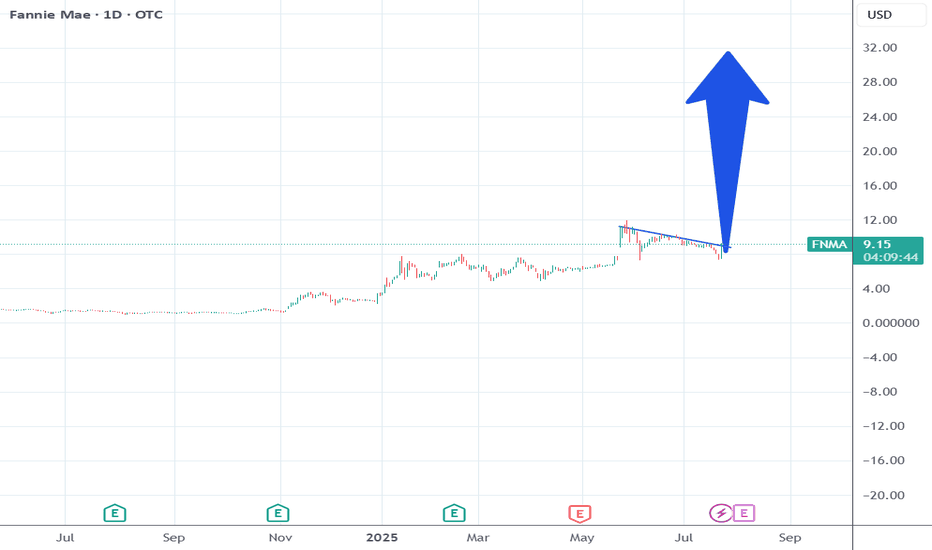

Trump will approve the FNMA privatization within 10 days.Trump works for Wall St. He plans his moves based on what Wall St wants.

He says stuff at certain times to get the markets to react in key times for Wall St.

The overall market is going to correct within the next 30 days.

FNMA just did a shakeout the last 3 weeks.

So Trump will time his announcement to correlate with the events of Wall St.

Remember he was going to do this his 1st term.

18 dollars in the next 3 weeks.

FNMAS trade ideas

FNMA: great looking consolidation Price is showing impressive relative strength during recent market weakness with 3 weeks of tight closes

• W-bottom structure forming

• Fund accumulation increasing

• EPS estimates for 2025–26 rising sharply

• Regulative catalyst + Bill Ackman backing

Next mid-term resistance zone: 12–16

Macro/Weekly structure

Thank you for your attention and I wish you successful trading decisions!

FNMA looks like a Crypto Meme coin...FNMA looks like a crypto meme coin that just got done with a long accumulation after going through a rug pull... except this rug is the 2007-2008 crash, and the accumulation time is 17 years!!! This is a big moment on the chart, I don't think this is any ordinary breakout. This is a monumental moment on the chart with President Trump in office now. Who knows if they get NASDAQ Compliant or go private it can really change as a company and valuation overall.

FNMA near term resistance possibleFNMA daily update

Government has determined a path to release from conservatorship, if this happens then this stock will be relisted and be worth a lot more than the current value

At present the stock is nearing a short to medium term resistance level using elliot wave and fibonacci/ harmonics between $4.62 and $4.69

There is a clear crab pattern that aligns with Robert Miners 5th wave projection levels as well, with RSI closing in on 80 which is extremely overbought (But largely irrelevant in trends)

It does hint that there will be a short to medium term pause which would align with getting more details of the plan to release these massively profitable behemoths from government conservatorship

I've been long on this stock for years and already pulled my original money back out, but see some complex corrections happening for a while around where we are before blasting upward into a larger wave 3 structure

FNMA Daily wave 5 projection3x potential ends of wave 5s,

Likely to see some significant moves up to finish a wave

It will be interesting to see what happens from there but I suspect there will be some retracement and possible complex correction for quite a while before pushing higher

The triangle is over a decade long... so likely to continue higher medium to long term

FNMA Monthly BreakoutFull disclosure, I've owned this stock from 2011 and already pulled my original money out and also scaled back in again over time

Has had a multi year triangle building for years, and broke out of this and closed outside of this at a daily level in the last 12 hours

A trump victory puts the release from government conservativeship back on the table again which is a solid catalyst...

