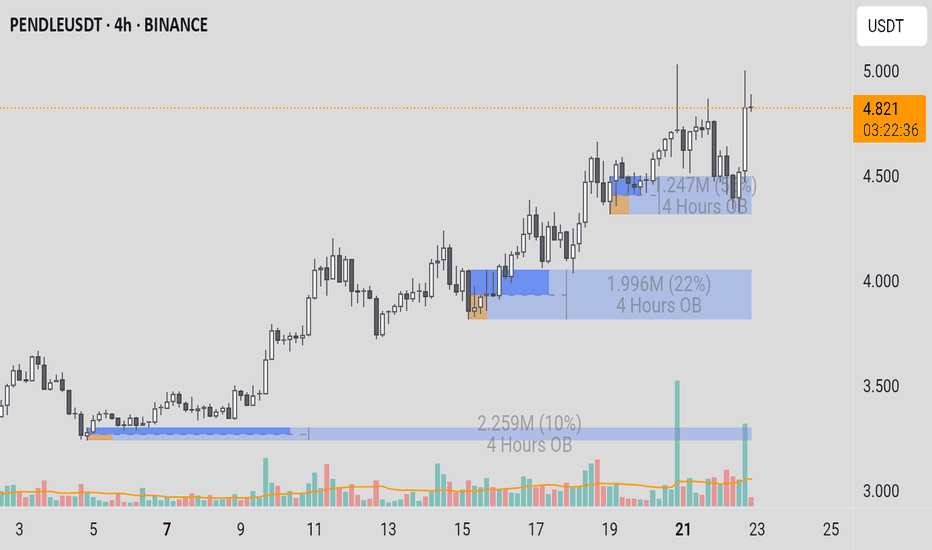

PENDLEUSDTDetailed Analysis of PENDLE/USDT 4-Hour (4h) Chart

Here is a structured insight and interpretation of the PENDLE/USDT chart as of July 22, 2025, to support trading decisions.

1. Chart Type and Instrument

* Chart Type: The presented chart is a Candlestick Chart.

* Instrument: The traded asset is PENDLEUSDT on the Binance exchange.

* Timeframe: The analysis is conducted on the 4-Hour (4h) timeframe, which is ideal for identifying short to medium-term trading opportunities (swing trading).

2. Identification of General Trend

This chart clearly displays two contrasting trend phases:

* Downtrend and Accumulation (Late June - Early July): In the first half of the chart, PENDLE was in a downtrend, which then slowed down and transitioned into a consolidation or accumulation phase around the $3.100 - $3.400 price level. The price failed to make a new low, signaling a weakening of selling pressure.

* Strong Uptrend (Starting July 9 - Present): Around July 9, a significant trend reversal occurred. The price successfully broke out of the accumulation zone and initiated a very strong and structured uptrend. This is confirmed by a consistent series of higher highs and higher lows.

3. Support and Resistance Levels (based on Order Blocks)

The chart analyst has marked key levels using the Order Block (OB) concept, which indicates zones of high liquidity.

* Support (Demand Zone):

* $4.500 - $4.700 (Blue OB): This is the nearest and most relevant support zone at the moment. The price is currently consolidating just above this area after an impulsive upward move.

* $3.900 - $4.100 (Blue OB): This was a crucial previous support zone. The price bounced strongly from this area around July 18-19, which became the launchpad for the move to the current level.

* $3.100 - $3.250 (Blue OB): The foundation of the entire uptrend. This is the origin demand zone where buying pressure first took dominant control.

* Resistance (Supply Zone):

* $5.300 - $5.600 (Orange OB): This is the major resistance zone above the current price. This area is likely the primary target for buyers and represents a significant hurdle where selling pressure is expected to increase.

4. Price Patterns and Key Events

* Market Structure Shift (July 9): The strong upward price movement on July 9 definitively broke the previous downtrend structure. This was the first and most important signal that market sentiment had shifted from bearish to bullish.

* Bullish Consolidation: The current price action (July 21-22), which is moving sideways above the $4.500 support zone, is forming a bullish consolidation pattern. This pattern is often a pause phase where the market "takes a breath" before continuing its primary trend.

