NZDAUD trade ideas

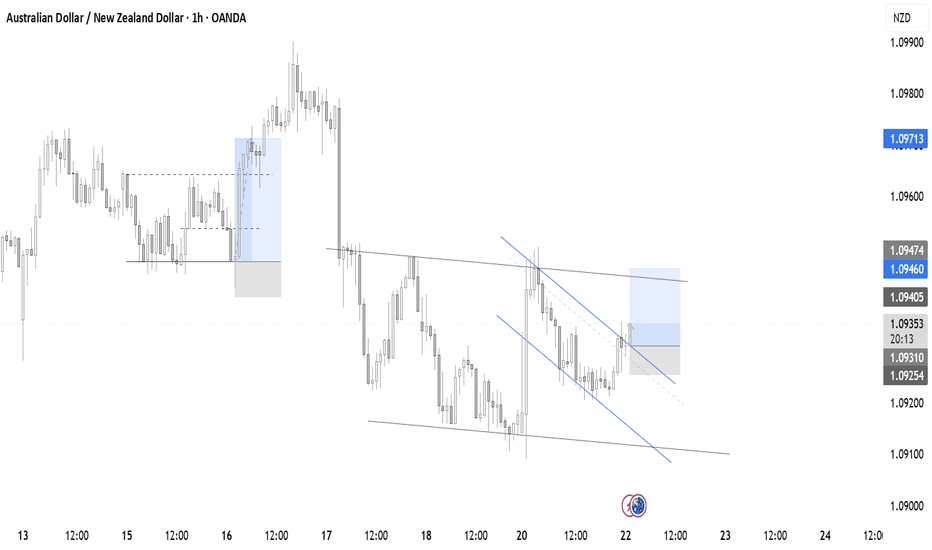

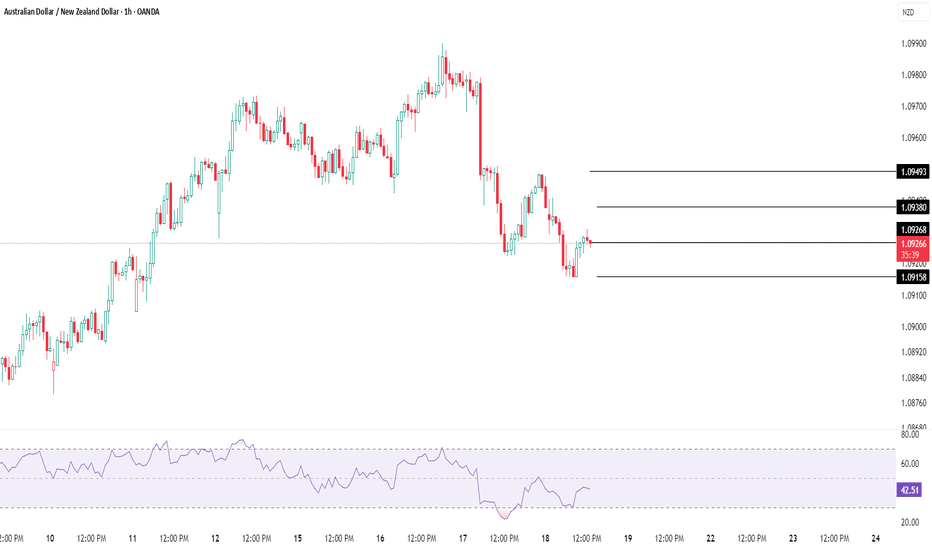

AUD/NZD – Falling Wedge Breakout with Bullish DivergenceAUD/NZD is currently forming a falling wedge pattern on the 1-hour timeframe, a structure typically associated with bullish reversals. Notably, bullish divergence on the RSI is developing while price continues to print lower lows, RSI is making higher lows, indicating weakening selling momentum.

