KSBP trade ideas

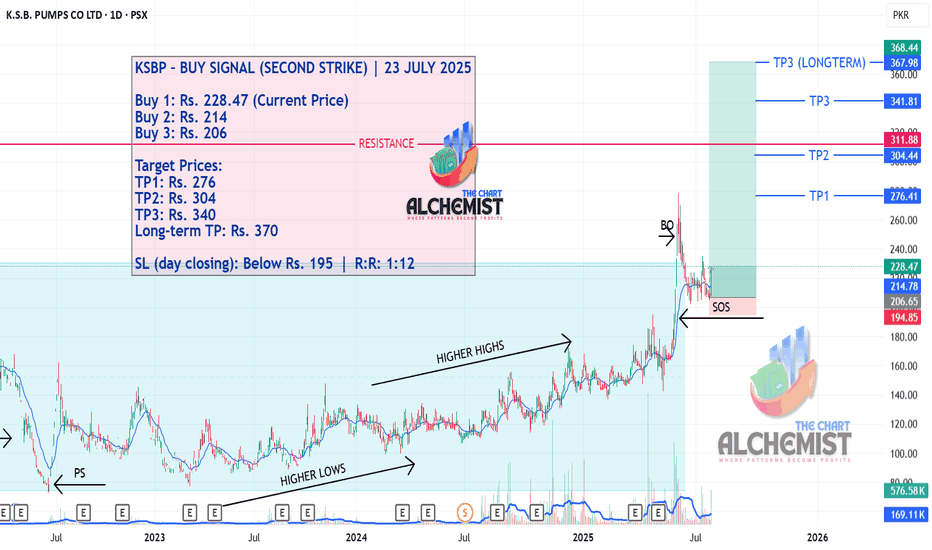

KSBP – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025 KSBP – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025

After completing a Wyckoff Re-accumulation Phase marked in a light blue color channel, KSBP stock broke out and achieved a high of Rs. 278 before entering a pullback. The pullback now seems to have ended, and the stock is poised to move higher toward several quantified upside targets.

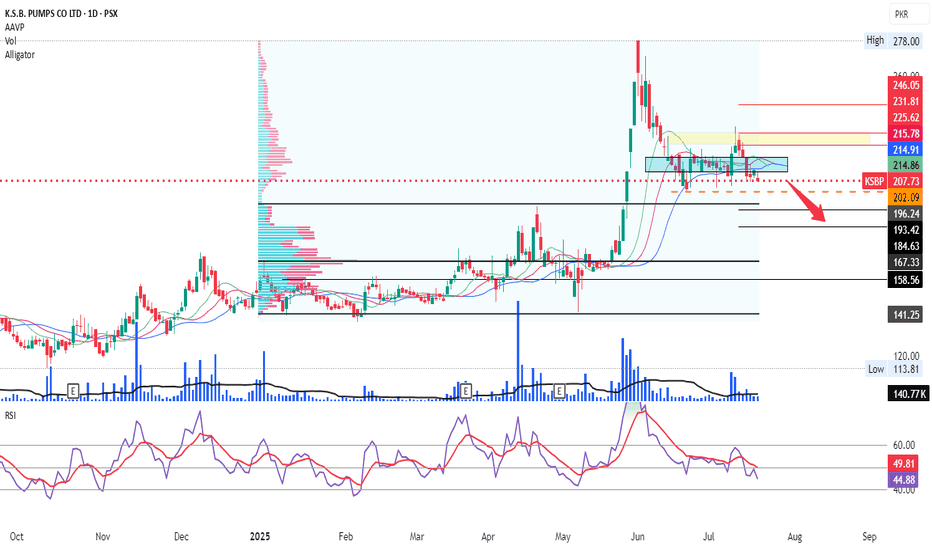

KSBP ON THE DAILY TIME FRAMEIndicators are weak..... needs to sustain the dotted marked line and IF NOT SUSTAINED, then, may eventually end up landing at around the 190-194 and 180-184 price levels and this downward movement, will be quite instant, in my humble opinion.

If maintained / sustained, then upside levels marked on chart for ready reference.

Trade Setup with Multi-Stage Target LevelsThe stock experienced a sharp upward movement, breaking out from a long consolidation phase and reaching a high near PKR 278. Currently, it has pulled back to PKR 235. The chart outlines a trading plan with multiple levels: the first entry point around PKR 226, and a second entry around PKR 210, indicating potential accumulation zones for traders. The initial target is set at PKR 245, the mid-term target at PKR 278, and the final target at PKR 314. The projected paths suggest two scenarios: either a bounce from current levels or a deeper pullback before resuming the uptrend. Volume spikes during the breakout phase suggest strong buying interest. Overall, the chart indicates a bullish outlook with clear risk management levels for potential entries and profit-taking.

KSBP LONG TRADE (SECOND STRIKE)KSBP LONG TRADE (SECOND STRIKE)

Those who missed, KSBP is offering another ride. It has potential to attain targets beyond current price.

It is in Spike Phase and it created several Inefficiency Zones and Defensive POI. Not to forget the Marubozu candles in the past week demonstrating strength of the uptrend.

🚨 TECHNICAL BUY CALL – KSBP🚨

BUY1: 257

BUY2: 247

BUY3: 237

📈 TP : Rs. 278

📈 TP : Rs. 298

📈 TP : Rs. 344 (LONG TERM)

🛑 STOP LOSS: BELOW Rs. 220 (Daily Close)

📊 RISK-REWARD: 1:7

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

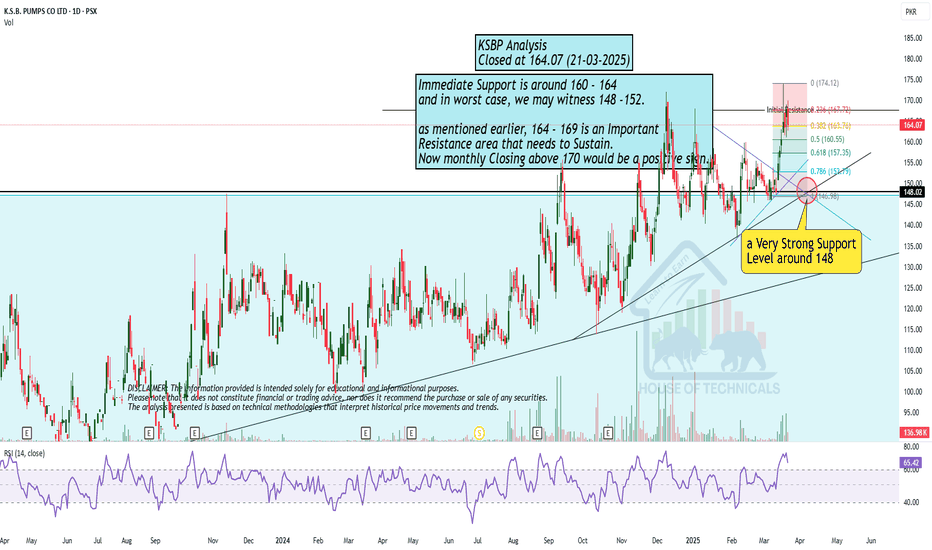

Hidden Bullish Divergence appeared.Hidden Bullish Divergence appeared.

Breaking Out a long Consolidation Box around

145 - 149.

164 - 169 is a Strong Resistance zone.

If this Level is Sustained, we may witness

200+

However, if 135 - 136 is broken, more Selling

Pressure will be witness & it may drag the price

towards 113 - 115.