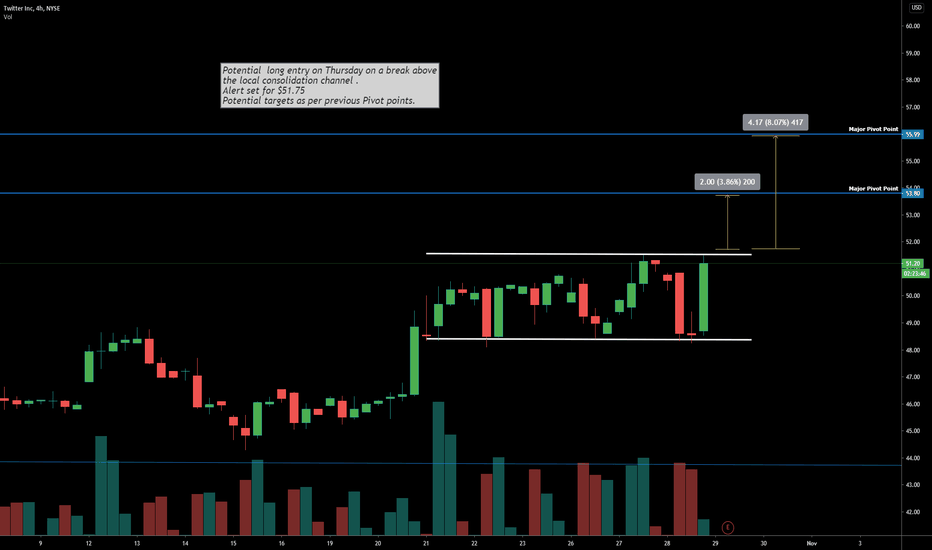

TWTR trade ideas

TWTR 5th leg up possibly completedHuge doji or spinning top candle means there is a price reversal on the way. Price may still go up but will not sustain. If the 1st week of November finishes lower than last week of October, expect a downside move further, targeting 36 first, then down to 32 is possible.

TWITTERThe idea is to go long, but just wait the end of the price setback.

We always should try to invest following the major trend which in this case is bullish.

Twitter (TWTR) – Twitter more than tripled the consensus estimate of 6 cents a share, with quarterly earnings of 19 cents per share. Revenue was well above consensus, however Twitter posted its slowest user growth since late 2017.

TWTR EW short-term bullish projectionTWTR is continuing its run after a gap-up post SNAP earnings. Conservative estimate puts TWTR PT at 52 early this week after which TWTR is likely to face a corrective wave down. This is likely to be a correction down to a demand zone at 46.2, after which, TWTR will resume moving up to start a larger Wave 5 up.

TWTR will report earnings 10/29 after the bell.

Twitter after earnings - Dropped hardTwitter just get hit hard after earnings. I personally was super impressed with their earnings and revenue growth. Free cash flow was awesome, too. US markets are doing well, globally, too. I really like Twitter but was bummed to see the drop. What's my game plan or thoughts?

I will wait until $40. I think there's a lot of support there. If some people sell and get shaken out, $40 is in perfect dip position. Possibly down to $38. I've set the levels and will try to wait as patiently as possible.

The market loves to value Twitter on its daily user growth and compare that to sites like Pinterest and Snapchat. Daily user growth is not a great metric and there is no industry standard. How do we know Snapchat is counting it the same way Twitter is or Pinterest? Or Vice versa? I trust the companies that are making money and actually delivering results to advertisers. Snap has never made a dollar in free cash flow, for example. So it's interesting to me to think the market would value some user numbers more than actual cash? But who knows. I may have this all wrong.

That's my personal view and let's find out what happens next! No advice, just watching. Also one final thing: I do think Twitter could do a better job at allowing free speech and keeping it a platform. Also their editorial recommendations and news stories are really bad and never related to my interests. This is an obvious change for them.

TWTR potential sustained rally target 53Judging after the after hours runs on TWTR, I think we can hit 53-55 region well before TWTR releases earnings after the bell. I still have yet to make a decision about what I will do with my decision, but social media seems to be looking favorable after earnings, might just roll the dice. Copyright Rohan Karunaratne 2020