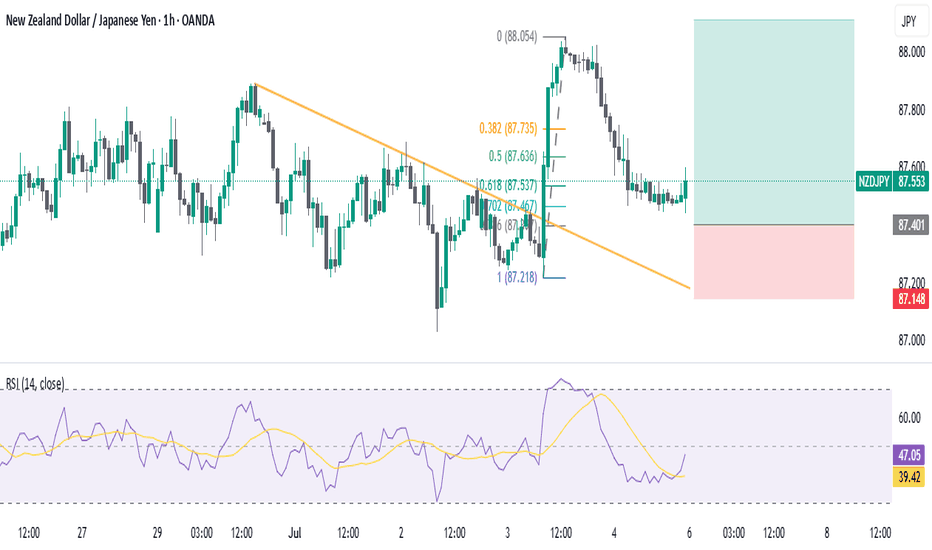

NZDJPY- Buy SetupNZDJPY 1H – Price has broken above a descending trendline and is showing bullish momentum. RSI is recovering from near-oversold levels, supporting the bullish bias. This entry aligns with the higher time frame trend, as NZDJPY remains bullish on both the 4H and Daily charts. Trade setup targets the continuation of the overall uptrend with a favorable risk-reward.

NZDJPY trade ideas

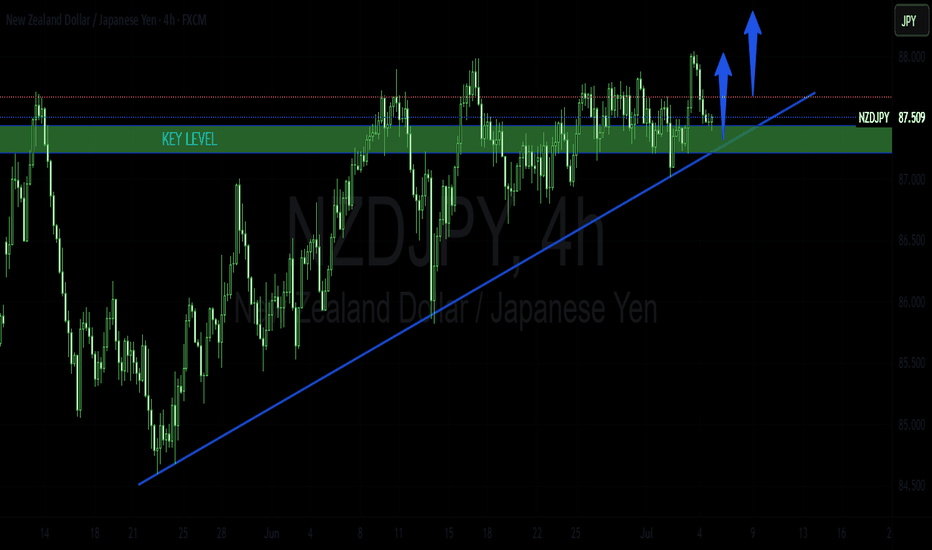

NZDJPY is in an ascending triangle?Looking at the technical picture, FX_IDC:NZDJPY is in an ascending triangle formation. According to the TA rules, such patterns tend to break to the upside, but a confirmation break is still needed. Let's dig in.

MARKETSCOM:NZDJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Trade closed manually. Plus USD short 'anticipation' trade? I have closed yesterday's NZD JPY trade for a small profit of +0.6. (to avoid NFP risk).

With an early close today due to independence day tomorrow, it's debatable whether there will be a post NFP opportunity.

I do think there is a case to say a pre event USD short 'anticipation' trade is a viable option. Something like an AUD or EUR USD - buy stop order a few minutes before the release. The reasoning being that the consensus is for a below forecast number, which would compound USD weakness.

The risk being NFP is particularly volatile and any triggered trade could whipsaw as the market digests the numbers.

Personally, it's not a trade I'll be attempting, I'm just saying I think it's a reasonable idea.

Wishing you a lovely weekend, today I'll be designated photographer as Michelle graduates her PGCE.

