TOST trade ideas

TOST Flat Base Breakout AttemptToast Inc. (TOST)

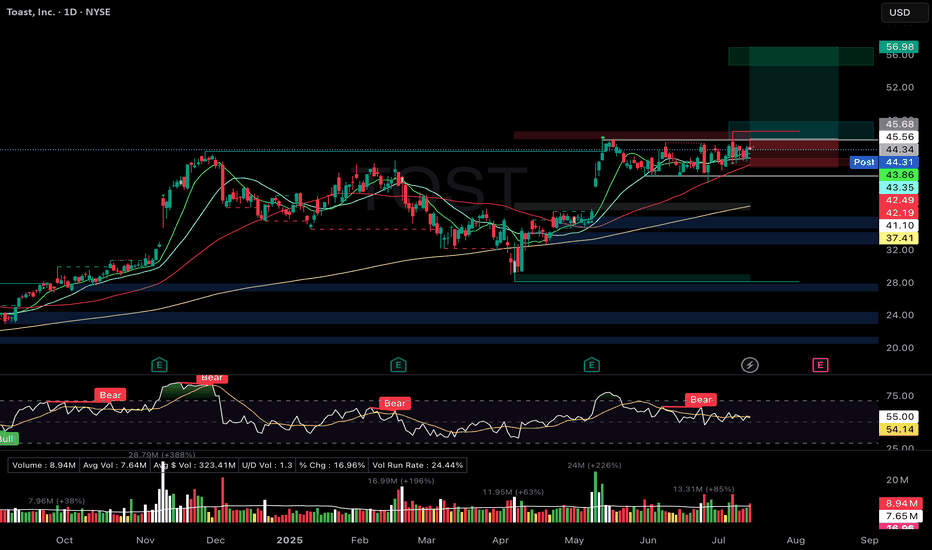

🚀 Entry: $45.68

📊 Setup: Flat Base Breakout Attempt

🛑 Stop: $42.19

🎯 Target: $56.98

🔑 Why I Entered:

Ideal flat base formation, tight consolidation under $45.56 pivot with volume drying up neatly between key moving averages.

Clear bullish moving average stack (rising 10/21/50/200 DMA).

Strong relative strength rating (92) with accelerating EPS growth signaling fundamental leadership.

🎯 What's Next:

Confirming breakout with strong volume above $46.00 pivot; will tighten stops accordingly once confirmed.

Earnings expected in four weeks—will closely manage the position as the event approaches.

TOST – Flat base breakout. Volume confirmation. Hammer off 21DMATOST – Toast Inc.

Setup Grade: A-

• Entry: $45.68 (7/15)

• Status: Active

• Trailing Stop: $43.96 (2x ATR)

• Setup: Flat base breakout. Volume confirmation. Hammer off 21DMA. RS: 92.

• Plan: Manage breakout hold. Raise stop if price holds above $46.

• Earnings: August 5

Toast: raise a toast!!!NYSE:TOST this has given so many chances to enter while still maintaining this flag, currently a double inside month and creating a tight flag here

can still enter here for a good risk reward, since the price has not gone anywhere, the IV on the options will be relatively lower and any increase in IV would mean your options gain value,

has earnings coming up in the next few weeks which will cause the IV to increase

plus being in payment processing space and Americans spending non stop should be a net positive for the business

Hard to find a "butter" trade than TOST - long at 42.49This is my first actual trade of TOST. No particular bias against it, just haven't traded it before. But looking at its paper results, I wish I had been.

Since the first of the year, it has outperformed QQQ more than 2:1 on a B/H basis, which I always like to see, but don't always get in a trade. But its 16.71% return pales compared to what I'd have gotten had I been trading it. It generated 16 signals since Jan 1.

The summed (non-compounded) return on those trades, collectively, would have been +49.2% and that includes an open signal that is down almost 5% right now. The average trade lasted 9 days (increased by one trade that lasted 56 days). The average gain in those 9 days was 3.08% (.33%/day or almost 8x the avg market return and 5x that of the QQQ so far this year). The median results were even better: +2.64% in 4.5 days (+0.59% per day held).

