SYS trade ideas

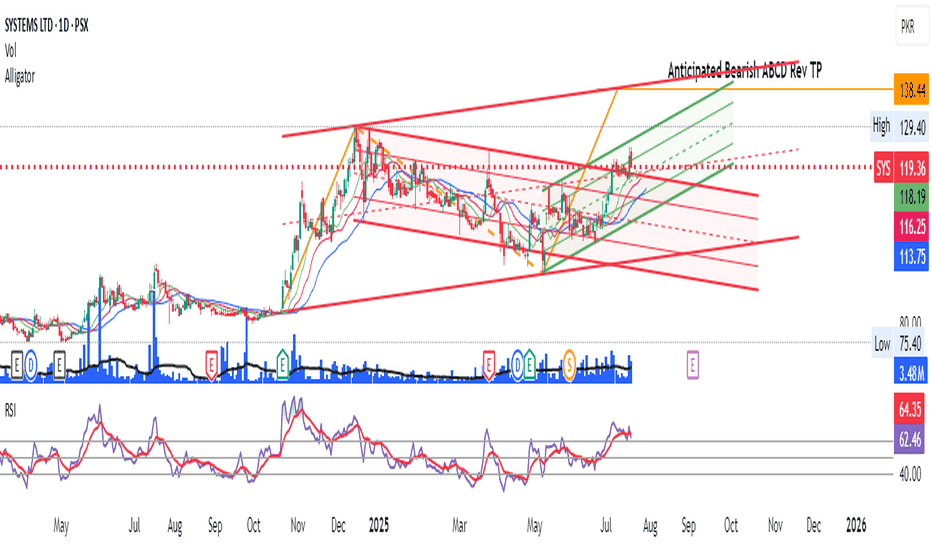

SYS – LONG TRADE (SECOND STRIKE) | 12 JULY 2025SYS – LONG TRADE (SECOND STRIKE) | 12JULY 2025

The stock previously trended downward in a pink channel but consolidated and formed a springboard (light blue channel). After achieving TP1 in our previous call, the stock has created a bullish structure, making this location a good spot for a second entry.

100 is a Very Important Support level.SYS Closed at 104.21 (05-06-2025)

100 is a Very Important Support level

that should be sustained on Monthly basis.

Immediate Resistance is around 114 & then

128 - 129. Crossing this level will make it

more Bullish with targets around 150+

But if it breaks 92, there would be more

selling pressure & next Support would be

around 82 - 83 then.

Weekly Closing just at Resistance!Weekly Closing just around Resistance

level (580), so a slight pressure may be seen, unless it

Sustains 580. If this be the case, 545 - 565 can be witnessed.

Bullish on Weekly TF & a perfect

Morning Star Formation on Weekly Tf.

Also, it has retested the previous breakout level

around 520.

Now it should Cross & Sustain 605-606 to continue

its Bullish Momentum & immediate targets can be around

650 - 655.

On the safe side, 596 - 621 Zone is a Resistance zone.

Re-Testing of Breakout Level around 520.Re-Testing of Breakout Level around 520.

If Weekly Candle Closes above 520 - 521, we may

expect an Upside towards 550.

Also there is Bullish Divergence so we may

expect that it will play this time & push the price upside.

On the flip side, 500 - 504 is the Channel Bottom.

and Remember, Once 650 is Crossed with Good Volumes,

it may expose New Highs targeting around 700.

SYS - PSX - Technical AnalysisOn daily time frame, price after defining a Higher Low of bull cycle is going up. A hidden bullish divergence has also played indicting that trend will continue. KVO also suggest that bull run is still on. TPs have been set using Fib.

Trade Value:

Buy CMP: 599.78

TP1: 679

TP2: 716

SL: 520

Very bullish Pak IT stock I'm very bullish on this Pakistani IT stock - the growth potential is immense for 5-20 years for long term holding

See sales growth & Profit margin and earning ratios - dps.psx.com.pk

Sales are to mostly foreign clients , therefore local currency and economic risk is manageable