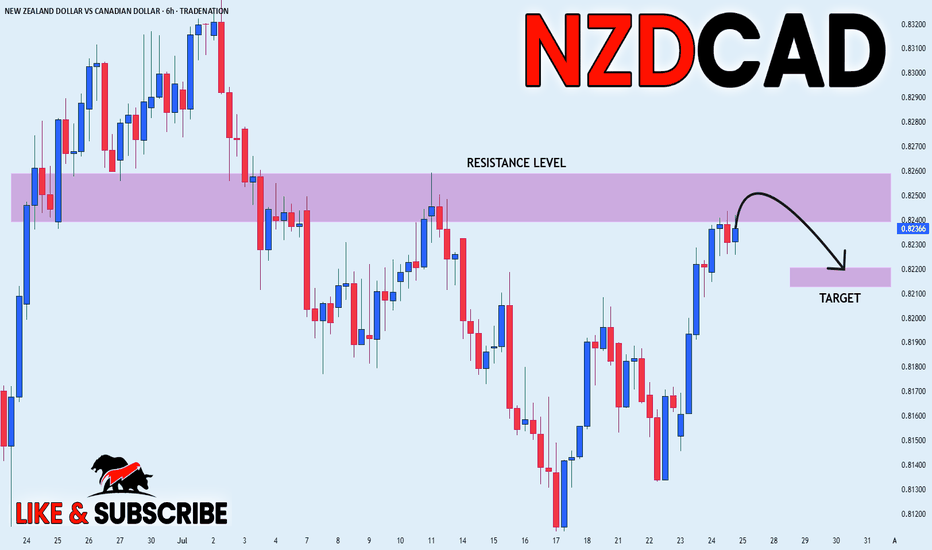

NZD_CAD POTENTIAL SHORT|

✅NZD_CAD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 0.8260

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD trade ideas

NZD/CAD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

NZD/CAD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 5H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.817 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CAD BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

NZD/CAD is trending down which is obvious from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a great trend following opportunity for a short trade from the resistance line above towards the demand level of 0.814.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

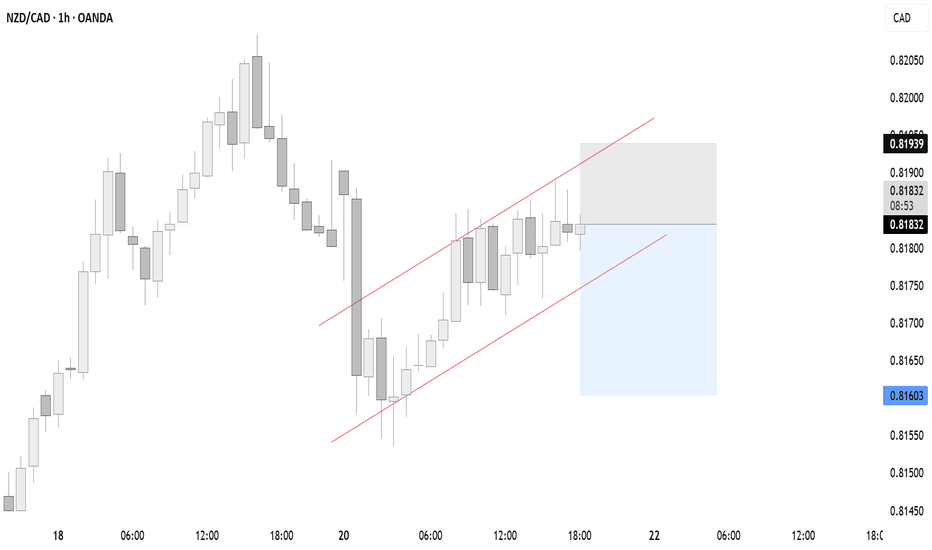

NZDCADThis is a 1-hour chart of NZDCAD, and you’ve clearly marked a descending channel with multiple respected touches on both trendlines — showing clean market structure.

Analysis:

- Price is approaching the upper boundary of the descending channel again.

