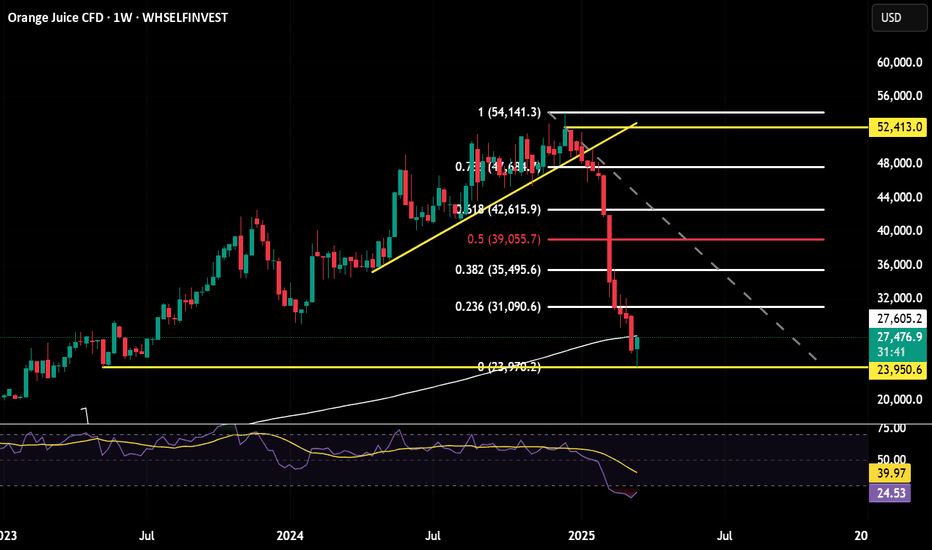

A good bounce inbound after this monster sell off on OrangeJuiceAfter this monster sell off I have been looking for a good entry on the smaller time frame for a bounce back up to the large consolidation area around the .618 retracement of the move down shown here on the weekly.

I think I have got that on Wednesday with an open lower followed by a nice impulsive move up. The positioning is set for a reversal, with speculators massively still short, on the technical side we have the RSI turning up on the weekly and already crossed over on the daily.

I am in from the Wednesday close and will be looking to add on the move up with good pull backs followed by rejections on the STF.

Invalid if Wednesdays low is taken.

ORANGEJUICE trade ideas

ORANGE JUICE Testing Key Support: Will Buyers Step In?FUSIONMARKETS:OJ has reached a significant demand area that has historically attracted buyers, leading to bullish momentum. This support level aligns with prior price reactions and represents a strong foundation for potential upward moves.

If the support holds and bullish confirmation appears, such as bullish engulfing candles or long lower wicks, I anticipate a move toward 502.70 level. Conversely, if the support is broken, the bullish outlook could weaken, paving the way for further declines.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

ORANGE JUICE : BULLISH TREND RESURGENCE- The market has registered higher highs and lows for 6-months ; the mid-term trend is then bullish

- Since the last market top, prices have registered another pull-back to $4.0774.

During this consolidation, the market has registered a rounding bottom pattern, highlighting the fact buyers remain powerful enough to switch market sentiment and lead prices to new highs.

Both moving averages are reversing the upside, acting as a dynamic short-term support to the market, while the DMI indicator also shows an increasing bullish pressure.

The Stochastic indicator is at the doors of its overbought zone, where bullish acceleration are likely to take place.

- The situation is frankly bullish for the Orange Juice. The continuation rounding bottom which takes place right above the last market overlap (defined by the market top registered in February) tend to support the scenario of a bullish trend resurgence.

The next targets can be found around $4.61, $4.78, $4.96 and above $5.00 by extension.

Pierre Veyret, Technical Analyst at ActivTrades

The information provided does not constitute investment research. The material has no been prepared in accordance with the legal requirements designed to promote the independence of investment research and such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Craze in orange juice. During COVID-19, we saw an increase in demand for orange juice/vitamin C as people strived to increase their immunity against COVID-19. For some households, this habit remained and orange juice became the go-to leisure juice.

