Nikkei 225 Index Surges Above 41,000 PointsNikkei 225 Index Surges Above 41,000 Points

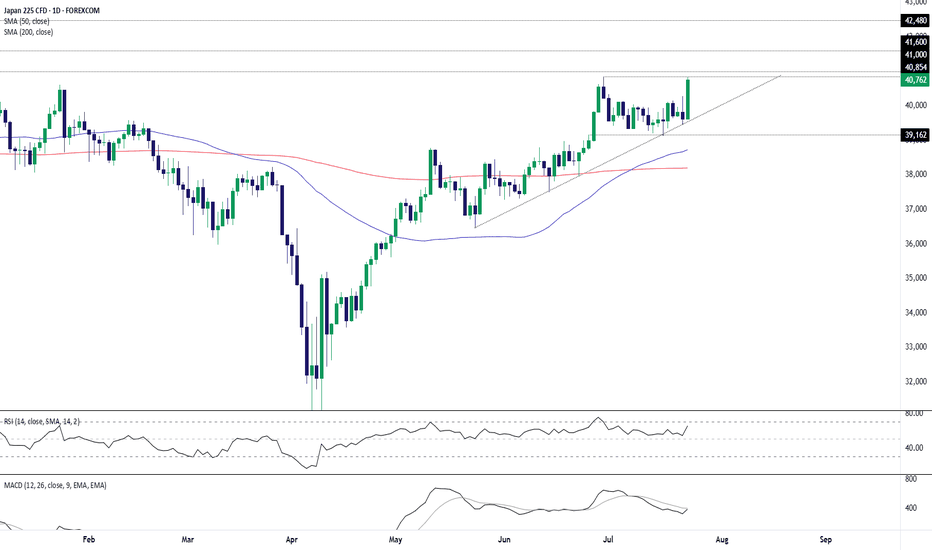

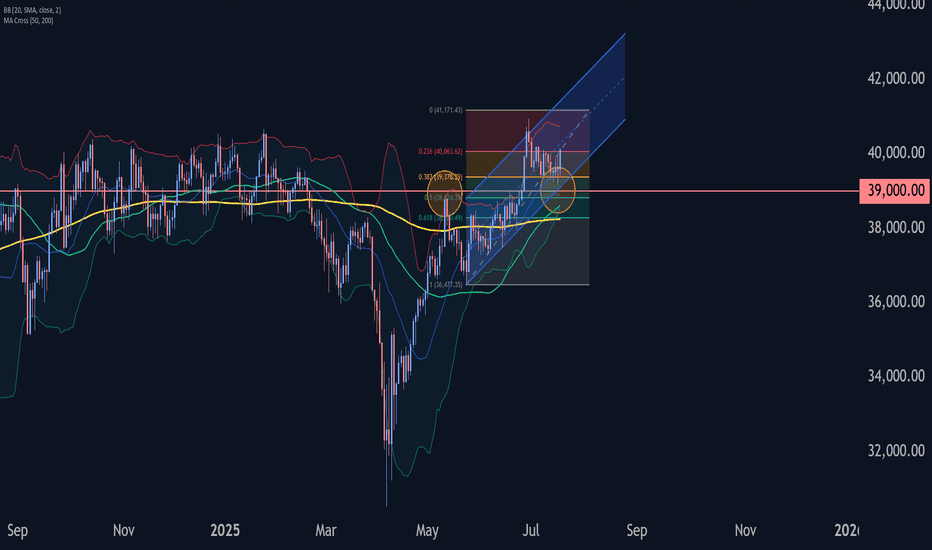

As the chart indicates, the value of the Nikkei 225 stock index has risen above the 41,000-point level — its highest mark since July 2024.

The primary bullish driver is the conclusion of a trade agreement between the United States and Japan. According t

About Japan 225 Index

JPN225 is a popular financial derivative based on the leading and most-respected Japanese stocks. This price-weighted index, valued in yen, has been calculated daily by the Nihon Keizai Shimbun (Nikkei) newspaper since the Index's inception in 1950. It comprises Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Japan 225: Breakout Watch as Tariff Cut Fuels RallyThe Japan 225 contract is ripping higher today on a trade deal being reached between the U.S. and Japan, including the apparent lowering of auto tariffs to 15%.

