OXTUSDT trade ideas

Orchid 290% Profits Target, MA200 & Price Action FractalThe classic signals are already present on this chart, the double-bottom, etc. But I also have a price action fractal plus an unconventional signal supporting a bullish jump.

The easy target here is 290%, it can be hit within months. Not more than two to be more exact after the bullish breakout is confirmed. Long-term there can be more growth.

The price action fractal is a 1,2,3 sequence. A correction leads to a low that leads to sideways and then a bullish breakout. (1) The correction, (2) then consolidation and finally (3) the bullish breakout.

The unconventional signal revolves around MA200. When MA200 starts to curve down prices tend to shoot up. Right now this indicator only has a tiny curve but this is the start.

If you look at the action around September 2024, MA200 started to curve down. Prices continued sideways for more then a month but eventually a bullish jump developed. It always happens when MA200 starts to curve down. As it goes down, prices go up.

This is another signal that can be used to spot a trend reversal.

Thanks a lot for your continued support.

Namaste.

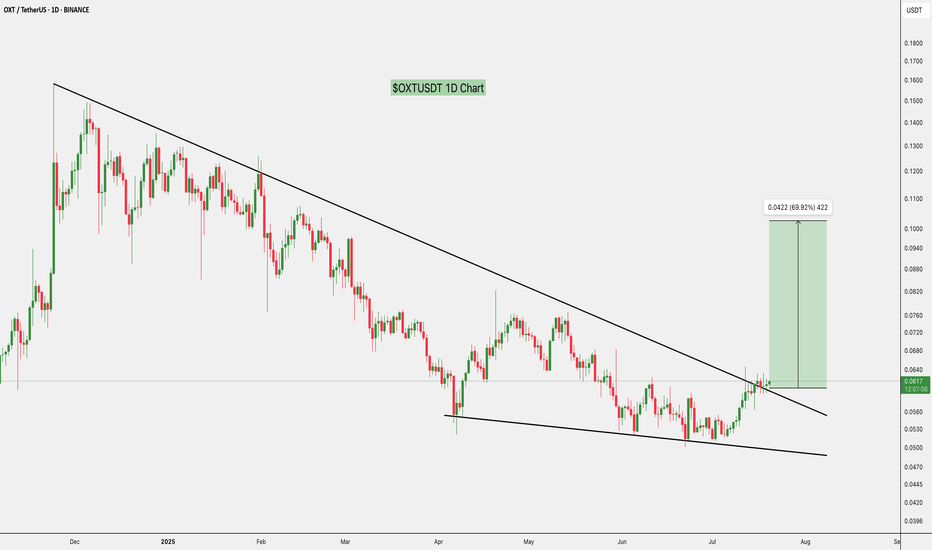

Will Orchid (OXT) rally to broken market structure?On the above 5 day chart price action has corrected almost 70% since the year began. A number of reasons now suggest a reversal in trend, they include:

1. Price action and RSI resistance breakouts.

2. A significant confirmation that legacy downtrend breakout now acts as support.

3. Price action confirmation horizontal support.

4. Forecast to broken market structure is also the Golden ratio, but that is not the same as saying a correction confirmation from structure will follow.

Is it possible price action continues correcting? Sure.

Is it probable? No.

Ww

Long OXTGood moment to try to Buy OXTUSDT. We have ready temporary low point that can be a first point in the forming new up trend. Also before we can see 3 fast move down and back days. It can be good signals that instrument to take a power for future move up. Now the good moment to take it with good risk rewards ratio. Will see...

UpdateThe only good thing about this chart is that for now price is holding onto EMA 150 support. If price loses this support and breaks below the daily EMA 150 it means you have to accept that this project is still in a bear market. For us to confirm that there’s a bull market ahead of us, price needs to break above and close above weekly EMA 150. For now, there’s a lot of uncertainty in the market. In conclusion, above weekly 150 EMA means there’s hope for bull market for this asset. Below daily 150 EMA means crabs and bears are in control. Between daily and weekly 150 EMA means uncertainty.

HUGE opportunity for $OXTThe breaking of the triangle is imminent, matter of hours/days if the trend continue in this way.

