RIPPLE trade ideas

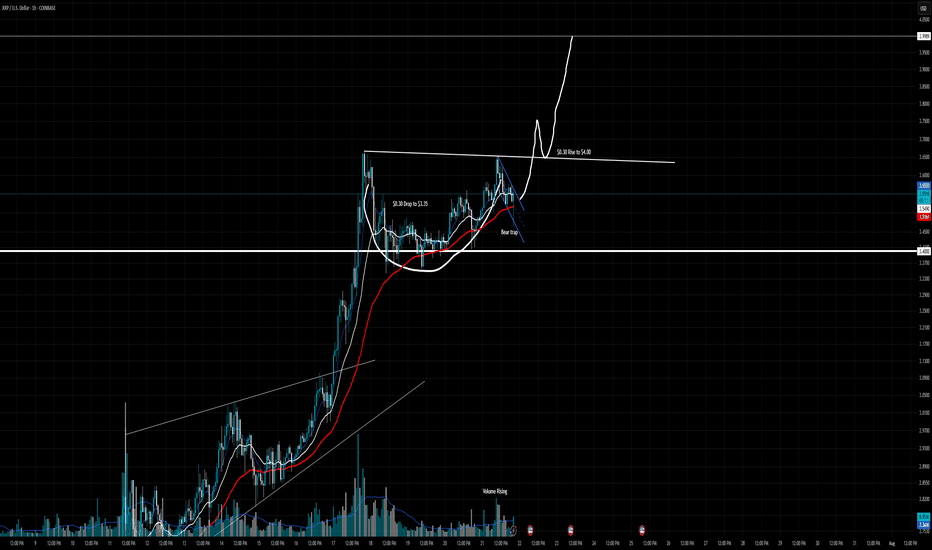

XRP/USD Chart Hack – Rob the Market Before the Bears Do🏴☠️💸 XRP/USD Crypto Market Heist Plan: Thief Trader Style 💰📈

"Break the Vault, Rob the Trend – One Candle at a Time!"

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

To all fellow money makers, day robbers & chart thieves... welcome to the vault!

We’re diving into the XRP/USD (Ripple vs. U.S. Dollar) with a bold Thief Trading™ Strategy, blending technical mastery and market intuition.

📊 THE PLAN: Rob the Resistance – Swipe the Highs

🔥 Based on Thief Trading-style TA & FA combo, here's the master heist setup:

Long Bias ⚔️

Target: The High Voltage Resistance Zone

Status: Overbought + Trap Level = High Risk, High Reward

Market Mood: Bullish but risky – consolidation & reversal zones ahead

Crowd Behavior: Bearish robbers strong above, but we strike below

🧠 Thief Wisdom:

“The vault's open, but not every vault is unguarded. Wait, plan, attack with strategy.”

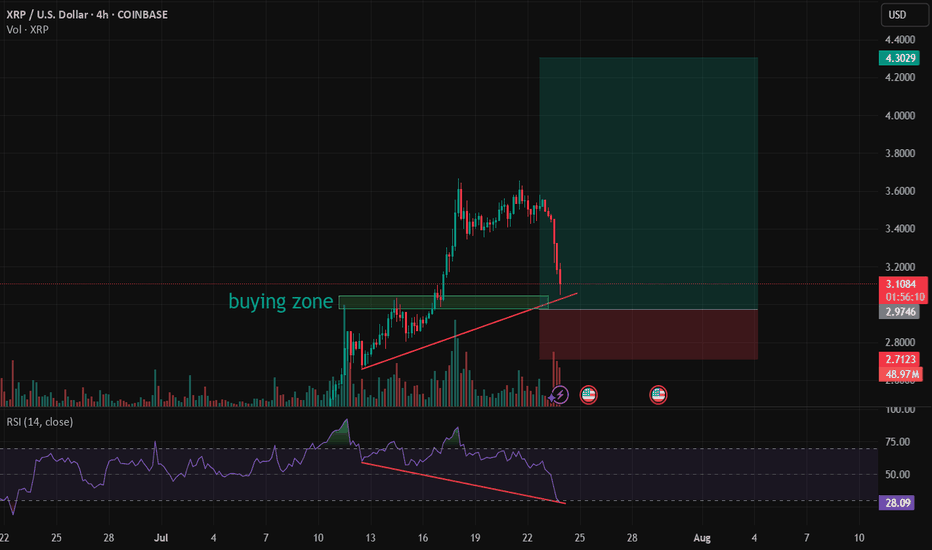

📥 ENTRY PLAN

The Heist Begins at the Pullback...

Use Buy Limit Orders (Thief Style: DCA / Layering)

Entry Zones: Near recent swing lows or within 15–30 min pullbacks

Let the price come to your trap – precision is our weapon

🛡️ STOP LOSS STRATEGY

Guard Your Loot – Always Secure Your Exit

SL Example: 2.8500 (3H TF swing low)

Customize SL based on:

⚖️ Your lot size

🎯 Risk tolerance

🔁 Number of entry layers

Remember: We don’t chase losses – we protect capital like it's gold

🎯 TARGET

Final Take-Profit: 4.0000

But hey… Thieves escape before alarms ring!