* Respecting Demand Zones: The chart shows that the price highly respects the marked demand zones. Each time the price corrected back to one of the blue zones (Order Block), buyers stepped in and pushed the price higher, confirming the strength of these zones.

5. Use of Technical Indicators

* Volume: A noticeable increase in volume occurred during the initial breakout (around July 9) and on each subsequent impulsive upward leg. This indicates strong participation and commitment from buyers, which validates the strength of the uptrend.

* Order Blocks (OB): The primary indicator on this chart is the visualization of the Order Block zones. The blue zones (Demand) act as support floors, while the orange zone (Supply) acts as a resistance ceiling. The success of this strategy relies on the price reaction upon entering these zones.

Rationale for Entry Decision (Case Study)

Based on the current market conditions on the chart, a logical entry opportunity (buy position) can be considered based on the consolidation pattern above the support.

An entry could be made around the $4.700 - $4.850 level for the following reasons:

* Following the Dominant Trend: A buy position aligns with the primary trend, which is strongly bullish, thereby increasing the probability of a successful trade.

* Confirmation of Strong Support: The price is currently holding firm above the demand zone (Demand OB) at $4.500 - $4.700. This indicates that buyers are successfully absorbing selling pressure and defending a new, higher support level.

* Continued Accumulation Pattern: The current price consolidation can be interpreted as a re-accumulation phase before the next leg up. Entering during this phase allows a trader to get in before the next potential impulsive move.

* Defined Risk Management: A buy position at this level allows for a clear and logical placement of a stop loss, for instance, just below the blue support zone (e.g., at $4.450). If the price breaks this level, the short-term bullish scenario would be invalidated.

* Favorable Risk/Reward Ratio: With a defined risk, the primary profit target is the overhead resistance zone at $5.300 - $5.600. This offers a potential reward that is significantly greater than the risk.

Risks and Factors to Watch For

* Consolidation Failure: There is a risk that this consolidation pattern fails and the price breaks down below the $4.500 support zone instead. If this happens, the price will likely seek lower support around the $4.000 level.

* Exhaustion (Market Fatigue): Although the trend is strong, a rapid ascent can lead to buyer exhaustion. Watch for signs of weakening momentum as the price approaches its previous high around $5.100.

* Major Resistance Ahead: The supply zone at $5.300 - $5.600 is a very significant obstacle. Traders should be wary of a potential sharp reversal or large-scale profit-taking in that area.

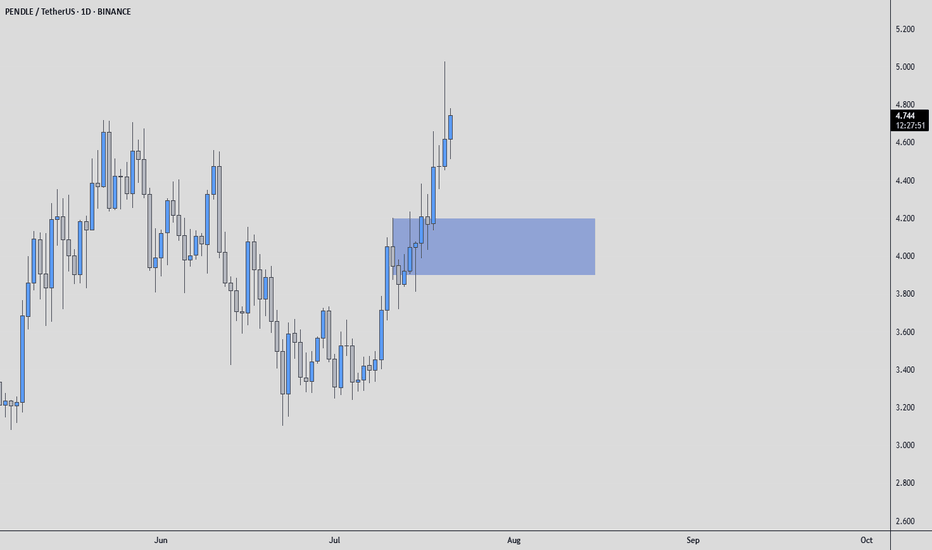

PENDLEUSDT trade ideas

PENDLEUSDT Mid-Term AnalysisVolume is increasing steadily, and the coin is cooking well.