Trade Setup:

Buy Stop Entry: 1.09309 (above recent Lower High — confirmation of breakout)

Stop Loss: 1.09094 (recent Lower Low )

Take Profit 1 : 1.09520

Take Profit 2 : 1.09740 (full pattern projection target)

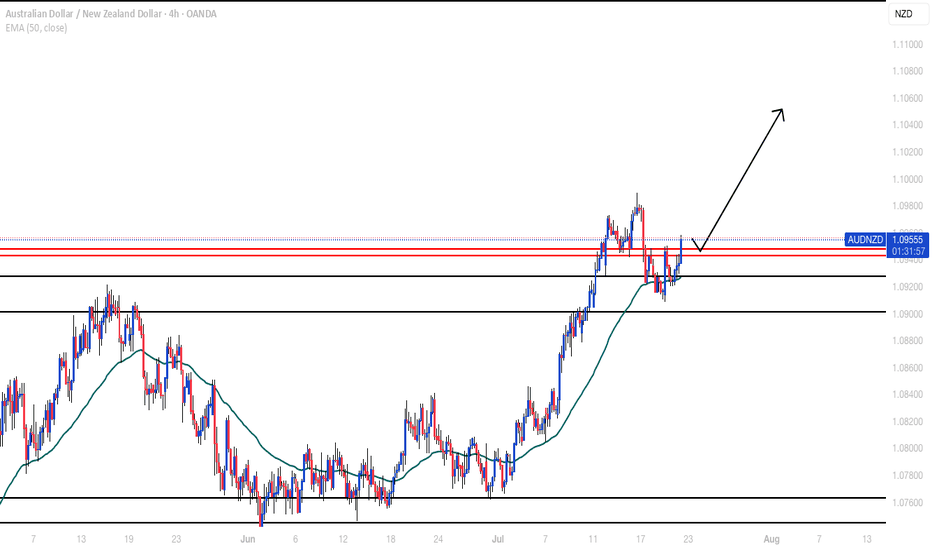

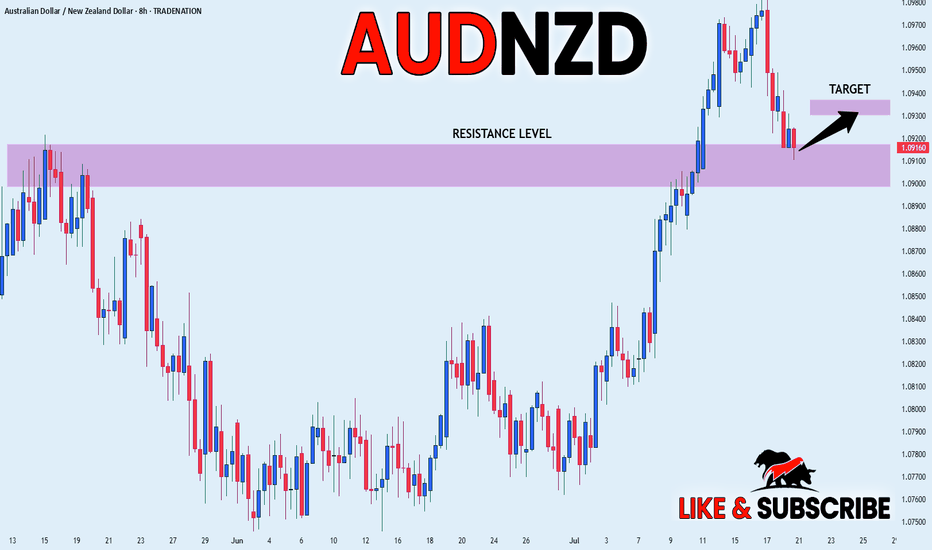

AUD_NZD GROWTH AHEAD|LONG|

✅AUD_NZD fell down sharply

But a strong support level was hit at 1.0910