- There’s a potential supply zone just above current price.

- The blue projection suggests a possible rejection from that upper zone, continuing the overall bearish trend.

- Repeated reactions at the channel edges signal strong technical respect.

What to Do Next:

- Wait for bearish confirmation (e.g. rejection wick, bearish engulfing) at the upper trendline/supply zone.

- If confirmed, enter a sell trade with targets toward the lower boundary of the channel.

- Place stop-loss just above the supply zone or last swing high.

Suggested Caption for Social Media:

"NZDCAD playing beautifully within this descending channel. Watching closely for a bearish reaction at this key zone. Patience is power in trading. Let the market speak. 📉🔥 #ForexAnalysis #NZDCAD #PriceAction #SmartTrading"

Let me know if you want it in a more casual or motivational tone.

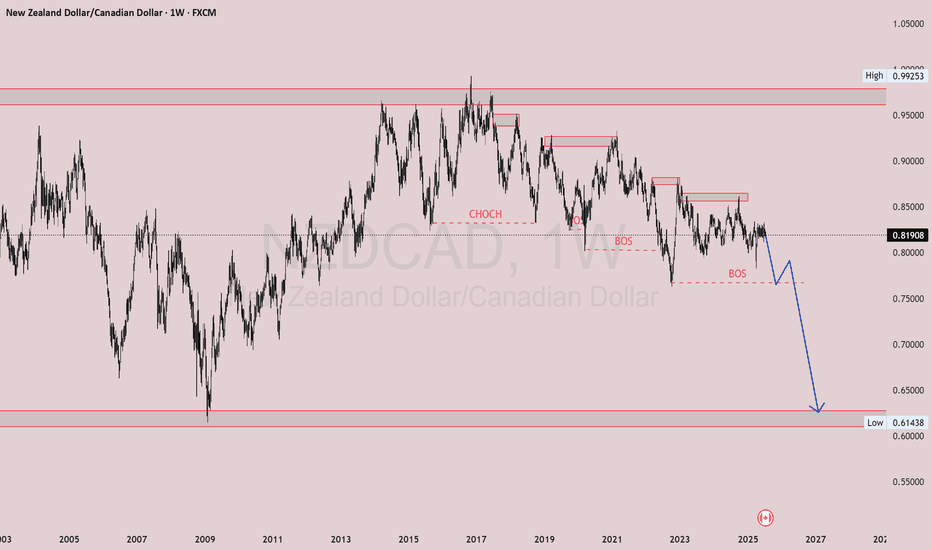

NZDCAD Weekly NZDCAD Weekly Outlook 🔍📉

After a clean CHoCH, price has continued forming lower highs and lower lows, confirming the bearish trend. We've now had multiple BOS, and price is respecting supply zones.

The chart shows a strong potential for a further drop, especially if the current structure fails to hold. Expecting price to continue down to the next major demand zone marked on the chart.

Bias: Bearish

Plan: Watching for a pullback into supply, then continuation to the downside.

This is a classic example of structure leading direction. Stay patient, wait for confirmations. 📊

---

You can also say:

"Smart money never rushes. Structure first, entry second. Let’s see how NZDCAD plays out."

[LONG] NZDCAD Daily bullish. 4H shifted bullish gears signal BUYCOT data suggests institutions are buying NZD less than CAD by the COT Friday release.

Marked on the daily chart, a bullish break of structure.

If we look at 4H timeframe, an internal bullish structure happened last Friday. This can be a signal that the Daily correction/pullback is done.

An internal bullish shift of structure is a confirmation that price may now continue its DAILY bullish move targeting the highs at 0.83441

NZDCAD Long Trade 1:1.37 OANDA:NZDCAD Long Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Institutions are Bullish, price is at good support, buying pressure is good also.

Risking 1% to make 1.37%

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Idea on a chartTrump letter 35% tariff on Canada. Trump has hit Canada very nard with a 35% tariff rate.

