China A50 bullish setupChina A50 remains in an uptrend, marked by higher lows since April and repeated bounces from the 50-day moving average. With both 50 and 200-day averages pointing higher, the bias favours playing from the long side.

A break and hold above 13812 would generate a bullish setup, opening the door for longs with stop beneath for protection. 13900 is the first hurdle, followed by 14000, with 14185 as a potential target. A clean break there would put 14409 in play. If the index can’t hold 13812, the focus flips back to the 50-day moving average as near-term support.

Good luck!

DS

CN50USD trade ideas

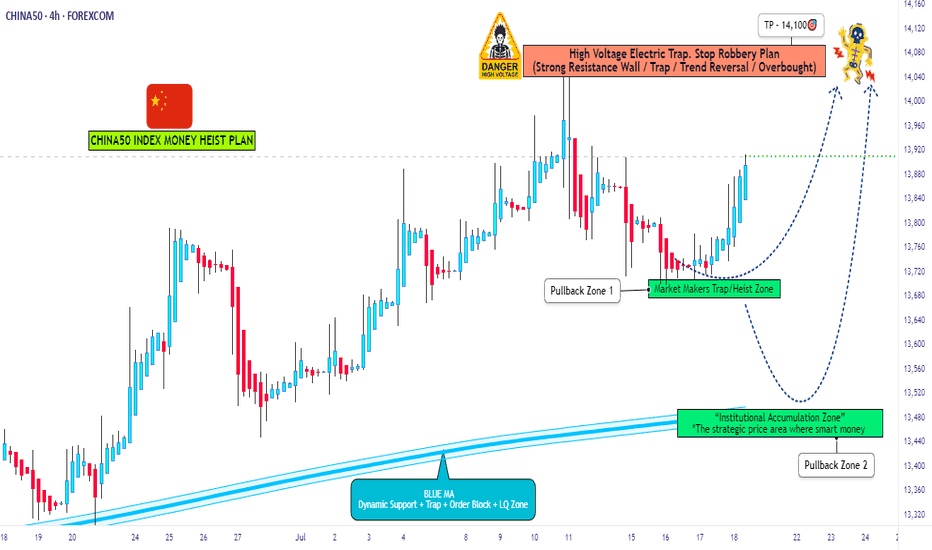

China50 Target Locked | Long Setup via Thief Strategy🏴☠️ CHINA50 Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the CHINA50 Index CFD like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 0.63700 after MA pullback

📍 Zone-2 Buy: Near 0.62800 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 13540 (4H swing low)

⛔ SL for Pullback-2: 13350

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 14100

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

CHINA50 shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

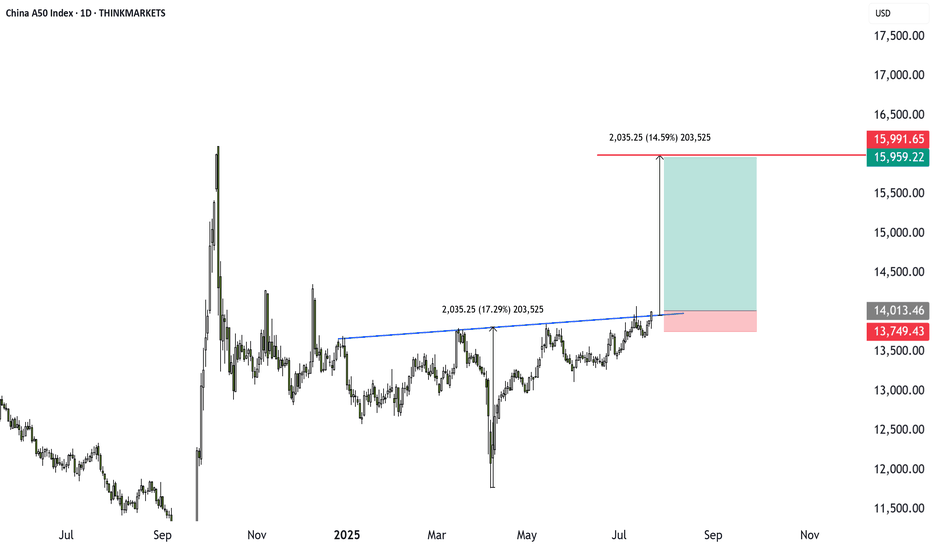

China A50 Breakout: 14% Opportunity Amid Summer Lull?Markets are quiet, but the China A50 is heating up. A bullish inverse head and shoulders pattern has formed, backed by stimulus hopes. Target upside is 14% with a strong risk-reward setup. Are you ready to trade it, or still on holiday?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

China50 to find sellers at current market price?CHN50 - 24h expiry

Selling posted close to the previous high of 13800.