The price has already bounced strongly from uptrend support established in May, putting a potential retest of the June 30 high of 40854 on

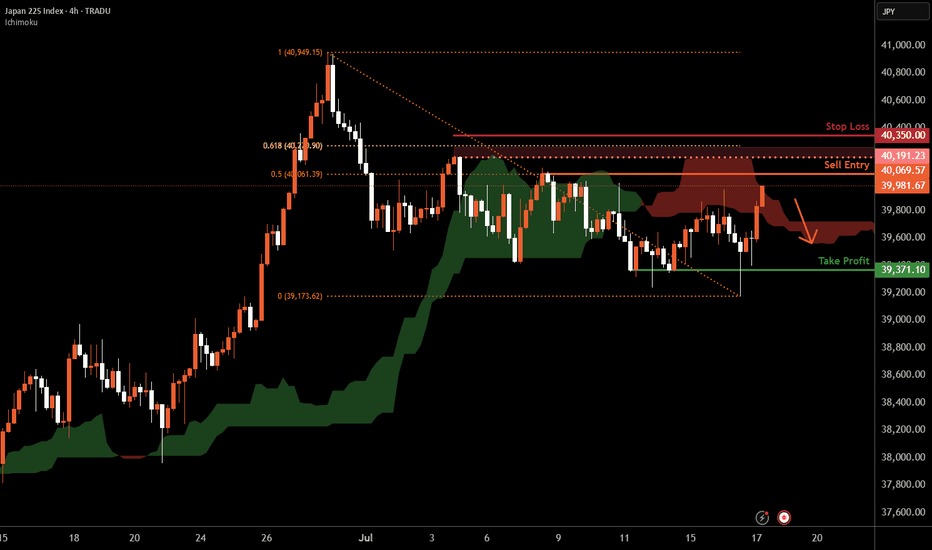

Nikkei 225 H4 | Swing-high resistance at 50% Fibo retracementThe Nikkei 225 (JPN225) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 40,069.57 which is a swing-high resistance that aligns with the 50% Fibonacci retracement.

Stop loss is at 40,350.00 which is a level that sits above the 6

JP225 Long Trap or Bull Escape? Heist in Motion.🦹♂️🎯 JP225 Ninja Heist: Breakout Loot Plan 💥💰 (Long Game Playbook)

🌟Hi! Hola! Ola! Bonjour! Hallo! Assallamu Allaikum!🌟

Dear Money Makers, Market Raiders & Silent Robbers, 🤑💰💸✈️

It’s time to gear up for the ultimate breakout heist on the JP225 / NIKKEI Index CFD Market. Based on my 🔥Thief Trading

Bit of a delay - New Falling Wedge ready to break upJapan like Hong Kong is showing strong signs of growth.

We first had the breakout above the Cup and Handle and now we are awaiting the breakout above the Falling Wedge...

There are some strong signs of upside fundamentally...