Thus I am expecting a rebound

And a move up towards the target of 1.0930

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

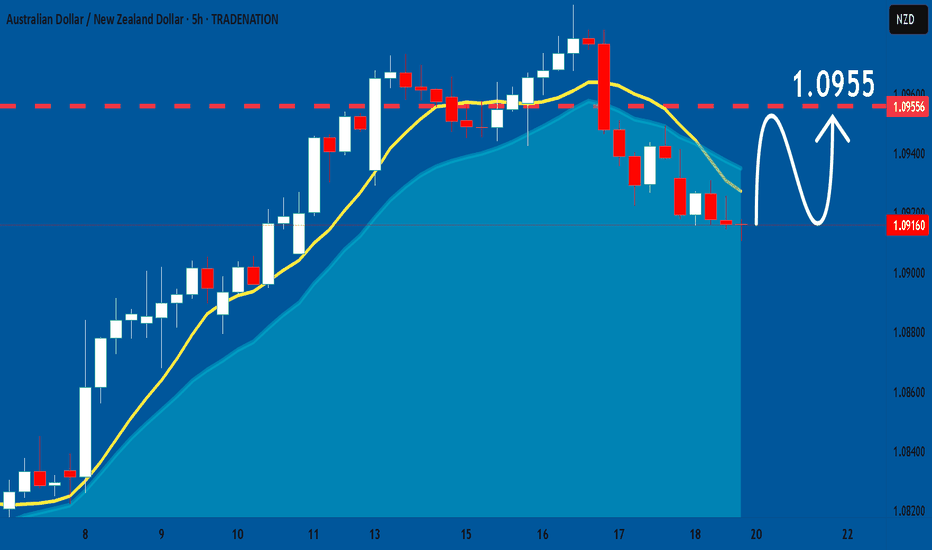

AUDNZD: Growth & Bullish Forecast

The analysis of the AUDNZD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

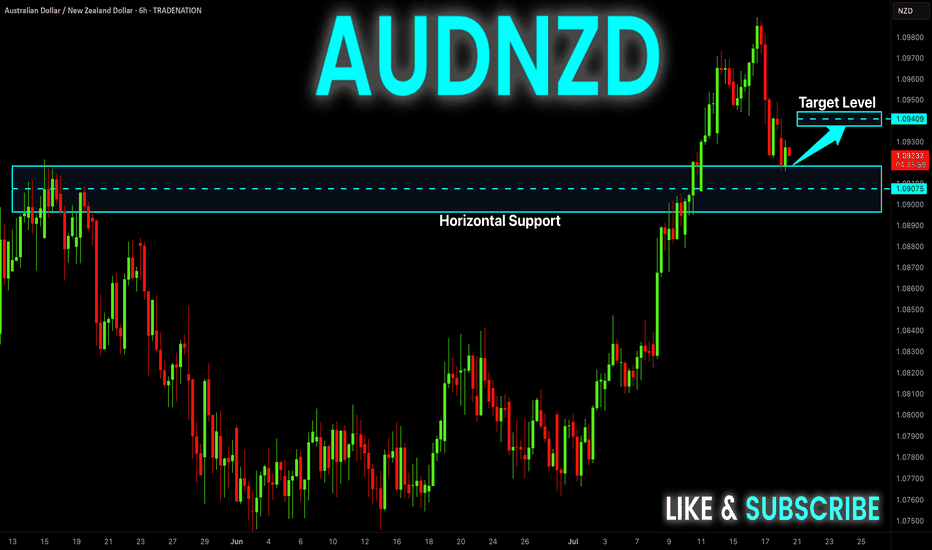

AUD-NZD Rebound Expected! Buy!

Hello,Traders!

