Soap bubbleOn Sunday, there will be elections, and this artificially maintained financial situation in the country, just like fuel prices, might burst like a soap bubble.

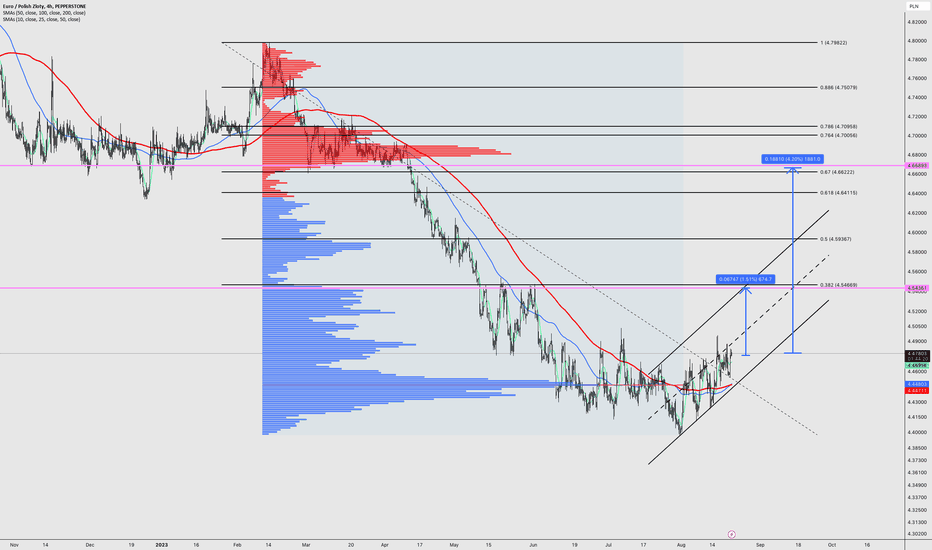

Fuel prices are artificially being kept low, and some gas stations are not operational due to fuel shortages. The government is distributing money left and right, all to win the elections. Winning the elections at the expense of the country's economy is not the best option. Elections are taking place this Sunday, and no matter which party comes to power, the Polish Zloty won't be able to artificially maintain its value. There was a powerful upward movement, and at the moment, we've made a strong collection move. The MA65 on the daily chart acted as resistance, after which buying volumes formed. I'm opening a long position with targets as shown on the chart.

PLNEUR trade ideas

One to put on the radar!A combination of sideways trading over a 6-week period, a mild buy signal on the DMI and the fact that price is consolidating above its 55-day ma all suggests to us that the market is trying to base.

We have cloud resistance that the market is pushing quite hard into, and should we see a close above 4.5042, the recent high it should be well placed for further gains to 4.55/4.56 and potentially to the 200-day ma around 4.5950.

Maintain a positive bias for now while above the 55-day ma at 4.45.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Big moves ahead EURPLN has finally bottomed out, created a nice round bottom and is starting to crawl upwards. Price is trading above both major moving averages (100 and 200) on H4. As you can our first target should be the 38% Fib retracement and our second longer term target is around the 61.8% Fib, just near the volatility gap.

EURPLN 1H - Support and ResistanceAnalysis:

EURPLN price is currently in range. We can take following trades on the bases of Support and Resistance levels.

------ Trade ------

Chart: EURPLN

Type: Long

Entry: 4.71925

Stop Loss: 4.71286

TP1: 4.72564

TP2: 4.73203

------ Trade ------

Chart: EURPLN

Type: Short

Entry: 4.67775

Stop Loss: 4.68600

TP1: 4.66950

TP2: 4.66125

EURPLN - Non Trending market - breakoutObserved Non-Trending Market on EURPLN (Euro / Polish Zloty)

Applied Strategy

1) If the market performs an up-trend, the "Buy Stop" order shall trigger at 4.7300 and make a profit of a 1:1 ratio.

2) If the market performs a down-trend, the "Sell Stop " order shall trigger at 4.652 and make a profit of 1:1 ratio.

EURPLN BUYI went short the Polish Zloty (PLN) via a long EURPLN position.

My models point to a overvalued Polish Zolty, that in combination with an underlying bullish structure gives us a nice setup.

Risk/Reward ratio = 6

This is a longer term position, if you take the trade, make sure your Broker charges you competitive swap rates.

Manage you risk properly.