JPY at Key Zone – EURJPY & GBPJPY Could Drop 1k+ PipsExactly one year ago, the JPY Currency Index broke above the falling trendline of a falling wedge, signaling the end of a bearish cycle that had lasted nearly five years.

As is typical after long-term reversals, the reaction was sharp and fast, and the price quickly reached the first resistance target of the pattern.

Since then, the index entered a lateral phase, with clear support forming around the 730 zone.

________________________________________

🔍 Current Price Action

Recently, the price pulled back to test that same support, and at the time of writing it sits at 737, forming a tight consolidation.

This suggests we’re again at an inflection point.

________________________________________

📊 Trade Outlook

From a medium-term perspective, I believe the index is preparing for another leg higher, potentially toward resistance at 780.

➡️ That would mean a 7% rise on the JPY Index – and this move could translate into more than 1,000 pips of downside for pairs like EURJPY and GBPJPY.

________________________________________

🔄 What’s Next?

In the coming sessions, I’ll focus on these two pairs as they offer the clearest setups and have the strongest volatility.

Stay tuned — follow for the next updates. 🚀

JPYX trade ideas

JPYX SHORT IDEAPattern: Rising Channel Breakdown

Entry: Price has broken below the rising channel, confirming a bearish structure. Retest might occur before further downside movement.

Target: Looking for price to reach the key support zone around 745.0

Confluence:

• Trendline break

• Lower highs forming

• Potential continuation towards key support

Waiting for a clean retest or strong bearish momentum confirmation before entering the trade.

JPY Currency Index Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# JPY Currency Index Quote

- Double Formation

* (Diagonal) | Completed Survey

* Trendline Crossing | Entry Feature & Short Position | Subdivision 1

- Triple Formation

* 012345 | Wave Structure | Subdivision 2

* 0.786 Retracement Area & Reversal Attempt | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias))

* (Uptrend Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

JPYXThe Japanese Yen (JPY, ¥) is the official currency of Japan and one of the most traded currencies in the world. It is often used as a safe-haven currency in times of economic uncertainty.

Here are some key details about the Japanese Yen (JPY):

• Currency Code: JPY

• Symbol: ¥

• Issued by: Bank of Japan (BoJ)

• Subunit: 1 yen = 100 sen (though sen is rarely used)

• Most Traded Pairs: USD/JPY, EUR/JPY, GBP/JPY, and AUD/JPY

• Monetary Policy: Controlled by the Bank of Japan, which often keeps interest rates low to stimulate the economy.

• Economic Influence: The yen’s value is affected by Japan’s exports, interest rates, inflation, and global market trends.

JPYXThe Japanese yen (JPY) is the official currency of Japan and one of the most traded currencies in the global foreign exchange market. Introduced in 1871, it is symbolized by “¥” and known for its stability, often serving as a safe-haven currency during economic uncertainty. The yen plays a crucial role in international trade, particularly in Asia, and is a key reserve currency alongside the U.S. dollar and the euro. Its value is influenced by Japan’s export-driven economy, monetary policies, and global market dynamics.

My plan SHORT for AUDJPT and LONG for JPYUSDI saw A strong DownTrend structure on OANDA:AUDJPY

I saw A Break Sell follow trend on M15 chart of AUDJPY

Also I Saw a strong Break buy follow trend on M15 chart of PEPPERSTONE:JPYX JPYUSD currency index.

So I make a plan SHORT for AUDJPY and also a plan LONG for JAPAN YEN

Target with RR= 3

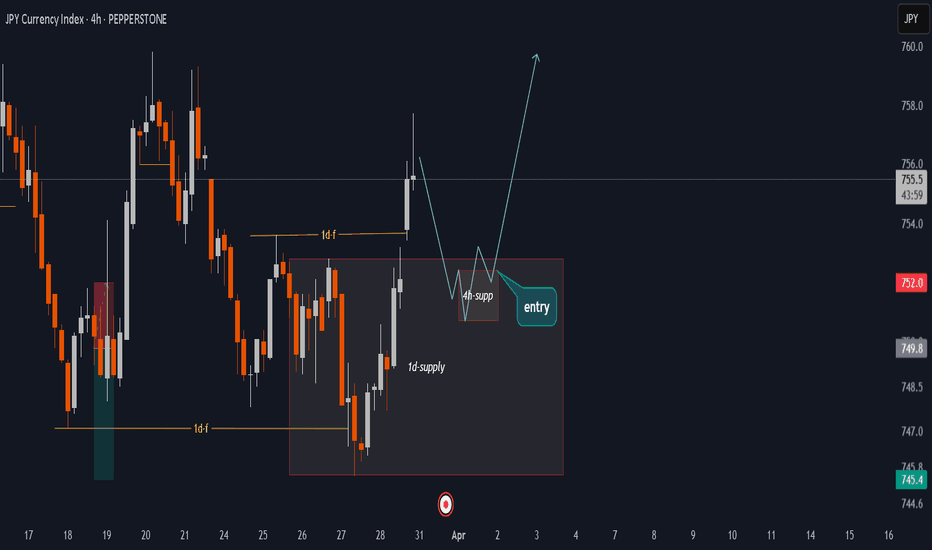

JPY currency index and JPY pairs ideas📊🇯🇵Since JPYX (JPY Currency Index), Daily chart rebounded from the Demand zone after the Jibun Bank Japan Manufacturing PMI yesterday.

Here we spotted some JPY pairs changed direction in Daily Chart as well. They are in BOS(Break of structure) stage, we are waiting a retest back to the Sell Zone and drop again.

JPY Index Reversal – FVG Tap and Potential Upside Move?The JPY Index has tapped into a high-probability Fair Value Gap (FVG) after taking out sell-side liquidity. This price action suggests a strong move to the upside may be on the horizon, with price moving from Internal Range Liquidity (IRL) to External Range Liquidity (ERL). With the FVG acting as a key reversal zone, targets are set at 747.5, 771.1, and the higher buy-side liquidity at 788.3.

DYOR

JPY Surge Ahead Could Trigger a Major Drop in GBB/JPYThe JPY Currency Index (JPYX) is approaching a key demand zone, highlighted in blue on the chart around the 748 level. After a sustained downtrend, this area is likely to serve as support, with a potential bullish reversal indicated by the projected price movement. A bounce off this zone could trigger a strong upward move, targeting higher levels.

However, if the support breaks, further downside momentum may occur. Watching for confirmation of reversal patterns is crucial before entering any long positions. The zone presents a high-probability area for buyers to step in, but patience is required for confirmation.

If the JPYX (Japanese Yen Index) bounces from the current demand zone and strengthens, we can expect the Japanese yen to appreciate. This would likely lead to a bearish impact on GBP/JPY, as a stronger yen typically causes a decrease in GBP/JPY price. The yen’s strength would outweigh the British pound, pushing the pair lower.

On the other hand, if the JPYX breaks through this support level and weakens further, the yen would depreciate, driving GBP/JPY higher as the pound strengthens relative to the yen.

Key points to watch:

A JPYX bounce could trigger a GBP/JPY drop.

A JPYX decline might result in a GBP/JPY rise.

The exact impact will depend on the strength of the yen's reaction and how the pound performs during this period.