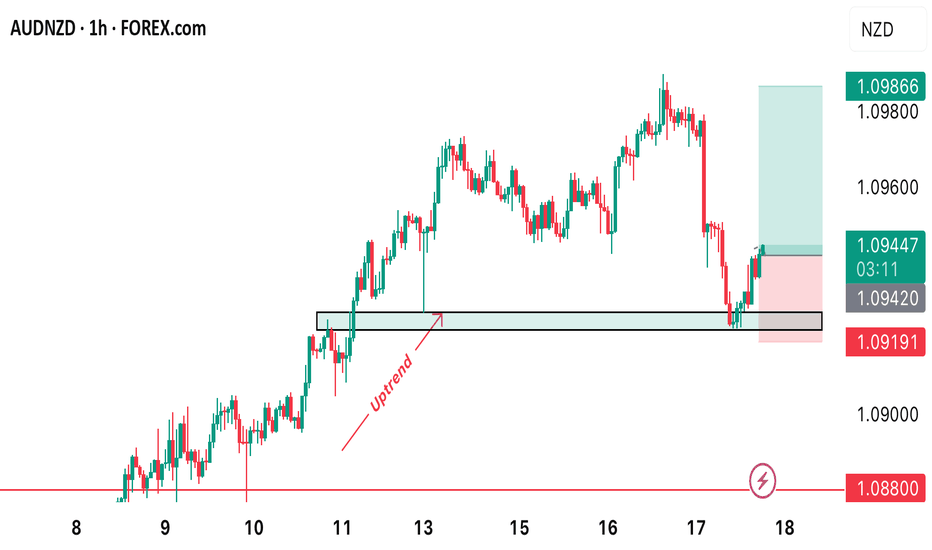

AUD-NZD is making a retest

Of the horizontal support

Level of 1.0909 and as the

Pair is trading in an uptrend

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

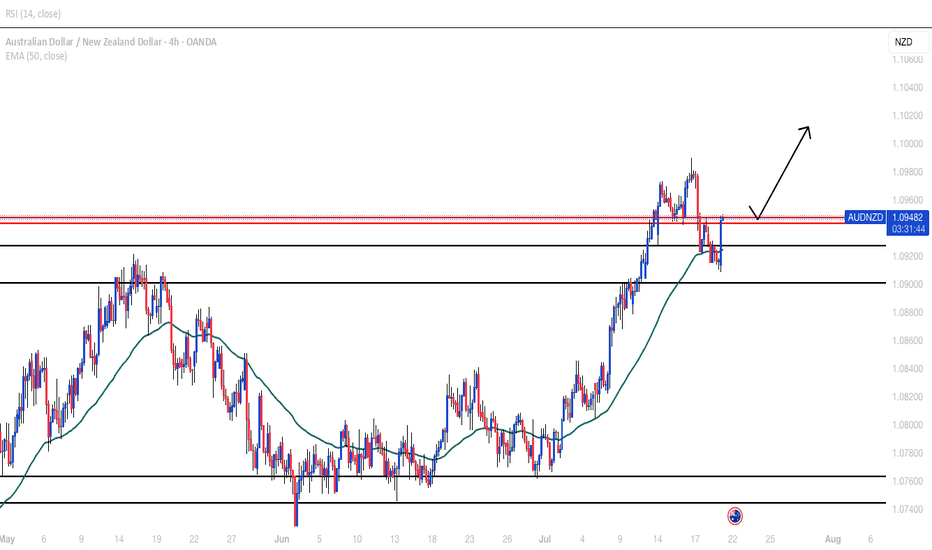

Fakeout or Pullback?The only signal that makes me lean more toward a fakeout rather than a clean pullback is the distance between the 100 and 200 moving averages and the current price.

At the moment, price is struggling around the 50 MA, and there’s a clear gap between it and the longer-term averages.

We need to give the market some time and see which direction gains confirmation. Until then, we stay patient and watch for clearer signals.

