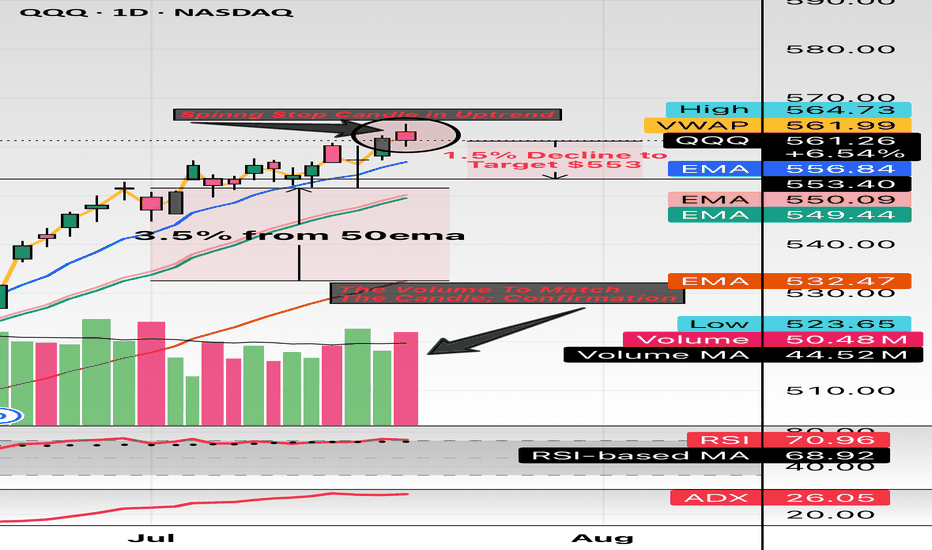

$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop

Key stats

About Invesco QQQ Trust, Series 1

Home page

Inception date

Mar 10, 1999

Structure

Unit Investment Trust

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

Invesco Capital Management LLC

Distributor

Invesco Distributors, Inc.

QQQ is one of the most established and actively traded ETFs in the world, albeit one of the most unusual. The product is one of a few ETFs structured as a unit investment trust. Per the rules of its index, the fund only invests in nonfinancial stocks listed on NASDAQ, and effectively ignores other sectors too, causing it to skew massively away from a broad-based large-cap portfolio. QQQ has huge tech exposure, but it is not a 'tech fund' in the pure sense either. The fund's arcane weighting rules further distance it from anything close to plain vanilla large-cap or pure-play tech coverage. The ETF is much more concentrated in its top holdings and is more volatile than our vanilla large-cap benchmark. Still, the fund has huge name recognition for the underlying index, the NASDAQ-100. In all, QQQ delivers a quirky but wildly popular mash-up of tech, growth, and large-cap exposure. The fund and index are rebalanced quarterly and reconstituted annually.

