Render – Re-Entry Opportunity After Hitting First TargetRENDER hit the first take profit target (TP1) with a ~52% gain — great execution. Now, after the expected pullback, price is approaching a key support zone, offering a second swing trade opportunity.

🔹 Entry Zone:

Around $4.00 support

🔁 Previous resistance turned support

🧭 Psychological level and structural base

🎯 Take Profit Targets:

🥇 $4.80 (recent local high / resistance)

🥈 $5.40 (next significant supply zone)

🛑 Stop Loss:

$3.69 (below key support & invalidation level)

RENDERUSDT trade ideas

#RENDER/USDT#RENDER

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.20.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.41

First target: 4.60

Second target: 4.78

Third target: 4.98

#RENDER/USDT#RENDER

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 3.55

Entry price 3.75

First target 3.92

Second target 4.14

Third target 4.40

RENDERUSDT likely to head towards 7 and beyondThis one looks very promising.

The price is trading between weekly resistance WR1 and weekly support WS1.

The price may hit WS1 again before making a bounce and aiming for WR1.

With resistance facing some pullback at WR1, it is likely to attempt that resistance again only to break it this time and continue its journey to further upward.

Very nice long opportunity from WS1 zone.

I am loading this one heavy on WS1 hit.

RENDER your thoughts, NOW!Hello - Below is the Market Profile for - RENDER

FET/USDT continues to display strong bullish structure on the 4H chart, as confirmed by successive POC shifts and value areas migrating upward. After consolidating between $0.72 and $0.78 with overlapping value, the price broke out and formed a clear demand zone around $0.78–$0.80, which was respected on the next session’s pullback. Volume has built up heavily around $0.84–$0.86, forming a balanced node which is now acting as a fresh value area. The current candle is printing above the POC, indicating buyers are still in control. As long as FET holds above $0.86, the bias remains long, with potential upside targets of $0.90 and $0.93. A breakdown below $0.84 would indicate rotation back into the previous volume pocket, making $0.80 the next demand zone to watch. Overall, structure is strong and favors buying dips rather than chasing highs.

My doodle is also very straightforward lol, wait for dips!

RENDER Testing Red Resistance Zone🚨 RENDER Testing Red Resistance Zone 🚨

RENDER is currently testing a significant red resistance zone. A breakout above this level could signal a bullish move, with the target set at the green line level.

📈 Technical Overview:

Resistance Zone: Red area currently being tested.

🎯 Breakout Target: Green line level upon confirmation.

TradeCityPro | RENDER: AI Token at Breakout or Breakdown Point👋 Welcome to TradeCity Pro!

In this analysis, I want to review the RENDER coin for you. This project is one of the crypto AI projects that gained a lot of hype after AI projects started trending.

🔍 The coin of this project currently has a market cap of $2.36 billion and ranks 45th on CoinMarketCap. Let’s move on to the analysis to see the technical condition of this coin.

📅 Daily Timeframe

As you can see in the daily timeframe, after the drop shown in the chart, with the price falling to the 2.774 area, a ranging structure has formed, and the top of this box is at the 4.52 level.

⭐ Currently, the price has reached the top of the box and is interacting with this level. If the box top is broken, the main bullish trend can begin, and the price may move toward the 6.682 area.

🎲 If this happens, pay attention to the volume, because the volume should increase alongside the price movement and be in convergence. If a large buying volume enters the market, the probability of this scenario increases.

📈 So for spot buying or opening a long position, you can enter on the breakout of 4.520.

🔽 To confirm the market turning bearish, we need to confirm the end of the current bullish leg. If the price gets rejected from the box top or if a fake breakout happens, a break of 4.119 confirms the rejection, and in that case, the price can move back down to the box bottom.

💥 The support levels ahead for the price are 3.513 and 2.774, which can be used as targets for short positions.

📊 The main trigger for the beginning of the next bearish leg is the 2.774 area. If this level is broken, the price will likely make a sharp downward move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Render is dumping Well, as you can see, the render has hit its daily resistance and broken the 4-hour uptrend from below and can go down to the daily support area. The first target is around 2.7 and the second target is the support area of $1.

This is not an investment offer or a buy or sell signal. This is simply my personal opinion. Please check it yourself and observe capital and risk management.

RENDER/USDT Technical Analysis:

FIB Level to watch: Measured from swing high $6.116 to low $2.476, we have the following retracement zones:

Level

Price

0.236

$3.335

0.382

$3.866

0.5

$4.296

0.618

$4.726

0.786

$5.138

RSI (14): Bullish but Not Overheated

Current RSI: 47

RSI(Daily) - 61

Recent High: 66.11

Interpretation: Momentum is strong but not yet overbought, offering room for continued upside. A breakout above 70 could signal short-term overheating, though it may also confirm trend strength.

Summary Outlook: Eyes on $4.72 Breakout

RENDER is riding a bullish wave with price action reclaiming major Fib levels and RSI pointing up. The $4.72 resistance (Fib 0.618) is the most important level to break for sustained upside. If bulls succeed, targets between $5.13 and $5.75 come into play.

