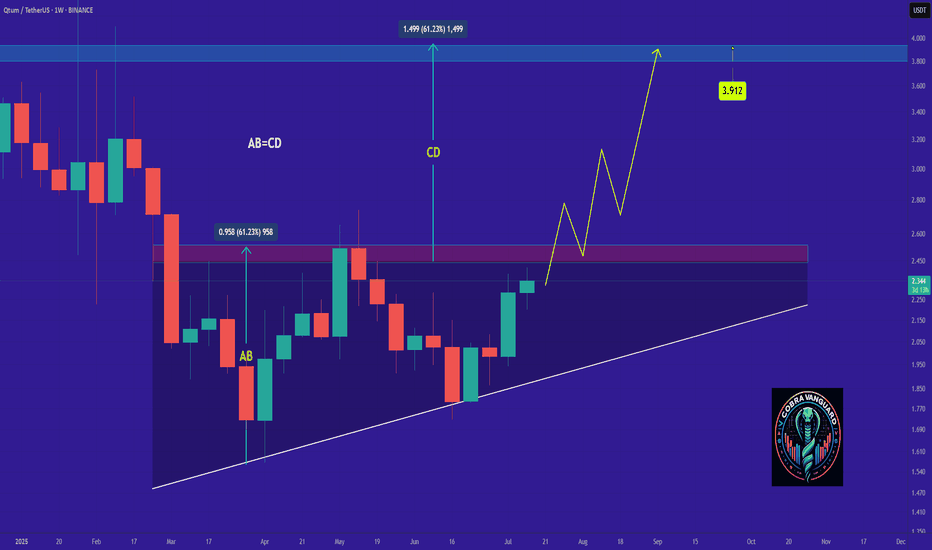

QTUMUSDT trade ideas

#QTUM/USDT#QTUM

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.25, acting as strong support from which the price can rebound.

Entry price: 2.30

First target: 2.35

Second target: 2.41

Third target: 2.47

QTUM May Surprise You All (3D Analysis)Qtum has formed a rectangle in weekly time period. Whenever it reachs the bottom, always turned back to gather upside liquidty till now.

The other interesting thing is, when Qtum first went upwards for liquidty, it took over 2 years to gather all remaining short liqudations. When it did again, it took less than a year. So the scale of time for gathering liquidty is squezing.

If Qtum can stay above the bottom of the rectangle, I believe there is a chance for %160 profit in long term. There is not even need for a leverage.

-%20 down here means that this coin is set for going hell and no way for recover.

But, there is %160 profit chance. The question is, are you willing to take that risk?

Cause I will.

Thanks for reading.

QTUM is almost ready...NASDAQ:QTUM -@qtum

Qtum is a smart contract platform forked from Bitcoin Core and Ethereum.🔐

#QTUM rejected the $2 support level and round number.

For the bulls to take control in the medium term, a break above the inverse head and shoulders neckline marked in orange at $2.47 is needed.🚀

QTUM ANALYSIS🚀#QTUM Analysis :

🔮As we can see in the chart of #QTUM that after consolidation there was a huge bullish move. Right now we could see #QTUM is trading around its major resistance zone. After the breakout we would see a good bullish move

⚡️What to do ?

👀Keep an eye on #QTUM price action. We can trade according to the chart and make some profits⚡️⚡️

#QTUM #Cryptocurrency #TechnicalAnalysis #DYOR

QTUMUSDT UPDATEQTUMUSDT is a cryptocurrency trading at $3.555. Its target price is $5.500, indicating a potential 50%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about QTUMUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. QTUMUSDT is poised for a potential breakout and substantial gains.

QTUM for a LONGQTUM looking good today on a pullback to FVG on the 4H chart at $3.00, maybe even to $2.95 , for a LONG. aVWAP's (Purple and White Lines) are at 3.60-3.68 but I would be looking for a take profit at ~4.23

Need to see volume and open interest at these levels though - sentiment is good for QTUM with hard fork success this week.

QTUM to 20$ soonQtum is a decentralized blockchain network that supports smart contracts using the Ethereum Virtual Machine. The blockchain itself is based on Bitcoin’s UTXO model, but uses proof-of-stake for consensus. Because Qtum is a hybrid project that takes the best parts of Ethereum and Bitcoin, it also has the ability to merge future updates from these projects and place them on top of the Team’s own unique developments.

Long QTUMThe good moment for try to Buy the QTUM. We are a ling time in the flat channel. And now we a tested the up level and do not touch the low level. It can be support point. After fast move up and back we can to stop on the middle line of flat channel and start to move up creating up trend. The good trade with small risk and good reward. Will see...

Important support and resistance zones: 2.950-3.403

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(1D chart)

The M-Signal indicators of 1D, 1W, and 1M charts are concentrated in the 2.950-3.403 section.

Accordingly, when the StochRSI indicator shows a downward trend in the overbought section, whether there is support near this section is an important issue.

-

(30m chart)

In order to change the trend, the MS-Signal indicator must rise above the price and maintain the price.

If the MS-Signal indicator rises above the price, the BW (100) indicator is formed at the 3.922 point and the HA-High indicator is formed at the 4.033 point, so the point to watch is whether this section can be broken upward.

When the StochRSI indicator enters the oversold zone and then rises, you should check for support near the 2.950-3.403 zone.

When you meet the HA-Low and BW(0) indicators, it is natural to enter a buy (LONG) position because there is a high possibility of an increase.

However, as I mentioned earlier, you should respond based on whether there is support near this area because you need to break through the MS-Signal indicator upward.

-

Rather than deciding how far it will fall or rise, it is important to consider which points are important support and resistance points and create a trading strategy based on whether there is support at those points.

Then, if you have traded according to the price movement, you can respond with a split transaction.

We are not analyzing charts, but trading to make profits, so you can respond appropriately and go with the flow.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, I expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------