As a bonus here, the stock is well above its 200d MA and is at the upper edge of the GC overlay bullish ribbon (also a good sign of strength). Like Monday's idea, none of this guarantees success, but it ups the odds.

While I don't do price targets, the 1 open buy signal was triggered 4.77% above where the stock is now, so I expect that to be eventually taken out. But, it's been 6+ weeks since that signal already, so how soon is anyone's guess. I will likely take my profits when my profit taking signal clicks, be that in one day or in weeks. Maybe I'll get lucky and it will take out that 4.77% level in a hurry. 5 of the 16 trades so far this year have eclipsed that level, so it's not out of the question. We shall see.

The win is all I seek. What the market gods deign to give me in terms of magnitude and time required is up to them. I will accept it.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

ToastyI'm really liking this chart and believe in the fundamentals. I believe we are seeing a pullback and have outlines 3 areas of support below. At least the first should be tested before another uptrend. I'd love it to get lower for selfish reasons and if it got to the 3rd green horizontal i'd buy some longer dated call options. FCF / EPS / Net margin all trending in the right direction.

Safe Entry Zone TOSTNote: Switch to 1H TF for better View and more details

Stock Current Movement Ranging.

4h Green is buy Zone stop loss Below.

4h Red Is Resistance Zone.

P.High Lines (Previous High) Consider as Strong Resitances!

Also My Beloved CAthie Wood BEST INVESTOR All Time (based on statics better than Warren Buffet Entire Histroy) Is BUYING!

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the

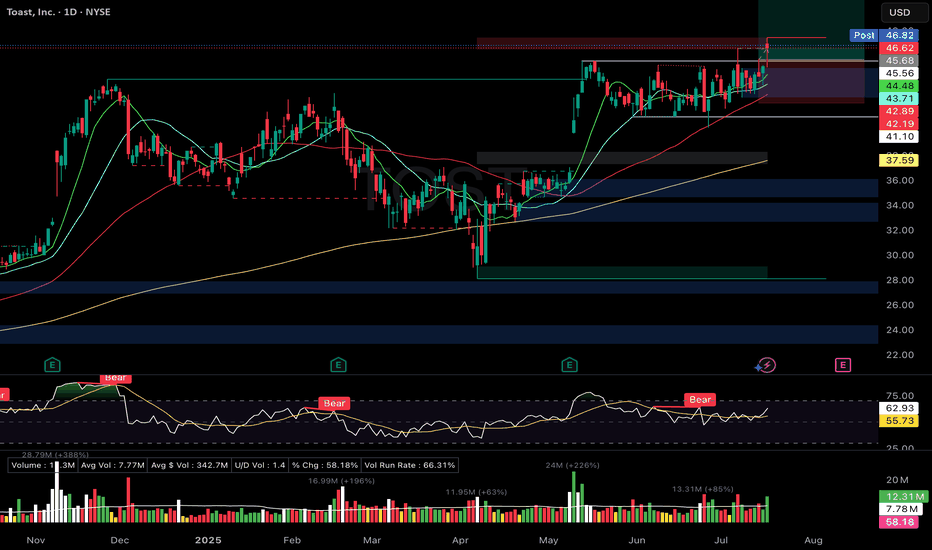

TOST getting toastyTOST Technical Analysis (Breakout Setup):

Current Pattern: Bull flag forming after a strong breakout from the $40.50 zone with increasing volume.

Resistance: $44.33 – key level to break for momentum continuation.

Support levels:

$42.00 (top of previous consolidation zone)

$40.55 (bull flag base and breakout pivot)

Ideal Breakout Play:

Watch for breakout above the flag’s upper trendline, ideally clearing $44.33 with volume.

A daily close above $44.33 confirms continuation — target $47–48 short-term, with potential run to $50 psychological.

Invalidation:

Break below $40.55 on volume negates the setup, suggesting failed breakout.

Favorable Path:

Consolidate slightly → Break flag above $44.33 → Ride momentum to $47–48. Risk/reward favors long bias above $44.33.

💡 This is a textbook bull flag following a high-volume breakout — high probability if volume confirms the breakout.

