Santana Minerals - good project, but not a buy yetGday,

I believe the project is currently under-valued as a producing asset. However, it is not producing. They just applied for a Mining Permit today. From their announcement, a minimum of 6 months until resource consent is granted, maybe a little longer for the full permit. I'm not an expert about what steps would then be required after that.

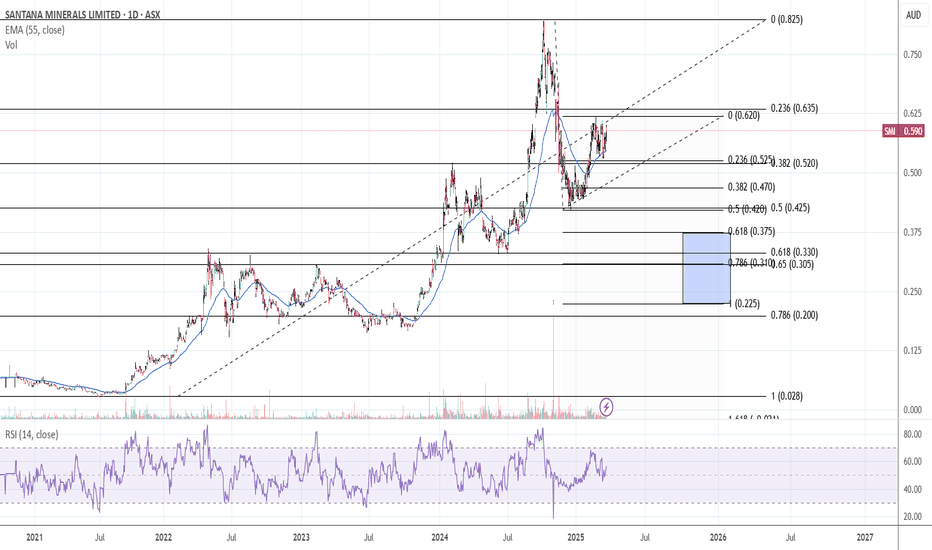

Then, they would have to commence construction... so production is a little ways off (3 years maybe???). So, I expect a number of investors will lose patience if the share price declines while physical gold continues higher. Some will sell and it MAY drop down into my blue box. I will re-evaluate the project and the timing should that happen. It may not happen, it may go to the moon without me on-board. But, the market is tough on explorers and developers these days. It all seems to be about cash-flow.

The gold grade seems good at >2g/ton. To some it may appear marginal, but check out Capricorn Metals on the ASX if that is how you feel. They are 3 years into production, grades LESS THAN 1g/ton of ore and they have an AUD 3.3B market cap and are netting 20% of gross income. If this project does anywhere near as well it is a screaming buy. But, I'll be waiting for lower prices simply because there are other projects out there that are (in my view) more undervalued and / or further on towards production. I was up 12% on Santana over a few months but sold and bought NTL at 0.049 two days ago... that is up 10% already.

SMI trade ideas

Santana MineralsGday,

I believe the project is currently under-valued as a producing asset. However, it is not producing. They just applied for a Mining Permit today. From their announcement, a minimum of 6 months until resource consent is granted, maybe a little longer for the full permit. I'm not an expert about what steps would then be required after that.

Then, they would have to commence construction... so production is a little ways off. So, I expect a number of investors will lose patience if the share price declines while physical gold continues higher. Some will sell and it MAY drop down into my blue box. I will re-evaluate the project and the timing should that happen. It may not happen, it may go to the moon without me on-board. But, the market is tough on explorers and developers these days. It all seems to be about cash-flow.

The gold grade seems good at >2g/ton. To some it may appear marginal, but check out Capricorn Metals on the ASX if that is how you feel. They are 3 years into production, grades LESS THAN 1g/ton of ore and they have an AUD 3.3B market cap and are netting 20% of gross income. If this project does anywhere near as well it is a screaming buy. But, I'll be waiting for lower prices simply because there are other projects out there that are (in my view) more undervalued and / or further on towards production. I was up 12% on Santana over a few months but sold and bought NTL at 0.049 two days ago... that is up 10% already.

Finer Market Points: ASX Top 10 Momentum Stocks: 31 Jan 2024 NASDAQ:PAA NYSE:FND ASX:FHS ASX:KM1 ASX:ZIP MIL:ALA BCS:LTM SIX:SMI SGX:CXU

Momentum leading shares are the market's best performers today. They are the fastest-growing shares on the ASX over the last 90 days. These companies can't get to be leaders without first appearing on our Launch Pad list.

The Launch Pad List is published weekly on Fridays.

Today's ASX's Top 10 Quarterly Momentum Stocks are:

Security (Security)

Pharmaust Limited (PAA)

Findi Limited (FND)

Freehill Mining Ltd. (FHS)

Kali Metals Limited (KM1)

ZIP Co Ltd. (ZIP)

Arcadium Lithium PLC (ALA)

LTM (LTM)

Santana Minerals Ltd (SMI)

Cauldron Energy Ltd (CXU)