Otherwise there will be one last push back before the next ATH, don't sleep on this one.

WeakPrice keeps failing to generate higher highs, while it has done a good job of forming lower lows. Soon If price fails to break above 12 cents and stay above this level, it could mean there’s no buying pressure which would potentially drag the price down back to around 8-9 cents. This is a crucial downtrend that must be broken, because only after breaking above this downtrend, big players might pour in.

OXT Looks Bearish (4H)It seems that from the point where we placed the red arrow on the chart, OXT has entered a complex correction. This correction appears to be either a Diametric or a Symmetric pattern.

From the red zone, it can drop towards the specified targets.

Currently, it seems to be in the early stages of wave E.

When the first target is reached, make sure to secure some profits and move the stop-loss to the entry point.

A daily candle closing above the invalidation level will invalidate this analysis and the bearish outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Error 404OXT failed to break out of the symmetrical triangle. Price is now heading back down to the support line of the triangle. If price fails to hold onto the support, OXT will bleed out bad. We all thought alt season is here, but it’s not. And with the DXY rising it’s taking down the entire market down with it. The DXY goes, the more OXT will bleed out.

Ascending ChannelI just made up an ascending channel. Like always, I don’t even know if this can be called an ascending channel or not, but I’m gonna assume it is an ascending channel and I think price is heading straight to the top of the channel. Price may surpass the top of the channel, but that is up for debate. Price may face resistance once it reaches the top of the channel according to past price action.

Ascending Broadening WedgePrice has found support on the weekly on the lower trend line of the breading wedge. I expect price to visit the top trend line of the broadening wedge which is about 33 cents which is about a 280% increase. Low market cap with increasing volume is a good sign. On top of all that, the chart has formed a massive inverse head and shoulders which increase the probability of the pop.

DYOR…

OXT WITHIN BUY ZONESCurrent price is still on a strong support level and this Level might not be visited again as buy trend would take us higher.

OXTUSDT.1DThe chart represents a daily time frame analysis of OXT/USDT (Orchid Protocol paired with US Dollar Tether) from June to early December 2024. My analysis begins by identifying a significant downtrend marked by the descending red trend line, termed R1, which highlights the resistance levels that have contained price movements since June.

Initially, the OXT price reached its high around mid-June at approximately $0.1190, and since then, it has been forming lower highs and lower lows, indicative of a bearish trend. The price tested the descending trend line in early August but failed to break through, confirming the strength of the resistance.

As of now, in early August, the price is attempting to stabilize above a support level, S1, marked at $0.0625. This support level is critical because it represents a previous price consolidation area from late July, suggesting it could be a potential reversal zone. However, if the price fails to sustain this level, it could fall towards the next support, S2, at $0.0535, which would align with the continuation of the existing bearish trend.

Looking at the technical indicators (not shown in the chart but typically used in such analysis), if the Relative Strength Index (RSI) is trending towards oversold conditions, and the Moving Average Convergence Divergence (MACD) shows a potential bullish crossover, it could indicate an impending bullish reversal or pullback.

To conclude, my current strategy would be cautious. I would monitor if the price can maintain above the S1 level and look for any bullish signals in the indicators to consider a long position. Otherwise, if the price breaks below S1, I would prepare for a potential short position, targeting the S2 as the next support level. As always, it’s crucial to place stop-loss orders to manage risk effectively in such volatile markets.

OXTUSDT's Situation: What Shall we Expect!Hi.

COINEX:OXTUSDT

Chart is Speaking It Self!!!

Simple analysis...

It appears to be moving within a Ascending triangle on the shorter time frame. Currently, it is attempting a breakout. A breakout retest of the triangle would indicate bullish momentum. However, if there is a rejection and a breakdown of the triangle, a bearish move is also expected.

Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

OXTUSDT ready to pump during alt seasonhi traders

OXTUSD has been retesting the support and it looks like it's ready for an impuse.

400 % profit is what we expect in the next months once the alt season is in a full mode.

Still early to buy . Patience will be required but if you're patient, you will be rewarded

We're bullish on OXT

Good luck