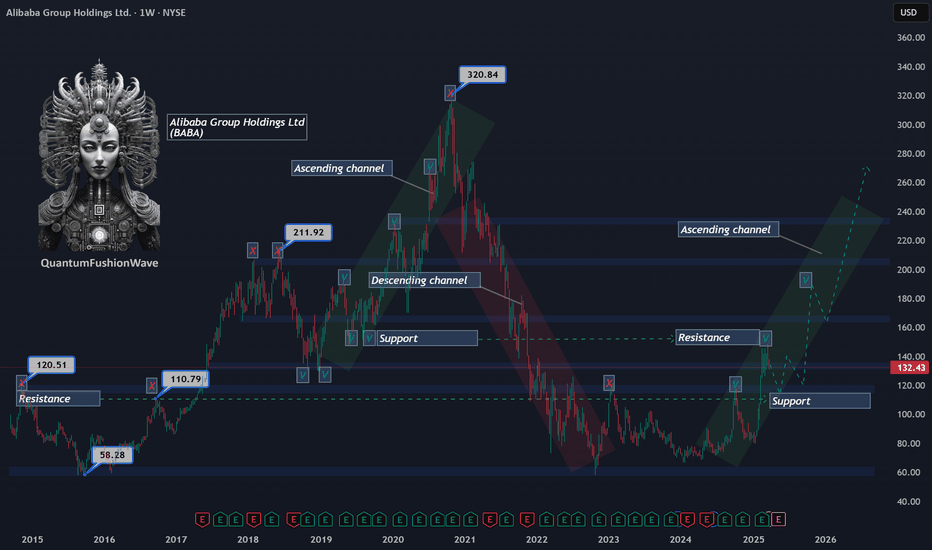

Baba waking up after 3 years accumuationMonthly

VRVP indicate huge multiyear volume accumulation

Need to close monthly May candle above last month's high

Weekly

Expecting green continuation candles (good thing that each weekly candle is making a higher high each) as low is probably in with that weekly reversal candle and volume spike

Medium term target 200

300 in the cards along with monthly target RSI 70, but let's see if it goes through 200 without any major reversal candle

BABAF trade ideas

Cooked I don't think it would actually go this low into the wedge but if it chatches the moving averages then rejects I would hold other wise just a retest of support im guessing since they came in under last three quarters it'll be more pain. Plus US lawmakers want it delisted for "national security". No beuno.

BABALICOUS Outlook Part 2 BABA continues the bullish outlook since we called it last on October 23rd.

Babalicous outlook Part 1 :

We continue with our update here!

Baba has broken through our previous resistance/ area of demand and has perfectly retested the zone.

As you can see our Area of demand has always been an area of tough resistance and as of now it is becoming strong support. In addition we have spotted a beautiful rounded bottoming pattern with a target of 80% or $210.00 price target from current levels. If BABA can close this monthly candle as is the $210 price level is sure to be tested!

Trading Analysis for Alibaba**Current Price:** $119.29

**Direction:** **LONG**

**LONG Targets:**

- **T1 = $125.00**

- **T2 = $130.00**

**Stop Levels:**

- **S1 = $115.00**

- **S2 = $110.00**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Alibaba.

**Key Insights:**

Alibaba remains one of Asia’s dominant e-commerce giants, benefiting from expanding consumer markets, cutting-edge technology adoption, and growing business digitization globally. The company is widely regarded as a foundational pillar of the Chinese economy, offering diverse revenue streams through retail, cloud computing, and logistics services. However, regulatory risks associated with China’s governance have introduced occasional volatility.

Institutional confidence is on the rise following recent news about potential restructuring efforts to unlock shareholder value across its sprawling business units. There has also been reassurance from the Chinese government regarding its role in encouraging private enterprise, which has boosted market sentiment.

**Recent Performance:**

Recent price action in Alibaba has demonstrated resilience, with the stock rebounding strongly from previous lows, supported by renewed investor confidence. The price has consolidated near the $119 level, signaling potential for continuation of the upward trend. During the last quarter, Alibaba recorded positive earnings growth, beating analyst expectations and providing momentum for buyers.

**Expert Analysis:**

Technical analysts report bullish patterns, including a potential breakout from its consolidation zone. Momentum oscillators, such as the RSI, show adequate strength without being overbought, suggesting room for further price appreciation. Volume trends also appear favorable, indicating institutional accumulation rather than retail speculation. Experts point toward its diversified revenue sources and structural improvements as reasons to anticipate solid future performance.