💼 1. Solid GDP & corporate profits

Japan’s economy grew about 2.7% a

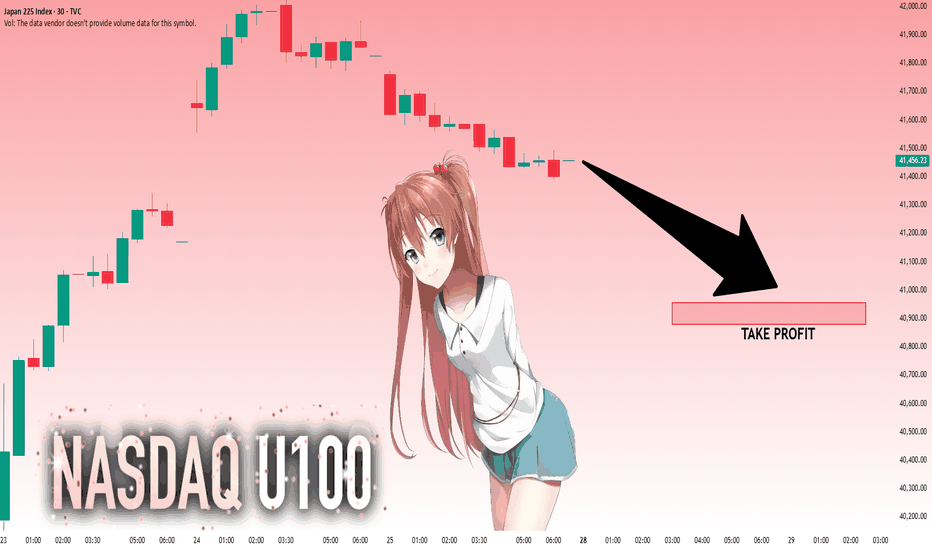

NI225: Move Down Expected! Short!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 41,456.23 will confirm the new direction downwards with the target being the next key level of 40,954.70 and a reconvened placement

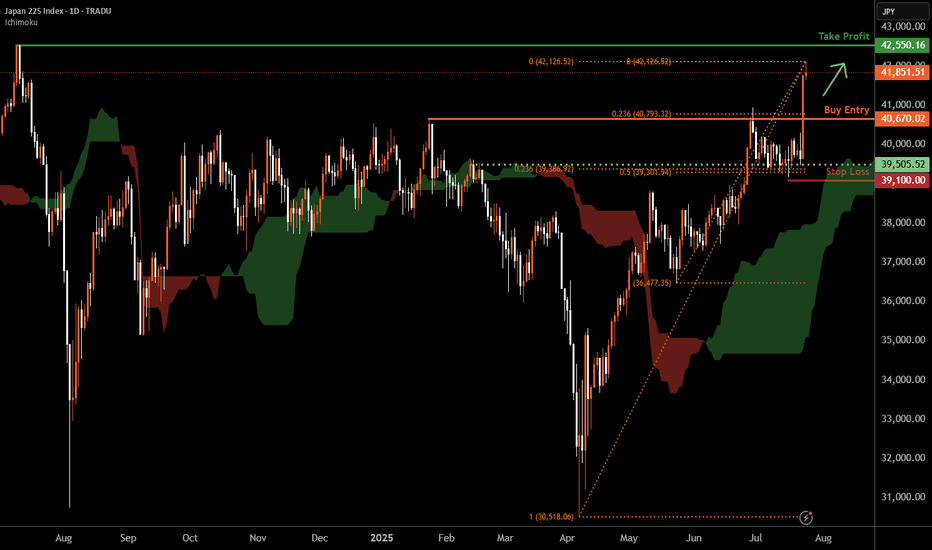

Nikkei 225 D1 | Strong upward momentumThe Nikkei 225 (JPN225) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 40,670.02 which is a pullback support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 39,100.00 which is a level that lies underneath an over

NIKKEI Buy Plan — ATH Breakout Incoming!🚀 NIKKEI Buy Plan — ATH Breakout Incoming!

Buyers should stay alert and confident — NIKKEI is not just aiming to break its previous all-time high, it's preparing to print a brand new one. The recent price action shows strong bullish continuation, supported by:

✅ Weekly Fair Value Gap respected and

Nikkei 225 Wave Analysis – 17 July 2025

- Nikkei 225 reversed from support area

- Likely to rise to resistance level 40550.00

Nikkei 225 index recently reversed up with the daily Doji from the support area located between the key support level 39000.00 (former resistance from May) and the support trendline of the daily up channel from M

JAPAN as a HERO? UP! GOKU Last Fight! JAPAN is the last one to join the party! The final fight for the #BlowoffTop.

Why is this so important? If you look at correlations with BTC, global liquidity, China, the Fed’s interest rates, and more, Japan plays a key role. After China, Japan is the next to wake up and give the final push to t

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Japan 225 Index reached its highest quote on Jul 11, 2024 — 42,483.1 JPY. See more data on the Japan 225 Index chart.

The lowest ever quote of Japan 225 Index is 14,356.0 JPY. It was reached on Oct 16, 2014. See more data on the Japan 225 Index chart.

Japan 225 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Japan 225 Index futures or funds or invest in its components.