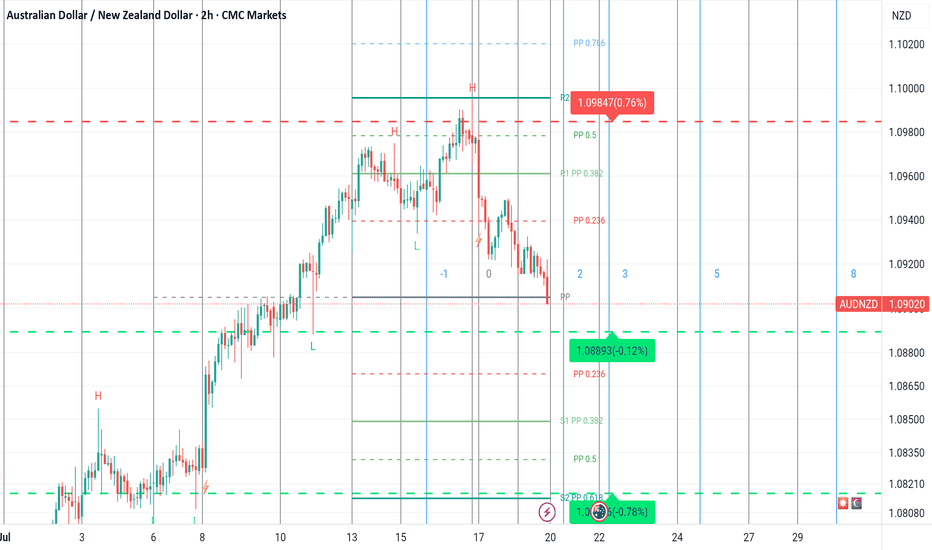

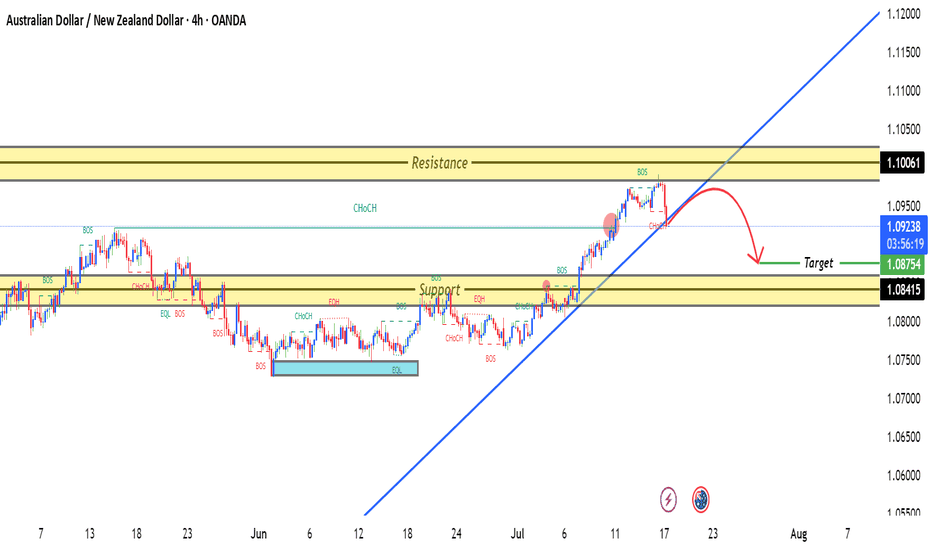

AUDNZD - Short-Term Pullback Expected from Key ResistanceAUDNZD - Short-Term Pullback Expected from Key Resistance

📈 Setup Overview:

AUDNZD has been trending bullish but has now reached a critical resistance level that aligns with the upper boundary of the ascending trendline. This confluence suggests a potential short-term pullback opportunity.

🔍 Analysis:

Strong bullish wave structure intact

Price testing key resistance + ascending trendline upper boundary

Expecting retracement toward trendline support

Overall bullish structure remains favorable for continuation after pullback

📊 Trade Details:

Entry: Sell Stop at 1.091745

Risk Management: 1:2 Risk-to-Reward Ratio

Bias: Short-term bearish pullback within larger bullish trend

⚠️ Risk Disclaimer: This is not financial advice. Trade at your own risk and always use proper position sizing.

AUDNZD 4H TIME FRAME ANALYSISAUDNZD is currently in a short-term downtrend on the 4-hour chart. Price has been forming lower highs and lower lows, confirming bearish pressure. Recent candles show rejection at higher levels, supporting downside continuation.

1.09400 – 1.09550: Strong resistance zone where price was previously rejected multiple times.

1.09380 (your entry) aligns with a minor lower high, reinforcing this level as a valid sell area.

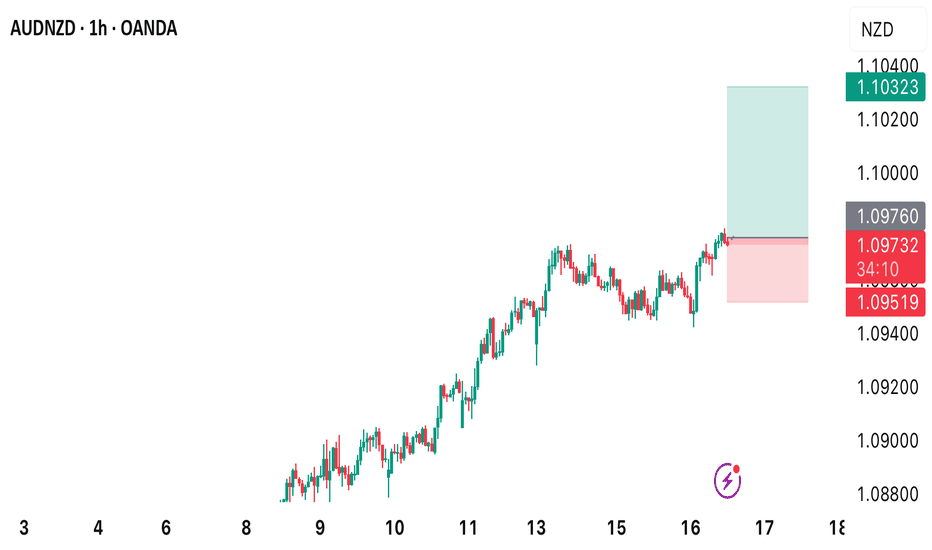

AUDNZD Breakout: Long Opportunity in Ascending ChannelToday I want to share with you a Long position opportunity in AUDNZD ( OANDA:AUDNZD ).

Let's first take a brief look at the AUDNZD fundamentals .

RBNZ kept rates at 3.25% , signaling likely further cuts in August.