I see no reason not to try a long from the blue box I’ve marked. This is where I’m interested, nothing more.

What we’re looking for:

✅ Entry from the blue box if the opportunity comes

✅ Clear footprint absorption and CDV support

✅ Structure reclaim for confirmation

No hype. No guessing targets. We let the market show us the next step.

If the setup aligns, we take it with tight risk. If it doesn’t, we wait.

Simple. Calm. Focused.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

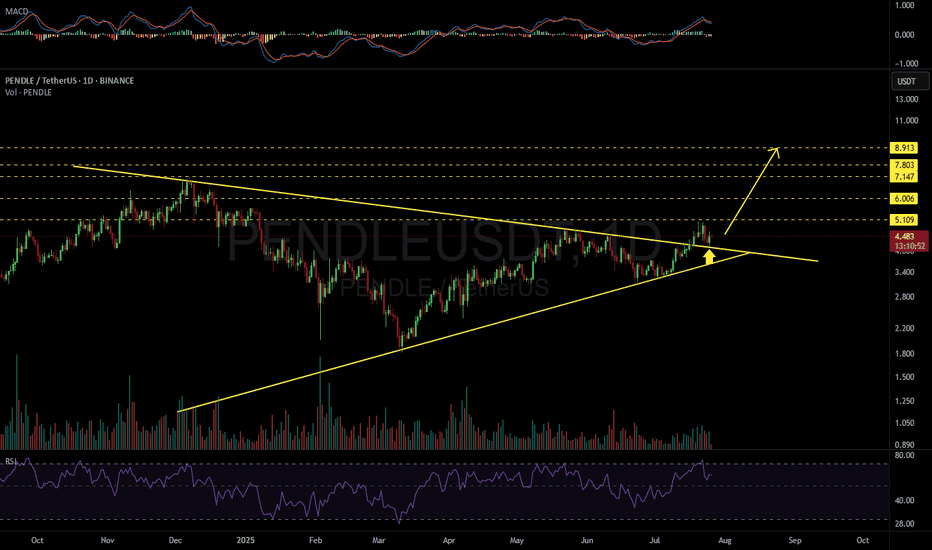

PENDLEUSDT 1D Chart Analysis|Bullish Breakout Eyes Higher TargetPENDLEUSDT 1D Chart Analysis | Bullish Breakout Eyes Higher Targets

🔍 Let’s break down the PENDLE/USDT daily chart, focusing on breakouts above key resistance, Fibonacci retracement dynamics, RSI momentum, and volume confirmation for a comprehensive bullish setup.

⏳ Daily Overview

PENDLE has staged a powerful recovery after pulling back to the 0.5 Fibonacci retracement level (around $3.12). Price is now testing the critical $4.68 resistance—the ceiling from the last corrective wave. RSI has jumped above 71, entering the overbought zone, a classic precursor to strong momentum moves. Volume is rising as bulls attempt a breakout, confirming participation behind the price action.

📈 Technical Convergence and Trend Structure

- Fibonacci Structure: The correction held the 0.5 retracement, a textbook bullish reversal zone in rising trends.

- Resistance Breakout: Price is challenging the $4.68 resistance. A daily close above, especially with high volume, would confirm the breakout and trigger bullish continuation.

- RSI Indicator: RSI has cleared the 70 mark, reinforcing strong momentum. Overbought RSI often supports further rallies when backed by breakout moves and rising volume.

- Volume Confirmation: Volume surged as PENDLE reclaimed lost ground and is now accelerating into the resistance test, suggesting trend conviction and confirming the move.

🔺 Bullish Setup & Targets

- First target: $5.54 — the next resistance based on historical supply and Fibonacci extension.

- If macro conditions like interest rate cuts align, the next potential target: $7.50 — the major extension target where price discovery is likely.

- Key trigger: A strong daily (or weekly) close above $4.68, combined with breakout volume, is likely to ignite the next leg up.

📊 Key Highlights

- Correction held at the 0.5 Fibo, signaling trend health and resetting momentum.

- A bullish daily structure aligned with a weekly breakout confluence.

- RSI and price action both making new local highs — strong uptrend indication.