Trump says will send tariff letters informing EU, Canada of the rates by Friday

Trump's letter to Canada - The Canada dollar has fallen sharply with Trump's 35% tariff rate on the country

The US dollar has jumped higher with 'risk' getting slammed.

The Canadian dollar a notable slide:

NZD/CAD THIEF TRADING ALERT: Bullish Loot Ahead – Are You In?🔥 NZD/CAD Heist: Bullish Loot Ahead! 🏴☠️💰

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba! 🚀

💸 The Master Plan:

Based on Thief Trading tactics (technical + fundamental analysis), we’re plotting a bullish heist on NZD/CAD ("Kiwi vs Loonie"). The vault is open—time to swipe the loot!

📈 Entry (Long Only):

Buy Limit Orders preferred (15-30min TF for pullbacks).

Aggressive? Enter anytime—just stick to the strategy!

🛑 Stop Loss (Protect Your Loot!):

Nearest swing low (4H TF) → 0.81500 (adjust based on risk & lot size).

Scalpers? Use trailing SL to lock profits!

🎯 Take Profit (Escape Before Cops Arrive!):

Primary Target: 0.83800 (or exit earlier if momentum fades).

⚠️ Warning (High Risk!):

Overbought? Yes. Bear traps? Likely.

Consolidation zone → trend reversal risk!

News releases? Avoid new trades—hedge or trail stops!

📊 Market Context:

Neutral trend (bullish bias forming 🐂).

Check: COT reports, macro trends, sentiment & intermarket signals BEFORE executing! 🔍 (go ahead to read 🔗🌏).

💥 Boost This Idea!

Hit 👍 LIKE & 🔔 FOLLOW to support the Thief Trading crew! More heists coming soon—stay tuned! 🚀

🚨 Reminder: Trade responsibly. This is NOT financial advice—just a risky, high-reward play. Manage your risk or get rekt!

NZDCAD– Potential Bulish SetupPerfect! Since you're planning a **swing buy** on NZDCAD, here’s an updated **heading** and **description** tailored for your bullish outlook:

---

📈 NZDCAD Swing Buy Setup – Bullish

NZDCAD is showing signs of a potential bullish reversal from a strong support zone, presenting a promising swing buy opportunity.

This setup is ideal for patient traders looking to catch the next leg higher. Always follow your trading plan and apply proper risk management.

NZDCAD Selling Trading IdeaHello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today NZDCAD analysis 👆

🟢This Chart includes_ (NZDCAD market update)

🟢What is The Next Opportunity on NZDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

NZDCAD is BullishPrice was in a downtrend, however the bulls seem to be warming up for assuming control of price action following the formation of a bullish divergence with double bottom reversal pattern formation. If previous lower high is broken with good volume then we can expect a bullish reversal as per Dow theory. Targets are mentioned on the chart.

