PLATINUM trade ideas

PLATINUM Strong Triangle buy opportunityLast time we looked at Platinum (XPTUSD) was more than 2 months ago (January 30, see chart below) getting our expected rise and hitting the 999.50 Target:

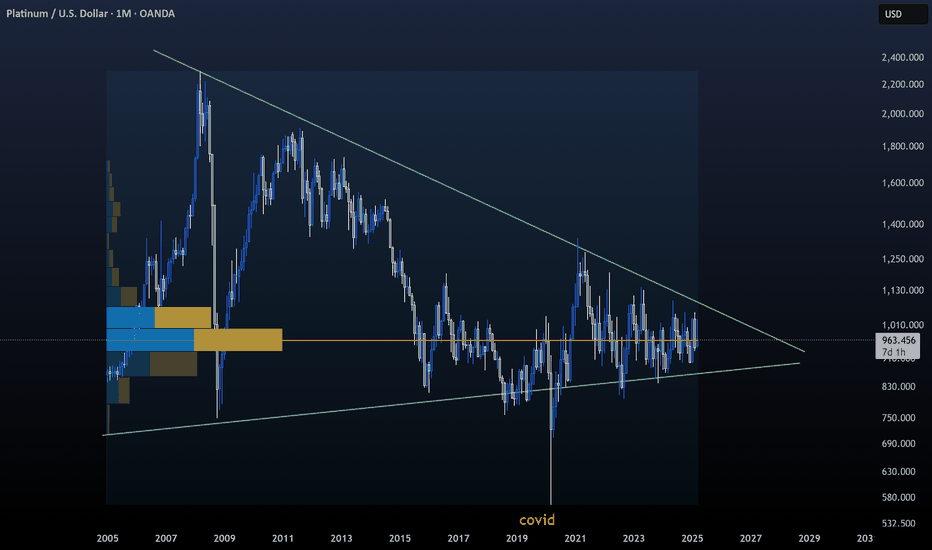

This time the price is at the bottom (Support Zone) of the 11-month Descending Triangle pattern, which is a technical buy opportunity. The last Bullish Leg hit the 0.618 Fibonacci retracement level, while the one before the 0.786.

As a result we have a minimum 985.00 Target on this emerging Bullish Leg.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Platinum: Looking for a LongNot the cleanest setup, to be honest — we've got heavy red candles, elevated volatility, closes near the lows, and overall sentiment is weak. Other commodities aren’t helping either.

Still...

We’ve come down to a solid level where a long looks worth a shot.

The sell-off seems largely driven by Trump’s tariff noise. But the broader play isn't just about raising tariffs — it’s a negotiation tactic. We saw the same with Mexico and Canada. Now other countries are starting to show willingness to talk too.

In my view, most of the downside pressure has likely been priced in — at least for now. I don’t expect another leg down straight away. Even if the market wants lower, it probably needs to base a bit first.

All in, I’m comfortable taking a long here. Let’s see how the open shapes up, but this one’s already in my trade plan.

There's a similar decent setup in palladium, but the stop is way too wide there, so I’m going with platinum.

Platinum Price Analysis: Breakout Strategy and Market OutlookIn this video, we take a look at platinum prices following a request from a reader. Despite a brief breakout, the price hasn't risen as expected and may be morphing into a classic triangle pattern. The best strategy now is probably to wait for a triple top to form before potentially trading a breakout. We also discuss different strategies, including trading within the pattern itself.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Platinum Portfolios: A Bullish Signal for Future Gains!Yesterday, as markets slept, a shadow flickered across Platinum’s charts. Portfolios materialized like cryptic clues—hours before prices erupted in a 3% vertical rally. But here’s the twist: the official CME report won’t land until tomorrow. By the time most traders react, the first wave will already be history.

The Setup: Why This Move Matters

1️⃣ "The Insiders Always Whisper First"

Last times, a similar pattern in Platinum’s options market foreshadowed a 150$ surge. History doesn’t repeat, but it rhymes.

These portfolios? They’re not random. They’re telegraphs from players who trade with one eye on the horizon.

