CSLLY trade ideas

ASX:CSL- Consolidating nicely around 200MA ( Accumulation)

CLS is underperforming the XJO for some time.

CLS Underperformance to XJO was last seen around 2009.

CLS nicely consolidated around 200 MA

I am invested for long term portfolio.

Great buy around 270$

Negative - 17th June - change in leadership CFO Mr David Lamont resigned.

Company is in acquisition spree making the best use of the opportunity.

Australia highest market cap company - good opportunity to keep adding in this retracement.

ATM Stock Research - Reiterates BUY at $282.54ATM Stock Research

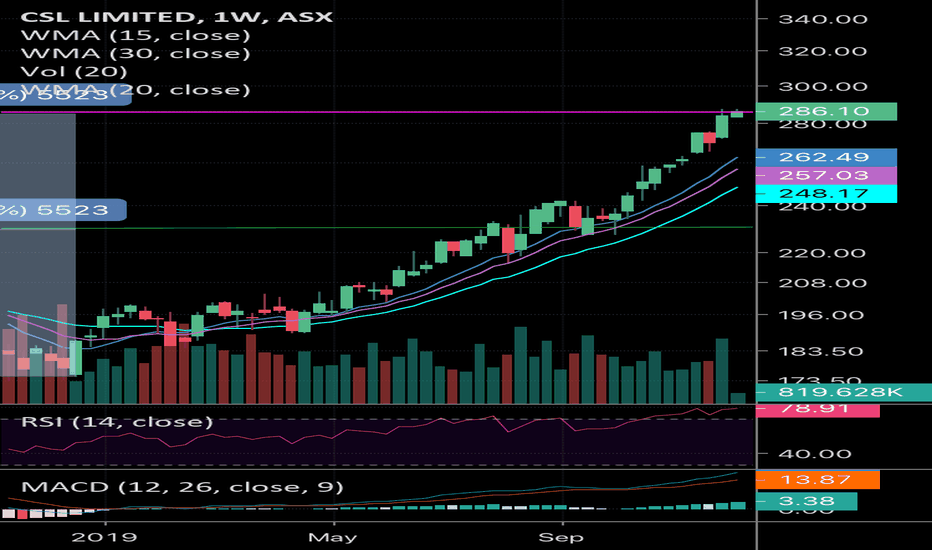

CSL Limited – Technical Analysis Summary-

CSL is a global biotechnology company that was listed on ASX at $2.30 per share back in June 1994. ATM stock research initially recommended the stock at $91.87 in 2016. The stock was at its peak on 20th February this year at $342.28. The Covid 19 Sell-off reversed the stock to $242.64 levels in March. Later the market wide recovery in April was not long lasting for CSL. Moreover, the recent trading update was not as expected and the investors took to profit taking, creating an opportunity for others. We believe given the strong fundamentals and being a quality healthcare company, the stock is still not fully priced and this makes it an attractive BUY at $282.54 at the time of report writing. There are short term resistances at $294 and then at $305. Once both of these resistance levels are broken, we see that CSL will march towards @ $3.21 in the medium term. ATM reiterates a Buy on CSL for all our clients and readers at the current levels.

atmstrategy.co.nz

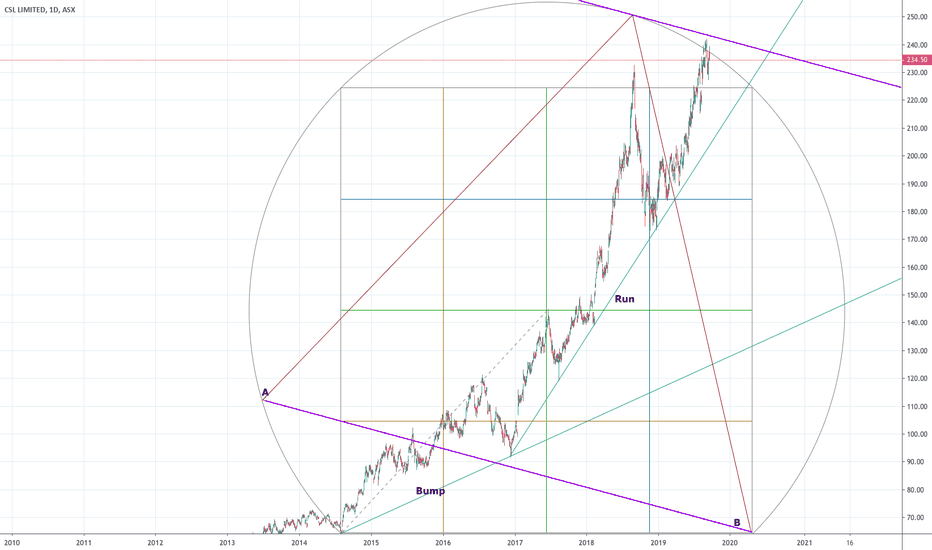

CSLLY Double BumpCSLLY has experienced many chart pattern formations over the years, including a horn bottom, an Adam bottom, an ascending broadening wedge which led to a bearish reversal, and is currently experiencing a ‘bump and run’ pattern. ~0.75 regression uptrend, overall very bullish even if a small bearish pullback does occur. A lot of bump and run patterns seem to be present within various pharmaceutical companies. Maybe its just my selection preference..

$CSL:ASX - CSL LIMITED - Mega whale showing signs of recoveryCSL is one of those mega stocks everyone used to have in their portfolios which is up something like 28,000% since the mid 90's. After the recent sell off it looks like its showing signs of recovery. Might be a day or two early, but certainly worth a watch.

Currently 739 buyers for 131,397 units vs 415 sellers for 80,974 units

CSL Limited is a biotherapeutics company that develops and delivers biotherapies. The Company's principal activities are research, development, manufacture, marketing and distribution of biopharmaceutical and allied products. Its segments include CSL Behring, Seqirus and CSL Intellectual Property. The CSL Behring segment manufactures, markets and develops plasma therapies (plasma products and recombinants). The Seqirus segment manufactures and distributes non-plasma biotherapeutic products. Seqirus manufactures, sells and distributes a range of vaccines, antivenoms and other pharmaceutical products in Australia and New Zealand. It also manufactures and markets in vitro diagnostic products through Seqirus immunohematology. The CSL Intellectual Property segment is engaged in licensing of intellectual property generated by the Company to unrelated third parties. The Company has facilities in Australia, Germany, Switzerland, the United Kingdom and the United States.

CSL ToppingFirstly, a large M formation is presenting on the end of long term 'Bump & Run' pattern. We have duplicated the AB trendline and placed it at the peak of the triangle within the gann emblem, it's purpose is to hold price and we look to short the stock below this level with stops obviously above it.

Head & Shoulders reversal?I'm just learning here. Starting simple. Feedback welcome.

A few things I'm seeing here:

Volume increasing at neckline

Volume decreased at right shoulder

Pullback to neckline on weak volume

Entry point at 3% above neckline - 196.76

Watching volume

Analysis based off "Technical Analysis of Stock Trends" by Edwards, Magee, Bassetti