Indicator

Support

Resistance

RSI(4h)

44.00

70.00

RSI(daily)

60

Fib 0.5

$4.296

$4.726 (0.618)

Fib 0.786

—

$5.138

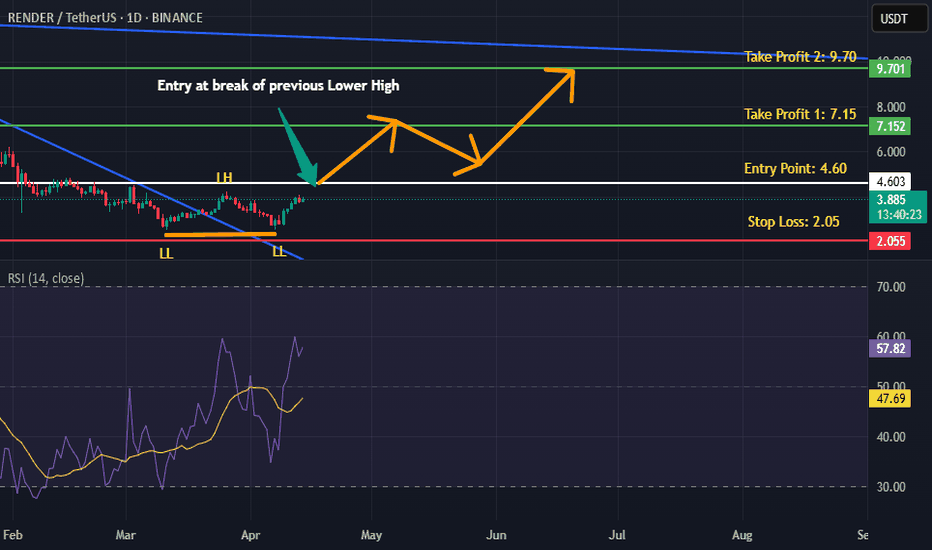

Render Is Ready, Bottom Confirmed (340% Easy Target)Render Token is super ready right now and the correction bottom is now confirmed. Notice this pattern on the chart. There are two lows and then a move back above support.

The current candle is the bullish signal. After trading lower, it is now at the upper end of the session, trading near the session high. This high is higher than the previous session open and the close of the one preceding it, the full green candle.

After the main low there were two strong green sessions. Followed by one red session and the current session moving lower, meaning bearish action. This bearish action is being negated and once this session closes green, we have a very strong bullish signal with the bottom confirmed. This will be the start of the next bull market phase.

There will be long-term growth. RENDERUSDT can grow much more than the 340% shown on the chart. It will definitely go much higher, this target is for the mid-term, within 3 months. It will start to grow now, in the coming days and weeks and everything will speed up. This target will hit but no big deal, there will be more.

Expect a correction between now and the final bull market bull-run. The correction can last three weeks just as it can last 2 full months or more. We will have a better idea when the bull market starts to develop. It is still very early but also very close. We have only a few weeks before the entire Cryptocurrency market turns green.

Namaste.

#Render (RNDR): Powering the Future of 3D GPU Rendering**Description**:

This trading idea highlights **Render (RNDR)**, a decentralized GPU rendering network that connects artists and developers with underutilized computing power across the globe. By offering scalable, cost-effective rendering solutions, **RNDR** is transforming industries such as visual effects, gaming, virtual reality, and the metaverse. Its integration with Web3 technologies positions it at the forefront of the digital content revolution. The increasing demand for high-quality 3D rendering in entertainment and immersive experiences makes RNDR a key infrastructure token in the next wave of digital creativity.

While RNDR has strong use-case fundamentals and growing adoption, it is essential to acknowledge the volatility of the crypto market. Price movements may be influenced by technology trends, investor sentiment, regulatory actions, and overall market dynamics. As with all crypto assets, risk awareness and responsible investing are crucial.

**Disclaimer**:

This trading idea is for educational purposes only and does not constitute financial advice. Investing in cryptocurrencies like **RNDR** carries substantial risk, including the possibility of total capital loss. Always perform in-depth research, assess your financial goals, and consult a licensed financial advisor before making investment decisions. Past performance is not indicative of future outcomes.

RNDR/USDT – Double Bottom Formation Signals Reversal PotentialRender (RNDR) is currently forming a Double Bottom pattern, signaling a potential bullish reversal from recent lows. The pattern is validated if the price breaks above the Resistance Neckline at 4.200, confirming strength from buyers.

📌 Key Technical Levels:

Key Support: 3.235 – a critical level where price previously found buying interest.

Order Block (OB) Zone: 3.400 - 3.484 – potential demand area for renewed bullish momentum.

Strong Resistance Zone: 5.800 - 6.200 – historical selling pressure likely to be met if price continues upward.

A decisive break above the neckline could trigger a rally toward the Strong Resistance Zone, aligning with prior structural reactions. However, failure to sustain momentum might see retests of Key Support and the OB zone for liquidity gathering. Traders should monitor volume confirmation and price reaction at these critical levels.