13868 has been pivotal.

Bespoke resistance is located at 13800.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We look for a temporary move higher.

We look to Sell at 13795 (stop at 13890)

Our profit targets will be 13515 and 13435

Resistance: 13821 / 13905 / 14000

Support: 13764 / 13676 / 13638

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA A50: 1st 1W Golden Cross in 10 years.China A50 is close to making the first 1W Golden Cross in 10 years and the set up couldn't be more bullish after a consolidation of almost a year. The index is far off its ATH but still this Golden Cross can easily make it test the R1 level. Long, TP = 16,320.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

China50 to find sellers at current swing high?CHN50 - 24h expiry

Selling posted close to the previous high of 13800.

13868 has been pivotal.

Bespoke resistance is located at 13800.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We look for a temporary move higher.

We look to Sell at 13795 (stop at 13875)

Our profit targets will be 13555 and 13505

Resistance: 13699 / 13760 / 13800

Support: 13600 / 13510 / 13431

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

"CHINA50 Money Heist: Will You Join the Gang or Get Robbed?"🚨 CHINA50 HEIST ALERT: Bullish Loot & Trap Escape Plan! 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting the ultimate heist on the CHINA50 Index Cash market! Our master plan focuses on a long entry—targeting the high-risk Red Zone (overbought, consolidation, potential reversal). Beware: Bears are lurking, and traps are set! 🏆💸 Book profits fast, stay wealthy, and trade safe! 💪🎉

🔓 ENTRY: The Vault Is Open – Swipe the Bullish Loot!

Buy Limit Orders: Place within 15-30min (recent swing low/high).

Alert Recommended! Don’t miss the heist.

🛑 STOP LOSS: Escape Route

Set near the latest swing low or below 4H MA (~13150.00).

Adjust based on risk, lot size, and multiple orders.

🎯 TARGET: 13840.00 (or Run Before It Hits!)

Scalpers: Only long-side plays! Use trailing SL to lock profits.

Swing Traders: Execute the robbery plan patiently.

📡 MARKET INTEL: Why CHINA50 is a Bullish Target

Fundamental Drivers: Macro trends, COT data, geopolitics, sentiment.

Intermarket & Index-Specific Factors in play.

👉 For full analysis, check the linkss below! 🔗🔗

⚠️ TRADING ALERTS: News & Position Safety

Avoid new trades during high-impact news.

Trailing SL is a MUST to protect profits.

💥 BOOST THE HEIST! Hit Like & Follow!

Support the plan → More profits → Easier robberies! 💰🚀

Stay tuned for the next heist! 🤑🐱👤🤩

CHINA A50 MARKET ANAYALIS AND PRICE PREDICTIONCHINA A50 Has activated a reverse order at an Institutional order Block. The reverse SET UP is perfect and complete because renegotiation has succeeded and also failed in the opposite direction and a renegotiation trend line has been broken with shift candle creating an imbalance in the market. Decision has been taken in favor of the Bulls already. Price will retrace very little to mitigate the Bullish order Block and Give the Bulls a perfect entry. RNR( Renegotiation Resistance) is the Target. This move is the rally for this week.

Entry, Stop Loss and Take Profits are clearly stated on the Chat.

GOOD LUCK GUYS!

DISCLAIMER

Any Analysis Can Fail Based on Market sentiments and uncertainties. You are advised to take full responsibility of your capital and manage your risk!

CHINA50 to break to the upside?CHN50 - 24h expiry

A break of the recent high at 13506 should result in a further move higher.

A Morning Doji Star formation has been posted at the low.

