NZDCHF trade ideas

It will rise only if SNB decidesThe NZDCHF pair is showing strong signs of recovery as the New Zealand dollar gains support from positive economic data and expectations of interest rate hikes. Meanwhile, the Swiss franc is under corrective pressure after a prolonged rally. With a bullish reversal pattern forming on the technical chart and buying momentum gradually returning, NZDCHF has strong potential to continue its upward trend in the near future.

NZDCHF Reversal Builds as Trade Data Surprises Bulls Eye 0.5078NZDCHF has formed a clear inverse head & shoulders pattern on the 4H chart, with price currently hovering above the neckline at 0.4840. The technical breakout remains valid, with bullish targets at:

TP1: 0.4993

TP2: 0.5078

SL: Below 0.4740

🧠 Fundamental Update – NZ Trade Balance (Apr 21):

Latest Data:

Actual: +80M

Forecast: +510M

Previous: +510M

✅ Still positive, but below expectations

⚠️ Weaker-than-expected trade surplus may weigh on NZD short-term

Combined With Recent CPI Data (Apr 16):

Inflation rose to 2.5% YoY, higher than forecast but still within the RBNZ's target band

Most price pressures are seen as temporary (fuel, education)

RBNZ cut OCR to 3.5% in April and has left the door open to further cuts

Markets still fully price in a rate cut on May 28, with a projected floor of 2.75% by October

🌏 Global Context:

Trade tensions and slowing global growth (esp. from U.S. tariff risk) are driving demand for safe havens like CHF

ANZ economists have revised forecasts for additional RBNZ easing to 2.5%, citing weak global sentiment

🧭 Interpretation for NZDCHF:

Short-term:

✅ Positive technical structure

✅ Net trade surplus supports slight NZD demand

⚠️ Trade miss and dovish RBNZ tone keep bullish momentum cautious

Medium-term:

⚠️ Macro headwinds + expected RBNZ cut may limit upside

⚠️ Potential pullbacks if rate-cut sentiment strengthens into May

💡 Final Trade Strategy:

Bullish bias valid above 0.4840, but watch for volatility

Profit-taking recommended at 0.4993

Be cautious near 0.5078, especially before the May 28 RBNZ meeting

A close below 0.4740 would invalidate the bullish setup

NZDCHF: Short Signal with Entry/SL/TP

NZDCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NZDCHF

Entry Point - 0.4892

Stop Loss - 0.4962

Take Profit - 0.4769

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD/CHF BEARS ARE STRONG HERE|SHORT

Hello, Friends!

NZD/CHF is trending down which is clear from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a classical trend following opportunity for a short trade from the resistance line above towards the demand level of 0.477.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDCHF Will Go Up! Long!

Please, check our technical outlook for NZDCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 0.489.

Considering the today's price action, probabilities will be high to see a movement to 0.492.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZD/CHF Triangle Breakout (17.04.2025)The NZD/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.4886

2nd Resistance – 0.4916

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

NZD_CHF WILL GROW|LONG|

✅NZD_CHF is making a recovery

Move up and made a bullish breakout

Of the key level of 0.4860 so we

Are bullish biased and a

Further move up is to

Be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CHF Bullish Breakout! Buy!

Hello,Traders!

NZD-CHF made a bullish

Breakout of the key horizontal

Level of 0.4880 which is now

A support and as the breakout

Is confirmed we are locally

Bullish biased and we will

Be expecting further growth

After a potential local pullback

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCHF market outlookFX:NZDCHF

NZDCHF has came back and reached above its neck level of the QM pattern the second time, also having several demand zones reached and respected, pushing price upwards and forming a compression. We can keep an eye out on this pair and make decisions when it reaches the resistance zone once again. There are two possible scenarios that could happen, if it’s able to break above the resistance zone and close bullish candles, we can look for long opportunities and buy it to resistance 2 which is at 0.49630. If there is a strong rejection from resistance, we can then look for pullback and enter on shorts.

However, due to the fact that NZDCHF is still very bearish on the H4 and Daily timeframes, our bias should be bearish and prioritize selling opportunities. On sell trades, we may be able to hold the position longer and target different take profit levels.

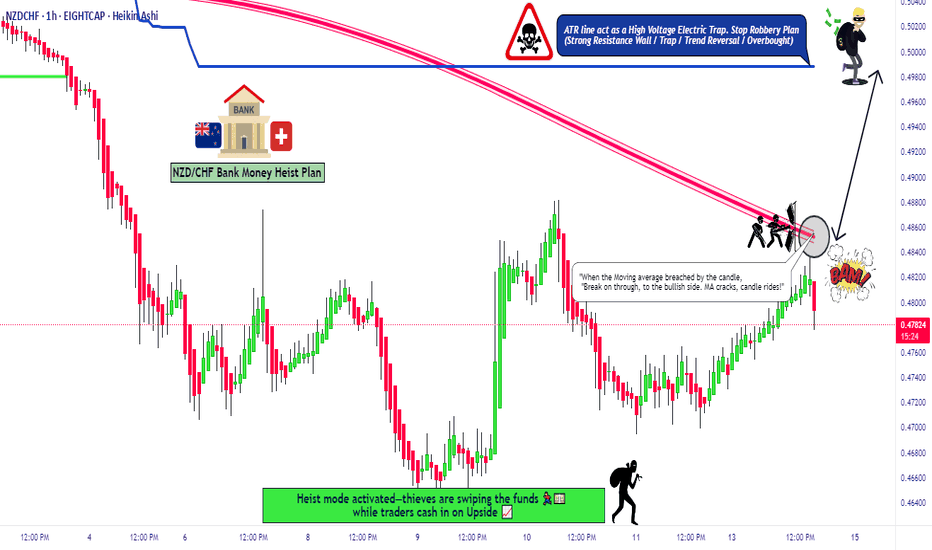

NZD/CHF "Kiwi-Franc" Forex Bank Heist Plan (Scalping/Day Trade)6 hours ago

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CHF "Kiwi vs Franc" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.48700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (0.47600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.49900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/CHF "Kiwi vs Franc" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZDCHF💡Chart analysis of the NZD/CHF currency pair (4-hour timeframe). The price is in a strong demand zone. The trader is waiting for a bullish candle to close to confirm the entry. The target is to reach previous resistance areas (swing highs). MACD indicator: The selling momentum on the indicator is beginning to weaken, supporting the bullish trend.

⛔️Not investment advice. For educational purposes only.

NZDCHF BUY?RSI on daily time frame is showing oversold which could be a sign of exhaustion.

Based on Daily & 4HR TF, the market seems to be forming a possible reversal pattern which could lead to a possible reversal.

We could see BUYERS coming in strong should the current level hold.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor

Bullish bounce?NZD/CHF is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 0.47071

1st Support: 0.46347

1st Resistance: 0.47992

1st Resistance: 1.1089

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.