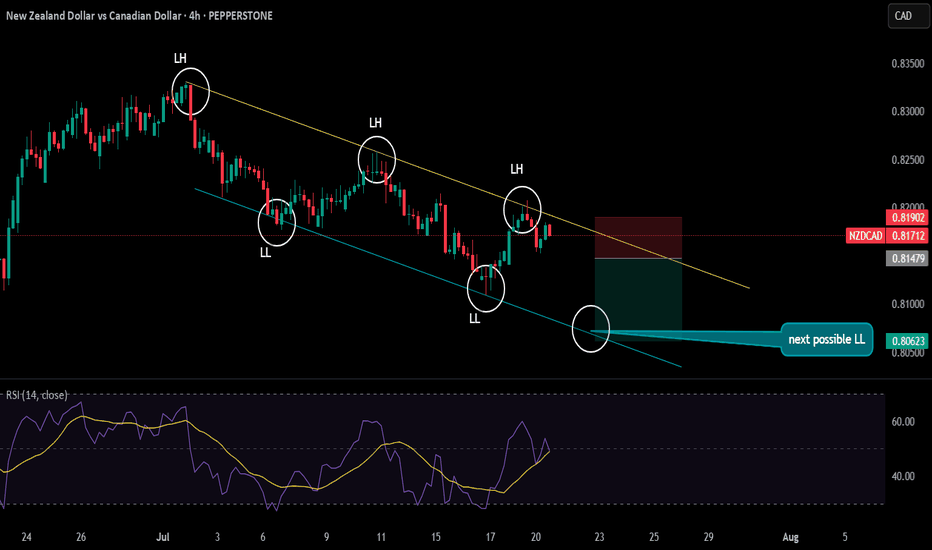

NZDCAD SHORT Market structure bearish on HTFs DH

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.82500

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 3.29

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

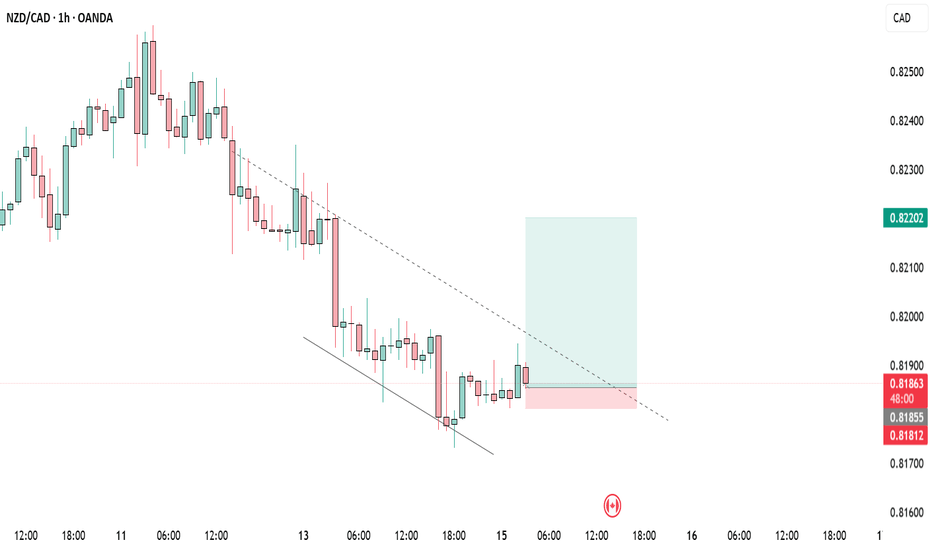

potential short setup on NZD/CAD🧠 Timeframe Sentiment Overview

Weekly (W): Bullish

Daily (D): Bullish

12H, 6H, 4H: Bearish

Bias: Weak bearish retracement inside HTF bullish trend. Caution advised—likely a counter-trend play or short-term pullback trade.

📉 Market Structure Analysis

Bearish BOS recently occurred on 4H with a sharp drop.

Price is now forming a potential lower high at previous support flipped resistance (around 0.82400–0.82550), shown in the red box.

Red arrow forecasts a continuation lower if price respects the short-term supply zone.

📊 EMA Confluence

Price is currently below both the 50 EMA (blue) and 200 EMA (red) → indicates a bearish short-term trend.

EMAs act as dynamic resistance in the supply zone.

🟥 Short Trade Setup

Entry Zone: Pullback into 0.82400–0.82577 (marked supply zone).

Stop Loss: Just above the red zone at ~0.82638.

Take Profit (TP): Weekly AOI at ~0.81680–0.81770, previous demand + liquidity zone.

Risk-Reward Ratio: Approximately 2:1 or better.

🔁 Strategy Notes

Since HTF is bullish (W + D), this is a counter-trend move, so confirmation (e.g. on 1H or 15m) is important.

Text on chart suggests waiting for 1H structure shift before executing the trade for better timing and lower risk.

✅ Confluences Supporting the Short

Clear 4H BOS and bearish momentum.

Bearish EMAs alignment (50 < 200).

Price entering previous support turned resistance.

Weekly AOI (target) is a high-probability demand zone.

Bearish momentum from 12H/6H/4H despite higher TF bullishness.

⚠️ Caution

Since W and D are bullish, price could bounce aggressively from the Weekly AOI.

