Saga Pure - If you can’t get a hold of Bergen CarbonIs this liquidation down trend over? Saga Pure, here I come. Probably the most interesting newcomer 2021 is heading for listing on Euronext Growth after easter. A green gem called bergencarbonsolutions.com Impossible to get a hold of shares. And imagine the day of listing. Mental it will be. So what better way to expose yourself, buy Saga Pure? Currently holding 30% of Bergen Carbons shares and options to buy more and more. Saga Pure is also so much more. I will buy my tits off. Remember, this is only my evaluation, so your own investment choices. Good luck :)

SAGAO trade ideas

SAGA PURE - Highflyer for next yearsSaga Pure changed their business philosophy.

Focused on renevable energy, decarbonization & recycling plastic. Further more engagements are expected

The company is as an Holding Company/Wealth Management Player engaged in following companies:

Bergen Carbon (carbon fibre production prototype in test, need time for industrial machines)

Horisont Energi (going public done)

Pryme (needs lot of money to be a market leader), Going public done

Everfuel (actual in correction)

Seems that correction is ahead. But afterwards bright future for Saga Pure seems possible.

Red Flag (2h chart) is typically for a continuation pattern. SAGE Pure still in there.

Idea for new investors:

Take positions below 3 NOK.

Dan/17.02.2021

3.88 NOK

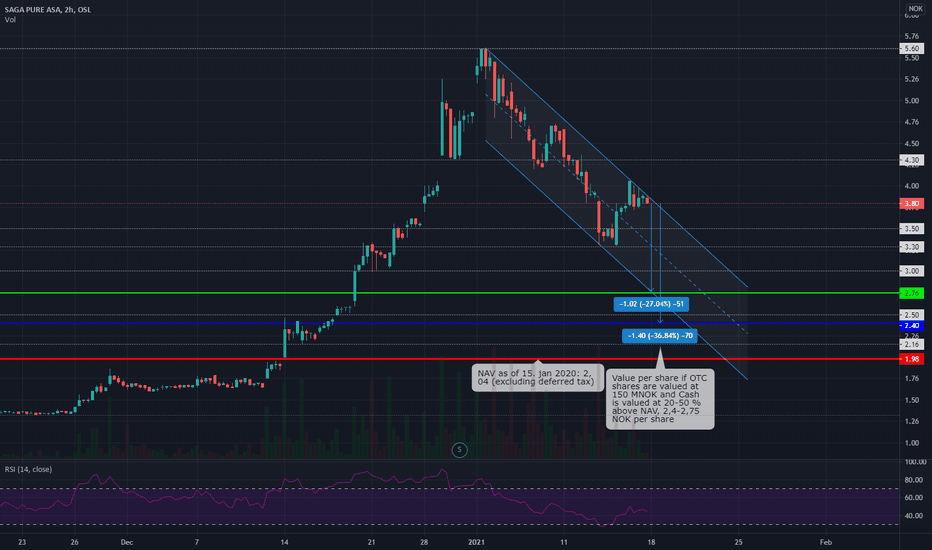

Saga Pure trading at 175-194 % of NAV (price target 2.2-2.9 NOK)Saga Pure ( OSL:SAGA ) is an investment company focusing on renewable and clean energy. Their investments are in both publicly traded companies and in private companies. The largest shareholder is Øystein Stray Spetalen.

The company was previously named Saga Tankers and owned stocks in S.D. Standard Drilling, an indoor sport arena and other smaller investments. Prior becoming an investment company the company owned various tanker vessels that was sold in 2011 and 2012. The company launched a new strategy in the fall of 2020 where investments would focus on renewable and clean energy. With a new strategy they divested what they considered outside the Company's main investment focus (except Vistin Pharma and Element), hired a new CEO (Bjørn Simonsen) and have issued shares a number of times to fund future investments.

According to my calculations, Saga Pure is currently trading at 175-194 % of net asset value. My price target is 2.2-2.9 NOK per share.

The company published a prospectus 11th of January 2021 as they are doing three subsequent offerings after the a number of private placements. According to my understanding of the prospectus:

Net asset value as of 15th of January 2021 before execution of subsequent offerings:

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Net cash-liabilities: 517.1 MNOK

Cash received from partial divestment of Everfuel ASA: 13.3-101.5 MNOK

NAV: 921.34-1,009.54 MNOK

In addition to the assets listed above they have an nine-month option for a 30 MNOK investment in Bergen Carbon Solutions.

NAV per share:

Post private placements (469,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options (484,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options + Subsequent offering I (488,149,831 shares), NAV 1,97-2,15 per share

Post private placements + CEO options + Subsequent offering II (493,049,831 shares), NAV 1,98-2,15 per share

Post private placements + CEO options + Subsequent offering III (497,849,831 shares), NAV 2.00-2.17 per share

If we assign the cash holdings with a value 20-50% above NAV the price target for Saga Pure is 2.2-2.8 NOK per share. If we value investment in private companies (executed in 11th and 28th of december 2020) at double the investment price target is 2.3-2.9 per share.

