Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.92 PKR

2.37 B PKR

53.11 B PKR

743.40 M

About PAK ELEKTRON LTD

Sector

Industry

CEO

Muhammad Murad Saigol

Website

Headquarters

Lahore

Founded

1956

ISIN

PK0034601010

FIGI

BBG000GNBV28

Pak Elektron Ltd. engages in the manufacture and sale of electrical capital goods and domestic appliances. It operates through the Power Division and Appliances Division segments. The Power Division segment manufactures and distributes transformers, switchgears, energy meters, and power transformers. The Appliances Division segment produces and assembles refrigerators, air conditioners, deep freezers, microwave ovens, water dispensers, televisions, generators, washing machines, and other domestic appliances. The company was founded on March 3, 1956 and is headquartered in Lahore, Pakistan.

Related stocks

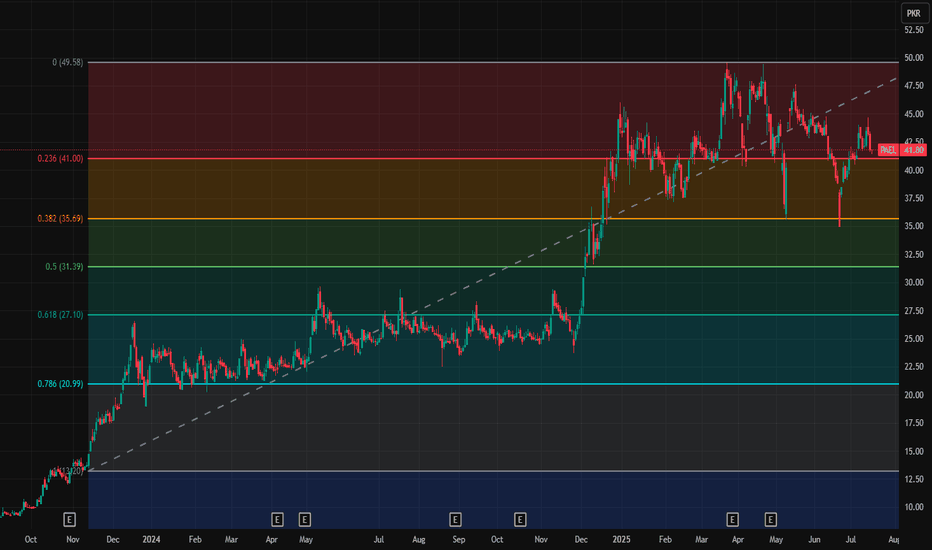

Bullish Breakout in PAEL: Buy on Dip for Short-Term GainsPAEL on the 15-minute timeframe shows a bullish setup with a recent breakout above the 20 EMA and 200 EMA, supported by a noticeable increase in volume—indicating strong buying interest. The current price is around PKR 44.70, and a "buy on dip" strategy is recommended within the 44.00–44.20 range.

PAEL SETUP ONCE AGAINPAEL is currently at its orderblock zone where the liquidity is resting if volumes come in at this level then we can expect a bounce again if the orderblock fails and there is no liquidity in OB then wait for downside levels and if the weekly ema 21 is broken then i see 30 level coming but still we

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PAEL is 40.93 PKR — it has increased by 0.59% in the past 24 hours. Watch PAK ELEKTRON LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange PAK ELEKTRON LTD stocks are traded under the ticker PAEL.

PAEL stock has fallen by −0.71% compared to the previous week, the month change is a 3.38% rise, over the last year PAK ELEKTRON LTD has showed a 57.42% increase.

PAEL reached its all-time high on May 26, 2017 with the price of 110.20 PKR, and its all-time low was 3.26 PKR and was reached on Mar 11, 2013. View more price dynamics on PAEL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PAEL stock is 2.69% volatile and has beta coefficient of −0.09. Track PAK ELEKTRON LTD stock price on the chart and check out the list of the most volatile stocks — is PAK ELEKTRON LTD there?

Today PAK ELEKTRON LTD has the market capitalization of 37.38 B, it has decreased by −3.24% over the last week.

Yes, you can track PAK ELEKTRON LTD financials in yearly and quarterly reports right on TradingView.

PAK ELEKTRON LTD is going to release the next earnings report on Sep 3, 2025. Keep track of upcoming events with our Earnings Calendar.

PAEL net income for the last quarter is 657.03 M PKR, while the quarter before that showed 504.50 M PKR of net income which accounts for 30.23% change. Track more PAK ELEKTRON LTD financial stats to get the full picture.

No, PAEL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 29, 2025, the company has 4.79 K employees. See our rating of the largest employees — is PAK ELEKTRON LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PAK ELEKTRON LTD EBITDA is 8.92 B PKR, and current EBITDA margin is 17.24%. See more stats in PAK ELEKTRON LTD financial statements.

Like other stocks, PAEL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PAK ELEKTRON LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PAK ELEKTRON LTD technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PAK ELEKTRON LTD stock shows the buy signal. See more of PAK ELEKTRON LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.