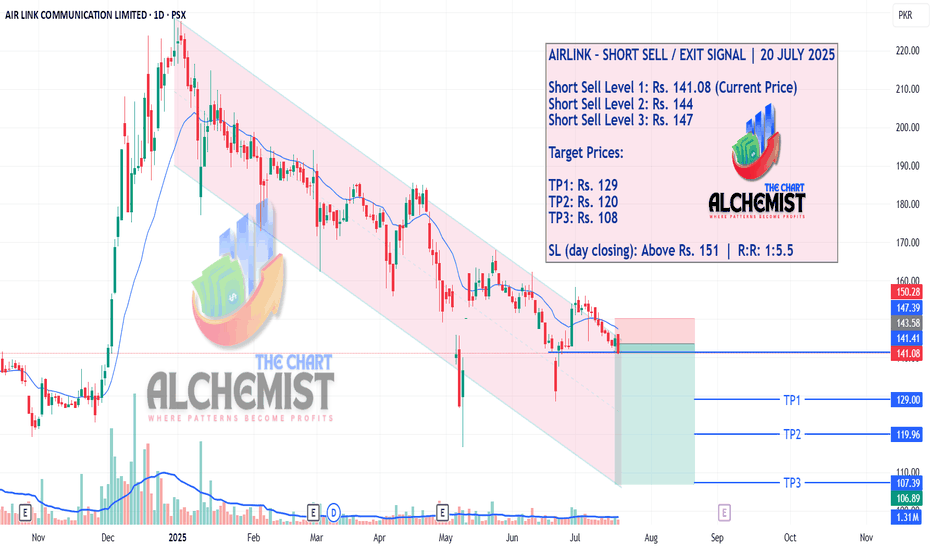

AIRLINK – SHORT SELL / EXIT SIGNAL | 20 JULY 2025AIRLINK – SHORT SELL / EXIT SIGNAL | 20 JULY 2025

AIRLINK has been trading inside a defined downward bearish channel, shaded in light pink. The stock recently tested the 20 EMA and failed to sustain higher levels, indicating that it may now begin a fresh downward leg. This setup presents a high-probability short sell or exit opportunity with clearly mapped downside targets.

AIRLINK trade ideas

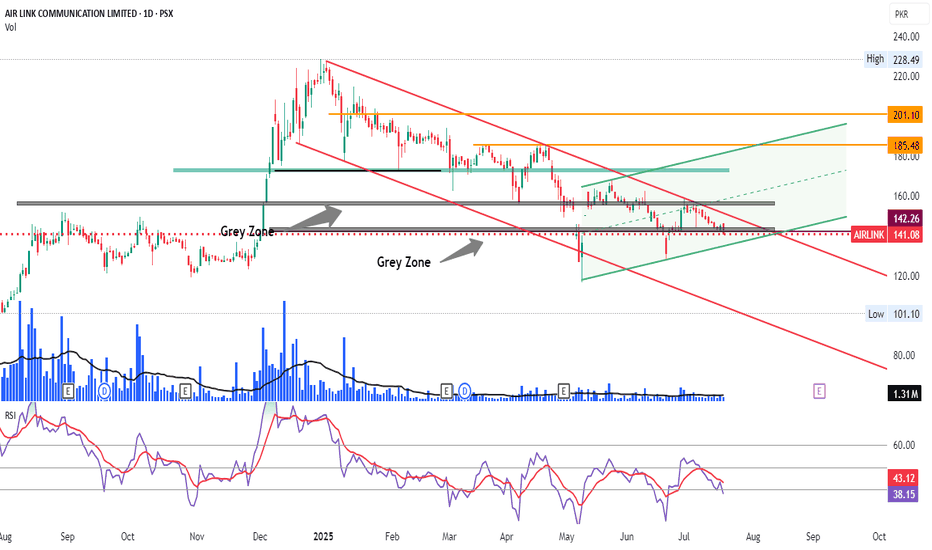

AIRLINK | An Imminent Reversal!!!Previous Trend: Bearish, confirmed by Lower Highs (LH) and Lower Lows (LL).

CHoCH (Change of Character): Bullish signal—price broke previous LH.

Pattern: Rounded bottom forming near the 200 EMA (~155), acting as strong support.

Volume: Slight pickup near bottom—early sign of accumulation.

Outlook: Bullish reversal likely. Break above CHoCH with volume confirms uptrend.

Airlink Technical Analysis: Potential Bullish SetupAirlink is moving in an uptrend, holding above a trendline, and is currently testing the 0.5 Fibonacci retracement level, a common area of support where buyers often step in. Price is also testing the 89-day EMA, a Fibonacci number that has historically acted as support, reinforcing the bullish outlook. Airlink is also a fundamentally strong company.

Trading Recommendations:

Buy 1 (CMP): 178

Buy 2: 166

Stop-Loss (Conservative): Closing below 118 (below the most recent higher low)

Stop-Loss (Aggressive): Closing below 140 (horizontal support level & below trendline)

Take Profit 1: 226

Take Profit 2: 268

Take Profit 3: Open

Happy trading!

AIRLINK offers 40% gain in till the final projectionThe stock has comfortably consolidated and has broken its last LH @ 149.5, crossing that will trigger the potential capital upside of 40%.

There is a bullish flag pattern being posted by the stock and further confirmed when the bullish flag pole is crossed around 152 level.

Instant entry can be made here with the first TP of 179.8 and second TP of 210. Final projections of the bullish flag is 220

AIRLINK - PSX - Technical AnalysisThe SCRIPT has recovered from the impact of the share selling by its Director and now showing bullish trend.

RSI is indicating bulls control after retrace. KVO also suggests Buyers in control taking prices up.

AB=CD pattern has been drawn to identify the TP.

Trade Values

Buy-1: 177.69 (If dips)

Buy-2: 210 (on crossing previous HH)

Buy-3 (Mkt): 192 (risky as it may retrace to test again Fib 0.38 or even Fib 0.50)

TP: 262

SL : 150

Our TP Hit & later it Lower Locked :-Da Shooting Star Formation is actually a Negative Sign

for a Stock.

If anyone is thinking to Enter, should wait for a Proper

Support level.

Immediate Support seems to be around 174 -175

& then around 164 - 165.

One plus point is that there is No Bearish Divergence

so far onn Daily TF so it may give a bounce from

the mentioned Support levels.

AIRLINK | Bullish Pennant PatternAIRLINK printed a bullish pennant pattern with no sign of divergence. A bullish trend continuation is expected, entry is suggested at 130-134 with the stop loss below previous lower high level at 113. Previous top of 151.83 considered as TP1 and after the break out it can leads towards the completion of pennant pattern, the price can projected towards 90.

Airlink: PSX Buy CallAirlink was in bullish trend and making HH and HLs. in last 77 sessions, it is moving in a consolidation box. Today it gave breakout of the consolidation box/Bullish flag formation with huge volume which show strength of Bulls. it is expected that price may go high and will touch TP-1 at 1:1 risk to reward. One may target TP-2 i.e. projection of bullish flag.

AIRLINK | Bullish Flag Pattern PossibilityGiven the current technical setup, buying is recommended at 118, which is a strong support level and also near the lower boundary of the descending channel. This entry point provides an attractive opportunity for a potential upside move, especially if the price starts reversing from this level.

Trade Setup:

Entry Point : 118

Stop Loss : 93 (below the recent support level to limit downside risk)

Target : 168 (potential breakout target from the descending channel)

This setup offers a favorable risk-reward ratio as it aims to capture a reversal from the support level while managing risk effectively with a well-defined stop-loss.