NZD/JPY 4-Hour Timeframe AnalysisNZD/JPY 4-Hour Timeframe Analysis

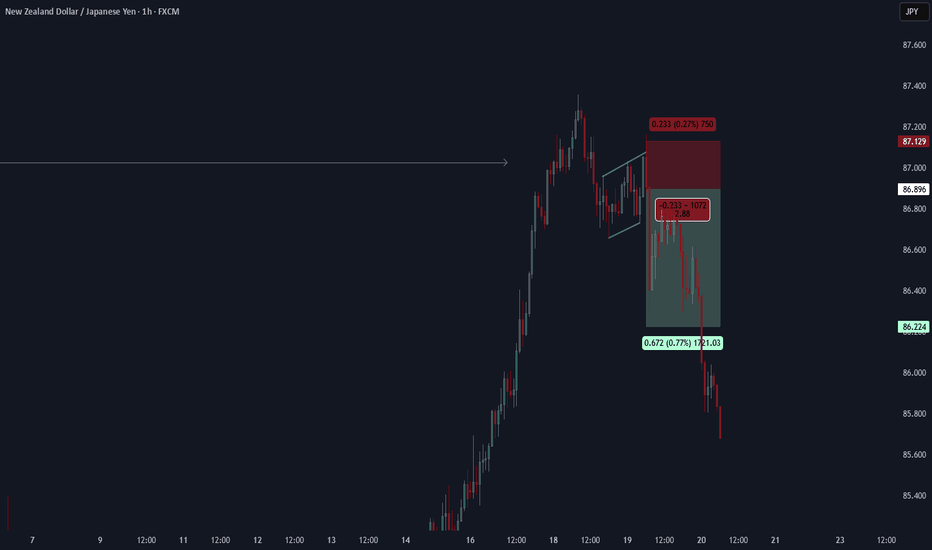

The NZD/JPY pair has been in a downtrend, showing a semi-consolidation phase on the 4-hour timeframe. A minor key resistance level at 86.500 has been established, where price initially attempted a breakout but later reversed, likely as a liquidity grab to trigger stop losses.

Currently, price is trading within a liquidity zone, and our strategy is to wait for a confirmed breakout above 86.500. A 4-hour candle close above this level would confirm bullish momentum, at which point we will look for a buy limit order at 86.900, anticipating further upside.

Key Technical Levels

🔹 Minor Key Resistance: 86.500 (Breakout Confirmation Level)

🔹 Buy Limit Entry: 86.900

🔹 Stop Loss (SL): 85.700

🔹 Take Profit (TP): 89.710 (Next Resistance Level)

Fundamental Insight

📈 NZD Strength:

Strong Economic Performance: New Zealand's economy continues to show resilience, with positive trade balance data and GDP growth, supporting the NZD.

Hawkish RBNZ: The Reserve Bank of New Zealand (RBNZ) remains committed to maintaining higher interest rates to control inflation, increasing demand for NZD.

📉 JPY Weakness:

Dovish Bank of Japan (BoJ): The BoJ maintains an ultra-loose monetary policy, keeping interest rates negative, which weakens JPY.

Lack of Intervention: While Japanese officials have expressed concerns about JPY depreciation, no concrete intervention has taken place, allowing further weakness.

Risk-On Market Sentiment: Investors are moving away from safe-haven assets like JPY, favoring higher-yielding currencies such as NZD.

Conclusion

Both technical and fundamental factors support a bullish outlook for NZD/JPY. A confirmed breakout above 86.500 could trigger further upside momentum, aligning with the broader fundamental landscape favoring NZD strength over JPY weakness.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

NZDJPY trade ideas

NZDJPY rallies to continue attract sellers?NZDJPY - 24h expiry

The primary trend remains bearish.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

The RSI is trending higher.

Bespoke resistance is located at 86.55.

We look to Sell at 86.55 (stop at 86.95)

Our profit targets will be 84.95 and 84.70

Resistance: 86.70 / 87.15 / 87.65

Support: 85.20 / 84.75 / 84.40

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Potential bullish rise?NZD/JPY has bounced off the support level which is an overlap support and could rise from this level to our take profit.

