for the last quarter is 352.45 M USD, while the quarter before that showed 177.70 M USD of net income which accounts for 98.33% change. Track more Toll Brothers, Inc. financial stats to get the full picture.

Yes, TOL dividends are paid quarterly. The last dividend per share was 0.25 USD. As of today, Dividend Yield (TTM)% is 0.79%. Tracking Toll Brothers, Inc. dividends might help you take more informed decisions.

Toll Brothers, Inc. dividend yield was 0.61% in 2024, and payout ratio reached 6.00%. The year before the numbers were 1.17% and 6.72% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 4.9 K employees. See our rating of the largest employees — is Toll Brothers, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Toll Brothers, Inc. EBITDA is 1.88 B USD, and current EBITDA margin is 19.46%. See more stats in Toll Brothers, Inc. financial statements.

Like other stocks, TOL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Toll Brothers, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Toll Brothers, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Toll Brothers, Inc. stock shows the buy signal. See more of Toll Brothers, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.