Monitor LTF reaction closely for exit/reversal.

NZDCAD Sell ForecastNZDCAD New Forecast👨💻👨💻

This is my personal trade and not in anyway a mandatory setup.

Note:

Follow proper risk management rules. Never risk more then 2% of your total capital. Money management is the key of success in this business...... Set your own SL & TP.

Please support this idea with a Like and COMMENT if you find it useful click "follow" on our profile if you will like these type of trading ideas delivered straight to your email in the future.

Thanks for your continued support!! lemme know your thoughts in the comment sec..

Trade Idea: Buy NZD/CADWhy NZD?

✅ Strong Exports: NZ posted a $1.2B trade surplus (dairy & goods booming).

✅ Economy Improving: GDP growing at 1.4%, RBNZ supportive.

✅ USD Weakness: NZD rising as the US dollar loses steam.

Why CAD Could Struggle?

⚠️ Oil Dependency: If crude prices drop, CAD suffers.

⚠️ US Trade Risks: Trump tariffs could hurt Canada.

⚠️ High Unemployment: 7% and rising—pressures BoC.

Trade Setup

🔹 Buy NZD/CAD (expect NZD to rise vs CAD).

🔹 Watch: NZ trade data, oil prices, US-Canada trade news.

What Could Go Wrong?

❌ Oil spikes → CAD strengthens.

❌ US-NZ trade issues → NZD weakens.

Verdict: NZD looks stronger short-term—good odds for this trade. 🚀

NZDCAD: High-Conviction Long - Fundamental Strength & TechnicalThis analysis identifies an extremely high-conviction long opportunity in the NZDCAD currency pair 📈🇨🇦🇳🇿. Our conviction is primarily driven by a significant divergence in monetary policy outlooks and economic fundamentals between New Zealand and Canada. New Zealand's economic resilience, underpinned by robust dairy prices and a less dovish central bank stance, contrasts sharply with Canada's decelerating growth, rising unemployment, and a central bank poised for further rate cuts amidst trade policy uncertainties. Technically, NZDCAD appears poised for an upward move from key support levels, supported by bullish momentum indicators on the 4-hour chart. This is a medium-term trade expected to play out over days to weeks. 🗓️

I. Fundamental Rationale: Diverging Economic Trajectories 📊🌍

The core of this trade lies in the starkly different economic paths New Zealand and Canada are currently on, creating a compelling fundamental case for NZD appreciation against CAD:

Monetary Policy Divergence:

New Zealand (NZD): The Reserve Bank of New Zealand (RBNZ) maintained its Official Cash Rate (OCR) at 3.25% in June 2025. Analysts anticipate a hold at the upcoming July 9 meeting, balancing growth concerns with an "uncomfortably high near-term inflation outlook". This signals a less aggressive easing path. 🏦🇳🇿

Canada (CAD): In contrast, the Bank of Canada (BoC) held its policy rate steady at 2.75% in June 2025, after nine consecutive 0.25% cuts since June 2024. Market expectations for the upcoming July 30, 2025 meeting indicate a 33% chance of a further 25 basis point cut, with economists anticipating gradual cuts to 2.25% by mid-2025. This clear easing bias is driven by consistently below-target inflation (1.73% in May 2025). 📉🇨🇦

Impact: This creates a clear and widening interest rate differential fundamentally favoring the NZD. 💰

Inflation Outlook:

New Zealand: Annual inflation accelerated to 2.5% in Q1 2025, exceeding market expectations and marking the highest rate since June 2024. This reinforces the RBNZ's cautious stance. ⬆️

Canada: Canada's CPI registered 1.73% in May 2025, notably below the BoC's 2.0% target, providing ample justification for further monetary easing. ⬇️

Economic Performance & Labor Market:

New Zealand: GDP is projected to grow by 1.9% in 2025. The unemployment rate remained unchanged at 5.1% in March 2025, with average hourly earnings increasing by 4.5% annually. 💼✨