Toast, Inc. (TOST) – Powering the Future of RestaurantsCompany Snapshot:

Toast NYSE:TOST is cementing its position as the go-to restaurant operating system, offering integrated solutions for payments, POS, inventory, and guest engagement—all tailored for food service businesses.

Key Catalysts:

Recurring Revenue Powerhouse 💸

ARR hit $1.7B in Q1 2025 — up 31% YoY

SaaS-driven model provides high visibility and stickiness

Expanding Client Base & Network Effects 📈

Serving ~140,000 locations, up 25% YoY

More locations = richer data + stronger product improvement + increased client lock-in

Enterprise-Grade Momentum 🏢🍔

Wins with Applebee’s (~1,500 locations) and Topgolf demonstrate Toast's scalability

Validates ability to support complex, high-volume operators

Operating Leverage in Motion ⚙️

As ARR scales, margins improve—positioning Toast for profitable growth over time

Investment Outlook:

✅ Bullish Above: $37.00–$38.00

🚀 Target: $60.00–$62.00

📈 Growth Drivers: Enterprise adoption, recurring revenue, SaaS scale, network effects

💡 Toast is becoming the digital backbone of modern restaurants—serving up growth with every seat. #TOST #SaaS #RestaurantTech

TOST in Buy ZoneMy trading plan is very simple.

I buy or sell when:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom channels

Stochastic Momentum Index (SMI) at oversold level

Money flow momentum is spiked negative and under at bottom of Bollinger Band

Target is upper channel around $42

TOST bullish setupTOST had a nice fakeout and then dump as the market pumped and dumped tech stocks. This stock fell right back into the wedge and is still setting up bullish imo. This dump allowed for a nice reset of BBWP and momentum, just what the doctor ordered. I would say we are back in the buy zone here. I have added supply and demand zones here.

My plan:

We are in the buy zone, if one of my swing trades pump I will add 100 shares.

My plays last week were 50% moves within a day so I closed them since thats one of my rules for selling options.

I have a 41$ covered call sold, and will look to sell more if we pump

Tost fails breakoutTost failed the breakout and I lost 120$ on my call. I am fine with this as I wanted some level of upside. My plan was to enter if the stock dumped and it has. I have started with 100 shares and have already locked in some profits from cash secured puts. My rule is to always close the puts if they are up 50% in a day and they were. Chart wise we note a falling volatility and momentum. This is still within the wedge, short interest in not massive. I am still bullish on the weekly.

Summary of bullish earnings:

In the fourth quarter, recurring gross profit streams climbed 39% year over year; adjusted EBITDA hit $111 million, an 18-percentage-point rise from the year before. Software-as-a-service average revenue per user rose 5%; yearly recurring revenue jumped 32%. Having full-year originations of more over $1 billion, Toast Capital made $43 million in gross profit. Driven by expense control and pricing tweaks, the business produced $134 million in free cash flow and saw a 56 basis point net take rate improvement.

From 32% to 33% growth in 2024, toast forecasts consistent gross profit streams to rise between 23% and 25% in 2025. With a 30% margin at the midway, the business predicted adjusted EBITDA between $510 million and $530 million. Toast predicts adjusted EBITDA between $100 million and $110 million and gross profit growth of 27% to 30% for the first quarter of 2025; stronger growth is projected in the second half of the year. Targeting more than 10,000 client sites in both domestic and international markets, the business intends to boost research and development funding as well as go-to-market growth.

TOST looks to breakoutTOST earings are coming around the corner and the company is JUST becoming profitable. This reminds me of SOFI and HOOD and how they picked up steam so heavily as the negative EPS dropped. The stock saw a nice 50% fib pullback and is now contracting right into earnings. These wedges have a habit of breaking down after an upward pump. This is where you want to look at short interest, this amount isnt tremendously high but could cause a false wedge breakout.

My plan: My target for the year is 56$

As I sell out of TSLL I might be adding this as a new play alongside NBIS

The premium is high so I would likely buy 1-200 shares and then start selling CSP here

TOST breakout signals: Bullish trend with $65 targetTOST stock has recently broken out of its base pattern, signaling a continuation of the upward trend with potential for further gains toward $65 or higher. As long as the stock remains above the key support zone of $35/$36, the long-term outlook remains bullish.