VICI trade ideas

Trade Idea: VICIVici properties is showing weakening in its trend. This has been directly tied to the weakness in XLRE - real estate

We believe VICI properties has much more downside. This specific Real estate play also has much property exposure to the casino type names.

With many of the Casino charts like MGM, LVS looking "topheavy" this may be a correlated play that already has headwinds from the weakening in real estate.

If the economy weakens to a degree the consumer discretionary stocks should also be hit.

Descending TriangleNeutral pattern until broken.

FFO (FWD)

1.50

P/FFO (FWD)

21.52

Div Rate (FWD)

$1.56

Yield (FWD)

4.82%

Short Interest

3.93%

Market Cap

$31.72B

No recommendation.

VICI Properties is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including the world-renowned Caesars Palace. VICI Properties' national, geographically diverse portfolio consists of 29 gaming facilities comprising over 48 million square feet and features approximately 19,200 hotel rooms and more than 200 restaurants, bars and nightclubs. Its properties are leased to industry leading gaming and hospitality operators, including Caesars Entertainment, Inc., Century Casinos Inc., Hard Rock International, JACK Entertainment and Penn National Gaming, Inc. VICI Properties also owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip. VICI Properties' strategy is to create the nation's highest quality and most productive experiential real estate portfolio.

Break out any way you look at itVici Properties. 4.8% yield VICI Properties Inc. is a real estate investment trust. The Company is primarily engaged in the business of owning and acquiring gaming, hospitality, and entertainment destinations, subject to long-term triple net leases. The Company segments include real property business and golf course business. The real property business segment consists of leased real property and real estate lending activities. The golf course business segment consists of approximately four golf courses. Its national, geographically diverse portfolio consists of approximately 28 properties, including Caesars Palace Las Vegas, Harrah’s Las Vegas, and the Venetian Resort, three of the entertainment facilities on the Las Vegas Strip. Across 62 million square feet and features approximately 25,000 hotel rooms and approximately 250 restaurants, bars, nightclubs, and sportsbooks. It owns approximately 34 acres of undeveloped or underdeveloped land on and adjacent to the Las Vegas Strip that is leased to Caesars.

VICI (VICI Properties) - Bullish finish to the quarterVICI Properties Inc

VICI Properties Inc. is a real estate investment trust. The Company is primarily engaged in the business of owning, acquiring and developing gaming, hospitality and entertainment destinations. Its operating segment consists of real property business and golf course business. Real property business segment consists of leased real property. Golf courses include the Cascata golf course in Boulder City, Nevada, the Rio Secco golf course in Henderson, Nevada, the Grand Bear golf course in Biloxi, Mississippi, and the Chariot Run golf course in Elizabeth, Indiana.

Analysis/Commentary

Turnaround in Sales

Based on the study of the previous quarterly earnings reports and subsequent price moves:

- Current quarter has been mixed, with buying opportunity now presenting itself

- Expectation for the price to move to MID point

- Trailing stop-loss on price above MID point

GOOD LUCK.

DO YOUR OWN RESEARCH!

$VICI with a bullish outlook following its earnings #StocksThe PEAD projected a bullish outlook for $VICI after a positive under reaction following its earnings release placing the stock in drift A

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

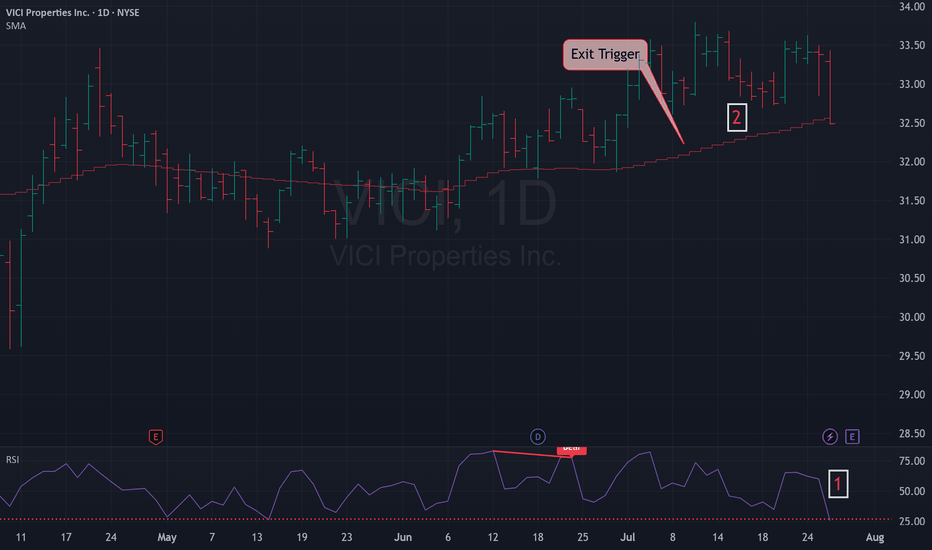

VICI Sell from Choppy Price Action

NYSE:VICI

I believe in taking my money off the table when I am not comfortable or the gut just says too. VICI was a small swing trade. Up 7% but we will take our money when we see the possibility of price action faltering to the downside or lackluster for the time being. This stock had formed a loose cup with handle where green dot was the price when introduced.

Cup and HandleLarge effective volume today with a pocket pivot in last 10 days

Effective Volume analyses the intraday volume on the minute level to determine what small and large players are doing in terms of accumulation and distribution. For using the indicator you should basically understand: if the red line goes up, large players are buying on average, if it goes down, they are selling.

Pocket Pivot: The price goes up compared to yesterdays close and

the volume today is higher than the maximum down volume of the past 10 days

NV is also high

No wising wedges

Not to long entry level yet

VICI Properties is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including the world-renowned Caesars Palace. VICI Properties' national, geographically diverse portfolio consists of 29 gaming facilities comprising over 48 million square feet and features approximately 19,200 hotel rooms and more than 200 restaurants, bars and nightclubs. Its properties are leased to industry leading gaming and hospitality operators, including Caesars Entertainment, Inc., Century Casinos Inc., Hard Rock International, JACK Entertainment and Penn National Gaming, Inc. VICI Properties also owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip. VICI Properties' strategy is to create the nation's highest quality and most productive experiential real estate portfolio.

Yield is over 5%

Not a recommendation

VICI PROPERTIES Plan Hey people, VICI PROPERTIES is in a bullish force, doji with rejection of sellers and it will give a false signal on the trend support for direct breakout of the consolidation zone. To go towards the next zone reach the top of the zone, which corresponds to the last highest of this level is the doji in daily and to go down due to the large volume of purchases on this TIMEFRAME.

Please LIKE & FOLLOW, thank you!