Canada: Real GDP contracted by 0.1% in April 2025, with a flash estimate pointing to another 0.1% decline in May, implying an annualized loss of 0.3% in Q2 2025. The unemployment rate rose to 7.0% in May 2025, its highest since September 2016 (excluding pandemic years). 📉🏭

Impact: New Zealand demonstrates greater economic resilience and a more stable labor market. 💪

Commodity & Trade Dynamics:

New Zealand: Benefits significantly from surging dairy prices, its top export commodity, which saw a substantial 10% increase in Q1 2025, with Fonterra forecasting record milk prices and production volumes. This contributed to a robust monthly trade surplus of $1.2 billion in May 2025. 🥛🧀💰

Canada: While the CAD maintains a strong positive correlation with oil prices, energy exports decreased by 5.6% in May, with crude oil exports falling 4.0%. Furthermore, Canadian exports to the US have declined for four consecutive months due to ongoing US tariffs. 🛢️📉

Impact: Strong commodity tailwinds and a healthy trade surplus for NZD, versus tariff-induced headwinds and declining energy exports for CAD. 🌬️

Yield Differential: The New Zealand 10-year government bond yield (4.57% as of June 30, 2025) is notably higher than Canada's (3.38% as of July 3, 2025). This provides a positive carry for holding NZD over CAD. 📊

II. Technical Rationale: Chart Insights (4-Hour Timeframe) 📈🔍

The technical picture on the 4-hour chart supports a bullish reversal from current levels, complementing the fundamental outlook:

Current Price Action & Long-Term Trend: NZDCAD is currently approximately 0.8277 (as of July 1, 2025). While short-term analyses may show a "sharp bearish trend," the pair is described as "trading in an uptrend and currently is in a correction phase" as it approaches a key support area. The 1-month change for NZDCAD is +0.13%, and year-to-date is +2.45%, indicating a longer-term bullish bias despite recent fluctuations. This corrective dip presents a favorable entry point. 📉➡️📈

Key Support & Resistance Levels:

Entry Point (0.8270) is strategically chosen near the immediate support cluster, specifically around the Pivot Point 1st Support of 0.8276 and an identified buying opportunity zone around 0.82700. ✅

Take Profit (TP) of 0.8350 is positioned just below the Pivot Point 3rd Level Resistance of 0.8356. 🎯

Stop Loss (SL) of 0.8220) is carefully placed below the key support levels of 0.8240 (Pivot Point 3rd Support) and 0.8236 (Pivot Point 3rd Support). A sustained break below this level would invalidate the bullish thesis. 🛑

Momentum Indicators:

RSI (14): The 14-day RSI for NZDCAD is around 41.78 to 54.33, suggesting a neutral to slightly bullish sentiment, with room for upward movement. 📊

MACD (12, 26, 9): A "bullish divergence" has been identified on the hourly timeframe, often signaling a return of buying interest. The MACD line is also observed to be slightly above its signal line, hinting at a potential bullish crossover. ⬆️

Moving Averages: The 50-day Simple Moving Average (SMA) is positioned slightly above the 200-day Exponential Moving Average (EMA). This configuration suggests a potential bullish crossover of longer-term moving averages, generally considered a positive long-term signal. 📈

III. Trade Setup: 📋✨

Currency Pair: NZDCAD 🇳🇿🇨🇦

Direction: Long (Buy) ⬆️

Entry Point: 0.8270

Take Profit (TP): 0.8350

Stop Loss (SL): 0.8220

Calculated Risk (in pips): 50 pips

Calculated Reward (in pips): 80 pips

Risk-Reward Ratio: Approximately 1.6:1 (A favorable ratio for a high-probability setup!) ✅

Key Considerations: Always adhere to strict risk management principles, risking no more than 1-2% of your total trading capital on this single trade. Be mindful of potential volatility around upcoming high-impact economic events in July, particularly the RBNZ and Bank of Canada interest rate decisions, and inflation data. 🗓️🔔

NZDCAD: Market of Buyers

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy NZDCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️