NATF – SECOND STRIKE | 01 AUGUST 2025 NATF – SECOND STRIKE | 01 AUGUST 2025

The stock is standing in an upward channel (marked light blue) and recently hit a high of Rs. 383. A healthy pullback followed, consolidating near the axis line, and briefly dipped below it as a spring. Today’s strong rebound confirms the pullback is likely over, signaling a second strike opportunity for continuation towards higher quantified targets.

NATF trade ideas

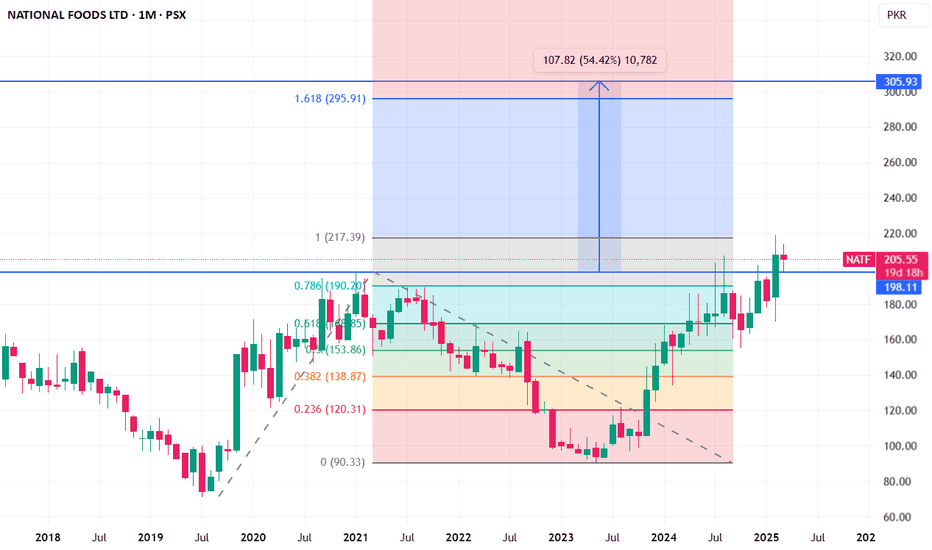

NATF - PSX - SHOWING a Flag PatternNATF Stock Analysis:

- *Buying Opportunity:* NATF is providing a buying opportunity.

- *Buying Range:* 205-200

- *Stop Loss:* 195

- *Target Levels:*

- Initial target: 215

- Final target: 238

- *Key Notes:*

- Hold the position until the target is reached.

- Use stop loss to minimize potential losses.