The overnight dip has been bought into and there is scope for further bullish pressure going into this morning.

We look for gains to be extended today.

Buying continued from the 78.6% pullback level of 13375.

We look to Buy a break of 13511 (stop at 13412)

Our profit targets will be 13808 and 13858

Resistance: 13506 / 13647 / 13815

Support: 13375 / 13274 / 13137

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA50 to find buyers at market price?CHN50 - 24h expiry

Buying continued from the 78.6% pullback level of 13375.

Offers ample risk/reward to buy at the market.

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Daily signals are mildly bullish.

We look to Buy at 13385 (stop at 13280)

Our profit targets will be 13695 and 13765

Resistance: 13543 / 13647 / 13700

Support: 13386 / 13300 / 13170

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

InterSecting Trend Line and Shark Pattern There's a chance that the Chinese shark might dive from the 14,000, following the harmonic Shark pattern and Fibonacci level of 1.138.

The 1.138 Fibonacci level intersects with the Daily trendline, Indicating a strong possibility of another downturn! 📉

Keep an eye on the charts.

"CHINA50" Index CFD Market Bullish Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (13300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 4H timeframe (13000) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 13800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"CHINA50" Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Phantom Heist: Sniping CHINA50 Longs for Epic Loot!🌍 Salutations, worldly wealth seekers! Ola! ✨

Dear Coin Conquerors & Chart Corsairs, 💸⚔️

Crafted in the 🔥 Phantom Trader’s cauldron of technical wizardry and fundamental finesse 🔥, behold our cunning plot to pillage the “CHINA50” Index Market. Follow the chart’s secret map, zeroing in on long entries. Our prize? Slip away near the treacherous ATR Red Zone, where overbought whispers, consolidation, reversals, and ambushes lurk, with bearish bandits poised to strike. 🦹♂️💰 “Secure your loot and treat yourself, traders—you’re a force to be reckoned with!” 🎊💥

**Entry 📊**: The vault’s cracked open! Seize the bullish bounty at current prices—the heist is on!

For precision strikes, set buy limit orders on a 15 or 30-minute chart at the latest swing low or high. Pro move: activate chart alerts to stay ahead of the game!

**Stop Loss 🛑**:

📍 Phantom SL planted at the recent swing low on the 8H timeframe (13500.00) for day or swing trades.

📍 Tweak SL to match your risk appetite, lot size, and open orders.

**Target 🎯**: Eye 14350.00—or vanish early if the market gets slippery!

🧨 **Scalpers, keep your wits!** 👁️: Stick to long-side scalps. Deep pockets? Dive in now! Lighter funds? Join swing traders for the caper. Use trailing SL to protect your treasure 💎.

💴 **CHINA50 Market Raid (Swing Trade Snapshot)**: Hovering in neutral territory with a bullish flicker, fueled by pivotal market tides. ☝

📰 **Uncover the full story**: Dive into Fundamental Signals, Macro Trends, COT Insights, Geopolitical Waves, Sentiment Cues, Intermarket Links, Index Drivers, Positioning, and Future Targets for the complete intel! 👉🔗🌎

⚠️ **Trade Warning: News & Position Strategy** 🗳️🚨

Market-moving news can stir chaos like a storm. Safeguard your gains:

- Avoid new trades during news drops.

- Use trailing stop-losses to lock profits and defend open positions.

💪 **Fuel our plunder!** 💥 Hit the Boost Button 💥 to supercharge our profit-grabbing game. Join the Phantom Trading Style crew and stack riches daily with flair. 🏅🤝🚀

Rendezvous at the next market ambush—stay sharp! 🤑🐆🎯

Chinese Fear Head & Shoulders Pattern.Oh no! China's stock market is showing signs of a downturn!

The dreaded "head and shoulders" pattern is emerging, buyer volume is plummeting, and despondent sellers are circling like sharks!

Brace yourselves as the market takes a nosedive, plunging below the 1.13 Fibonacci level!

Get ready for some potential turbulence!

"CHINA 50" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (13400) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 12950 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CN50 to find sellers at previous support?CHN50 - 24h expiry

Price action looks to be forming a top.

