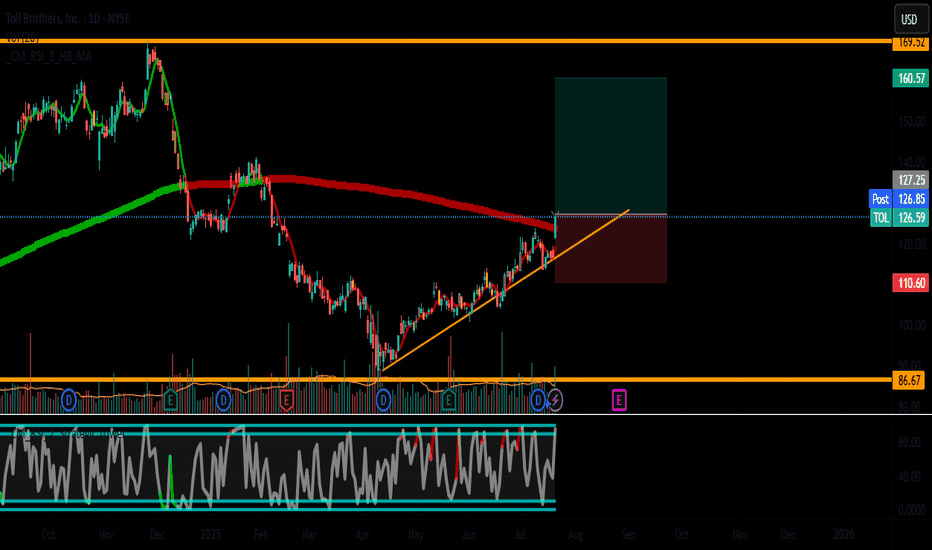

TOL (Toll Brothers) – Bullish Continuation Play🚀 Trade Idea: TOL (Toll Brothers) – Bullish Continuation Play

Entry: $127 | Stop Loss: $110.60 | Take Profit: $160.57

Risk/Reward Ratio: ~1:3

📈 Technical Setup

Trend:

Daily: Strong uptrend, higher highs & higher lows.

4H/1H: Bullish momentum with SMA(20) > SMA(50).

Key Levels:

Support: $121 (recent swing low) / $110.60 (strong demand zone).

Resistance: $127 (current breakout level) → Target: $160.57 (ATH potential).

Indicators:

RSI(14): 67 (bullish, no overbought signal yet).

MACD: Positive crossover on daily chart.

Volume: Rising on upward moves (bullish confirmation).

💡 Why TOL?

✅ Fundamentals:

Strong revenue & earnings growth (housing market resilience).

Undervalued P/E (~9.4x vs. sector avg. ~12x).

Healthy debt management (Score 10 in debt analysis).

✅ Catalysts:

Fed rate cuts could boost homebuilder stocks.

Strong backlog of orders (bullish for future earnings).

🎯 Trade Execution

Entry: $127 (break of consolidation).

Stop Loss: $110.60 (below key support, ~13% risk).

Take Profit: $160.57 (26% upside, near ATH).

Partial Profit-Taking: Consider scaling out at $145 (mid-term resistance).

⚠️ Risk Management

Position size ≤ 2-3% of portfolio.

Adjust SL to breakeven if price reaches $135.

🔍 Watch For:

Housing market data (new home sales, mortgage rates).

Earnings date (next report: Aug 2025).

📌 Comments? Would you take this trade? Let’s discuss below! 👇

#Homebuilders #Breakout #TOL #TradingView

(Disclaimer: Not financial advice. Do your own research.)

TOL trade ideas

Trading Analysis for Toll Brothers**Current Price:** $101.06

**Direction:** **LONG**

**LONG Targets:**

- **T1 = $103.25**

- **T2 = $106.10**

**Stop Levels:**

- **S1 = $99.00**

- **S2 = $97.50**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Toll Brothers.

**Key Insights:**

Toll Brothers, a leading luxury homebuilder, has shown significant strength in navigating current market conditions. Elevated demand for high-end housing has been bolstered by consumer confidence and stabilizing mortgage rates, allowing the company to maintain solid order growth and profitability. Toll Brothers’ focus on affluent markets and effective cost management is enabling it to weather challenges in the broader housing sector, positioning it well for near-term gains. Additionally, Toll Brothers' geographic diversification and premium brand recognition are driving continued client interest in its offerings.