Entry: 85.54

Why we like it:

There is an overlap support level.

Stop loss: 85.10

Why we like it:

There is an overlap support level that tis slightly above the 61.8% Fibonacci retracement.

Take profit: 86.65

Why we like it:

There is a pullback resistance level that is slightly above the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD Bearish Momentum & JPY Strength: Double Top Setup NZD opens the week with strong bearish momentum, signaling potential downside continuation. Meanwhile, JPY gains strength amid USD weakness, adding to the pressure. With a failed bullish breakout, a possible double top formation could push prices down toward the 85.000 level. Will this key support hold, or is further downside ahead? Share your thoughts in the comments!

NZD/JPY "Kiwi vs Yen" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (85.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (83.800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 87.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

NZD/JPY "Kiwi vs Yen" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

⭐☀🌟Fundamental Analysis⭐☀🌟

Fundamental analysis focuses on economic and political factors influencing NZD (New Zealand Dollar) and JPY (Japanese Yen).

New Zealand (NZD):

Interest Rates: The Reserve Bank of New Zealand (RBNZ) sets the Official Cash Rate (OCR). As of early 2025, assume the OCR is around 4.5% (based on prior tightening cycles). Higher rates typically support NZD, but if inflation is cooling (e.g., below 3%), rate cuts could loom, pressuring NZD downward.

Economic Data: Key drivers include dairy prices (a major export), GDP growth (projected ~2% in 2025), and employment (assume ~4% unemployment). Weak dairy prices or slowing growth could weaken NZD.

Trade Balance: NZ relies heavily on exports to China. If China’s economy slows in 2025, NZD may face headwinds.

Political Stability: New Zealand is stable, so no major political risk unless unexpected elections or policy shifts occur.

Japan (JPY):

Interest Rates: The Bank of Japan (BOJ) has historically kept rates near zero (e.g., 0.1% in 2024). If 2025 sees a shift to 0.5% due to inflation pressures (e.g., above 2%), JPY could strengthen, but gradualism is likely.

Economic Data: Japan’s GDP growth is slow (~1%), with deflation risks fading. Strong export data (e.g., machinery, autos) supports JPY.

Safe-Haven Status: JPY gains in risk-off scenarios (e.g., geopolitical tensions or equity sell-offs).

Yen Carry Trade: Low rates make JPY a funding currency. If global risk appetite rises, JPY weakens as traders borrow yen to buy higher-yielding assets like NZD.

NZD/JPY Impact: Higher NZD yields vs. JPY favor bullishness, but JPY strength could emerge if global risk aversion spikes or BOJ tightens unexpectedly.

⭐☀🌟Macro Economics⭐☀🌟

Macro factors extend beyond fundamentals to broader economic cycles:

Global Growth: Assume 2025 global GDP growth is ~3%. Strong growth favors NZD (commodity currency), while slowdowns boost JPY (safe haven).

Inflation Trends: NZ inflation cooling (e.g., 2.5%) vs. Japan’s rising (e.g., 2%) could narrow the yield gap, pressuring NZD/JPY lower.

Monetary Policy Divergence: RBNZ pausing or cutting vs. BOJ tightening could shift NZD/JPY bearish.

Commodity Prices: NZD benefits from rising dairy, meat, and lumber prices. A commodity rally supports bullish NZD/JPY.

Currency Intervention: Japan may intervene if JPY weakens past 150 vs. USD (NZD/JPY less directly affected but still relevant).

⭐☀🌟Global Market Analysis⭐☀🌟

Equity Markets: Bullish global stocks (e.g., S&P 500 up 5% YTD) favor NZD (risk-on) over JPY (risk-off).

Bond Yields: Rising NZ 10-year yields (e.g., 4.8%) vs. Japan’s (e.g., 1%) support NZD/JPY upside.

Forex Trends: If USD/JPY is climbing (e.g., 148), JPY weakness could lift NZD/JPY. Conversely, USD/NZD strength signals NZD weakness.