There is no clear indication that the downward move is coming to an end.

Risk/Reward would be poor to call a sell from current levels.

A move through 13500 will confirm the bearish momentum.

The measured move target is 13350.

We look to Sell at 13600 (stop at 13700)

Our profit targets will be 13400 and 13250

Resistance: 13600 / 13650 / 13700

Support: 13500 / 13400 / 13350

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA 50 Index Cash Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50 Index Cash" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (13100) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 14400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50 Index Cash" Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CN50 / CHINA50 Indices CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CN50 / CHINA50 Indices CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (13500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (13150) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 14400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, On Chain analysis, Sentimental Outlook etc....

CN50 / CHINA50 Indices CFD market is currently experiencing a Bearish to Bullish 🐃 trend,., driven by several key factors.

➤🔰 Fundamental Analysis

Fundamental factors assess the intrinsic drivers of the CHINA50:

Economic Growth:

China’s GDP growth is projected at 4.5% for 2025 (per IMF estimates), down from 4.9% in 2024, reflecting slower private consumption and export contributions—bearish signal.

Policy Support:

Aggressive fiscal stimulus (e.g., RMB 5tn local government debt quotas) and monetary easing (PBoC rate cuts to 3%) aim to counter deflation and boost sentiment—bullish counterweight.

Corporate Earnings:

A50 companies (e.g., Kweichow Moutai, CATL) show mixed results: consumer staples hold steady, but tech and industrials face margin pressure from tariffs—neutral to bearish.

Trade Environment:

Trump’s tariffs (25% on Mexico/Canada, 10% on China) reduce export competitiveness, though transshipments may mitigate impact—bearish short-term, neutral long-term.

Property Sector:

Stabilization efforts (e.g., debt restructuring) reduce drag, but residential investment remains weak—neutral, with upside potential.

Explanation: Fundamentals are mixed—stimulus supports the index, but slower growth and trade pressures weigh it down, suggesting cautious optimism.

➤🔰 Macroeconomic Factors

Macroeconomic conditions globally and domestically influence the CHINA50:

China:

Inflation at 1.5% (core), negative output gap (-0.5%)—subdued demand pressures growth—bearish.

PBoC easing and fiscal expansion (4% deficit) signal robust support—bullish offset.

U.S.:

Fed rates at 3-3.5%, PCE 2.6%—USD softening (DXY ~105) aids Chinese exports—bullish for CHINA50.

Tariffs disrupt trade flows—bearish short-term impact.

Eurozone:

PMI 46.2 (Eurostat)—stagnation reduces demand for Chinese goods—bearish.

ECB at 2.5% supports global liquidity—mildly bullish.

Global:

Japan 1%, emerging markets mixed—slow growth limits export recovery—bearish.

Oil at $70.44—stable costs, neutral for Chinese firms.

Explanation: Macro factors tilt bearish due to global slowdown and tariffs, but domestic stimulus and USD weakness provide a bullish buffer.

➤🔰 Commitments of Traders (COT) Data

COT data reflects futures positioning:

Speculators:

Net long ~30,000 contracts (down from 40,000 at 2025 peak)—cautious optimism, suggesting room for upside—bullish.

Hedgers:

Net short ~35,000 contracts—stable, profit-taking by producers—neutral.

Open Interest:

~70,000 contracts—steady interest indicates sustained market focus—neutral to bullish.

Explanation: COT shows a balanced market—not overbought, with speculators still favoring upside, supporting a bullish lean despite recent cooling.

➤🔰 Geopolitical and News Analysis

Geopolitical events and news impacting the CHINA50:

U.S.-China Trade Tensions:

Trump’s 10% tariff on Chinese imports (escalated from earlier threats) strains exports—bearish. China vows to “resolutely counter” (Reuters, Mar 7), hinting at retaliatory measures—mixed short-term volatility, bearish long-term if unresolved.

National People’s Congress (NPC):

“Two Sessions” (Mar 5-7) set a 5% GDP target, upped defense spending 7.2%, and issued RMB 1.3tn in special bonds (CNBC, Mar 6)—bullish domestic signal, but analysts doubt sufficiency against trade headwinds (SCMP, Mar 6).