**Recent Performance:**

The stock has demonstrated a strong upward trajectory over the past month, gaining more than 8%, and showing resilience above key technical resistance levels at $98. Growth in its share price has been bolstered by firm institutional buying, which is evident from upward trends in volume. Last week, Toll Brothers reported higher-than-expected revenue and net income figures, leading to renewed investor optimism. The stock's strong momentum following these earnings highlights its potential for further appreciation.

**Expert Analysis:**

Many market experts remain bullish on Toll Brothers, emphasizing its pricing power amid consistent demand for premium homes. Analysts note that its ability to expand gross margins while also maintaining strong delivery numbers is a testament to the company’s effective strategy in a challenging macroeconomic environment. The stock’s breakout above $100 serves as a technical signal to traders that higher price levels are likely to be tested in the near term, with potential upside targets of $103 and beyond.

**News Impact:**

Recent housing industry data reaffirm stable construction trends in Toll Brothers' target markets, strengthening its long-term prospects. Management’s updated guidance further reflects confidence in delivering stronger revenue figures in the upcoming quarters. Additionally, if Federal Reserve policies around interest rates remain consistent or favor stable borrowing costs, Toll Brothers could attract further investment interest. These external factors, combined with Toll Brothers’ internal strategies, contribute to its positive trading outlook.

---

**Trading Recommendation:**

Toll Brothers currently presents a compelling LONG opportunity, driven by robust demand for luxury housing, strong recent financial performance, and bullish technical indicators. The stock's upward momentum and favorable industry conditions suggest targets of $103.25 and $106.10 as achievable milestones in the short term. Conservative stop levels at $99.00 and $97.50 provide downside protection, making this an attractive setup for traders aiming to capitalize on near-term growth potential. Continued monitoring of housing market trends and macroeconomic factors is advised to refine strategies.

TOL (Toll Brothers, Inc.) TA & Trade Idea

Short-term Outlook (1–4 Weeks):

• Analysis: Oversold stochastic oscillator showing bullish crossover potential. Price approaching strong historical support near $90–$95. Candlesticks indicate seller exhaustion.

• Trade Direction: Long

• Confidence Score : 75% (Bullish reversal likely)

Medium-term Outlook (1–3 Months):

• Analysis: Significant correction from recent highs (~$150). Price action likely to consolidate near current levels. Bullish divergence forming on weekly indicators suggests recovery rally could target resistance at ~$110.

• Trade Direction: Cautiously Long (Target: $110)

• Confidence Score : 70% (Possible consolidation then bounce)

Long-term Outlook (6–12 Months):

• Analysis: Strong multi-year uptrend intact despite deep retracement. Price well above multi-year support levels (around $75–$85). Long-term fundamentals and weekly chart suggest continuation of bullish long-term trend after current correction completes.

• Trade Direction: Long (Buy-and-hold)

• Confidence Score : 80% (Bullish long-term trend intact)

Trade Summary:

• Short-term: Long from current oversold levels ($93).

• Medium-term: Hold/add positions targeting recovery to $110.

• Long-term: Maintain bullish stance targeting previous highs ($130–$150) over 6–12 months.

Has the TOL been paid?As trading view states, Toll Brothers, Inc. engages in the design, building, marketing, and arranging of financing for detached and attached homes in residential communities. The technicals are neutral and the analysis's naively have given this company a buy rating.

However, among the real estate companies affected by the LA Fire, TOL seems to be among the worst. Moreover, they've been mean reverting to the 52 week mean and are still above the 20 day Bollinger bands, which suggests a price around 128 may still be possible. For the past 4 days or so, speculators have pumped the price up, only to have it close red . At some point, the bearish fundaments will likely match the technicals and the 20 day mean reversion may continue downward.

To me, it seems that the only thing holding this stock up is big money and institutional investors which daily cost average into it during the pre-market driving it up.

TOLL Brothers #TOL new high vs US single family home priceHomemakers are making money over fist.

Does this confirm that the housing bull market will continue.

It seems like it doesn't it

This ratio highlights the housing bottom in the 90's

this Ratio also topped out in 2005 before the housing bubble popped

#Roaring20's

TOLToll Brothers is a company which designs, builds, markets, sells, and arranges financing for residential and commercial properties in the United States. In 2020, the company was the fifth largest home builder in the United States, based on homebuilding revenue. The company is ranked 411th on the Fortune 500.

Bias: Buy/Long

High risk as the setup is ahead of earnings.