The Bottom Line

This isn’t just about Platinum. It’s about trade pattern recognition. The market rewards those who connect dots before they’re obvious.

So, ask yourself:

Are you watching the right data?

Will you be ready when the next domino falls?

Stay sharp. Stay curious. And never underestimate the whispers. 🧠💥

Bullish winds are blowing. Will you sail with them? 🌪️🚀

Do your own research or follow along with us! Two minds are preferable to one!

Platinum Breakout Looming: A 6x Risk-Reward Setup in PlayPlatinum is setting up for a breakout above $1,010, with chart patterns pointing to a target near $1,092 and a potential 6x risk-reward ratio. While other metals have already moved, platinum could offer a strong short-term trade if the breakout triggers.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

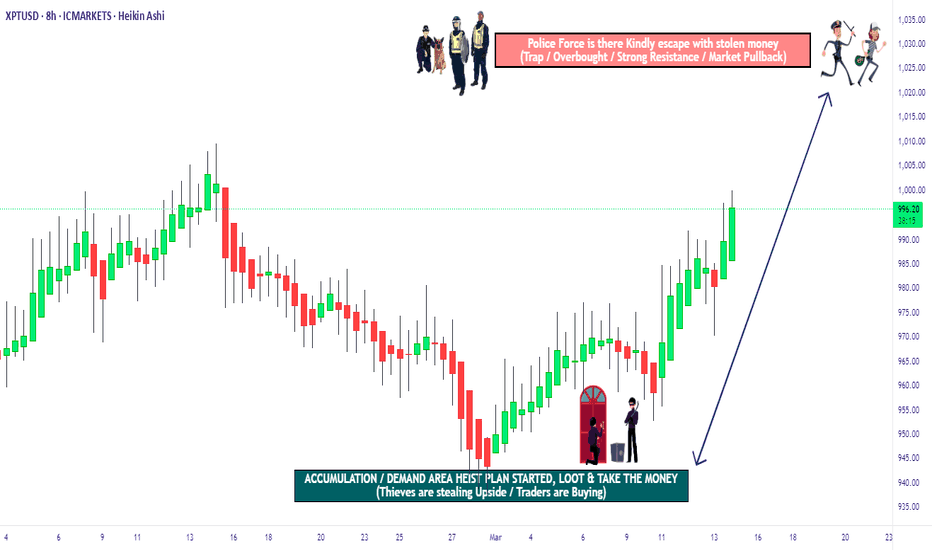

XPT/USD "The Platinum" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (970.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1025.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XPT/USD "The Platinum" Metals Market is currently experiencing a bullish trend,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

PLATINUM IS COMPLETELY UNDERVALUED, BUY NOW!TVC:PLATINUM CAPITALCOM:PLATINUM

Platinum is absolutely undervalued and is currently trading at only $975 USD.

The Gold to Platinum Ratio just hit a new all time high with the Current Ratio being 3,09 even though Platinum has traded since the 1970s till 2016 at a consistent average of 1:1. Gold's all time low against Platinum was at 0,42 in June 2008; AKA the 'Great Financial Crisis'.

Every single indicator shows that right now is the perfect time to buy Platinum especially because the 'Gold rush' is in its absolute final stages.

Keep in mind that Platinum is around 15 times rarer than Gold on Planet Earth.

May fortune favor the bold, and as always - DYOR NFA ! ;)

CYANE

Platinum at Trendline Support – Will the Rally Continue?Platinum is holding strong at the lower trendline of a bullish parallel channel, keeping the uptrend alive. This key support level has previously fueled upward moves, and traders are now watching to see if the rally will continue. Adding to the bullish case, a bullish divergence has formed on the 15-minute timeframe, signaling weakening downward momentum and acting as a strong confluence for a potential bounce.

Further supporting the bullish outlook, sentiment data from MyFxBook shows an overwhelming bias: 91% of traders are long, while only 9% are short. This extreme sentiment, combined with the technical setup, suggests strong buying interest in Platinum.

A bounce off the trendline, supported by the bullish divergence and sentiment data, could reignite upward momentum, pushing Platinum toward the upper channel resistance. However, a break below the trendline might signal a potential reversal.

