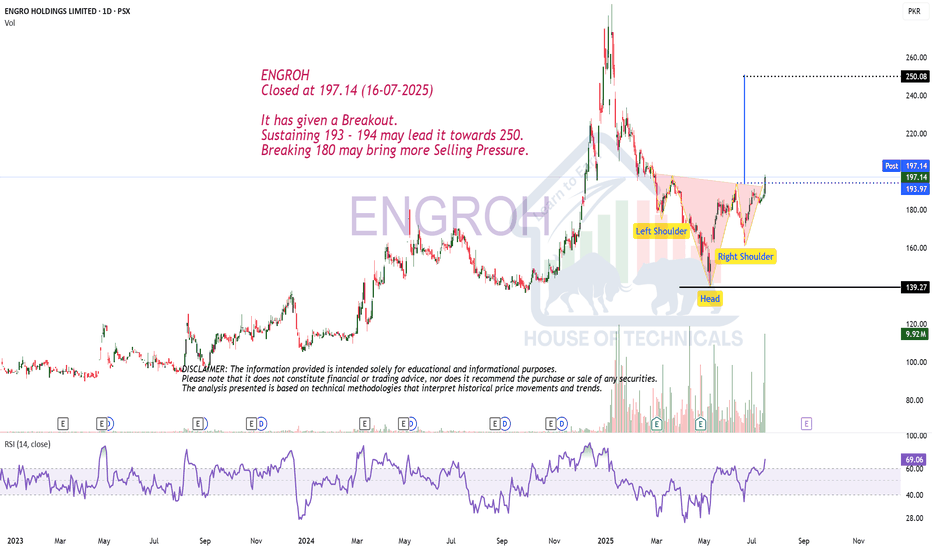

ENGROH trade ideas

PSX ENGROH OutlookENGROH holding had completed the correction cycle and breakout from last high.

1. Breakout of head& shoulder pattern

2. Breakout of last high

3. Breakout of EMA convergence

4. Confirmation of Bullish Divergence breakout

5. Start the sub wave3 of primary Wave3 targeting the 247 level

6. if WAVE 3 is extending then target will be 302

EngroH Bounce expectedEngroH is going to form an M pattern for which it has to take a bounce and then will fall back.

Bounce can be expected to Fib-0.618 (212) or Fib-0.786 level (245).

RSI and Stoch are in recovery phase. MACD still bearish.

Playing on levels should be prioritized with trailing stoploss once it reaches 212.

Exit should be planned near 245. Staying long can be fatal.

This is my personal opinion, not a buy / sell call.

Bullish Divergence on Daily tf.ENGROH

Closed at 182.38 (27-06-2025)

Bullish Divergence on Daily tf.

Immediate Resistance is around

193 - 194.

Crossing it with Good Volumes may result

in upward price movement towards 200+

However, if 160 is broken this time,

we may witness further selling pressure

towards 145 - 150.

Bullish divergence in ENGROHBullish divergence is observed in the daily timeframe for ENGROH. The current downtrend is expected to reverse after the bullish divergence. The current downtrend is likely to reverse into an uptrend and reach levels indicated on the chart. When the trend starts to reverse and breaks the entry point level indicated on the chart, it will be considered a confirmation of the trend reverse and a good point to take a long position.

ENGROH-Long term Buying CallAt present, ENGROH is in bearish trend after making head and Shoulder pattern, and making LL and LH. At the moment, it is taking support at 78.6% Fib level. if it breaks this level, then possible support level will be around 135 which is also projection of Head & Shoulder pattern. For long term buying, suggested level ranges between 135-125.

Play On LevelsRetested the Breakout Level around 180 - 185 &

Closed just above a Very Important fib level around

188.

But, 188 - 195 is Very Important Resistance as of now.

If 195 is Crossed with Good Volumes, 212 - 215 can be

touched initially.

Couple of Positive Weekly Candles with comparatively good

volumes may confirm HL on Monthly basis.

On the flip side, 175 - 184 is a Support Zone & also Double

Bottom around 175 - 176, so Short Term Traders may

expect a bounce from this level.

ENGROH Possibly Established A LowENGROH (184.50) has completed the 61.8% Fibonacci retracement of its 134.36 to 287.88 rally at 179.76, marking a decline of over 35% from its January 2025 high of 287.88. Based on my wave count, the correction appears to be complete, with a potential low established at 177.05.

A sustained move above 188.50 would confirm emerging strength, initially targeting 194.60. Such a move would reinforce the bullish reversal structure, setting the stage for a minimum upside towards 206.30, with the potential to extend to 226.

Traders should closely monitor price action above 188.50, particularly on expanding volume, as this would provide a strong buy signal for further upside.

Different Patterns on Different Time FramesCup & Handle Pattern formation on Monthly TF.

H&S pattern on Daily TF.

S1 around 192 - 193

S2 around 183 - 185

Worst Case scanerio Support around 150.

Should not break 130 - 135.

Upside Targets can be around :

Immediate Resistance around 234 -235

Short to Medium Term : 250 - 270

ABCD Pattern Target around 300