Toll Brothers Inc. ($TOL) AnalysisSector: Consumer Cyclical - Residential Construction | Country: USA

Company Overview:

Toll Brothers Inc., a key player in the consumer cyclical sector, specifically residential construction, holds a significant position in shaping the real estate landscape in the United States. Known for its innovative approach and commitment to quality, Toll Brothers Inc. plays a crucial role in the dynamic and ever-evolving construction industry.

Performance Metrics:

NYSE:TOL demonstrates robust signals and compelling performance metrics within the wide-net screening, indicating its potential for growth and resilience in the residential construction sector.

Relative Strength: NYSE:TOL exhibits a remarkable relative strength, boasting a score of 7.8 against its sector and 4.53 against the S&P500. This suggests a notable outperformance, underlining its competitive edge and market strength.

U/D Ratios: With U/D ratios standing at 1.0 (50 days) and a strong 1.69 (15 days), NYSE:TOL showcases positive market sentiment, emphasizing recent bullish activity and supporting a favorable outlook.

Detected Base Depth: A substantial detected base depth of 22.4% positions NYSE:TOL strategically, indicating a solid foundational level and potential for significant upward movement.

Price Dynamics:

The last closing price's slight deviation of 4.53% from base resistance suggests a favorable positioning, indicating potential for a breakout.

Robust volume, standing at 71.73% above the 15-day average, indicates heightened investor interest and active participation, contributing to positive market sentiment.

Recent candlestick patterns reveal a 0.24% range in the last candle body and a solid 69.0% closing range, indicating recent price stability and a strong closing stance.

Short-term Trends:

Over the last 10 days, NYSE:TOL has experienced rising prices, accompanied by increasing volume and accumulation. This alignment suggests a bullish sentiment among investors, supported by short-term positive trends.

EMA Analysis:

Historical EMA patterns indicate that NYSE:TOL typically encounters local tops when the price closes around 55.89% above its 50-day Exponential Moving Average (EMA). Currently, the last closing price is 9.04% away from the 50 EMA, providing insights into potential correction levels.

Trade Idea:

With an entry point set at $87.31, the trade idea presents an opportunity aligned with current market dynamics.

A disciplined stop loss at $83.82 mitigates risk at 4%, adhering to prudent risk management principles.

The trade targets an attractive 11.66 Risk-Reward (RR) ratio, with a target price of $128.03, anticipating a total profit of 46.65%.

Conclusion:

Toll Brothers Inc. ( NYSE:TOL ) emerges as a strong contender in the residential construction sector, supported by impressive relative strength, positive short-term trends, and insightful EMA dynamics. The proposed trade idea aligns with a base breakout strategy, presenting an attractive risk-reward profile for investors seeking opportunities in the dynamic realm of residential construction.

High Mortgage Rates Taking a Toll in the Housing MarketComments on Quantitative Analysis Sector Comparison

Homebuilder sentiment dropped to a five-month low in September as higher rates push prospective buyers out of the market

Revenues from land sales are little.

Comments on Business

Continuous hike in interest rates and high-cost environment are concerning.

There was a reduce in headcount, causing SG&A spending to be reduced.

KPI’s driving Revenue and Earnings

Home deliveries expected to decrease from united delivered in the prior-year quarter.

Adjusted home sales gross margin is expected to decline from the year-ago period.

SG&A estimated to rise from the year-ago period.

For fiscal 2023, home deliveries are anticipated to decline from fiscal 2022.

By extrapolating nine months ended data, company is highly unable to meet the targeted home deliveries for the quarter and fiscal year of 2023.

Catalysts

Earnings not meeting targeted home deliveries.

Trade Structure

Dec 75/65 Bear Put

TOL: Entry, Volume, Target, StopEntry: with price above 75.97

Volume: with average or greater volume

Target: 81.41 area

Stop: Depending on your risk tolerance; Based on an entry of 75.98, 74.17 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

Momentum Stock: Toll BrothersToll Brothers, Inc. is an American real estate company known for its emphasis on luxury. It operates primarily in the residential real estate sector, focusing on the design, construction, and sale of various types of homes across the country. These range from detached and attached homes in luxury residential communities to condominiums through its City Living division. Their clientele primarily includes first-time, move-up, empty-nester, active-adult, and second-home buyers.

In addition to residential properties, Toll Brothers also has a broad scope of operations. The company designs a range of single-story living and first-floor primary bedroom suite home designs. It also develops communities with recreational amenities like golf courses, marinas, and fitness centers. It has land development and selling arms, as well as apartment development, operation, and rental divisions. The company also provides several interior fit-out options such as flooring, lighting, and home-automation, thereby increasing its engagement with customers and strengthening its role in the housing market.