- Volume confirming the move—a real breakout is underway, not a false start.

🚨 Conclusion

PENDLE/USDT looks primed for continuation higher. The blend of a successful 0.5 retracement retest, breakout attempt above $4.68, robust RSI, and volume surge all point to bullish follow-through. Watch for a confirmed close above resistance as the catalyst for further upside, with $5.54 and $7.50 the next logical targets if momentum persists.

PENDLE ranging = preparing for a movePENDLE is in a nice range. The price is currently in the middle of the range; however, if it gets overbought, it is likely that the price will visit the top of the range. If this range ultimately forms a bull flag, there is upside potential to consider.

Full TA: Link in the BIO

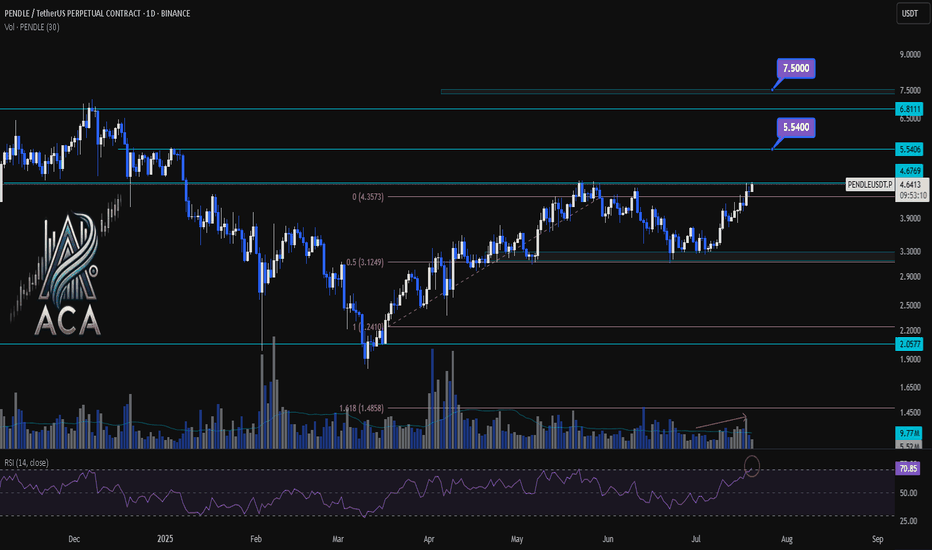

PENDLE – Bullish Continuation Setup from Key Support ZonePENDLE remains one of the standout performers in the crypto space, maintaining its bullish market structure even amid broader market uncertainty. With price currently holding well above key support, this presents a favorable opportunity for a swing long position, especially if the broader market stabilizes.

📥 Entry Zone:

$3.50 – $4.30

🔹 Confluence with previous resistance turned support

🔹 Demand zone within bullish structure

🔹 Ideal for scaling in

🎯 Take Profit Targets:

🥇 $5.45

🥈 $6.30

🥉 $6.85

🛑 Stop Loss:

Daily close below $3.00

Structure breakdown

PENDLE/USDT Technical Analysis – April 9, 2025🔍 Market Structure & Price Action

PENDLE has recently bounced from a significant demand zone around the $2.00–$2.20 area, highlighted by the thick blue box at the bottom of the chart. This area has acted as strong support in the past and shows renewed buying interest, evident from the bullish reversal and increased volume around mid-March.

Price action suggests the formation of a potential reversal structure, with the most recent swing low marking a possible higher low compared to the previous downtrend. The chart shows multiple black horizontal lines representing historical support/resistance zones.

🧠 My Perspective & Additional Insight

This chart suggests an early-stage reversal with bullish momentum building. The fact that price bounced cleanly from a macro support zone and is attempting to break above key EMAs strengthens the bullish bias.

With this head&shoulder should give to the price a real boost!

However, volume confirmation will be critical—look for a breakout above $3.25 with strong buying volume to confirm the move.

If planning to enter:

Entry: On reclaim of $3.20 with volume.

Stop Loss: Below $2.60 (or tighter depending on risk).

Targets: $4.25 → $5.42 → $7.50.

Patience is key. If price consolidates above EMAs, the bullish structure will remain intact.