Related funds

Classification

What's in the fund

Exposure type

Technology Services

Electronic Technology

Retail Trade

Stock breakdown by region

Top 10 holdings

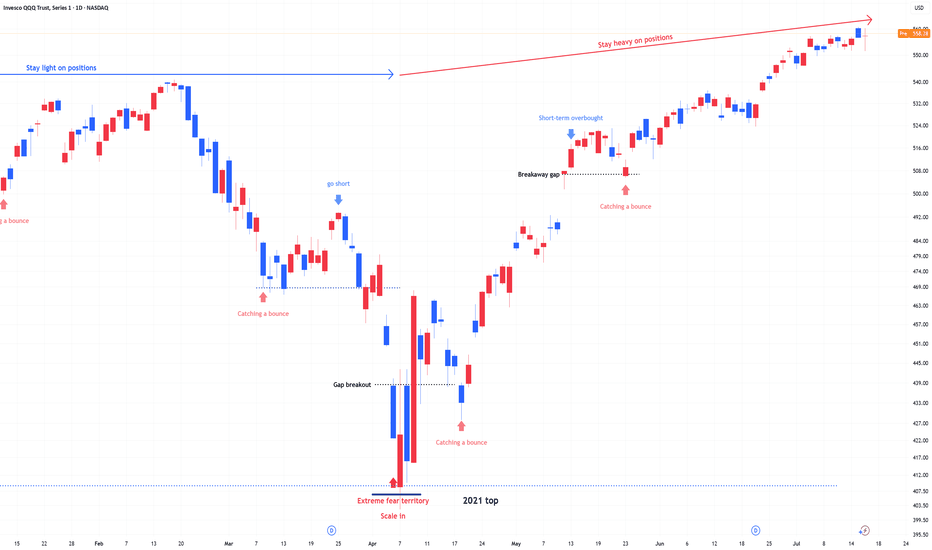

QQQ : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market ha

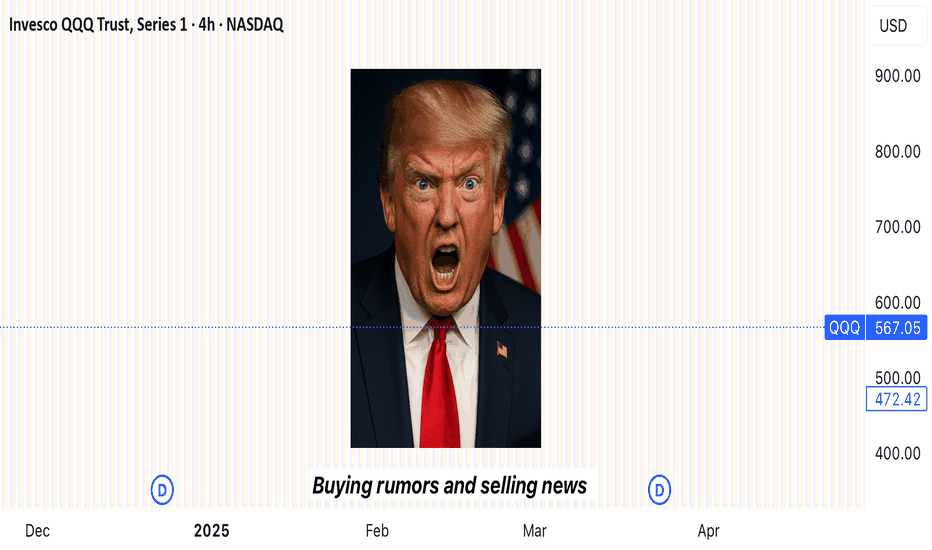

“Buy the rumor, sell the news”

---

### 🎯 **“Buy the Rumor, Sell the News” – A Trader’s Mind Game**

Imagine you’re not just following the market… you’re dancing ahead of it. This strategy flips traditional thinking on its head—and rewards those bold enough to act **before** the spotlight hits.

---

### 🕵️♂️ **Step One: Buy t

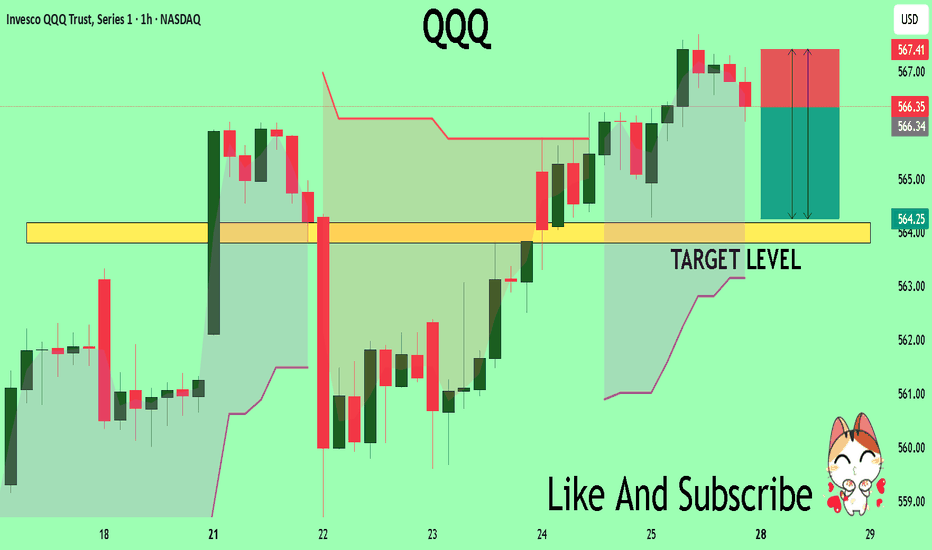

QQQ Massive Short! SELL!