**News Impact:**

Recent news surrounding Alibaba’s potential spin-offs of various segments, especially its cloud division and international commerce unit, has injected fresh optimism into its valuation prospects. These moves suggest that management seeks to unlock inherent value for shareholders and simplify operational complexities. Additionally, no significant geopolitical escalations have arisen recently, which contributes to a stable trading outlook. Investors remain cautious, but confidence has visibly improved.

---

**Trading Recommendation:**

Considering Alibaba’s strong fundamentals, improving technical performance, and market-friendly restructuring developments, a LONG position presents a favorable setup. Traders should aim for upside targets of $125 and $130, supported by near-term recovery patterns. Utilizing stops at $115 and $110 manages downside risk effectively. This opportunity aligns well for those seeking exposure to growth in global e-commerce and cloud industries, with Alibaba providing attractive prospects for potential gains.

```

BABA Showing Potential, But Not Quite ReadyNYSE:BABA has gone on a crazy run this year showing signs of strength. Recently price has stall out leaving us at a cliff hanger. The bull run was more than likely fueled by large investors accumulating shares at previous years lows as shown on the chart. In Wyckoff that typically happens in Phase B, the cause building phase. During this phase price consolidates with multiple tests or fake outs of the range as 'big money' accumulates shares at lows and soaks up the remain liquidity. The recent breakout confirms that supply has been absorbed, and price is ready to move higher, this marks the end of Phase B. The breakout is also called a 'Sign of Strength' in Wyckoff Method, which is also used a trap for buyers, hence the quick move back into the trading range. This move marks the beginning of Phase C, which typically creates a Spring or LPS (Last Point of Support). The Spring will fall below the trading range and quickly recover, while the LPS will find the last point of support within the range and gradually move higher. As you can see in the chart price has not fallen to either, which means there may be more downside to ensue. This correlates with recent "Tariff Wars", so pay attention to the news when or if price retraces to these lower levels. I have currently identified a redistribution pattern on the 1H timeframe which is showing signs of completion and that price is ready to continue down. If prices breaks above $117.50 this will more than likely invalidate the redistribution.

Alibaba - Don't Forget Chinese Stocks Now!Alibaba ( NYSE:BABA ) still remains super interesting:

Click chart above to see the detailed analysis👆🏻

After we saw the very expected parabolic rally on Alibaba about four months ago, Alibaba is now perfectly retesting major previous structure. Yes, we could see a short term pullback in the near future but this just offers a perfect break and retest after the rounding bottom pattern.

Levels to watch: $110, $140

Keep your long term vision,

Philip (BasicTrading)

$BABA slingshot ++ china long previsous bullish divergence ;

new scenario

Uptick in volume , slinght shot RSI & MACD oversold ,

China & Trump deal is inevitable china needs a plan but Trump keeps poking , you know you have the upper hand just wait a while ++ pushed back the TikTok deal so you have an extra 75 days with that you know they need some time as China was clearly unprepared ;;;;

anyways, I'm bullish and this goes for NASDAQ:JD NASDAQ:BILI aswell .

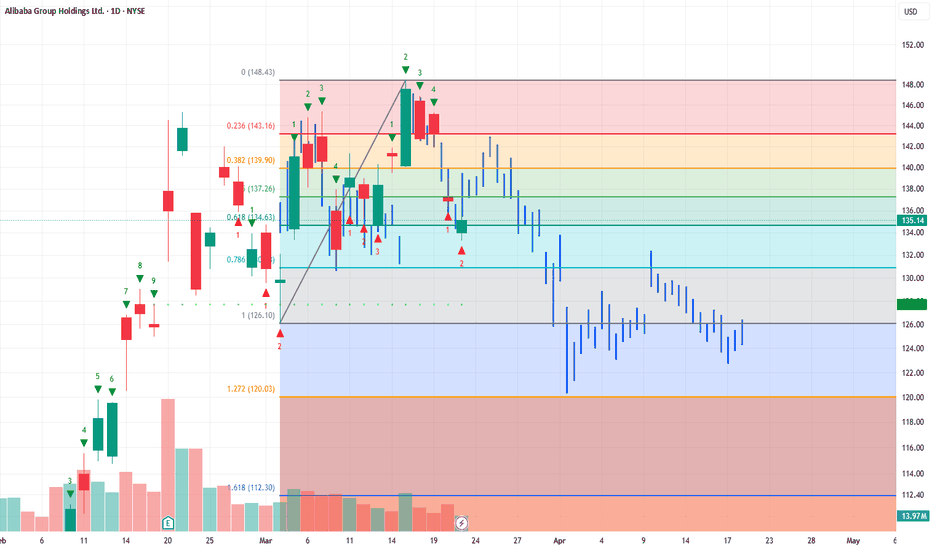

Alibaba (BABA) Technical Analysis:Retracement Within an Ascending Channel

Alibaba (BABA) has faced strong supply pressure at $149, a key price level that previously acted as support in 2019 and has now flipped into resistance. The inability to reclaim this level has triggered a retracement, with the stock currently trading around $132, showing signs of continued corrective movement.

