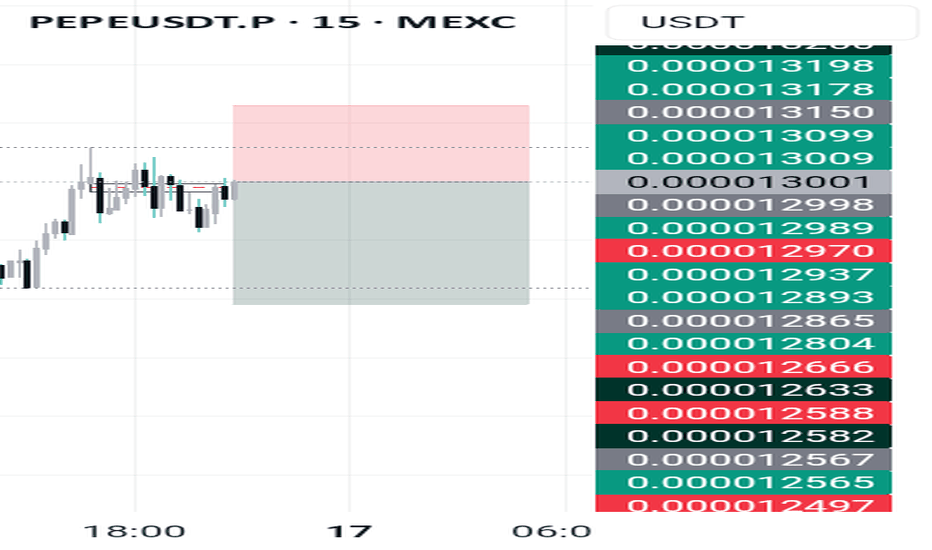

PEPE Breaks Out After Triple Bottom – Retest Incoming?PEPEUSDT just printed a textbook 3-tap support rejection, followed by a Break of Structure (BOS) through the descending trendline — now bulls are watching for a retest entry opportunity.

--Key Technical Highlights:

🔹 3 Rejections @ Support: Price respected the ~$0.00001000 level multiple times, building a strong base.

🔹 Break of Structure (BOS): Momentum shifted as PEPE broke the local highs and pierced descending resistance.

🔹 Wait for Retest: Ideal entry comes on a pullback to the previous resistance for a clean breakout confirmation.

🔹 Target: $0.00001351 – Based on prior swing highs and fib extension levels.

**A failed retest could invalidate the setup — watch lower support (~$0.00000900) for last line of defense.

PEPEUSDT trade ideas

PEPE SHORT Despite all the recent buzz about an alt-season, I don’t think the market is quite ready yet. PEPE is currently following the downtrend resistance line, which suggests the trend is likely to persist. A key level to consider for taking profits is around 0.0000079 — a significant price point for PEPE that previously sparked a major rally just before Christmas. This trade has a brilliant risk to reward!

Pepe update hello friends✋️

Considering the drop we had, you can see that the price was well supported in the specified area and buyers came in. Now in the return of the price, we can buy step by step in the specified support areas and move with it until the specified goals, of course, with the management of shame and risk...

*Trade safely with us*

Sell Opportunity Pepe has been moving within a bearish flag, and now the sell opportunity is almost ripe.

An aggressive trader can entry after a breakout to the downside and hold to 0.00000749.

Or

If you are a conservative trader, wait for a breakout and retest before you enter. Once that happens, enter you sell trades and hold to 0.00000749.

Or

Will PEPE/USDT Reach $0.000011?PEPE coin is showing signs of technical strength amid renewed crypto market optimism. It is currently trading around $0.000009890 with a modest rise of over 1.69% in the past 24 hours but still remains within a tight consolidation range. This hints towards a potential breakout, offering a potential upside of more than 50%.

The PEPE price has been trading within a descending parallel channel but has formed a small ascending parallel channel within

Interestingly, the CMF is dropping while RSI is making every attempt to keep the price elevated, holding the ascending support

This suggests that the strength of the rally is coiling up but the money flow into the platform has decreased

This may place the PEPE price at a crucial juncture as the token is required to break out of the resistance of the main channel to sustain within the ascending trend channel. Hence, the upcoming weekend could have a huge impact on the PEPE price, as a rise above $0.00001 could invalidate the bearish thesis.

Time to short? 🐸 PEPEUSDT – Breakdown of Ascending Channel & Potential Drop to Key Support

📉 Timeframe: 1D

🗓️ Date: July 9, 2025

---

🧠 Technical Overview:

After several weeks of consolidation within a short-term ascending channel, PEPE has reached a key resistance zone and is showing signs of bullish exhaustion. Volume divergence and failure to break resistance with strong momentum are increasing the probability of a bearish breakdown.

