GGL trade ideas

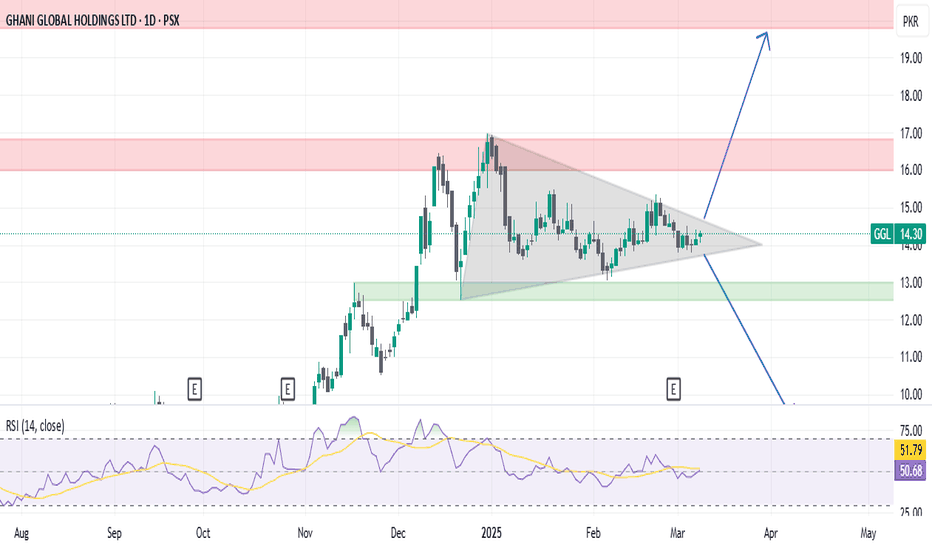

GGL Likely to Touch PKR 20.62 SoonGhani Global Holdings Limited (PSX: GGL) is displaying strong bullish signals, with rising volume and a steady uptrend pushing the price closer to key resistance levels. The stock recently rebounded from support around PKR 12.00 and has been forming higher lows on the daily chart — a classic bullish structure.

Momentum indicators like RSI remain in healthy territory, and a breakout above PKR 16.96 (the 52-week high) could trigger a rally toward PKR 20.62. With improving investor sentiment and positive fundamentals, GGL looks poised to test this level in the short to medium term.

This is not buy or sell call do your own research.

GGL: Time Cycles Indicate a 500% returnAnalyzing the time cycles of GGL reveals a consistent pattern of increasing bullish moves over successive cycles. Starting with a 5-bar rally (2015), followed by 15 bars (2016), then 25 bars (2021), the trend suggests an upward trajectory. If this progression holds, we could see a 35-bar move from the current cycle, potentially culminating in August 2025.

An upward trendline aligns with this projection, reinforcing the bullish sentiment. Additionally, with PSX currently in a bullish phase, GGL will likely align its performance with the KSE100 index, adding further strength to this outlook.

Based on historical patterns and market dynamics, an all-time high (ATH) of Rs.53 is on the horizon by August 2025, Patience and proper risk management are key to riding this potential bull wave!

GGL - PSX - Technical AnalysisOn daily TF, GGL is following the bullish parallel channel. Price is almost at the bottom support of the channel with 45% Fib retracement. Therefore, one can enter the trade at this time.

Trade Values:

Buy1: 13.95 (Current Market Price)

Buy2: 13.55

SL: 13.50

TP-1: 18.27

TP-2: 19.95

GGLThe price has experienced a retracement subsequent to forming a triple bottom pattern. This pattern necessitates a breach of its resistance level at 10.70 for completion. Following a successful breakout and subsequent retest, there is potential for the price to gravitate towards its subsequent resistance level at 11.65.

GGL - PSX - possible setup.GGL appears to be in an accumulation phase, marked by a bullish divergence and the formation of a bullish candlestick pattern. Consider initiating a buy position if the price surpasses 10.30, with a suggested stop-loss set at 9.37. Targets for profit-taking could be set at 11.20 (TP1) and 11.90 (TP2).