Geopolitical Risks: Tensions (e.g., U.S.-China trade war escalation) boost JPY, capping NZD/JPY gains.

⭐☀🌟COT Data (Commitment of Traders)⭐☀🌟

COT reports from the CFTC show speculative positioning:

NZD Futures: If net long positions are rising (e.g., +10,000 contracts), bulls dominate. Net short (-5,000) signals bearish pressure.

JPY Futures: Heavy net short positions (e.g., -50,000) indicate JPY weakness (carry trade unwind risk). Net long suggests safe-haven buying.

NZD/JPY Inference: Bullish if NZD longs increase and JPY shorts persist; bearish if reversed.

Note: Exact COT data requires real-time access (e.g., CFTC release March 7, 2025). Check the latest report for precision.

⭐☀🌟Intermarket Analysis⭐☀🌟

NZD Correlations: Positive with AUD (0.8 correlation) and commodity indices (e.g., CRB). AUD/NZD strength or commodity rallies lift NZD/JPY.

JPY Correlations: Negative with equities (-0.7 vs. Nikkei). Equity declines strengthen JPY, pressuring NZD/JPY.

Gold: Rising gold prices signal risk-off, favoring JPY over NZD.

⭐☀🌟Quantitative Analysis⭐☀🌟

Technical Levels:

Support: 83.50 (50-day SMA), 82.00 (200-day SMA).

Resistance: 85.00 (psychological), 86.50 (Fibonacci 61.8% retracement from prior high).

RSI: At 55 (neutral), no overbought/oversold signal.

Bollinger Bands: Price near upper band (e.g., 84.80) suggests potential pullback.

Volatility: Implied volatility (e.g., 10% annualized) indicates moderate moves ahead.

Probability: 60% chance of testing 85.50 if bullish, 55% chance of 83.00 if bearish (based on historical ranges).

⭐☀🌟Market Sentiment Analysis⭐☀🌟

Retail Sentiment: If 70% of retail traders are long NZD/JPY (contrarian signal), a reversal may loom.

News Sentiment: Positive NZ economic releases vs. Japan’s cautious BOJ tone could tilt sentiment bullish.

⭐☀🌟Positioning (Next Trend Move)⭐☀🌟

Short-Term (1-4 weeks):

Bullish Target: 85.50 (break above 85.00 resistance).

Bearish Target: 83.50 (support test).

Medium-Term (1-3 months):

Bullish Target: 86.50 (if risk-on persists).

Bearish Target: 82.00 (200-day SMA breach).

Long-Term (6-12 months):

Bullish Target: 88.00 (multi-year resistance).

Bearish Target: 80.00 (if global recession hits).

Trend Direction: Mildly bullish short-term unless risk-off spikes.

⭐☀🌟Overall Summary Outlook⭐☀🌟

Current Price: 84.500.

Bias: Mildly bullish short-term due to NZD yield advantage and risk-on sentiment, but JPY strength could cap gains if global risks rise.

Key Drivers: RBNZ vs. BOJ policy, commodity prices, global risk appetite.

Prediction: Bullish to 85.50 short-term (70% probability) if equities hold; bearish to 83.00 (60% probability) if JPY safe-haven flows dominate.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