---

📌 Key Levels:

✅ Major Resistance: 0.00001150 – 0.00001200

🟡 Mid-Term Support: 0.00000929 (currently being tested)

🔴 Critical Support: 0.00000597 – a historical low with strong previous reactions

---

📊 RSI Insight:

The RSI is currently hovering in the neutral zone (45–55).

A failure to push above the 60 level could signal continued bearish pressure.

---

💡 Trade Idea (Short Setup):

If price confirms a breakdown below 0.00000929:

Short Entry: Below 0.00000900

Target 1: 0.00000780

Target 2: 0.00000597

Stop Loss: Above 0.00001100 or invalidation of the channel breakdown

---

⚠️ Disclaimer:

This is a technical analysis-based outlook and not financial advice. Always apply proper risk management and stick to your stop loss.

Trading plan for PepeI've marked the new monthly pivot point on the chart for you. I've also outlined potential scenarios based on the higher timeframe analysis and highlighted key trading levels for this week.

Pepe has followed my indicator's local trend perfectly over the last two weeks, increasing the likelihood of an upward move toward the resistance zone without further correction. However, if the local low is breached, the expected rally to resistance would likely be delayed.

Trade safe and stay adaptive!

Lingrid | PEPEUSDT Inverse Head and Shoulder. Bullish Reversal ?BINANCE:PEPEUSDT is forming a potential reversal setup after rebounding from the 0.00000876 support within a well-defined downward channel. Price action shows signs of accumulation with a right shoulder (RS) formation and a potential breakout brewing above the descending blue trendline. A clean push toward the 0.00001125 resistance would confirm the pattern and may trigger further upside toward the red trendline.

📈 Key Levels

Buy zone: 0.00000876–0.00000900

Sell trigger: failure below 0.00000876

Target: 0.00001125

Buy trigger: breakout and retest of 0.00000960–0.00000980

💡 Risks

Strong resistance from downward channel could limit upside

Breakout failure may trap buyers near 0.00000980

Low liquidity increases volatility risk near major levels

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

PEPE is cooking something!⚡️ Hello, everyone! Today I noticed a catastrophic gap: so much time has passed, and I still haven't written about PEPE!

With the emergence of hundreds of thousands of new memecoins, the old ones seem to have disappeared into oblivion. B ut is that really the case, and does PEPE still have a chance? Let's find out!

Having closed all the gaps above and below, PEPE has no further pronounced magnet for movement and is likely now entering a consolidation phase.

🕓 It is worth remembering that the narrative itself is still important in meme coins. And PEPE is an eternal meme, it will live forever, it is literally the embodiment of meme culture in the world. So from this point of view, there is definitely no need to fear the token's oblivion.

⚙️ Metrics and indicators:

Volume - forms a divergence with the price. Throughout the correction, sales volumes continue to decline, signaling the exhaustion of sellers.

Money Flow - harmony with the price. Liquidity continues to decline, positions are being closed. But, in general, the indicator is in the neutral zone.

Support/Resistance - PEPE has now reached the largest zone of interest at 0.00000817 and is trying to consolidate there. This is a powerful level around which consolidation can be expected before further growth. However, if the price falls below it without the possibility of returning, it will be an extremely bearish signal.

Liquidity Depth - As we know, the price moves from one liquidity to another; this is its fuel. And now, there is significantly more of this fuel accumulated at the top. PEPE has always been a highly speculative asset, and during prolonged one-sided movements, extremely high funding is formed in it. This further provokes sharp jumps in price.

📌 Conclusion:

PEPE will definitely not die as a narrative, so there is nothing to worry about. Of course, thousands of new memecoins have stretched liquidity across the market, and many have left PEPE for new shiny things.

But in truly difficult times, when your FARTCOIN and HarryPotterObamaSonicInu are down 90% in a day, many will return to PEPE, especially at such a low price.

According to technical analysis, PEPE is doing much better than DOGE. Flat liquidity inflows, decreasing sales volumes. Those who wanted to leave have already left. And I personally am already starting to look at spot purchases of PEPE at current levels.

🔥 Have a great week, everyone!

