VSCO trade ideas

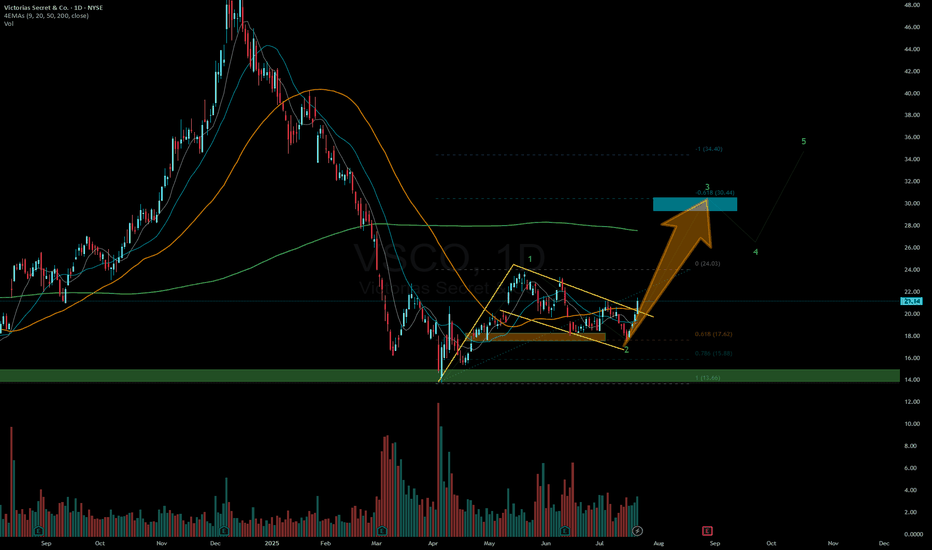

Victorias Secret (VSCO) Bull Run Incoming? Insider Signals?Victorias Secret & Co. (VSCO) Based in Ohio, USA has recently seen a dip in asset value to $16, but recovery could be imminent.

On the 1 Day chart both a bullish RSI divergence and CVD divergence seems to be forming. The DMI appears to show the bearish directional movement is slowing, and the ADX still remains above 20.

In march Insiders were reported to have purchased 1.92M shares. Conversely only 20,000 shares were sold by Insiders (Robinhood Analytics). Insider activity may indicate undisclosed company confidence.

The order book shows a decent number of open interest for $25.00. Subsequently this price target is located near key resistance areas that in my opinion, price will most likely touch in the near future.

Earnings are set to be released in May and traders and institutions may begin to price in fundamental factors before the report .

Given the above technical and fundamental signals, insider activity, and approaching earnings report. My hypothesis is bullish with a price target of $25.00 before 06/20/2025.

Will tariffs and politics stop VSCO's upwards movement? Or do the technicals and Insider moves signal a current discounted buy?

Disclaimer: Not financial advice.

VSCO – 30-Min Long Trade Setup!📈

🔹 Ticker: VSCO (NYSE)

🔹 Timeframe: 30-Min

🔹 Setup Type: Falling Trendline Break + Support Bounce

🔸 Price at Breakout: ~$18.59

📊 Trade Plan (Long Position)

✅ Entry Zone: $18.50–$18.60 (trendline breakout + yellow reaction zone)

✅ Stop Loss (SL): Below $17.97 (structure support marked by white line)

✅ Take Profit Targets:

📌 TP1: $19.49 (red resistance line)

📌 TP2: $20.62 (green line – previous high / supply zone)

📐 Risk-Reward Calculation

📉 Risk per Share:

$18.59 - $17.97 = $0.62

📈 Reward to TP1:

$19.49 - $18.59 = $0.90 → 1.45:1 R/R

📈 Reward to TP2:

$20.62 - $18.59 = $2.03 → 3.27:1 R/R

📊 Technical Confluence

📌 Falling Trendline Breakout: Clean break through descending resistance (pink line)

📌 Ascending Triangle Formation: Price compressing into resistance with higher lows

📌 Demand Zone: Held support at ~$17.97

📌 Yellow Zone: Retest zone + potential breakout confirmation

⚙️ Execution & Management Strategy

🟢 Entry Confirmation: Bullish candle close above yellow zone

🔄 After TP1 Hit:

— Move SL to breakeven

— Book 50% profits

🎯 Ride remaining position to TP2

📉 Trail SL as price climbs

⚠️ Invalidation Scenario

❌ Close below $17.97

❌ Weak breakout without volume support

❌ Sharp rejection from yellow zone

🦅 Final Thoughts

✔ Classic breakout pattern with solid R/R

✔ Multiple confirmations from price action

✔ Great setup for swing or intraday momentum traders

VSCO/USD – 30-Min Long Trade Setup !📌 🚀

🔹 Asset: VSCO (Victoria's Secret & Co.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Reversal Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $22.21 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $21.19 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $23.55 (First Resistance Level)

📌 TP2: $25.31 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $22.21 - $21.19 = $1.02 risk per share

📈 Reward to TP1: $23.55 - $22.21 = $1.34 (1:1.3 R/R)

📈 Reward to TP2: $25.31 - $22.21 = $3.10 (1:3 R/R)

🔍 Technical Analysis & Strategy

📌 Downtrend Breakout: Price has broken a falling trendline, signaling a bullish reversal.

📌 Support Rejection: The price bounced off $21.19 support, showing buyer strength.

📌 Volume Confirmation Needed: Ensure high buying volume when price holds above $22.21 to confirm bullish momentum.

📌 Momentum Shift Expected: If price remains above $22.21, it could push toward $23.55, and further to $25.31.

📊 Key Support & Resistance Levels

🟢 $21.19 – Stop-Loss / Support Level

🟡 $22.21 – Breakout Level / Long Entry

🔴 $23.55 – First Resistance / TP1

🔴 $25.31 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure high buying volume above $22.21 before entering.

📉 Trailing Stop Strategy: Move SL to entry ($22.21) after TP1 ($23.55) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $23.55, let the rest run toward $25.31.

✔ Adjust Stop-Loss to Break-even ($22.21) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If the price fails to hold above $22.21 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $22.21 before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Bouncing from $21.19 support suggests a potential reversal.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.3 to TP1, 1:3 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📈

🔗

#StockMarket 📉 #VSCO 📊 #TradingNews 📰 #MarketUpdate 🔥 #Investing 💰 #Trading 📈 #Finance 💵 #ProfittoPath 🚀 #SwingTrading 🔄 #DayTrading ⚡ #StockTrader 💸 #TechnicalAnalysis 📉 #EconomicNews 🏛️ #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bullish 🐂 #RiskManagement ⚠️ #TradingCommunity 🤝

VSCO to $37.50My trading plan is very simple.

I buy or sell when:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes above it's Bollinger Bands

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at 100 period channel

Stochastic Momentum Index (SMI) at oversold level

Money flow momentum is spiked negative and under bottom of Bollinger Band

Price at or near 2.618 Fibonacci level

Entry at $31

Target is $37.50 or channel top

Victoria's Secret (VSCO) AnalysisCompany Overview: Victoria's Secret NYSE:VSCO is undergoing a strategic transformation aimed at revitalizing its brand and capturing a larger share of the lingerie and intimate apparel market. The company is leveraging new partnerships, focusing on digital expansion, and embracing inclusivity to appeal to a broader customer base.

Key Developments:

Partnership with Amazon:

Victoria's Secret's collaboration with Amazon represents a significant move to expand its digital footprint. By listing products on one of the world's largest e-commerce platforms, the company gains access to Amazon's vast customer base, potentially driving substantial online sales growth.

This partnership enables Victoria's Secret to reach new customers who prefer online shopping, aligning with broader retail trends where e-commerce continues to take a larger share of sales.

Brand Transformation and Inclusivity:

The company is undergoing a brand overhaul, focusing on inclusivity and diversity. By showcasing a wider range of body types and promoting a more inclusive brand image, Victoria's Secret aims to reconnect with a broader audience, particularly Gen Z and Millennial consumers who value representation and authenticity.

This strategic shift is expected to enhance the brand's market appeal, improve customer perception, and potentially boost sales and market share.

International Expansion:

Victoria's Secret is targeting high-growth international markets such as China and India, where demand for premium and luxury lingerie is on the rise. The expansion into these regions is a strategic effort to tap into new revenue streams and capitalize on growing consumer purchasing power.

Establishing a stronger presence in these markets positions the company to benefit from increasing global demand for premium intimate apparel.