Weekly Review to follow, please feel free to offer thoughts or questions:

NZD JPY long NZD JPY long .. As discussed this morning, I feel the environment supports a 'risk on' trade. Today's US data hasn't altered my view.

I'm leaving the USD alone due to being wary of pre NFP profit taking.

Its a 20 pip stop loss with 30 pip profit target. The risk to the trade is negative sentiment or USD liquidity if dollar weakness returns.

I will close the trade before NFP if it's ongoing.

*Arguably the GBP has been a 'catalyst short' opportunity today. But I feel like I'm late to the party on that one.

Please feel free to offer thoughts or questions:

NZDJPY to find sellers at market price?NZDJPY - 24h expiry

Trading has been mixed and volatile.

Price action looks to be forming a top.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 87.80.

We look to Sell at 87.80 (stop at 88.00)

Our profit targets will be 87.00 and 86.85

Resistance: 87.80 / 88.00 / 88.25

Support: 87.20 / 87.00 / 86.75

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD_JPY WAIT FOR BREAKOUT|LONG|

✅NZD_JPY is trading in an

Uptrend and the pair has formed

A bullish triangle pattern

And we are bullish biased

So IF we see a bullish breakout

It will be our signal that

A bullish continuation is

Likely and we will be

Able to enter a long trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY Technical + Fundamental Short Alignment = Short SetupToday, I want to review the NZDJPY ( OANDA:NZDJPY ) pair short position from a fundamental and technical perspective . It seems to be in a good zone for a short position.

Do you agree with me?

----------------------------------------

First, let's look at the fundamentals of NZDJPY.

New Zealand (RBNZ):

The Reserve Bank of New Zealand cut the OCR by 25bps in May and hinted at further easing if inflation continues to cool. Recent CPI data has shown clear disinflation trends, increasing the likelihood of more rate cuts in the second half of 2025. Consumer confidence is also declining, and retail sales have been weaker than expected.

Japan (BoJ):

The Bank of Japan is under growing pressure to tighten monetary policy. Inflation remains above 2%, and market expectations for a rate hike later this year are building. Any shift from ultra-loose policy supports JPY strength, especially against weaker yielders like NZD.

Macro Summary:

Diverging monetary policies: RBNZ easing, BoJ possibly tightening.

NZD weakened by soft data, JPY strengthened by policy expectations.

Risk sentiment is currently neutral-to-negative, favoring safe-haven JPY.

Conclusion:

Short NZDJPY is fundamentally justified. The pair aligns with macro forces: NZD is pressured by rate cuts and weak growth, while JPY is poised to strengthen with upcoming policy shifts.

----------------------------------------

Now let's take a look at the NZDJPY chart on the 4-hour time frame .

NZDJPY is currently trading near the Potential Reversal Zone(PRZ) .

In terms of classic technical analysis , it appears that NZDJPY has successfully formed a Rising Wedge Pattern .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

Based on the above explanation , I expect NZDJPY to drop to at least 87.159 JPY if the lower line of the Rising Wedge Pattern and the Support zone(86.50 JPY-87.00 JPY) are broken, the second target could be 86.043 JPY .

Note: Stop Loss(SL): 88.378 JPY

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ Japanese Yen Analyze (NZDJPY), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

"(NZD/JPY) Kiwi-Yen Bandit Trade: Steal 200+ Pips This Week!"🚨 NZD/JPY Bank Heist: Loot the Kiwi-Yen Rally Before the Cops Arrive!

🌟Hola! Kia ora! Konnichiwa! Hello, thieves! 🌟

Attention all market bandits & profit pirates! 🏴☠️💰

Your favorite 🔥Thief Trading Crew🔥 is back with another high-stakes forex robbery—this time targeting the NZD/JPY "Kiwi vs Yen" vault!

🔓 The Master Plan:

Long entry = Our golden key to the bank.

Target: The high-risk Yellow ATR line (where traps lurk, but so do MASSIVE profits!).

Danger zone: Overbought signals, bearish ambushes, fakeouts—but we steal smarter!

📈 Entry Point:

"Vault doors cracked open—swipe those bullish gains NOW!"

👉 Pro thief move: Set buy limits near 15-30min swing lows/highs for sneaky pullback entries.

🛑 Stop Loss (Escape Route):

Thief SL: Hide below the 4H moving average (85.800).

Adjust based on your risk appetite & loot size.

🎯 Take Profit: 88.500 (Time to vanish with the cash!)

⚡ Scalpers’ Corner:

Only scalp LONG—no bearish bets!

Big stacks? Raid the market now.

Small budget? Join swing traders & execute the heist slow & steady.

Trailing SL = Your getaway driver. 🚗💨

💡 Why NZD/JPY?

