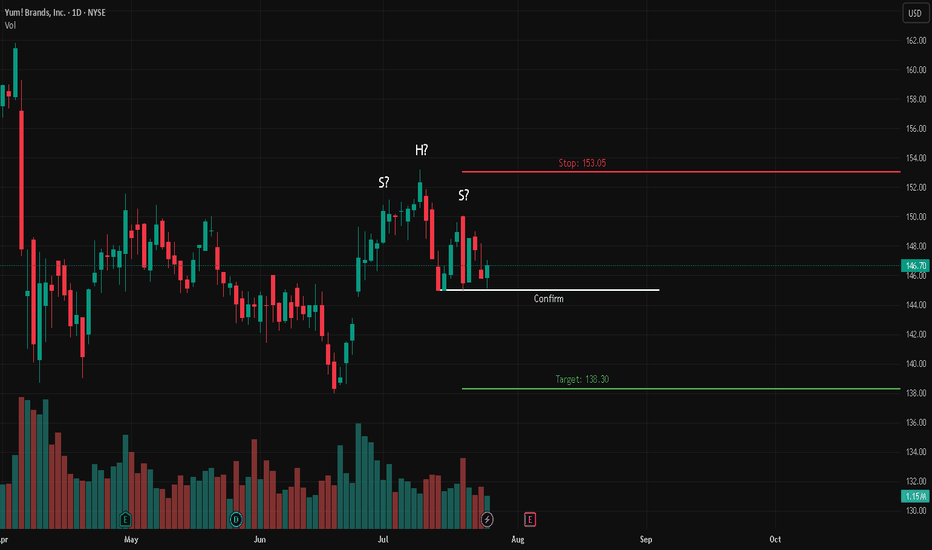

Yum! Brands Inc. (YUM) – Potential Head & Shoulders Breakdown📉 Short Setup

🔍 Description:

Yum! Brands Inc. (NYSE: YUM) appears to be forming a Head & Shoulders pattern — a potential bearish reversal signal. The neckline support is holding for now, but a confirmed breakdown below this level would suggest downside momentum.

📊 Trade Details:

🔹 Entry: Below nec

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.07 USD

1.49 B USD

7.55 B USD

277.54 M

About Yum! Brands, Inc.

Sector

Industry

CEO

David W. Gibbs

Website

Headquarters

Louisville

Founded

1997

FIGI

BBG000BH3GZ2

Yum! Brands, Inc. is a service restaurant company, which engages in the development, operation, franchise, and licenses of a system of restaurants. It operates through the following segments: KFC Division, Pizza Hut Division, Taco Bell Division, and Habit Burger Grill Division. The company was founded in 1997 and is headquartered in Louisville, KY.

Related stocks

YUM - LONGYum another one that is not a 6/6 its a 2-3/6 at best but is exhibiting great behavior and I decided to try so for a trade today .

I was in and out several times and I did manage to keep some as a swing . Bought super late , it works sometimes .

Trade results so far you can see on 5 min shot I pa

Fast food restaurant stock prices can potentially declineI am cautious and afraid that fast food restaurant stocks such as McDonald, Pizza Hut, Starbucks etc. will soon see a steady decline. Looking back at history, when USA threatens tariffs on countries such as China, Canada, Mexico and Europe at large, consumers in those countries become hesitant to sp

YUM: linear regression channel tradeA price action above 133.50 supports a bullish trend direction.

Increasse long exposure for a break above 136.00.

The target price is set at 145.00, which is the upper range of the linear regression channel pattern.

The stop-lossprice is set at 129.00, which is the lower range of the linear regressi

Yum! Brands: Bearish Shark With Bearish Divergence and Daily 3LSWe have a 1.13 Shark here with Bearish Divergence Visible on the Weekly Timeframe, and right now on the Daiy Timeframe was have a Confirmed 3 Line Strike. If things go as I expect we will see YUM work it's way down and below the trendline before then making it's way towards the 0.618 Fibonacci Retra

Pullback in Yum BrandsYum Brands had a strong rally in late 2022. Now after a pause, the restaurant company may interest pullback buyers.

The first pattern on today’s chart is $125.70, a daily closing high from last April. YUM hesitated below that level in November and then began the New Year by testing it. Prices are n

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where YUM is featured.

Frequently Asked Questions

The current price of YUM is 146.70 USD — it has increased by 0.60% in the past 24 hours. Watch Yum! Brands, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Yum! Brands, Inc. stocks are traded under the ticker YUM.

YUM stock has fallen by −1.10% compared to the previous week, the month change is a 1.20% rise, over the last year Yum! Brands, Inc. has showed a 16.25% increase.

We've gathered analysts' opinions on Yum! Brands, Inc. future price: according to them, YUM price has a max estimate of 200.00 USD and a min estimate of 140.00 USD. Watch YUM chart and read a more detailed Yum! Brands, Inc. stock forecast: see what analysts think of Yum! Brands, Inc. and suggest that you do with its stocks.

YUM stock is 1.36% volatile and has beta coefficient of 0.36. Track Yum! Brands, Inc. stock price on the chart and check out the list of the most volatile stocks — is Yum! Brands, Inc. there?

Today Yum! Brands, Inc. has the market capitalization of 40.78 B, it has decreased by −4.08% over the last week.

Yes, you can track Yum! Brands, Inc. financials in yearly and quarterly reports right on TradingView.

Yum! Brands, Inc. is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

YUM earnings for the last quarter are 1.30 USD per share, whereas the estimation was 1.29 USD resulting in a 0.94% surprise. The estimated earnings for the next quarter are 1.46 USD per share. See more details about Yum! Brands, Inc. earnings.

Yum! Brands, Inc. revenue for the last quarter amounts to 1.79 B USD, despite the estimated figure of 1.85 B USD. In the next quarter, revenue is expected to reach 1.94 B USD.

YUM net income for the last quarter is 253.00 M USD, while the quarter before that showed 423.00 M USD of net income which accounts for −40.19% change. Track more Yum! Brands, Inc. financial stats to get the full picture.

Yes, YUM dividends are paid quarterly. The last dividend per share was 0.71 USD. As of today, Dividend Yield (TTM)% is 1.88%. Tracking Yum! Brands, Inc. dividends might help you take more informed decisions.

Yum! Brands, Inc. dividend yield was 2.00% in 2024, and payout ratio reached 51.40%. The year before the numbers were 1.85% and 43.19% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 28, 2025, the company has 40 K employees. See our rating of the largest employees — is Yum! Brands, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Yum! Brands, Inc. EBITDA is 2.59 B USD, and current EBITDA margin is 34.61%. See more stats in Yum! Brands, Inc. financial statements.

Like other stocks, YUM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Yum! Brands, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Yum! Brands, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Yum! Brands, Inc. stock shows the buy signal. See more of Yum! Brands, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.