New Zealand's central bank expected to lower rates by a quarter-The New Zealand dollar has rebounded on Tuesday. NZD/USD is trading at 0.5615, up 1.3% on the day. This follows a 5% plunge over the past two days.

The Reserve Bank of New Zealand is widely expected to lower interest rates by a quarter-point at its rate meeting on Wednesday. The markets have priced in a quarter-point cut at 75% and a jumbo half-point cut at 25%. The RBNZ slashed rates by a half-point in February, a response to weak economic growth and an inflation rate of around 2%, the midpoint of its target band.

The market meltdown and escalation in trade tensions due to new US tariffs could force the RBNZ to lower rates faster and deeper than previously expected. There is massive uncertainty in the air and the central bank will have to re-evaluate inflation and growth expectations, given the tariff turmoil.

There is growing talk of a global recession, which would badly hurt New Zealand's export-reliant economy. China is New Zealand's largest trade partner and the escalating trade tensions between the US and China could turn into a New Zealand nightmare. China has imposed 34% reciprocal tariffs on the US, drawing a threat from President Trump that he will counter with a 50% tariff if the Chinese tariff is not removed.

The RBNZ is dealing with the tariff crisis without Governor Adrian Orr, who suddenly resigned last month in the middle of his five-year term. The government has appointed Christian Hawkesby as Governor for a six-month term, after serving as the acting governor after Orr resigned.

NZDUSD trade ideas

NZDUSD 2 scenarios I have 2 scenarios for NZDUSD

1: Bearish scenario : according to last strong bearish movement it can continue bearish trend and break weekly support. for this scenario we need to break the 0.56880 support level and trendline first. if it broken it would touch 0.55921-0.55131 and then according to strength of trend, we will find out whether it can break this support level (0.55921 - 0.55131) or not. (I would update idea)

2. Bullish scenario : according to important and strong weekly support level and that it's hard to price to break it. trend can revers on it and start a bullish trend. for this scenario we need price to break the 0.58179 - 0.58825 resistance level.

If any of these scenarios happen, it can make a big move.

I will definitely update my analysis.

It's just my personal analysis and I have no responsibility for your trades. thanks for your attention.

RBNZ rate decision coming upWe are keeping a close eye on the RBNZ interest rate decision and if it will stick to its 25bps cut, or not. Let's dig in.

FX_IDC:NZDUSD

MARKETSCOM:NZDUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

NZD/USD NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

NZD/USD Forecast: Bulls Aiming Higher from 0.55351I initiated a buy signal on NZD/USD based on precise insights from the EASY Trading AI strategy. Entered at 0.55351, with Take Profit set at 0.56173333 and Stop Loss at 0.54792333. The EASY Trading AI system's algorithms have identified bullish accumulation signals alongside improving market sentiment and technical indicators confidently breaking minor resistance zones. This combination of bullish momentum and technical reinforcement supports a short-term price rally towards my indicated Take Profit. Keep risk management tight and maintain discipline.

LONG ON NZD/USDNZD/USD has been oversold since last week.

It has finally given a change of character (choc) on the lower timeframe witching to bullish.

it is currently in the pullback/retracement phase of the new change.

With the dollar in a overall downtrend and getting ready to fall, this correlation should cause the NZD/USD pair to rise.

I have brought NZD/USD looking to make 200-300 pips this week.

NZDUSD: Long Trading Opportunity

NZDUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy NZDUSD

Entry - 0.5560

Stop - 0.5509

Take - 0.5667

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDUSD INTRADAY loss of support at 0.5680NZD/USD maintains a bearish outlook, reinforced by the prevailing downtrend and a confirmed break below the previous consolidation zone.

Key Resistance Level: 0.5680 – previous support turned resistance

Downside Targets:

0.5520 – initial support

0.5460 and 0.5370 – longer-term bearish targets

An oversold bounce may retest 0.5680, but unless the pair breaks above this level, a bearish rejection could reinforce downside continuation toward the key support zones.

A daily close above 0.5680, however, would invalidate the bearish scenario, potentially shifting momentum toward 0.5780, with further gains to 0.5850.

Conclusion

NZD/USD is bearish below 0.5680. Watch for rejection at that level to confirm further downside potential. A break and daily close above 0.5680 would shift the outlook to bullish, opening the path toward 0.5780 and beyond.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NZDUSD triple bottom suggests more pain aheadIn this video, I break down a bearish technical setup on NZD, based on a triple bottom and descending triangle pattern, with a potential drop of over 700 pips.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

NZD/USD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

We are going long on the NZD/USD with the target of 0.568 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/USD Analysis: Exchange Rate Nears 2025 LowNZD/USD Analysis: Exchange Rate Nears 2025 Low

Less than a month ago, we analysed the NZD/USD chart and:

→ highlighted the key resistance level at 0.5800;

→ outlined a potential scenario involving a decline from that zone.

Now, the NZD/USD pair is trading close to its lowest level of 2025, recorded on 3 February near 0.5525. The latest surge in volatility appears to be driven by President Trump’s widely discussed decision to impose substantial tariffs on trade with multiple countries.

For context, the Australian dollar has fallen to a five-year low amid concerns that retaliatory trade measures could trigger a global recession. The New Zealand dollar, however, has remained somewhat more stable — possibly because traders are anticipating Wednesday’s Reserve Bank of New Zealand (RBNZ) meeting, where the central bank may signal efforts to stabilise the currency. According to Forex Factory, a rate cut from 3.75% to 3.50% is expected.

