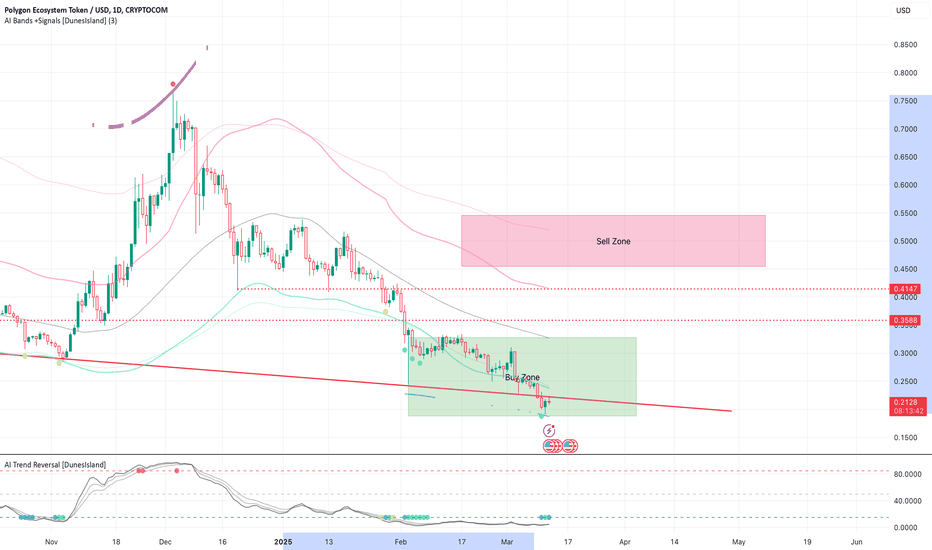

Polygon: More (short-term) Upward PotentialFor Polygon’s POL, we primarily expect further corrective rises during the blue wave (iv), but below the $0.51 mark, renewed sell-offs should take over. These declines should then drive the price down below the support at $0.15, allowing the large wave to reach its conclusion there. Our alternative scenario – where the low of wave alt. in green would be already behind us (probability: 33%) – is still relevant. This scenario would be reinforced with a jump above the resistance at $0.51 but only finally confirmed with increases above the next higher level at $0.76.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

POLUSD trade ideas

POL (ex-Matic) Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

#

- Double Formation

* (A+ Set Up)) | Completed Survey

* (Area Of Value)) - * Swing Low | Subdivision 1

- Triple Formation

* (Middle Range)) & Retest Area | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 50.00 USD

* Entry At 65.00 USD

* Take Profit At 90.00 USD

* (Uptrend Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Weekly trading plan for NEAR, ATOM & PolygonIn this idea I marked the important levels for this week and considered a few scenarios of price performance

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

Global plan for PolygonIn this video I considered the global possible price movement, also made possible scenarios for the current week

The price has already reached an important level and is now trying to stay above it, if the price fails to stay above the Pivot point, there are more chances to see a fall to the first support zone

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

#Poly Analysis on 19.04.2025**Overview:**

POLYG (Polygon) remains a key Layer 2 scaling solution for Ethereum, offering low-cost, high speed transactions. Recent partnerships (e.g., Disney, Meta) and adoption in DeFi/NFTs underscore its long-term viability. However, macro risks (regulation, ETH upgrades) may impact short-term price action.

**Key Fundamentals:**

- **Adoption:** 50K+ dApps, ~2M daily txns.

- **Revenue:** Sustainable fee model post-Polygon 2.0 upgrade.

- **Catalysts:** zkEVM adoption, institutional interest.

**Disclaimer:**

Crypto trading carries high risk. Past performance ≠ future results. DYOR. Not financial advice. Manage leverage/risk (SL suggested). Volatility may exceed expectations.

$POL still accumulatingPSX:POL dropped lower than I expected but its a better opportunity to continue to DCA, HODL for the long term, at this point we are in the lower side of the cycle. From the top it dropped ~75%. I think there will be a short term bounce as every indicator is oversold at this point. Lets see what the markets will do..

Pol (ex-MATIC) Cryptocurrency Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Pol (ex-Matic) Cryptocurrency Quote

- Double Formation

* (TL) | 1 | Completed Survey | Entry Bias | Subdivision 1

* (TL) | 2 | Support On Bias & Behalf At 0.3200 USD

- Triple Formation

* 012345 | Wave Count Entry | Subdivision 2

* Numbered Retracement | Downtrend | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Polygon: Shaken UpFollowing an impressive 60% rally from the low of the green wave on November 5, POL has seen a sharp pullback since Tuesday, shedding about 20% of its value. The price remains stuck within our blue Target Zone between $0.30 and $0.47. However, it should exit this range during the ongoing blue upward wave (i) to surpass the August 21 high at $0.60. However, if the price instead falls below the support at $0.28, the green wave alt. will mark a new low. This would delay the development of the blue five-wave upward structure – a scenario we rate with a 37% probability.

Polygon: Gain Momentum!In the Polygon chart, we primarily expect an imminent lower low of the magenta wave (2) within our magenta Target Zone (between $0.4711 and $0.3058) before a trend reversal occurs. Afterward, a significant uptrend should begin, starting with the turquoise wave 1, which should break through the resistance level at $0.60. You can use our zone to establish long positions, with stop-losses placed 1% below the low or directly at the support level of $0.31 to minimize downside risk. If the coin breaks downward out of our Zone (42% likely), we will have to expect a further drop with the green wave alt.(2).

Polygon: Bottom Formation? POL recently moved sideways within our magenta-colored Target Zone (between $0.4711 and $0.3058). From a technical perspective, this development could be the start of a bottom formation. However, we primarily expect a deeper low of the magenta wave (2). Afterward, the turquoise wave 1 should drive the price above the resistance level at $0.60. Within our Target Zone, long positions can be opened, with stops set about 1% below the lower boundary or at the support level of $0.31. If the price falls below this mark (42% probability), we will have to place the coin in the green wave alt.(2).

POL: Consolidation POL recently moved sideways within our magenta-colored Target Zone (between $0.4711 and $0.3058). We expect a drop below the previous low within this range before the price should place the low of the magenta-colored wave (2). Following this, it should rise above the resistance at $0.60 with the turquoise wave 1. Therefore, traders can open long positions within this range, placing any stops 1% below the lower boundary. If the price falls significantly below the $0.31 mark (42% likely), our alternative scenario will come into play, which anticipates an even lower wave alt.(2) in green.