This must have caused a squeeze on the existing supply as the demand caught orange farmers and juice producers by surprise. Can technicals come into play and put a pause on this wild price rally??

Orangejuice Strong Bullish long Hot Summer in EuropeAlongside apple juice, orange juice is one of the most popular juices in Central Europe. It is produced by pressing oranges and mandarins and has a sweet-sour taste. Use of the designation “juice” is defined in the Fruit Juice Regulation. According to this, drinks may only be labelled as juice if they are produced entirely from the juice or flesh of the relevant fruits.

Strategy: Strong Bullish

Use corrections to position size

RSI is giving permanent trend continuatoion signals, and the trend is becoiming more stronger

Orange Juice has broken the iportant resistance of 2.29 and reaching its first target at 4.80-5$

Orange Juice to soon get a retraceOrange Juice is now on an extreme significant resistence level ( +20 years tested multipletimes )

That sounds like a celling/roof for me. Shorting it to the next possible support may be a good trade idea.

OJ Potential For Bearish ContinuationLooking at the H4 chart, my overall bias for OJ is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. Looking for a sell entry at 2.1151, where the 100% Fibonacci projection line and 23.6% Fibonacci line is. Stop loss will be at 2.2944, where the previous swing high is. Take profit will be at 1.9053, where the 50% and 61.8% Fibonacci line are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Orange Juice Potential For Bearish DropOn the H4 chart, the overall bias for OJ is bearish . To add confluence to this, price is crossing below the Ichimoku cloud which indicates a bearish market. Looking for a sell entry at 2.1151, where the 23.6% Fibonacci line and 100% Fibonacci projection line are. Stop loss will be at 2.2944, where the previous swing high is. Take profit will be at 1.9053, where the 50% and 61.8% Fibonacci lines are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Orange Juice Potential For Bearish DropOn the H4 chart, the overall bias for OJ is bearish . To add confluence to this, price is crossing below the Ichimoku cloud which indicates a bearish market. Looking for a sell entry at 2.1151, where the 23.6% Fibonacci line and 100% Fibonacci projection line are. Stop loss will be at 2.2944, where the previous swing high is. Take profit will be at 1.9053, where the 50% and 61.8% Fibonacci lines are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

OJ Potential For Bearish ContinuationOn the H4 chart, the overall bias for OJ is bearish . To add confluence to this, price is crossing below the Ichimoku cloud which indicates a bearish market. Looking for a sell entry at 2.1151, where the 23.6% Fibonacci line and 100% Fibonacci projection line are. Stop loss will be at 2.2944, where the previous swing high is. Take profit will be at 1.9053, where the 50% and 61.8% Fibonacci lines are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Orange Juice Potential For Bearish DropOn the H4 chart, the overall bias for OJ is bearish. To add confluence to this, price is crossing the Ichimoku cloud which indicates a bearish market. Looking for an immediate sell entry at 2.1151, where the 23.6% Fibonacci line and 100% Fibonacci projection line are located. Stop loss will be set at 2.2944, where the previous swing high is located. I am looking to take profit at 1.9053, where the 50% and 61.8% Fibonacci lines are located.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

OJ Potential For Bullish MomentumOn the H4 chart, the overall bias for OJ is bullish . Furthermore, the price is above the Ichimoku cloud , indicating that the market is bullish . Looking for a pullback buy entry at 1.9053, where the 50% and 61.8% Fibonacci lines are located. We've set a relatively safe stop loss at 1.6846, which is where the 23.6% and 78.6% Fibonacci lines intersect. The take profit level will be 2.1151 , which is where the 23.6% Fibonacci line and 100% Fibonacci project line are located.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Range Pro Trading 💹 System Range Pro Trading 💹 System ,,going short , use range bars. as for taking profit , next Friday or Tuesday

Orangejuice does need much waterWater will get a scarce ressource, Mr. Schwab said. He should know it, as WEF Boss.

Long on sugar, small correction then upSitting through a small correction on Sugar (hopefully) this may go down to the upper medium line to hit support and then start a Wave V to the upside to target the outer warning line of the pitchfork. This is inline with a previous high which may form resistance.