RBA paused at 3.60% , but dovish bias remains; markets expect more easing ahead.

As NZD is more pressured by immediate rate cuts than AUD, the fundamental setup favors a bullish AUDNZD.

Now let's find a long position for AUDNZD using technical analysis .

AUDNZD seems to have managed to break through the Heavy Resistance zone(1.0963 NZD-1.0870 NZD) and is moving near the Support zone(1.0964 NZD-1.0954 NZD) on the 1-hour time frame .

AUDNNZD is also moving in an Ascending Channel .

I expect AUDNZD to rise at least to the Resistance lines , the second target is the Resistance zone(1.103 NZD-1.0993 NZD).

Note: Stop Loss(SL): 1.0944 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

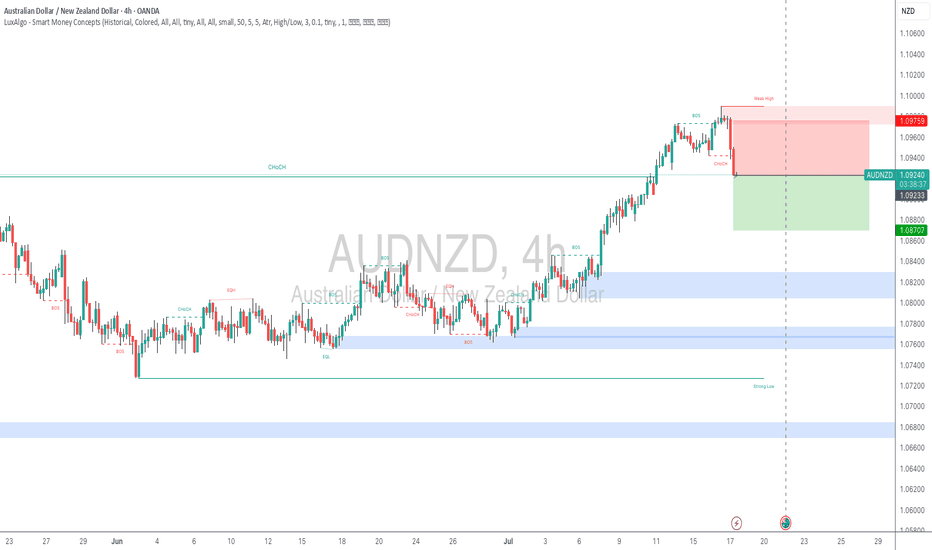

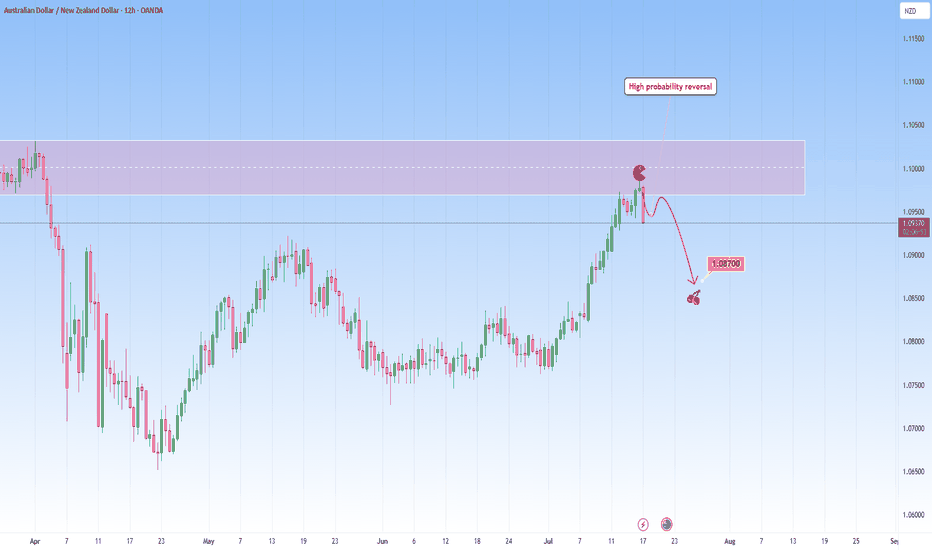

AUDNZD: Ongoing Reversal from ResistanceI am watching for a reversal on AUDNZD as marked on my chart, expecting a reversal with a downside target at around 1.08700.