New Leadership Driving Transformation:

With new industry veterans in key leadership roles, including a CEO experienced in retail transformation, Victoria's Secret is set for accelerated growth. The revamped leadership team is focusing on strategic initiatives aimed at revitalizing the brand, enhancing customer experience, and driving financial performance.

Investment Outlook: Bullish Outlook: We are bullish on VSCO above the $27.00-$28.00 range, as the company's strategic initiatives and renewed focus on inclusivity are expected to drive growth and market expansion. Upside Potential: Our price target for Victoria's Secret is set at $45.00-$46.00, reflecting potential gains from the Amazon partnership, brand transformation efforts, and international expansion strategy.

🚀 VSCO—Reinventing the Brand and Expanding Horizons! #RetailTransformation #EcommerceGrowth #InclusivityInFashion

VSCO: Bear Case ScenarioMy bear case scenario for VSCO has the stock dropping to about $5 before heading higher. I will say current price is finding some support (horizontal green dotted line) which if it holds can cause a wedge to form sending us higher.

That being said, I dont think the drop is done. If you are going to buy at these levels it is not a bad idea, but dont go all in and have some cash set aside to continue to DCA.

Victoria's Secret Faces 30% Plunge as Turnaround Efforts StumbleVictoria’s Secret & Co., ( NYSE:VSCO ) experienced a staggering 30% drop in premarket trading on Thursday, sending shockwaves through the market as the lingerie giant's full-year sales outlook disappointed analysts and underscored its ongoing struggle for relevance.

The company's projection of $6 billion in net sales for the year fell short of expectations, signaling challenges in connecting with consumers amid changing trends. JP Morgan analyst Matthew Boss downgraded the stock to underweight, citing unmet sales improvement promises.

Despite initiatives such as a revamped fashion show and expanded apparel offerings, Victoria’s Secret ( NYSE:VSCO ) has failed to reverse its declining sales. Comparable sales fell by 6% in the crucial holiday quarter, despite better-than-expected profitability driven by enhanced inventory management.

While the company reported strong international sales growth of approximately 24%, this segment remains a small fraction of its overall business. Chief Financial Officer TJ Johnson highlighted North American sales as the primary challenge, attributing it to aggressive promotions and intense competition, particularly in the underwear category.

Chief Executive Officer Martin Waters acknowledged the need for continued promotional activity in the current quarter, particularly in areas where Victoria’s Secret ( NYSE:VSCO ) struggles to gain market share. Analysts echoed concerns about management execution, with BMO analyst Simeon Siegel lowering the price target amid skepticism about the company's turnaround efforts.

The stock's 26% decline over the past year, coupled with the record-setting premarket plunge, reflects mounting uncertainty about Victoria’s Secret's future. As the company grapples with shifting consumer preferences and intensifying competition, investors await evidence of successful execution to restore confidence in its prospects.

In conclusion, Victoria's Secret ( NYSE:VSCO ) faces significant challenges as it strives to regain its footing in the lingerie market. With sales falling short of expectations and investor confidence waning, the company must demonstrate effective strategies to adapt to evolving consumer demands and revitalize its brand image.

$VSCO making it's next leg higher in an on-schedule extension -NYSE:VSCO is up 11% since 01/24/2024 after moving out of a longer-term bullish retracement. The price action has remained strong, triggering the sale of the first half of our VSCO inventory at $27.00 flat -

If the DXY continues to leg lower we could see another definitive risk on period in equities, theoretically giving VSCO the catalysts to achieve our target 2 profit level of $29.59/share before reaching parabolic phase.

I'm writing this 1/31/2024 - 4 hours prior to the FOMC, If the price action trades flat on the day (1/31/2024) and opens lower on 2/1/2024 we will consider managing that risk of reversal and potentially close out the rest of our VSCO inventory in the money before surrendering any unrealized gains.

( NONE of the information in this post should be construed as investment advice )

Short VSCO* Got bid UP in late November, ahead of (then after) a bigger LOSS than expected at Earnings.

* Churned for 1 month up here (between $25 and $29)

* Finally broke down BELOW support at 25.

* "2 down month in force" according to Strat

* Technically, it's a pretty strong double top at $29 visible on this daily chart.

IF this stock holds BELOW 25, then I would like to see this drop to $20 by March, which I think is VERY doable.