Investments:

Everfuel ( OSL:EFUEL ), 1.8 million shares, listed on Euronext Growth, market price as of 15th of January 2021 153 NOK, fair value 275.4 MNOK

Vistin Pharma ( OSL:VISTN ), 2,284,280 shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 20 NOK, fair value 45.69 MNOK

Element ( OSL:ELE ), 970 thousand shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 5 NOK, fair value 4.85 MNOK

Horisont Energi ASA, 35 MNOK, not listed, fair value at investment date 35 MNOK

Bergen Carbon Solutions AS, 30 MNOK (+option agreement with the right to invest additional 30 MNOK in a nine-month period), not listed, fair value at investment date 35 MNOK

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Capitalization and indebtedness adjusted for post-balance sheet events, private placements and investments:

Cash: +537.2 MNOK (including private placements, excluding potential proceeds from subsequent offerings)

Trading securities: +18.1 MNOK

Long term debt: -0 NOK

Other current financial debt: -38.2 MNOK (including 35 MNOK investment in Horisont Energy)

Net cash-liabilities: 517.1 MNOK

Other noteworthy changes in balance sheet:

Saga Pure has divested 700,000 shares in Everfuel between 29th of October 2020 and 6th of January 2021. Bringing their investment from 2.5 million shares to 1.8 million shares. The price for the 700,000 shares sold is unknown. The market price per share has a low of 19 NOK and a high of 145 NOK in the same period. This will have a positive effect on their cash holding by 13.3 - 101.5 MNOK.

Private placements since 20th of October 2020:

Number of shares prior 20th of October 2020: 286,149,831

54,000,000 (2020-10-20), gross proceeds 70.2 MNOK, cost 1.5 MNOK, net proceeds 68.7 MNOK

34,000,000 (2020-11-30), gross proceeds 54.4 MNOK, cost 1.2 MNOK, net proceeds 53.2 MNOK

35,000,000 (2020-12-14), gross proceeds 73.5 MNOK, cost 1.3 MNOK, net proceeds 72.2 MNOK

30,000,000 (2020-12-21), gross proceeds 87 MNOK, cost 2.0 MNOK, net proceeds 85 MNOK

30,000,000 (2020-12-29), gross proceeds 123 MNOK, cost 2.0 MNOK, net proceeds 121 MNOK

Number of shares post private placements: 469,149,831

Number of shares available in subsequent offerings:

4,000,000, price 2.1 NOK per share, potential gross proceeds 8,4 MNOK (bringing the total number of shares to 473,149,831)

4,900,000, price 2.9 NOK per share, potential gross proceeds 14,21 MNOK (bringing the total number of shares to 478,049,831)

4,800,000, price 4.1 NOK per share, , potential gross proceeds 19,68 MNOK (bringing the total number of shares to 482,849,831)

Subscription period ends on 27th of January for all three subsequent offerings.

Number of shares the board has allocated to share options (25 million shares authorized to allocate for options for employees and key persons):

5,000,000, strike 1.5 NOK

5,000,000, strike 2.0 NOK

5,000,000, strike 2.5 NOK

10,000,000, authorized but not allocated

Other information from the prospectus:

Saga pays a fee on a total of NOK 200,000 ex. VAT each month to Ferncliff Holding AS for consultancy services carried out by Martin Nes and Øystein Stray Spetalen. Ferncliff Holding AS is a company owned and controlled by director and main shareholder in Saga, Øystein Stray Spetalen.

The Company pays on a hourly basis for back-office services such as accounting, and a monthly fee for rent of office premises and common costs.

Trading idea: Long Saga PureGreen investment company Saga Pure has retraced from the peak earlier in the month after strong performance in December, due to general profit taking and a subsequent offering subscription period.

Idea/ Triggers:

* The subscription period ends January 27th.

* Saga Pure has reacted well to DeMark exhaustion signals previously.

* European buyers (Clearstream Banking Nominee acct) adding to on a daily basis in their pursuit for green investments. With regards to this being a trigger for potential continued price appreciation, look to the price appreciation in Norwegian hydrogen company NEL where the Clearstream Banking Nominee account is now the largest holder.

* Portfolio company, Horisont Energi, will be listing on Euronext Growth soon and might be a potential trigger. The share prize has doubled in the grey market after a successful offering in December.

Risk factor: Overall market is stretched on valuation and positioning, and a general risk off event is likely to impact small-caps.

NB! The company has more than NOK 500 mnok in cash looking for investments, and would use a price depreciation to buy stakes at discounted prices.

Solum Tempus Narrabo