This is a high probability setup taken into account the overextended upside move to this resistance zone.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

AUDNAZD at the Trendline resistance AUDNZD has recently been trending in a bullish wave. However, the pair has reached a key resistance level aligned with the upper boundary of the ascending trendline. This suggests a potential short-term pullback. Price action indicates that AUDNZD may retrace towards the trendline support before resuming its upward movement in alignment with the prevailing bullish structure.

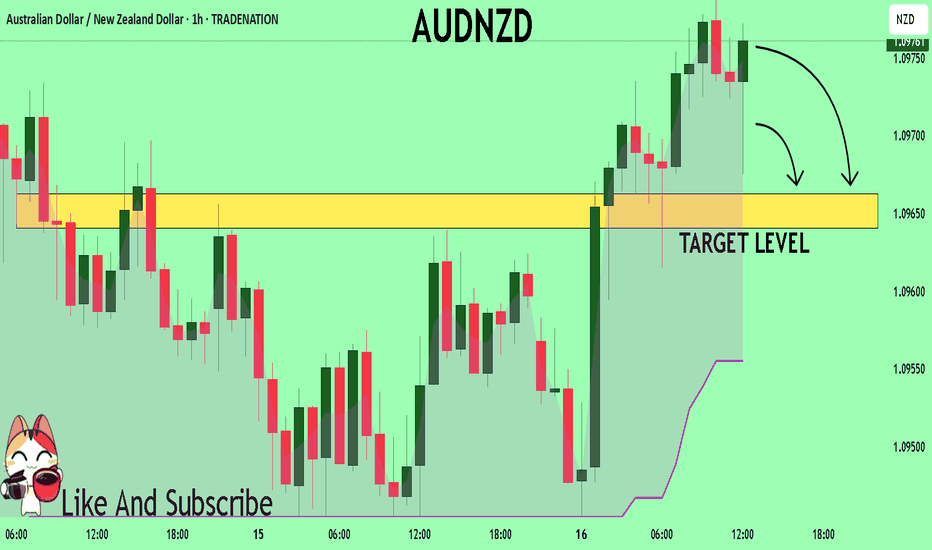

AUDNZD Under Pressure! SELL!

My dear followers,

This is my opinion on the AUDNZD next move:

The asset is approaching an important pivot point 1.0975

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0966

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDNZD - sentiments Bullish - BUY AUDNZD is trending in bullish trend with HH and HL. Market has took correction from fib level of 0.382-0.5 which is a good support level. Futher, market has shown channel which is a continuation pattern.

we can instant enter in the market with our SL below last HL. Targets are TP1 and TP2 with a R:R of 1:1 and 1:2.

Stealing Pips Like a Pro – AUD/NZD Long Heist, MA Breakout Setup🎯 AUD/NZD Heist: Bullish Bank Robbery 🚀💰 (Thief Trading Style)

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Robbers, 🤑💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to loot the AUD/NZD "Aussie vs Kiwi" Forex Bank!

🔎 The Heist Setup (Long Entry Focus)

🐂 Bullish Breakout Strategy:

Entry: Wait for MA breakout (1.08150) then strike!

Alternative Entry: Place Buy Stop above MA OR Buy Limit near pullback zones (15-30min timeframe).

Pro Tip: Set an ALERT for breakout confirmation!

🛑 Stop Loss (Thief’s Safety Net):

"Yo, listen up! 🗣️ If you're entering via Buy Stop, don’t set SL until after breakout!

Thief’s SL Zone: Nearest swing low (1.07500 – 3H timeframe).

Adjust SL based on your risk, lot size, and trade plan.

🎯 Profit Targets:

1st Target: 1.08600 (or escape earlier if cops lurk!).

Scalpers: Only scalp LONG! Use trailing SL to protect gains.

⚠️ Critical Heist Rules:

Avoid news chaos! 🚨 No new trades during high-impact news.

Lock profits with trailing stops.

Cops (Bears) are strong near resistance – don’t get caught!

💥 Boost the Heist!

💖 Hit the "Boost" button to strengthen our robbery squad! More likes = more 💰easy money heists!

Stay tuned for the next big steal! 🏆🚀🐱👤

AUDNZDHigher Highs (HH) & Higher Lows (HL): The pattern of higher highs and higher lows is an indication of an uptrend, showing that the buying momentum is strong.

Entry: Place a buy stop order just above the recent higher high (HH). This allows you to enter the trade if the price continues moving upward, confirming the bullish momentum.