Global South Appeal:

Foreign Minister Wang Yi positions China as a stable power amid U.S. “chaos” (Bloomberg, Mar 7)—bullish for investor confidence in emerging markets.

Property Sector:

Ongoing stabilization efforts noted at NPC—neutral, reducing systemic risk but not yet driving growth.

Explanation: Geopolitical tensions (tariffs) weigh heavily, but NPC stimulus and China’s global positioning provide bullish offsets, creating a volatile yet supported outlook.

➤🔰 Intermarket Analysis

Relationships with other markets:

USD/CNY:

At 7.20 (hypothetical)—weaker yuan vs. USD aids exports, bullish for CHINA50, though tariff impact mutes gains—mixed.

Hang Seng Index:

~20,000 (assumed)—strong correlation with CHINA50, reflects similar stimulus/tariff dynamics—neutral to bullish.

S&P 500:

~5,990—range-bound, neutral correlation; U.S. risk-off could lift CHINA50 via safe-haven flows—mildly bullish.

Commodities:

Oil $70.44, iron ore $100/ton—stable, neutral for Chinese industrials; gold $2,930 signals risk-off—bullish for China as a hedge market.

Bond Yields:

China 10-year 2.5% vs. U.S. 3.8%—yield gap supports capital inflows—bullish.

Explanation: Intermarket signals are mixed—USD/CNY and bonds favor CHINA50, but global equities and commodities suggest cautious stability.

➤🔰 Index-Specific Analysis

Factors unique to the CHINA50:

Technical Levels:

50-day SMA ~13,400, 200-day SMA ~12,800—price below 50-day but above 200-day signals consolidation—neutral.

Support at 13,200, resistance at 13,500—current price tests support.

Sector Composition:

Financials (40%), consumer goods (25%), tech (20%)—financials steady, tech hit by tariffs—mixed impact.

Volatility Index:

Implied volatility at 18%—moderate, suggesting ±200-point daily swings—neutral.

Market Breadth:

60% of A50 stocks above 200-day MA—broad participation, mildly bullish.

Explanation: Technicals and composition suggest a market in transition—neither strongly bullish nor bearish, with potential to swing based on catalysts.

➤🔰 Market Sentiment Analysis

Investor and trader mood:

Retail Sentiment:

55% short at 13,260 (trending on X)—contrarian upside potential—bullish signal.

Institutional:

Mixed—Morgan Stanley sees volatility, Goldman targets 14,000 by Q4 2025—neutral to bullish.

Corporate:

Firms hedge at 13,500-13,600—neutral, awaiting clarity on trade.

Explanation: Sentiment leans bearish short-term due to trade uncertainty, but retail shorts and institutional targets hint at bullish recovery potential.

➤🔰 Next Trend Move

Projected price movements:

Short-Term (1-2 Weeks):

Range: 13,200-13,500.

Dip to 13,200 if trade data disappoints; rebound to 13,500 if stimulus details emerge.

Medium-Term (1-3 Months):

Range: 13,000-14,000.

Below 13,200 targets 13,000; above 13,500 aims for 14,000, driven by policy clarity.

Catalysts: Trade balance, tariff developments, PBoC actions.

Explanation: The index is at a pivot—short-term downside risks from external pressures, medium-term upside from domestic support.

➤🔰 Overall Summary Outlook

CHINA50 at 13,260.00 balances bearish pressures (global slowdown, tariffs, post-rally correction) with bullish drivers (stimulus, USD softness, COT longs). Technicals suggest consolidation, sentiment is cautious but not panicked, and fundamentals favor long-term recovery. Short-term, a dip to 13,200 is likely, with medium-term upside to 14,000 if policy offsets trade headwinds.

➤🔰 Future Prediction

Bullish: 14,000-14,500 by Q3 2025 if stimulus scales up, tariffs soften, and global demand rebounds—60% probability.

Bearish: 12,800-13,000 if tariffs escalate, growth falters, or stimulus disappoints—40% probability.

Prediction: Bearish short-term to 13,200 (trade uncertainty), then bullish to 14,000 by mid-2025 (policy support prevails).

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