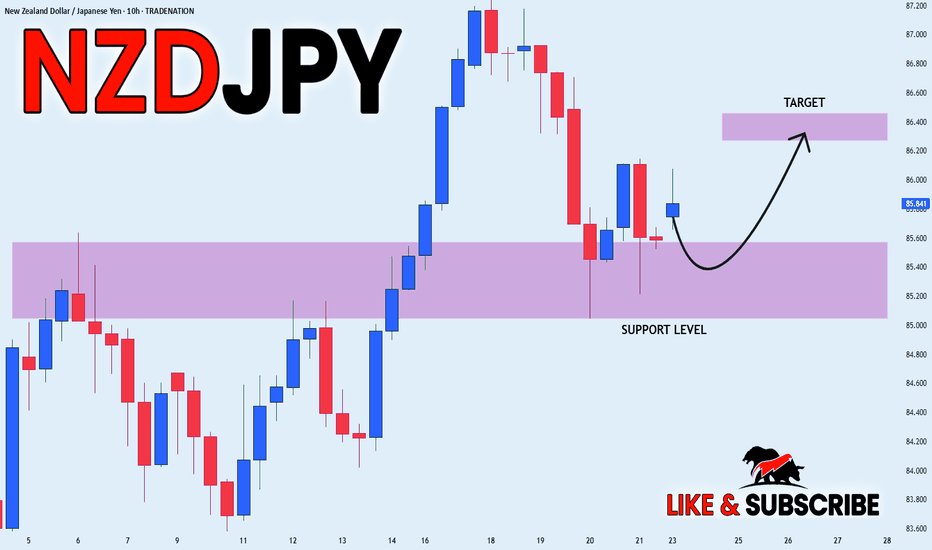

NZD_JPY WILL GO UP|LONG|

✅NZD_JPY has retested a key support level of 85.200

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 86.400 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD/JPY Bearish Opportunity – Resistance Rejection & Weak NZ Eco🔹 Current Price: 86.46

✅ TP1: 85.84 – First Support Level

✅ TP2: 85.22 – Intermediate Support

✅ TP3: 84.12 – Major Support Zone

🔻 Stop Loss: 87.57 (Above Resistance)

🔥 Why Are We Bearish?

1️⃣ Strong Resistance Rejection & Bearish Indicators

Price is rejecting a strong resistance zone (87.00-87.57), where sellers have stepped in before.

MACD Bearish Crossover confirms downside momentum.

RSI Reversal from Overbought suggests a cooling-off period for buyers.

2️⃣ Weakening New Zealand Economy

Consumer confidence dropped to 89.2 (previously 97.5) in Q1 2025, signaling economic slowdown.

New Zealand GDP expected to contract by 0.8% in 2025, adding bearish pressure.

The RBNZ remains cautious about interest rate hikes, reducing NZD's strength.

3️⃣ Technical Setup Aligns with the Short Trade

Key Resistance Holding: 87.00-87.57 area has historically rejected price.

Bearish MACD & RSI Divergence indicate momentum is fading.

Potential Breakdown to 84.12 if support levels fail.

📌 Conclusion

NZD/JPY is rejecting a strong resistance level, with bearish technical indicators and weak fundamentals in New Zealand’s economy supporting further downside. This setup offers a high-probability short trade for both swing traders and short-term setups.

NZDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring NZDJPY for a selling opportunity around 85.800 zone, NZDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 85.800 support and resistance area.

Trade safe, Joe.

NZD/JPY 1D // 18 March 2025 AnalysisWe can see the price approaching the downtrend on NZD/JPY on the daily timeframe.

Looking to see how the price reacts to the marked area of resistance around the 86.500 area and the trendline.

Potential swing sell situation with a target around the 83.826 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

NZDJPY - Shifting Trends Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉NZDJPY has been overall bearish , trading within the falling channel marked in red.

However, it is currently retesting the lower bound of the channel which lines up perfectly with the support zone marked in blue.

📈As per my trading style , as long as the support zone holds, I will be looking for buy setups on lower timeframes.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish bounce?NZD/JPY has bounced off the pivot and could rise to the 1st resistance level.

Pivot: 85.10

1st Support: 84.01

1st Resistance: 86.85

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDJPY is BullishPrice is in an uptrend, and has printed a higher high, it has also retraced to 0.618 printing a potential higher low, Moreover, it has also tested the 4 month old descending trendline. According to Dow theory, it would now go on and print a higher high. Targets are mentioned on the chart.

NZDJPY: Time For Pullback 🇳🇿🇯🇵

I see a nice opportunity to buy NZDJPY after a test of a key daily support.

As a confirmation, I spotted the insidebar pattern with a breakout

of the upper boundary of its range.

I expect a bullish movement at least to 85.75

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish drop?NZD/JPY has reacted off the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 86.85

Why we like it:

There is a pullback resistance level.

Stop loss: 87.63

Why we like it:

There is a pullback resistance level.

Take profit: 85.71

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.