Good trading :-)

PENDLE – Bullish Continuation?After months of consolidation, PENDLE appears ready to break out of its weekly range.

RSI breakout: Momentum has finally pushed through a long-term descending trendline — a potential shift in trend strength.

Technical structure: Clear higher lows, repeated resistance tests — bulls may be gaining control.

Key Fibonacci levels:

0.618 reclaimed ($5.12),

Next potential targets: $6.50 – $10.19 (1.618 extension),

Higher extensions: $15.24 and $20.30 if bullish momentum continues.

If this breakout confirms with a strong weekly close, PENDLE could enter a new trend phase and aim for price discovery.

PENDLEUSDT → Resistance retest. One step away from distributionBINANCE:PENDLEUSDT is preparing for distribution after a prolonged consolidation. The price is testing a key resistance level, which, if broken, will trigger a rally...

The coin is breaking through the flat resistance and consolidating above the upper border of the range. The key level is 4.400. If the bulls hold their ground above this level, the growth may continue.

Bitcoin is showing bullish dynamics, which supports the altcoin market. The bullish trend may continue in altcoins as well. Pendle may move from consolidation to distribution.

Resistance levels: 4.32, 4.400

Support levels: 4.024, 3.622

If the coin manages to consolidate above the key resistance level, thereby confirming the breakout, the price may move to aggressive growth. In this case, the target could be 4.800.

Best regards, R. Linda!

Pendle New ATH, Resistance & Support —Highest Ever Within MonthsWatch the same price range alternate between resistance and support, the blue line/space on the chart.

There is also a long-term double-bottom and the Adam & Eve formation, all together in the same chart.

This paints a picture of a changing cycle. The recovery from the A&E is quite strong. From the 11-March low we have two long months of painful recovery, slow and steady growth. But PendleUSDT now trades above resistance/support.

The chart is self-explanatory, once on the bullish zone, PENDLEUSDT can grow. This is the situation now. Resistance was conquered 9-May. The proceeding days it was tested as support and holds.

We can expect some consolidation above this level and then boom! A strong advance hitting new highs. Pendle is set to hit its highest prices ever in 2025 and then some more. $11 and $16 are the main targets.

Thank you for reading.

Namaste.

PENDLE Bearish Head and Shoulders – Potential Pullback at the Ne CRYPTOCAP:PENDLE Bearish Head and Shoulders – Potential Pullback at the Neckline 📉

CRYPTOCAP:PENDLE has formed a bearish head and shoulders pattern. We could see a potential pullback at the neckline before the price moves down to the green line level as the next target. 📊

PENDLEUSDT 📈 PENDLEUSDT 4H Analysis:

Price rebounded from the 2.444 demand zone after a short-term breakdown and is now stabilizing above the 200 EMA, with the bullish trendline still intact. Key resistance lies at 3.219, and breaking it could open the path to 3.602. However, a drop below 2.626 and the trendline may trigger a deeper correction.

PENDLEUSDTshort selling set up 📉

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

PENDLEI'm take short selling, cancel close position if break above strong high

RR 1 : 2

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

#PENDLE/USDT#PENDLE

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 2.63.

Entry price: 2.85

First target: 3.07

Second target: 3.20

Third target: 3.40

#PENDLE: Unlocking Yield Tokenization in DeFi**Description**:

This trading idea focuses on **PENDLE**, a DeFi protocol that introduces yield tokenization, allowing users to separate and trade future yield from underlying assets. By enabling a secondary market for yield-bearing tokens, **PENDLE** provides investors with new opportunities for maximizing returns and managing risk exposure in decentralized finance. With the growing demand for innovative yield strategies, **PENDLE** has positioned itself as a key player in the evolving DeFi landscape, attracting liquidity and institutional interest.

Despite its potential, the cryptocurrency market remains highly volatile, with factors such as regulatory developments, macroeconomic conditions, and investor sentiment influencing price movements. As always, a cautious approach and proper risk management are essential when trading **PENDLE** or any digital asset.

**Disclaimer**:

This trading idea is for educational purposes only and should not be considered financial advice. Trading cryptocurrencies like **PENDLE** carries significant risk, including the possibility of losing your entire investment. Always conduct thorough research, assess your financial situation, and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.