−241.89 K USD

856.54 K USD

About Greene Concepts, Inc.

Sector

Industry

CEO

Leonard M. Greene

Website

Headquarters

Clovis

Founded

1952

FIGI

BBG000C26CB6

Greene Concepts, Inc. engages in the beverage and bottling business. It offers its Be Water product that supports total body health and wellness. It operates a beverage and bottling plant located in Marion, North Carolina. The company was founded by Leonard M. Greene on August 18, 1952 and is headquartered in Clovis, CA.

Related stocks

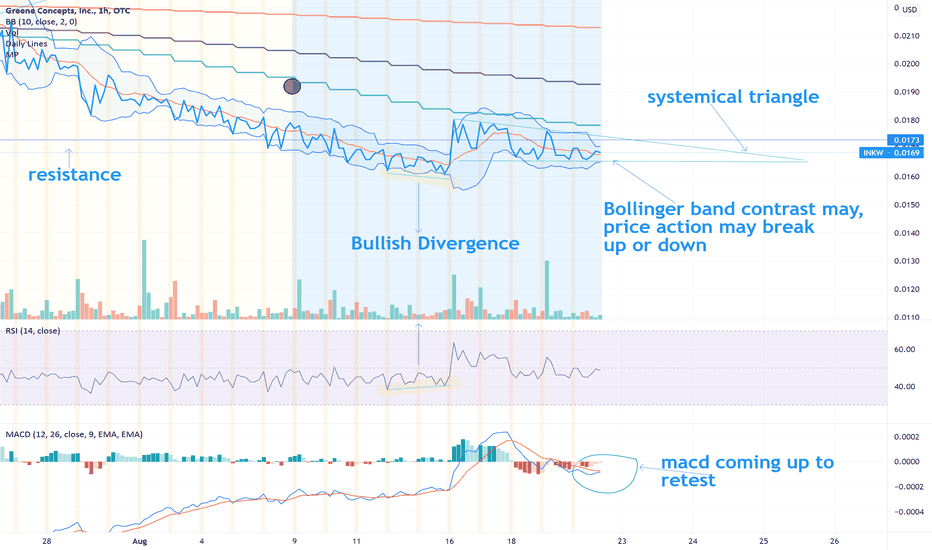

inkw chart analysisif we get more news about the sports drink acquisition this could run pretty explanation is charted.

The Barchart Technical Opinion rating is a 100% Sell with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

$INKW Chart AnalysisUpon review bullish divergence can be seen when combing rsi with price action which may signal a reversal.

Price action is breaking above Bollinger bands which may signal bullish trend.

ema is coming over sma signaling trend change.

cup pattern is spotted as well

has gone through a healthy pull back

INKW - Be Water Gamble Be Water - artisan water. I have personally seen it sold out on Amazon with people screaming for more. Water is a fine commodity and these guys have the source. We live in a world where people will pay for water...the liquid that you can drink out of puddles and probably have the same effect on your

INKW Chart AnalysisUpon review 2 signs of divergence can be seen when combining rsi with price action, both outside and in the overbought/oversold region of the rsi

due to this their should be a change in trend following, this may consolidate due to bear market conditions

-price action is also rising back up to 20sma

$INKW Bull Pennant (Log) Comes to a Head as Trend BeckonsINKW is sitting in a constructive lateral consolidation following an explosive upward breakout in January. The MA's are rising and RSI is pointing to a bullish relative signal as the bull pennant comes to a head.

Greene Concepts, Inc. (www.greeneconcepts.com) is a publicly traded company.

Through

INKW BullishINKW in my opinion is way undervalued. It looks like the correction is over and support found on upward trendline putting in a higher low. The MACD looks to be getting ready to cross back over to continue this uptrend. INKW has placed application in to be up listed to the OTCQB. Their goal is for NA

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of INKW is 0.0006 USD — it has decreased by −7.69% in the past 24 hours. Watch Greene Concepts, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Greene Concepts, Inc. stocks are traded under the ticker INKW.

INKW stock hasn't changed in a week, the month change is a −25.00% fall, over the last year Greene Concepts, Inc. has showed a −64.71% decrease.

INKW reached its all-time high on May 2, 2006 with the price of 6,220,000.0000 USD, and its all-time low was 0.0001 USD and was reached on Feb 6, 2017. View more price dynamics on INKW chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

INKW stock is 40.00% volatile and has beta coefficient of 0.31. Track Greene Concepts, Inc. stock price on the chart and check out the list of the most volatile stocks — is Greene Concepts, Inc. there?

Today Greene Concepts, Inc. has the market capitalization of 1.27 M, it has decreased by −7.14% over the last week.

Yes, you can track Greene Concepts, Inc. financials in yearly and quarterly reports right on TradingView.

INKW net income for the last quarter is −102.48 K USD, while the quarter before that showed −75.08 K USD of net income which accounts for −36.50% change. Track more Greene Concepts, Inc. financial stats to get the full picture.

No, INKW doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Greene Concepts, Inc. EBITDA is −298.52 K USD, and current EBITDA margin is −56.30%. See more stats in Greene Concepts, Inc. financial statements.

Like other stocks, INKW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Greene Concepts, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Greene Concepts, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Greene Concepts, Inc. stock shows the sell signal. See more of Greene Concepts, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.