Toll Brothers' strong financial performance and market position can make it an attractive proposition for stock investors. As of 11th July 2023, Toll Brothers has a market capitalization of $8.63 billion and an EBITDA of $1.84 billion. The company also exhibits a healthy Profit Margin of 13.59% and an Operating Margin TTM of 16.86%, indicating strong operational efficiency.

The performance of Toll Brothers' stock also stands out. The stock has appreciated by 68.16% in the past year (or closer to 100% from the lows and highs of its run), while its five-year and all-time price performance stands at 106.82% and 3844.98% respectively. Such long-term appreciation signals robust business growth and operational strength, thereby generating significant investor interest.

Moreover, the company has a solid dividend policy, providing a yield of 1.09%. This could be an attractive aspect for income-oriented investors. Additionally, the company's P/E ratio stands at 6.37, which is relatively low, suggesting the stock could be undervalued given the company’s earnings.

Toll Brothers also has strong institutional backing. Major institutions, including Vanguard Group Inc and BlackRock Inc, hold substantial shares in the company, which generally lends credibility and stability to the stock.

However, potential investors should also consider the associated risks. The real estate market is cyclical and can be affected by various factors, including interest rates, economic conditions, and government regulations. Furthermore, investors should keep an eye on the company's debt levels and monitor insider selling, which might suggest potential concerns among those with intimate knowledge of the company.

Toll Brothers presents an interesting investment opportunity due to its strong market position in the luxury housing market, robust financial performance, consistent dividend policy, and significant stock appreciation over time. Potential investors should weigh these strengths against the inherent risks associated with the real estate market and the company's specific financial structure.

In terms of any kind of short term entry, I would want to wait for a pullback with an indication of the uptrend continuing in order to get better value. The RSI and MACD are both pretty high at the moment which you would expect for a momentum stock, but you can see where they have dipped down to in the past and where better value for an entry might be found.

For risk management, a trailing stop loss of around 12% would have kept you in most of this trade. If it broke below that it could have been a good sign to exit and look for a new entry when the trend resumed.

As always how you interpret and decide to act on any results is up to you. This is just data not financial or trading advice and past performance is in no way any guarantee of future performance. Think of it as a way to spot stocks you might be interested in and can add to your watch list and perform further research on and or discuss with your broker.

Again. Not trading advice . Industries and companies change. Trends can end. Do your own research / discuss it with your advisor, but might be one to watch.

Trading to $TOL to $82According TipRanks, the average price target for Toll Brothers is $71.22. This is based on 11 Wall Streets Analysts 12-month price targets, issued in the past 3 months.

The highest analyst price target is $82.00 ,the lowest forecast is $57.00.

The average price target represents 4.67% Increase from the current price of $68.04.

Breakout Cup "Toll Brothers" buy about 72$"Toll Brothers" has broken above a previous resistance area with a strong price gain supported by greater than normal volume . Be careful as it could pull back. Perhaps look for a buy price if it reaches 72$ to confirm direction"

1% maximum size of your portofolio

TOL - Buy the dipsHome builders had a steep fall in the 1st half of 2022 and had been building a base in the 2nd half. They have now emerged from the base and appear to be on the slow path to recovery.

TOL has seen at least 3 gap ups since it's last golden cross on 8 Nov22. A sign that moemntum has been building since this golden cross. There was an attempt to break above it's neckline @ 5.50 on 13 dec but soon dips below again (a shallow dip though) until it propelled above the neckline again at the start of this year.

Any near term dip would be a low risk opportunity to long with initial stops just below $49.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Take care and Good Luck!

TOL Housing collapse hasn't even started!Why is TOL rallying with other home building stocks? Great Depression 2 on the horizon, companies have begun laying off and will do so in spades soon. 30 year mortgages went from 3.2 percent to 6.5-7%, gas is $7 a gallon, credit card debt is a record $1.1 trillion! If interest rates stay UP house prices will come DOWN the American ponzi scheme of indentured slavery is based on long loans and the cost of the MONTHLY payment. Home builders are tone deaf to what's just begun....... Steer clear this sector for the foreseeable future!

TOL - Bear Flag in the makingBear Flag is a continuation pattern. The current trend is down and is now consolidating in a bear flag. Short if and as it breaks at least $0.50 below the bear flag.

trail stops down diligently as bear markets are prone to sharp bear rallies.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Cheers.