short 0800.hk sloppy moveentered into a short position on 0700.hk on 27-sep based on multiple ideas convergence: stoch 5-3-3 over bought came down while broke through 20d EMR and stoch 5-3-3- 0.382 and also most important conv with HSI weakness as tech sector has been the weakest sector for 2 weeks already. a bit sloppy as I didn't have much time to follow closely due to work, and it was not the best entry timing on the day.

TCEHY trade ideas

Tencent: short-term short, long-term longTencent: short-term short, long-term long

Based on what have I observed for the past few months, tencent's price is on a short-term bearish trend caused both by its under-expected earning on online games, China's regulation on online game industry overall, as well as the elephant in the room, trade war.

Short term wise, RSI negative reversals are coming on by on. Currently the price may go down to 291, which is the 0.618 retracement level since December, 2016, a two year term fibonacci retracement. But the RSI reversal indicates that it may go even lower to 274.

But long term speaking, AD Line is trending upwards even the price keep going lower since March 2018, for the past 5 months. That is to say, 274-291 could be a crucial range for us to predict what may happen next.

TENCENT - ready to move UPTENCENT is a solid company that has been hit from the ongoing turbulence in the region.

The chart shows us that practically since January the stock gradually entered in a long 4th wave (down).

The projections of this move gave a target (black line) not far from the low of past Friday.

In addition Momentum shows that the stock is deeply oversold.

So, with solid Fundamentals, with Wave 4 almost over and with Momentum in deeply oversold area, I see an opportunity in the upcoming 5th Wave.

Tencent Holdings ADR - Recovery SignalsI like what I am seeing on the Tencent ADR chart. The price has been knocked back as a result of fears around Chinese government regulation - but as you may know - I'm always up for a good reversal play. The stochastic is signaling a bullish crossover while the RSI is signaling a bullish divergence. Currently at $39.99, the price is extended well below it's 200-day moving average which trades at around $51.52. A positive move in the US tonight could spark a turnaround on the oversold Hang Seng and Asian markets.

________________________________________

Please feel free to contact the Unum Trading desk for any Trading related queries : 011 384 29 29

Unum Capital. An authorised South African Financial Services Provider (FSP 564)

Flash note: Hang Seng 50 Future/Tencent + ADR /NasperAccording to Lester Davids, Trading Desk analyst at Unum Capital:

"Some positivity on the Tencent Chart - Could be a driver tomorrow.

- Bullish Divergence

- Extended well below it's 200dma (HK$404)

- Chinese market sentiment overwhelming negative"

Contact the Trading Desk on +27 (0)11 3842920 or tradingdesk@unum.co.za to discuss.

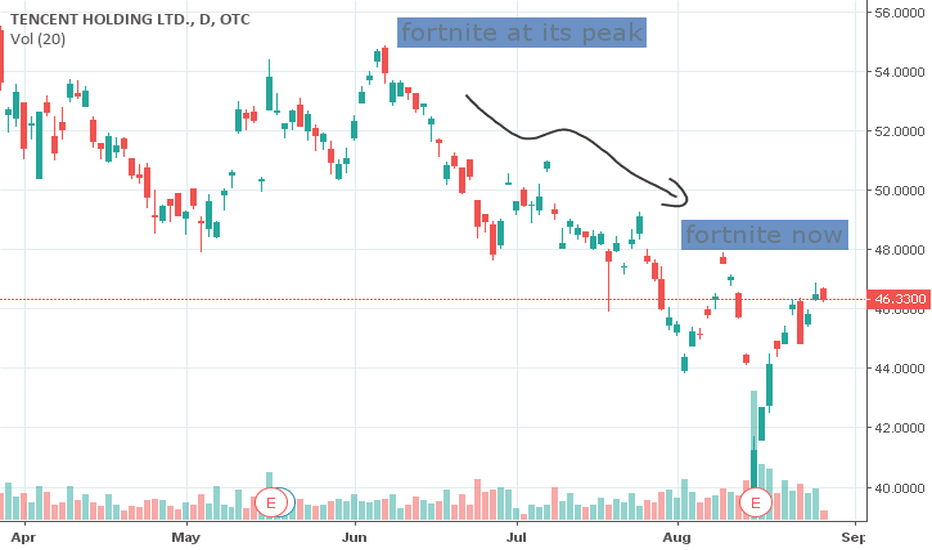

Tencents stock change from fortnite Tencent is a trending NASDAQ stock from china, formerly a bullish stock now very volatile often losing from lack of progress in the game Fortnite.

Tencent gets forty percent of Epicgames profits, the creators of Fortnite battle Royale, one of the most popular games ever created with nearly 150 Million downloads! unfortunately for Epicgames the game is dying and less people are playing the game

which means less profits

OTC:TCEHY

Distribution Phase in ProgressSupporting Technicals:

- Various indications of distribution phase identified

- Tencent is trading weaker than market

- FFI remains below zero signalling fund outflow

- MACD momentum remains downward bias

Risk:

- FFI is below zero but upward sloping

Stop:

Above short term down trendline (Green)

Target:

1st Objective is HK$340-350 zone

(Fibo 1.618% + Previous minor consolidation phase)

TCEHY very long term outlook fib levels looking at places to add/start a position in this monster

Tencent is a massive Chinese company that owns WeChat and a sizable portion of Fortnite among many other things

Pretty confident that FB's data on Americans is nothing compared to the data WeChat has on Chinese people due to how much the "super app" is used.

TENCENT - long term scenario

This is, again a very long term scenario! But for long term investments, you really should be able to see where something could potentially go. Not to say that you are going to be right even 50% of the time on such calls but I still believe they are important! If you can't come up with a scenario that would generate above average returns, there most likely ain't one!

I hope you liked this! Like and follow if you want and take care!

TENCENT (700) Downward Bias - Weekly ChartHKEX:700 (Weekly Chart) traded below its 8 month old upward trend line with heavy volume sell off seen during the week of March 19th-23rd.

Last week of March, stock price made failed attempt to trade back above the trend line. This became evident that the trend line has turned from support to resistance. Weekly MACD is also trading in bearish momentum.

Applying Fibo, the expected downward target is HK$360-370.