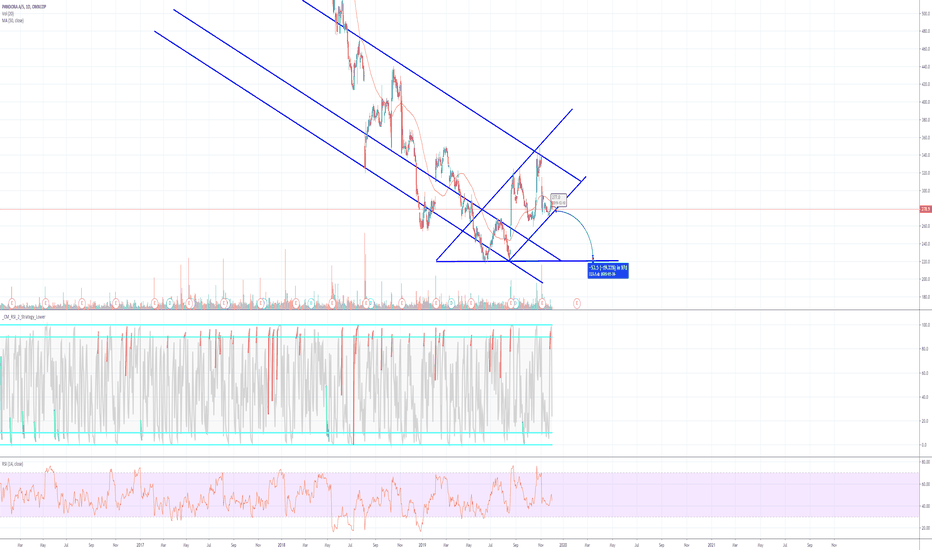

Pandora Bullish Technical AnalysisPandora is at a low point right now. It has a strong support under and some good support-points over. If Pandore gets a good support it will start a bullish trend. When is reaches the support it could go fast and go up a lot. Pandora will follow the OMX C25 Index and go up over the next few months.

PNDORA trade ideas

Will Pandora continue up the channel?Tuesday the annual earnings report was released and the stock jumped 17,6%.

Several finincial institutions have increased their price targets, e.g. Danske Bank from 310 to 365,

and a lot of large players are heavily invested. On the other hand, american hedgefond,

Coltrane Asset Management, increased their short position yesterday.

The stock is now at an interesting point as it's touching the MA89 and nearing the bottom of the

new channel that has formed since tuesday.

If it stays in the channel I think the following weeks can be very profitable, but it could also drop out

as it has been heavily shorted.

What do you think?

Is time for Pandora bearish positions over? Bullish perspectiveThe technical analysis matches with the fundamental perspectives, suggesting a new bullish time ahead after

two years of bearish trend. Immediately after rebounding from the 61.8 Fibo level (measurement taken from the big bullish move on a weekly trend) some news have suggested the interest of some Equity Funds of acquiring the danish company and, after that, other news have suggested the hiring of Rotschfield consultancy in order to help the company in case of a possible acquisition process. This has given the boost to the price, which is now showing in the 1W framework a clear bullish scenario under formation; important to mention that the short interest index shows now a value of just 5%, compared to the double digit value registered some until few weeks ago. The feeling is that the bearish strenght is becoming weaker and weaker.

Medium-Long Term Overview

In my analysis, the price is moving towards a next target of 516 DDK, which is the 50% retracement of the major uptrend move and at the same time is the 50 EMA in the Weekly.

After a short pullback, my long term view is the reaching of a target price in the range between 629 DDK and 671 DDK, corresponding to the area of both the 38.2% retracement of the big uptrend move and the 50% retracement of the big bearish move from 2016