DFML trade ideas

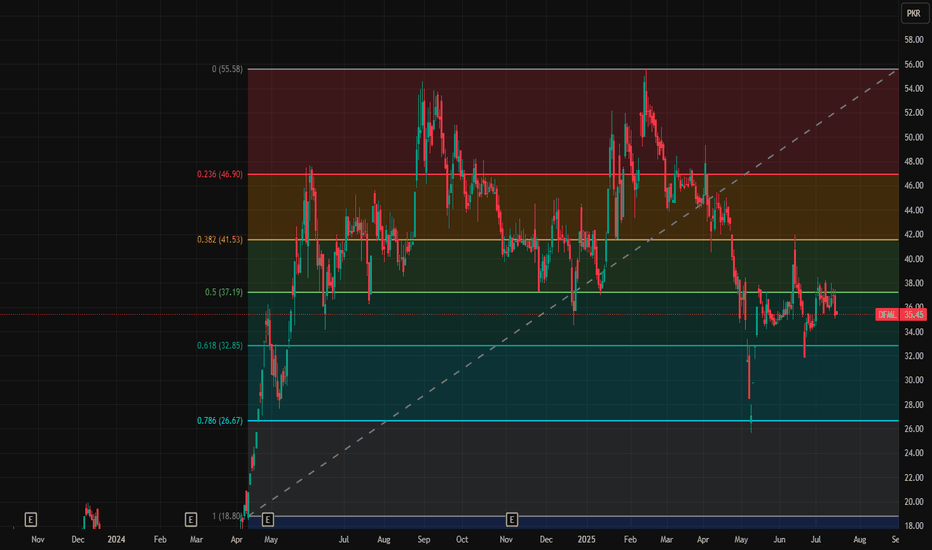

DFML exposing 40% gains The stock has touched the HH of 54.6 previously and therafter retraced 0.718 FIV level, now broke out the falling wedge pattern.

Small size entry can be taken here for TP1 of 59, position size can be increased once it crosses 48.85, Breakout of previous HH @ 54.6 will confirm the bullish ride towards arc formation projection of 91.85 However, final target as per our trade plan is

DFML Dragon Pattern BreakoutThis chart for Dewan Farooque Motors Ltd (DFML) displays a "Dragon Pattern," a bullish reversal signal. The pattern is characterized by two distinct lows (labeled as Foot #1 and Foot #2), followed by a breakout above the resistance line (marked as "Entry"). The head and hump within the pattern indicate consolidation before the breakout. The take profit targets are clearly outlined at 51 PKR (Take Profit 1) and 53.80 PKR (Take Profit 2), with the current price at 47.40 PKR. A stop-loss is set at 44.20 PKR, indicating a risk-reward ratio of 2. The chart suggests a favorable potential upside, supported by increased volume during the breakout.

DFML for LongDFML can have a swing trade position for LONG trade.

Levels and targets are defined clearly.

DISCLAIMER:

The information provided doesn't guarantee results. 𝙏𝙧𝙖𝙙𝙞𝙣𝙜 𝙞𝙣 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙢𝙖𝙧𝙠𝙚𝙩𝙨 𝙘𝙖𝙧𝙧𝙞𝙚𝙨 𝙧𝙞𝙨𝙠𝙨. Individuals should perform a thorough analysis and consider their risk tolerance before making investment decisions. 𝙄 𝙖𝙢 𝙣𝙤𝙩 𝙧𝙚𝙨𝙥𝙤𝙣𝙨𝙞𝙗𝙡𝙚 𝙛𝙤𝙧 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙡𝙤𝙨𝙨𝙚𝙨 𝙧𝙚𝙨𝙪𝙡𝙩𝙞𝙣𝙜 𝙛𝙧𝙤𝙢 𝙖𝙘𝙩𝙞𝙤𝙣𝙨 𝙗𝙖𝙨𝙚𝙙 𝙤𝙣 𝙩𝙝𝙞𝙨 𝙥𝙤𝙨𝙩. Consult with a qualified financial advisor before entering the stock market.

DFMLStock Summary: DFML closed at 46.13 and currently holding above the 50-day SMA on the daily chart. The stock tested downward trendline two sessions back and successfully closed above it. DFML is currently trading 41.50% higher then its 200-day moving average, indicating an upward trend.

Recommendation: Initiate buying positions on weakness or when it approaches the support zone and set stop losses below PkR 44.44 to manage risk effectively.

DFML🚀 Stock Alert: DFML

📈 Investment View: Technically Bullish 📈

🔍 Quick Info:

📈 Entry Range: 20.50-20.70

🎯 First Targets : 22

🎯 Second Targets : 23

⚠ Stop Loss: 20

⏳ Nature of Trade: Scalping

📉 Risk Level: Medium

☪ Shariah Compliant: NO

💰 Dividend Paying: NO

📰 Technical View: DFML has demonstrated a breakout above the 20 level, affirming strong bullish momentum in the recent trading session, culminating with a closing price of 20.76. This bullish sentiment is further substantiated by the RSI indicator. Accordingly, the initial upside target for DFML is established at 22, with a subsequent target at 23. Conversely, a notable support level is identified at 20. In the event of a breach and subsequent closure below this support level, it is advisable to employ a stop-loss strategy.