−0.0054 USD

−2.51 M USD

0.00 USD

501.40 M

About FORTUNE MINERALS LD

Sector

Industry

CEO

Robin Ellis Goad

Website

Headquarters

London

Founded

1988

FIGI

BBG000PWSKJ6

Fortune Minerals Ltd. engages in the exploration and development of mineral properties. The firm focuses on advancing the vertically integrated NICO cobalt-gold-bismuth-copper project, comprised of a proposed mine and mill in the Northwest Territories. It also owns the Sue-Dianne copper-silver-gold deposit and other exploration projects in the Northwest Territories and maintains the right to repurchase the Arctos anthracite coal deposits in northwest British Columbia. The company was founded by Robin Ellis Goad on August 2, 1988 and is headquartered in London, Canada.

Related stocks

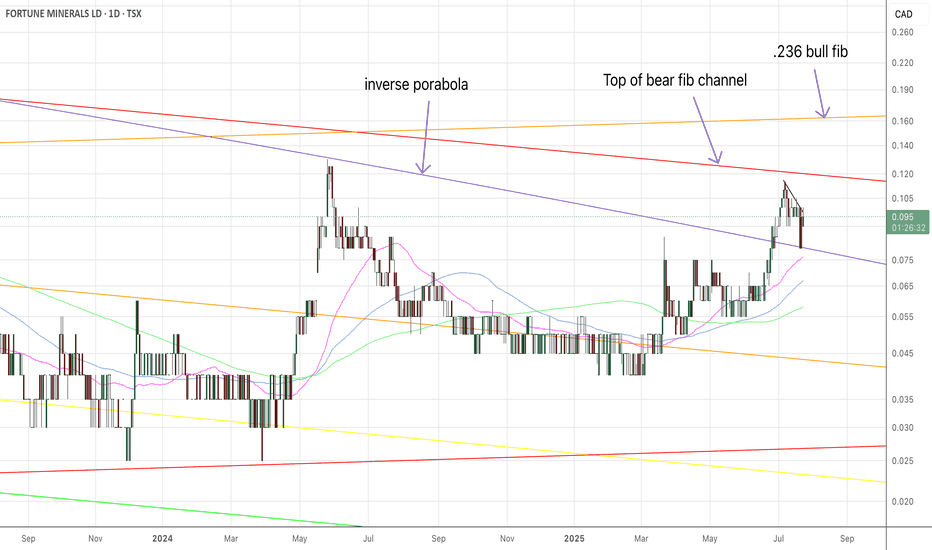

Fortune MineralsAfter banging off the top of the bear fib, the price came down and bounced off the top of the all-time inverse parabola. We got a pretty good bounce on low volume, but a landing on the moving averages is not in the rear-view mirror. A return to the 1-level bear fib, and you start to think about do

Fortune MineralsThe price is slipping away from the bears, but I don't think anyone was harmed, because there's no short interest. Even the bears are bullish. They may have wanted to buy, or convert, more shares at a lower price, but they're not upset to see higher prices. Nobody is upset to see higher prices,

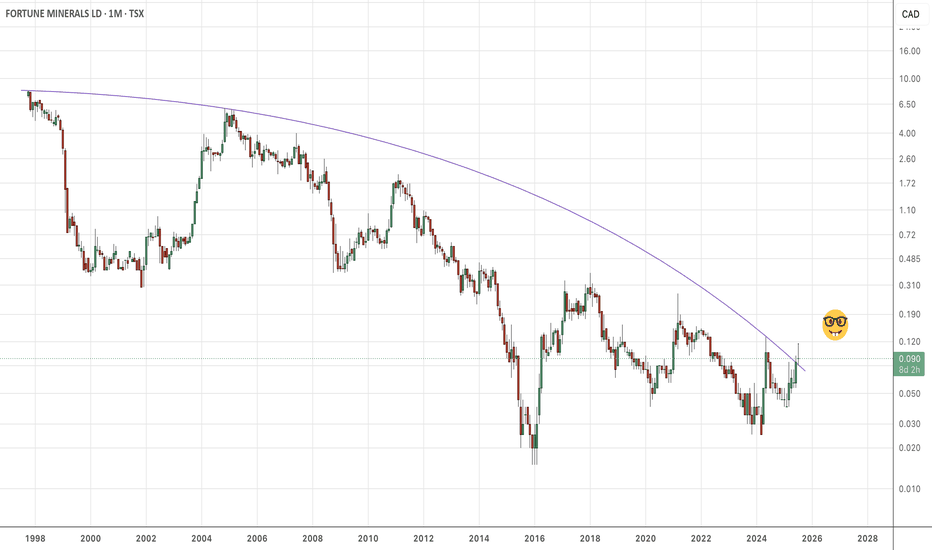

Fortune MineralsAnd here she is in log.

With OBV rising, the $.25USD pivot is in the headlights, but that's just the first step. We have a higher swing high on the dailies, but that does not make FT bullish. You need a higher-swing-high on the weeklies or a longer timeframe. So, the pump to $.25 is the pum

Fortune MineralsI'm showing you a strong overhead that has been tested many times, and is now breaking out. It's kind of an IQ test, and the bears are failing it. There is little to no incentive to sell here, when we're about to "snap-to" $.25. Why would anybody sell here?

And that's why the price has seen t

Fortune MineralsHi guys,

I want to show the technical landscape that FT price finds itself in. I talk a lot about this fib and that fib, but I hope this clarifies things. As I've said before, above the .236 bull fib, it's bullish. That is the major threshold where new market participants come into the pictur

Fortune or folly?We have a breakout on the weeklies, and a target at the top of the funnel. The funnel being the consolidation post-capitulation. We're looking at a recovery, and $.25 is the "neckline", or the "pivot". %.25 is just the beginning, and above that looms the log overhead at $2, which is giving the be

Fortune MineralsFT is primed to pamp back to $.25USD. Price is consolidating at the .786 "bear fib", and is being compressed under what I believe is a kind of inverse parabola. We shall see, but a return to 1-level bear fib, and $.25 is a fait accompli.

I hate to see guys bailing right as the party gets underwa

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of FTMDF is 0.0615 USD — it has decreased by −12.14% in the past 24 hours. Watch Fortune Minerals Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Fortune Minerals Limited stocks are traded under the ticker FTMDF.

FTMDF stock has fallen by −16.67% compared to the previous week, the month change is a 3.54% rise, over the last year Fortune Minerals Limited has showed a 4.24% increase.

FTMDF reached its all-time high on Feb 21, 2012 with the price of 1.0760 USD, and its all-time low was 0.0001 USD and was reached on Jan 31, 2018. View more price dynamics on FTMDF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FTMDF stock is 14.01% volatile and has beta coefficient of 1.55. Track Fortune Minerals Limited stock price on the chart and check out the list of the most volatile stocks — is Fortune Minerals Limited there?

Today Fortune Minerals Limited has the market capitalization of 35.32 M, it has increased by 5.01% over the last week.

Yes, you can track Fortune Minerals Limited financials in yearly and quarterly reports right on TradingView.

FTMDF net income for the last quarter is −676.25 K USD, while the quarter before that showed −1.13 M USD of net income which accounts for 39.90% change. Track more Fortune Minerals Limited financial stats to get the full picture.

No, FTMDF doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 4 employees. See our rating of the largest employees — is Fortune Minerals Limited on this list?

Like other stocks, FTMDF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Fortune Minerals Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Fortune Minerals Limited technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Fortune Minerals Limited stock shows the buy signal. See more of Fortune Minerals Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.