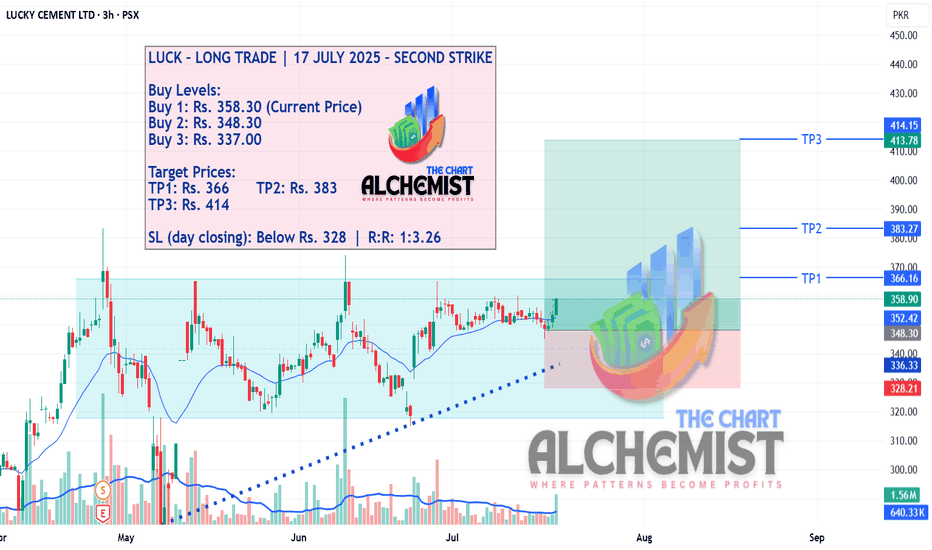

LUCK – LONG TRADE | 17 JULY 2025 – SECOND STRIKELUCK – LONG TRADE | 17 JULY 2025 – SECOND STRIKE

LUCK has been in a consolidation phase within a trading range (marked by a light blue channel) since April 2025. The latest price action suggests strength and positioning for a breakout, offering a favorable entry with promising upside potential.

LUCK trade ideas

LUCK - Bullish ReverThe price appears to have bounced from a recent low around the 830 level, forming a potential reversal pattern. The price is currently trading around PkR848.50 after a downward trend that seems to have reversed. There are marked support zones near 830-840 PKR, and the price is showing some recovery with higher highs and lows.

Entering a long position might be considered if the price sustains above the current resistance at PkR850, as this could indicate a continued upward movement. A stop-loss could be set below the previous support at around PkR815.50 to limit downside risk, while targeting a move back towards PkR900 or higher, depending on momentum. However, confirmation of bullish strength is key before fully committing to the position.

LUCK - BULLISH CHANNEL UP TREND CONTINUATIONLUCK - BULLISH CHANNEL UP TREND CONTINUATION

Luck is trading in a bullish channel and currently forming an Abandoned Bullish Baby formation, which suggests a bullish reversal. We anticipate a continuation towards the next bullish targets of 979, 1015, and 1100. The immediate risk is defined below 888.00.

LUCK Cement (LUCK) Chart AnalysisPattern Identification

The pattern displayed in the chart is a Symmetrical Triangle. Symmetrical triangles are characterized by two converging trendlines connecting a series of sequential peaks and troughs, creating a shape that resembles a triangle. This pattern typically indicates a period of consolidation before the price breaks out, either upward or downward.

Key Features of the Symmetrical Triangle on the Chart

Converging Trendlines:

The upper trendline connects the highs.

The lower trendline connects the lows.

Horizontal Resistance:

The price has tested the horizontal resistance level around PKR 1,008.06 multiple times without breaking it convincingly.

Projected Price Movement:

The height of the triangle is measured from the highest peak to the lowest trough within the pattern.

This height is then projected upwards from the breakout point to estimate the potential price target.

Current Price Action

The current price is around PKR 891.70, and it is very close to the resistance level of PKR 1,008.06.

Future Forecasting

Based on the symmetrical triangle pattern and the current price action, we can make the following predictions:

Bullish Scenario:

If the price breaks above the resistance level of PKR 1,008.06 with strong volume, it could indicate a bullish breakout.

The projected price target in this scenario is calculated by adding the height of the triangle to the breakout point. This suggests a potential target of approximately PKR 3,411.63.

The breakout needs to be confirmed with a sustained move above the resistance and an increase in trading volume.

Bearish Scenario:

If the price fails to break above the resistance and starts declining, it could retest the lower trendline of the symmetrical triangle.

A breakdown below the lower trendline would indicate a bearish scenario. The potential downside target in this case would be around the previous significant support level of PKR 304.72.

Conclusion

The symmetrical triangle pattern is a neutral pattern that could lead to either a bullish or bearish breakout. Currently, the price is close to the resistance level, and a breakout above this level would be a strong bullish signal with a significant upside potential. Conversely, failure to break the resistance could lead to a bearish move towards the lower trendline or even lower.

Traders should watch for a confirmed breakout or breakdown with strong volume before making trading decisions.