Skeptic | PEPE : Spot & Futures Triggers for Maximum EdgeWelcome, traders, its Skeptic! Ready to dissect PEPE’s next moves? I’m diving into a pro-level analysis of PEPE, the #30 crypto and 3rd largest meme coin with a $4.08B market cap. This Analysis delivers a comprehensive breakdown—quick facts, 2025 performance, community strength, and technical triggers for spot and futures trading, all rooted in HWC, MWC, LWC cycles. Trade with no FOMO, no hype, just reason. 🙌 Let’s master PEPE! 🚖

Quick Facts

PEPE, an Ethereum-based meme coin launched in April 2023, is inspired by the Pepe the Frog internet meme. With a 420.69 trillion token supply, it features a deflationary burn mechanism and redistribution rewards for long-term holders. Currently trading at $ 0.00000946 , it ranks as the # 30 cryptocurrency and the 3rd largest meme coin behind Dogecoin and Shiba Inu, with a $ 4.08B market cap. Let’s unpack its 2025 performance and technical setup for actionable trades. 📊

2025 Performance & Community

PEPE has faced significant volatility in 2025, down 25.7% year-to-date and 35% this month. Despite this, its community remains robust with 456,000 + holders, and an impressive 37% haven’t sold in over a year , signaling diamond hands and strong belief in the project. This resilience suggests potential for recovery if market sentiment shifts.

Technical Analysis: Cycle-Based Breakdown

From a cycle perspective, Weekly/Monthly timeframes are range-bound, meaning lower timeframes drive most price action and shape near-term opportunities. Let’s break it down:

Daily Timeframe

After a 100% jump from May 6-22, 2025, PEPE retraced nearly the entire move. Momentum is currently bearish on the Daily, but declining volume during this pullback suggests traders view it as a correction rather than a trend reversal. Interest in heavy trading is low, indicating limited momentum for now.

Key Insight: The Daily is bearish but lacks strong selling pressure, hinting at consolidation. Watch for volume spikes to confirm directional moves.

Triggers for Spot Trading

Long Trigger: Break above resistance at $ 0.00001403 , confirmed by a volume surge during the breakout. For extra confirmation, check PEPE/BTC.

If PEPE/BTC breaks its downtrend line, it signals liquidity inflow and potential for strong growth. The primary trigger is a break of 0.0000000001399 on PEPE/BTC, which could spark explosive rallies for PEPE. Use indicators/oscillators (e.g., RSI) for additional confirmation, as PEPE/BTC volume is fake due to it being a ratio.

Key Insight: A PEPE/BTC breakout is a strong bullish signal, but volume confirmation is critical to avoid fake moves.

4-Hour Timeframe for Futures Triggers

On the 4-hour chart, PEPE has started an uptrend momentum. Should you go long on a break of resistance at $0.00001049? No —the Daily remains bearish, making the first wave risky. First-wave moves against the Daily often face high volatility and fake breakouts, lowering your win rate. Instead:

Long Trigger: Wait for the second uptrend wave after breaking $0.00001049, forming a range ceiling. Confirm with a volume increase, RSI entering overbought, or other oscillators to avoid fake breakouts or stop-loss hunts.

Short Trigger: Break below support at $ 0.00000894 is a strong short trigger, aligning with the bearish Daily. This setup offers favorable R/R ratios, especially if 4-hour momentum turns bearish. Set alarms for this level to catch the move.

Pro Tip: Shorts are safer due to Daily alignment. For longs, skip the first wave, wait for the second, and use tight risk management to navigate volatility.

Final Vibe Check

This PEPE Analysis arms you with precise triggers for spot and futures trading, leveraging cycle-based strategies. With a range-bound Weekly, focus on Daily and 4-hour for opportunities. Short at $0.00000894 aligns with the trend, while longs need second-wave confirmation above $0.00001049 or a PEPE/BTC breakout at 0.0000000001399. Protect your capital—stick to MAX 1%–2% risk per trade. Want more cycle-based setups or another pair? Drop it in the comments! If this analysis sharpened your edge, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which PEPE trigger are you watching? Share your thoughts in the comments, and let’s crush it together!

Pepe flashing golden cross signal! The overall market is shaky and btc will be a driving factor whether Pepe can pump with bullish momentum. With this said we have flashed a golden cross which is a good indication that momentum could be building. When we mix this with oversold ti on most time frames and a few bullish divergences showing, I feel Pepe could be ab to break out of our falling wedge pattern. Breaking our rsi downtrend on the daily will be a good starting point to gauge further market sentiment. Wait for confirmation.

Pepe Prepares To Grow After 5 Weeks Red (5X Possible)I am sorry, the system is not working and won't let me write more than a few lines. This is the best I managed to publish without getting an error.

You can get the idea by looking at the chart and drawings. It points to higher prices in the coming weeks and months. Namaste.