One worth watching... as I think this is about to rocket based on my 15 years of watching it

FNMAS | 2 Longs | No half measuresGeneral

FNMAS recently visited the bottom of the range. While i personally would prefered a dip under it - didnt happened yet - we shall see. So far i will stay on the sidelines aslong price didnt break above "Area 1".

Another potential buy for me would be if price breaks above the 50% of the range and generates a higher swing.

1. Long (Black arrow)

Price moves above "Area 1" and generates a higher swing (Generated Swing). I could also see a break above "Area 1", dip under it and another retake and then going higher. Doenst matter, the plan stays with the break above the "generated swing"

Target: A bit under the s/r level that also worked as starting point of the last downtrend.

SL: After we broke above the Higher Swing (Generated Swing) i dont want price to go lower than "Area 1"

Time duration: Days, weeks, months, years... ;)

2. Long (Blue arrow)

Price moves above the 50% of the range and generates a higher swing (Generated Swing). The 50% level should also hold or atleast beeing retaken shortly after dipping under it.

Target: Next s/r level that also was the starting point of the last downtrend in confluence with a bigger s/r level

SL: A bit under area 1

Time duration: Days, weeks, months, years... ;)

Good luck

Disclaimer:

- This information does not constitute as financial advice and is only for entertainment purposes. I am not your financial advisor.

- You trade entirely at your own risk

- Make your own research

- Finance and trading is evil, capitalism is bad, duh

$FNMA looks like a great long term buy at these levels$FNMA looks to have just found support at the bottom of a wedge after correcting from a long term downtrend. Should price get above $3.52, it looks like the next target could be $17.58.

R/R is great from these levels with 17x+ upside for 20% of risk. Stop at $.69 and move up as price rises from here.

Fannie Mae 2000-2021.According to the book Good to Great by Jim Collins, the stock achieved a fifteen-year result 7.56 times higher than the market in the 20th century. I want to update that comparison with 21st-century data to see how stocks have progressed further. For more details see my blog, an article should come out soon on this topic.

Fannie Mae 1984-1999.According to the book Good to Great by Jim Collins, the stock achieved a fifteen-year result 7.56 times higher than the market in the 20th century. I want to update that comparison with 21st-century data to see how stocks have progressed further. For more details see my blog, an article should come out soon on this topic.

Don't Fight the Fannie FNMA longShowing very bullish movement off of a long basing bottom pattern. Developing into a Cup n Handle breakout on all time frames. Interesting from a fundamental aspect as well since they are now a company with profits. I like it long long as it continues to look bullish on the shorter time frame set ups. GL all

A look at Fannie Mae's long term rangeFannie Mae is setting up to be an interesting rectangular chart pattern. At some point FNMA will breakout and it'll be a high probability trade. Until then, the range lows offer an interesting long set-up with targets at the top of the range. This could take 2-5 years before breaking out (or less/more). From 1970 - 1986, FNMA did nothing except trade in a range before finally breaking out. Just a good one to keep an eye on, potentially a good indicator for the broader market as well - everytime Fannie Mae hit the lows of the range the broader market was a great buy.

Percentage increase from the lows of the range generated a strong average return since 2013

Next Target 1.00Similar to my analysis on FMCC this is in lockstep with the overall market I see it losing about 50% in the next week or so. The only way this can go back up is to get out of conservatorship. The administration is dealing with other issues and if they don't get elected this could linger for years as I don't see Biden doing anything to help these two companies that have trillions of dollars of assets under their control.

Fannie MAE on breakout watch Federal National Mortgage Association is a government-sponsored company, which engages in the provision of liquidity for purchases of homes and financing of multifamily rental housing and refinancing existing mortgages. It operates through the Single-Family and Multifamily segments. The Single-Family segment offers liquidity to the mortgage market and increase the availability and affordability of housing for single families. The Multifamily segment includes guaranty fees on the mortgage and on the multifamily mortgage loans. The company was founded in 1938 and is headquartered in Washington, DC.