Despite the short-term weakness, BABA remains within a developing ascending channel, suggesting a potential higher timeframe bullish structure. If the retracement extends, the next significant level to watch is $110, a historical 2016 resistance level that could now act as a demand zone. A strong reaction and rejection from this level would reinforce the validity of the ascending channel and increase the probability of a trend continuation toward previous all-time highs.

Key Levels to Watch:

Resistance: $149 (2019 support turned resistance)

Current Price: $132 (active retracement zone)

Support Levels:

$110 – Historical resistance from 2016, potential demand zone

$100 – Psychological level, further downside risk

Traders should monitor price action around these key levels, as a confirmed breakdown below $110 could invalidate the channel and shift market structure to a more bearish outlook, while a strong bounce could provide a high-probability long setup within the channel’s framework.

Beginning of the Uptrend for Stock #01Beginning of the Uptrend for Stock #01: 9988 (BABA)

The price has broken out of a consolidation range that lasted approximately two years, supported by a normal volume distribution.

The stock has risen to meet the Fibonacci Extension resistance level of 161.8 at a price of 144 HKD. Currently, it is forming a sideways consolidation pattern on the smaller timeframe, establishing a base structure viewed as re-accumulation.

The 6-month target is set at the Fibonacci Extension level of 261.8, which corresponds to a price of 189 HKD. This target aligns with a price cluster based on the valuation from sensitivity analysis, using the forward EPS estimates for 2025-2026 as a key variable for calculations, along with the standard deviation of the price-to-earnings ratio.

Wait for the Right Moment to Accumulate Shares within the Consolidation Range

Purchase near the support level of the range when the price pulls back. Look for a candlestick reversal pattern as a signal to add to your position.

However, should the price break down to the lower consolidation range, the stock would lose its upward momentum, potentially leading to a prolonged period of consolidation or a deeper pullback to around 90 HKD.

Always have a plan and prioritize risk management.

$BABA on its way to $120s into AprilI would honestly be surprised if it doesnt gap down this Monday before the open. The weekly imo, looks like a mess atm and could gap into $120s easy. If it doesn't, I would expect some consolidation for a fall into the First week of April. We're right at the golden pocket retrace at the .618, very common retracement level, if we look at Fibs with a bearish perspective and measure a retrace back to the lower golden pocket at 1.61 fib from highs, $112.30 would be my ultimate target if we can break $126. $126 opens the flood gates to our ultimate target at $112.

Alibaba (BABA) Share Price Declines from 40-Month HighAlibaba (BABA) Share Price Declines from 40-Month High

As shown in the Alibaba (BABA) share chart, the price reached a 40-month high this week, surpassing $145 per share.

Bullish sentiment is being fuelled by news related to AI prospects in China. According to media reports:

→ China’s AI spending is increasing through investments from state-owned enterprises, private companies, and local authorities, aiming to keep pace with the US $500 billion Star Gate project.

→ Alibaba plans to invest $52 billion over three years in artificial intelligence and cloud computing.

Technical Analysis of Alibaba (BABA) Shares

Despite a positive fundamental backdrop, the chart signals potential concerns:

→ The price is near the upper boundary of the ascending channel, which could act as resistance.

→ Bulls attempted to break the $145 level (which has acted as resistance since late February) on 17 March but failed, as the price could not hold above this mark.

→ Using your preferred oscillator, you are likely to observe a bearish divergence between peaks A and B.

This suggests that bullish momentum may be weakening, and investors could consider taking profits after Alibaba’s exceptionally strong price rally—up approximately 70% since early 2025. If so, a break below the orange trendline could lead to a correction towards the median of the blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.