Technical analysis of NZD/USD chart

Price movements in 2025 have formed an ascending channel (marked in blue), but bears broke through the lower boundary late last week near the 0.5666 level.

This suggests that even if NZD/USD sees a short-term rebound, it may face resistance around that same level — a classic “break-and-retest” pattern often watched by traders.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Symmetrical triangle.NZDUSD is moving in a downtrend. I tried to draw lines, and it looks like a symmetrical triangle is more likely to be traded today. It's first seen that price attempted to push above the triangle, but it fell straight down again, leaving the upper side with a big wick, also known as a rejection candlestick. Price then continued to move below with a steady movement and steady pullback up again as well. I see that it's currently very deep back into triangle pattern, kind of making the whole pattern more invalid. I think another key factor to think about is that trend lines aren't always straight lines when it speaks to the market, it can also move in zones that extend beyond and below a trend line. At the current moment, price eventually managed to not just push below triangle, but is also gaining momentum down. So here is my trade. Hope you all find success.

NZD USD #0004 Short Position Trading - Passed weeks have shown a sign of a false breakout indicating buyer sentiment is not strong

- a strong signs for reversal may be in place.

- entry limit is placed at the last HIGH of the weekly candles indicating the area with the dense Liquidity Pool.

- SL and TP are as labeled in the diagram.

- biased is strongly short for this pair.

- Estimation of holding time 2-3 weeks the shortest.

#NZDUSDLevels where price reactions are most likely to occur during the day. Naturally, at each level, you can have buy and sell positions and you can freely use the levels for a new order or for TP of your postions. The levels are updated daily!

The results of price reaction to these levels will be shown in the upcoming videos.

NZD_USD RISKY LONG|

✅NZD_USD has hit a key structure level of 0.5520

Which implies a high likelihood of a move up

As some market participants will be taking profit from short positions

While others will find this price level to be good for buying

So as usual we will have a chance to ride the wave of a bullish correction

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD and NZD: WTH? RBNZ now in focusRisk aversion intensified on Friday, sending the Australian dollar down 4.56% and the New Zealand dollar 3.53% lower.

The declines followed a move by US President Donald Trump to impose a 10% tariff on imports from both Australia and New Zealand. Australian Prime Minister Anthony Albanese confirmed there would be no retaliation, noting the US represents less than 5% of Australia’s export market. New Zealand, with a higher 12% exposure, also ruled out countermeasures.

For the New Zealand dollar, markets will now be focused on this week’s Reserve Bank of New Zealand decision, where a 25-basis point rate cut is widely expected. Barring further tariff news, this could be the most important event determining whether this sell-off continues.

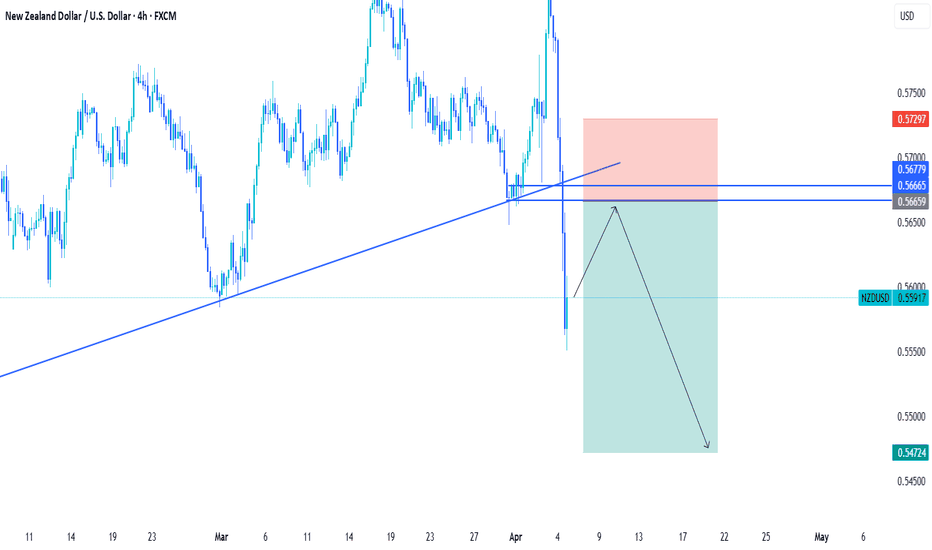

NZD/USD 4H Chart Breakdown – Trendline Breach & Bearish Setup📉 NZD/USD 4H Chart Analysis

1. Trendline Break 🚨

* Price was following a strong uptrend line (↗️)

* Broke below it sharply ➡️ Bearish sign

* Momentum shifted from bullish to bearish

2. Retest Resistance Zone 🔄

* After the drop, price bounced back into a blue resistance box (🧱)

* This was previous support → now resistance

* Classic "break → retest → drop?" setup forming

* Expecting a possible rejection here (✋)

3. Target Point 🎯

* Bearish continuation may push price to 0.55166 zone

* This is your target point (📍)

* Previous key support — might attract buyers again

4. Scenarios to Watch:

✅ Bearish Confirmation:

Price gets rejected at resistance (🧱)

Forms bearish candle (📉)

Continues down to target (🔽🎯)

❌ Bullish Invalidator:

Price closes above resistance zone (🔼)

Breaks back inside trend = Bullish comeback (🟢)

Current Bias:

🔴 Bearish unless price reclaims resistance above 0.5700

👀 Watch that zone closely for a potential entry signal