My dear followers,

This is my opinion on the QQQ next move:

The asset is approaching an important pivot point 566.35

Bias - Bearish

Safe Stop Loss - 567.41

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend

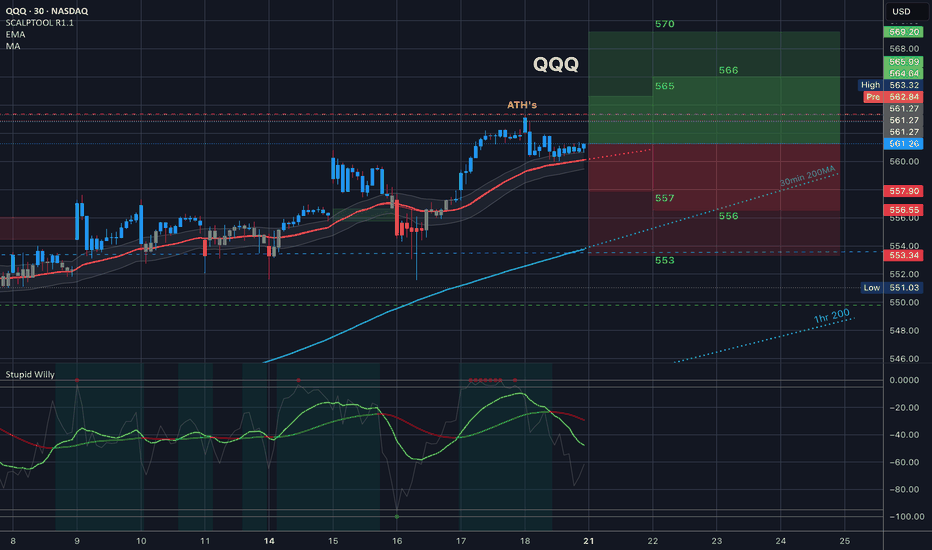

QQQ July 14th 2025I failed to update my trade journal at the end of last week and am going to try to be better about it this week. I am going to try to keep these posts more brief so I can remain consistent and meet my goal of creating an accurate timeline of my trades. For this week, I am going in with a bullish bia

QQQ What Next? SELL!

My dear followers,

I analysed this chart on QQQ and concluded the following:

The market is trading on 554.20 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 540.50

Safe Stop Loss - 560.82

About Used Indic

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

QQQ trades at 566.37 USD today, its price has risen 0.24% in the past 24 hours. Track more dynamics on QQQ price chart.

QQQ net asset value is 566.27 today — it's risen 3.69% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

QQQ assets under management is 358.14 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

QQQ price has risen by 4.48% over the last month, and its yearly performance shows a 22.14% increase. See more dynamics on QQQ price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 3.69% over the last month, showed a 19.91% increase in three-month performance and has increased by 22.95% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 3.69% over the last month, showed a 19.91% increase in three-month performance and has increased by 22.95% in a year.

QQQ fund flows account for 15.43 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

QQQ invests in stocks. See more details in our Analysis section.

QQQ expense ratio is 0.20%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, QQQ isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, QQQ technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating QQQ shows the strong buy signal. See more of QQQ technicals for a more comprehensive analysis.

Today, QQQ technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating QQQ shows the strong buy signal. See more of QQQ technicals for a more comprehensive analysis.

Yes, QQQ pays dividends to its holders with the dividend yield of 0.50%.

QQQ trades at a premium (0.02%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

QQQ shares are issued by Invesco Ltd.

QQQ follows the NASDAQ 100 Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Mar 10, 1999.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.