Bullish momentum fueled by:

Fundamentals (COT data, macro trends)

Market sentiment & intermarket flows (Full analysis in bi0 linkks! 🔗👉👉👉)

⚠️ Heist Alert! News = Police sirens! 📢🚨

Avoid new trades during high-impact news.

Trailing stops = Your invisibility cloak.

💖 Support the Crew!

SMASH THAT BOOST BUTTON! 💥

Help us dominate the charts & loot daily with the Thief Trading Style! 💰🔥

Next heist coming soon… Stay sharp, thieves! 😎🔪

NZD-JPY Potential Short! Sell!

Hello,Traders!

NZD-JPY is slowly approaching

A horizontal resistance level

Around 87.994 so despite

The strong uptrend

We will be expecting a

Local bearish pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT FROM RESISTANCE|

✅NZD_JPY is set to retest a

Strong resistance level above at 88.000

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 87.341

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY to continue in the upward move?NZDJPY - 24h expiry

The primary trend remains bullish.

The selloff has posted an exhaustion count on the intraday chart.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 87.30.

We look to Buy at 87.30 (stop at 87.10)

Our profit targets will be 88.00 and 88.20

Resistance: 87.80 / 88.00 / 88.20

Support: 87.20 / 87.00 / 86.80

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD/JPY: Bullish Breakout or Another Fade?NZD/JPY hasn’t closed above the 200-day moving average since July 2024, racking up more than ten failed bullish breaks in that time—seven of them in the past month alone. If today’s probe finds more traction, it could be the catalyst to bring bulls off the sidelines, especially on a close above 88.00 where wedge and horizontal resistance intersect.

If that plays out, traders could look to initiate longs above 88.00 with a stop below it or the 200-day moving average for protection. Minor resistance sits at 88.39, offering a nearby hurdle for the setup. Should that give way, 89.20 or 90.00 stand out as logical upside targets.

Alternatively, if the pair fails at the 200-day moving average again, the setup could flip, allowing shorts to be established beneath the level with a stop above for protection. 87.00 or wedge support around 50 pips lower may come into play as downside targets.

Momentum indicators favour upside near term. RSI (14) has broken its downtrend and moved further above 50, while MACD is on the cusp of a bullish crossover, confirming the signal.

Good luck!

DS

Bullish bounce?NZD/JPY is falling towards the support level which is a pullback support that lines up with the 23.6% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 87.562

Why we like it:

There is a pullback support level that aligns with the 23.6% Fibonacci retracement.

Stop loss: 87.34

Why we like it:

There is a pullback support that aligns with the 50% Fibonacci retracement.

Take profit: 87.98

Why we like it:

There is a pullback resistance level that lines up with the 145% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD/JPY 2H Chart – Bullish Breakout from Symmetrical TriangleNZD/JPY has broken out of a symmetrical triangle pattern formed by points A to E, signaling a potential bullish continuation. The breakout above the triangle resistance occurred near the 87.3 zone, with price currently pulling back slightly for a possible retest. If the retest holds, the pair is likely to move toward the next resistance target at 88.376. The structure suggests strong momentum favoring buyers in the short term.

NZDJPY Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for NZDJPY is below:

The price is coiling around a solid key level - 87.737

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 87.205

My Stop Loss - 87.976

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY TECHNICAL AND FUNDAMENTALS DETAILED ANALYSISNZDJPY has just completed a bullish breakout from a well-defined symmetrical triangle on the 4H chart, confirming the start of a fresh impulsive move. Price action has broken cleanly above the descending trendline resistance around 87.400, supported by consecutive bullish candles with momentum. This breakout structure is signaling trend continuation, and I’m now targeting 89.500 as the next key resistance zone. The pair has also held higher lows consistently, showing strong bullish pressure in the medium term.

Fundamentally, the New Zealand Dollar remains supported by the Reserve Bank of New Zealand’s persistent hawkish stance. With the RBNZ maintaining higher interest rates to combat sticky domestic inflation, NZD has found strong backing in recent sessions. On the other hand, the Japanese Yen continues to weaken across the board, with the Bank of Japan maintaining ultra-loose monetary policy and no real signals of tightening. Japan’s latest inflation reading came in weaker than expected, further dimming any hawkish BOJ bets.

Today’s sentiment also reflects a global risk-on environment, with equities up and commodity-linked currencies like NZD benefiting. This reinforces bullish momentum in NZDJPY, especially as yield differentials between New Zealand and Japan favor carry trades. Technically, the pair could see brief pullbacks toward 87.100–86.900, which may offer fresh entries for bulls aiming to ride the breakout wave toward 89.500.

With technical confirmation, bullish momentum, and a supportive macro backdrop, NZDJPY looks well-positioned for further upside. I’ll be watching for sustained price action above the breakout zone, and any dips will be viewed as buying opportunities. The trend is up, and momentum is real—this is a textbook breakout setup aligned with both fundamentals and price action.