Platinum at Key Support Zone – Will Buyers Step In?OANDA:XPTUSD is approaching a significant support zone, marked by prior price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bullish bounce if buyers step in.

If the price confirms support within this zone through bullish price action—such as long lower wicks or bullish engulfing candles—we could see a reversal toward 978.700, a logical target based on previous market structure and price behavior.

However, if the price breaks below this support zone and sustains, the bullish outlook would be invalidated, potentially leading to further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Platinum Prices Poised for Decline as Seasonality & Supply ZonePlatinum prices are currently approaching a key Supply zone as the Futures contract PL1! retraces following an initial bearish impulse. This price action suggests that the market may be poised for further downside movement.

Analyzing seasonal trends reveals a potential for bearish behavior, consistent with patterns observed over the past decade. Historically, this time of year has often been associated with a decline in platinum prices, making the current setup particularly noteworthy.

With these indicators in mind, we are actively monitoring the market for short setups. The convergence of the price approaching the Supply zone and historical seasonality trends reinforces the possibility of a downward move in platinum. As the market unfolds, we aim to position ourselves accordingly to take advantage of any shorting opportunities.

✅ Please share your thoughts about Platinum in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

XPT/USD "Platinum vs US Dollar" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "Platinum vs US Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1070.000 (or) Escape Before the Target

🔵Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XPT/USD "Platinum vs US Dollar" Metals Market is currently experiencing a Bullish trend., driven by several key factors.

🟢Fundamental Analysis

Demand and Supply

- Demand for Platinum is increasing due to its use in catalytic converters and investment appeal.

- Supply disruptions in South Africa, a major Platinum producer, may impact global supply.

Market News

- Platinum prices rose 1.5% yesterday due to increased demand and supply concerns.

- The US dollar index is down 0.2% today, supporting precious metal prices.

⚪Macro Economics

- Global Economic Outlook

The global economy is expected to grow at a slower pace in 2025, with a forecast of 3.0% global GDP growth rate.

- Interest Rates

The US Federal Reserve is expected to keep interest rates on hold in the near term, while the European Central Bank is expected to maintain its accommodative monetary policy stance.

- Inflation

Inflation expectations are muted, with the US Consumer Price Index (CPI) expected to rise by 2.0% in 2025.

- Geopolitics

Geopolitical tensions between the US and China remain a concern, with the potential to impact global trade and economic growth.

🔴Trader Positioning

Institutional Traders

52% short, 48% long

Retail Traders

55% long, 45% short

Hedge Funds

50% short, 50% long

COT Report

Non-Commercials (Speculators)

net long 5,500 contracts

Commercials (Hedgers)

net short 3,500 contracts

🟠Market Sentiment

Retail Sentiment

Bullish (55% of retail traders are long)

Institutional Sentiment

Bearish (52% of institutional traders are short)

Hedge Fund Sentiment

Neutral (50% of hedge funds are short, 50% are long)

🟡Overall Outlook

Based on the analysis, the overall outlook for XPT/USD is bullish in the short term, driven by increasing demand, supply concerns, and a bullish market sentiment. However, the pair may experience a short-term correction due to the bearish sentiment among institutional traders.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XPTUSD H1 ShortRecommendations

Entry Point Analysis: The planned entry point at 970.90 USD is below the current price, which could be a good entry opportunity if the price continues to decline. Check the charts and confirmations to see if the trend continues.

Set stop loss: The stop loss at 990.20 USD is reasonable and allows you to limit your losses if the price goes against your position.

Take profit target: The take profit at 950.70 USD shows a good risk/reward ratio. If the trend continues, reaching this target is possible.

PLATINUM - Sell Setup at Key Resistance ZoneOANDA:XPTUSD is approaching a significant resistance zone, an area where sellers have previously stepped in to drive prices lower. This area has previously acted as a key supply zone, making it a level to watch for potential rejection.

If price struggles to break above and we see bearish confirmation, I anticipate a pullback toward the $1,021 level.

However, a strong breakout and hold above resistance could invalidate the bearish outlook, potentially leading to further upside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation before jumping in.

I’d love to hear your perspective in the comments.

Best of luck , TrendDiva