💡 If momentum slows, don’t be greedy. Exit smart, exit rich.

📡 FUNDAMENTAL + SENTIMENTAL OVERVIEW

The bullish bias is supported by:

📰 Macro Events

📊 On-Chain Signals

📈 COT Reports

🔗 Intermarket Correlations

📢 Sentiment Analysis

👉 Stay updated with the latest data — knowledge is the thief’s ultimate tool.

⚠️ TRADING ALERT – News Can Wreck the Heist

To survive news spikes:

🚫 Avoid entries during high-impact releases

📉 Use trailing SL to protect your open profits

🛑 Adjust exposure during uncertain volatility

❤️ SUPPORT THE CREW – BOOST THE PLAN

If this plan added value, hit the 🔥BOOST🔥 button.

It helps grow the Thief Trading Team, and together we rob smarter, not harder.

💬 Drop your feedback, thoughts, or charts below – let’s build the crew!

💎 Every candle tells a story. We don’t follow the trend – we rob it.

💣 Stay alert, stay rogue, and I’ll see you at the next market heist.

💰 Until then… chart smart, trade savage. 🐱👤💵

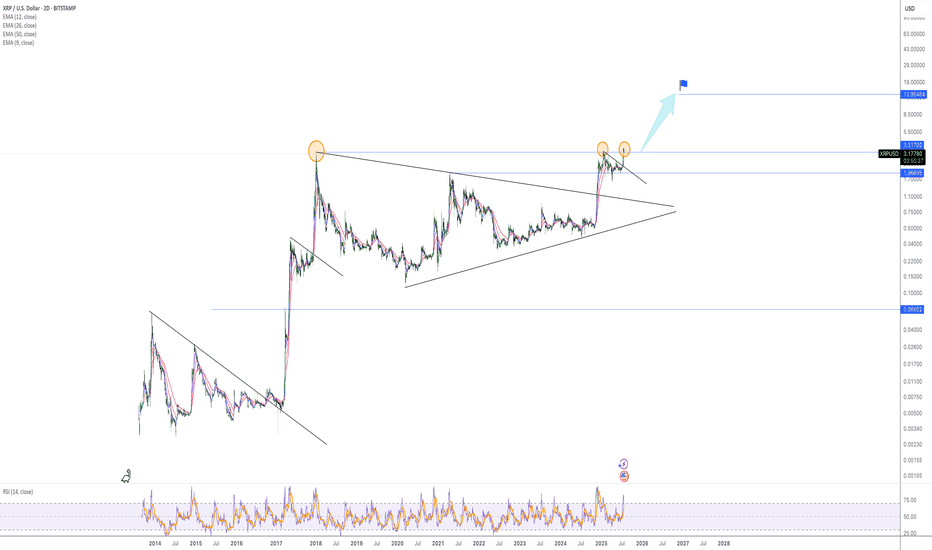

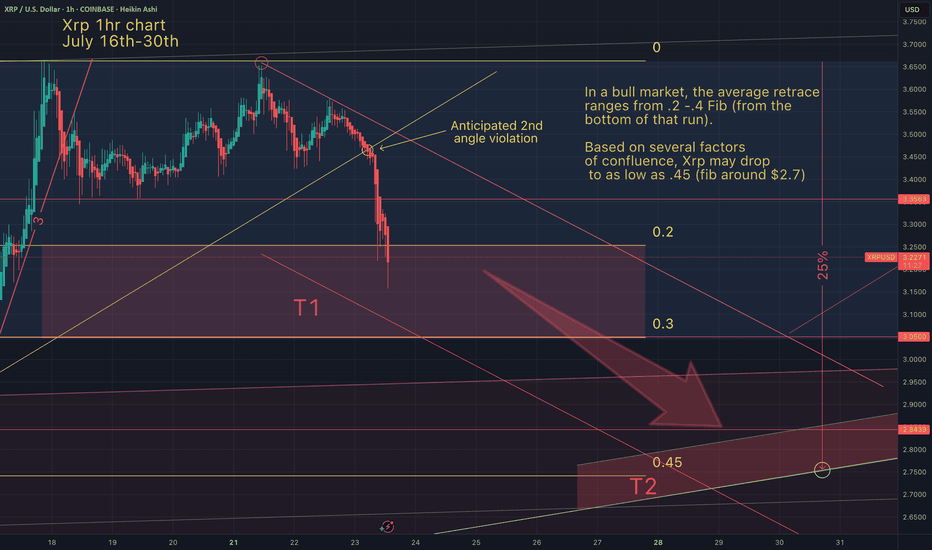

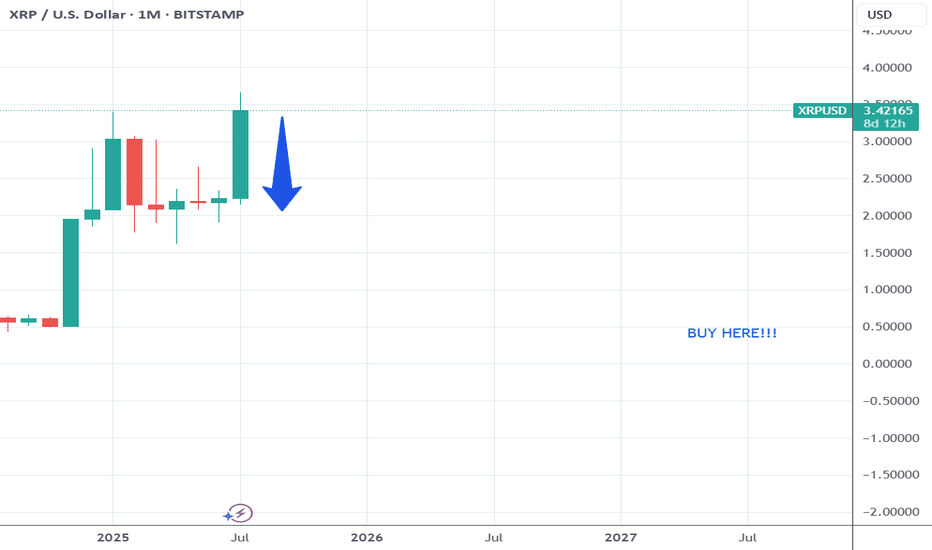

Relax and watch the show - target = 13 dollarDear,

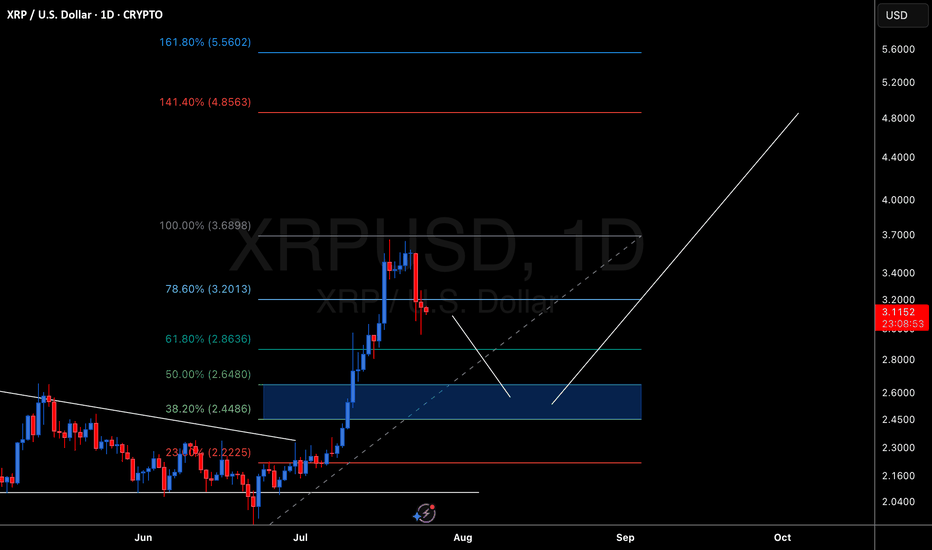

In a bull market it is normal to see a 10, 20% pullback before the next impulsive wave.

It is a normal level for XRP to reject for now because we came near the ATH.

With the next test of ATH i believe we will move fast trough it.

My personal target for this bull run is 13 dollar. It can go higher but i believe the market will be overbought.

Currently the RSI levels are cooling of, the 1H and 4H oversold so i believe we will reverse soon.

Take care.

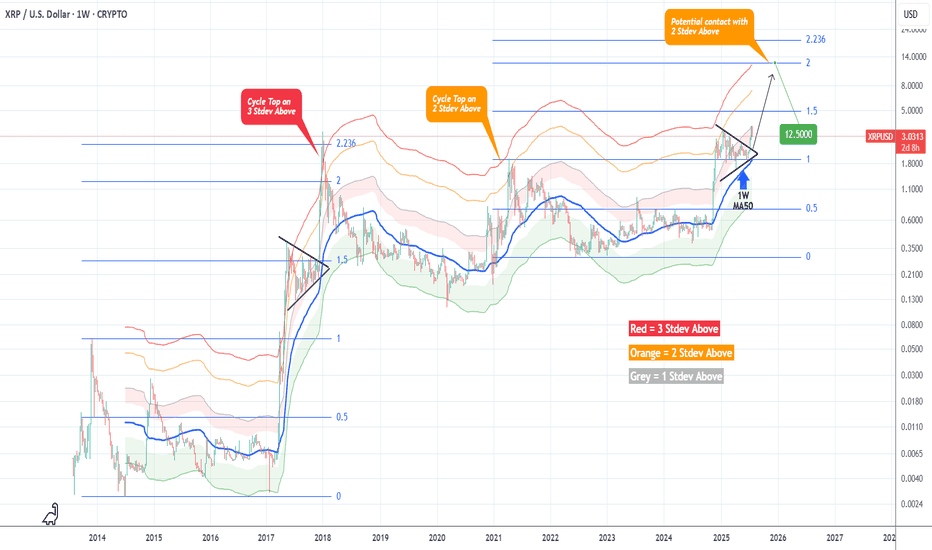

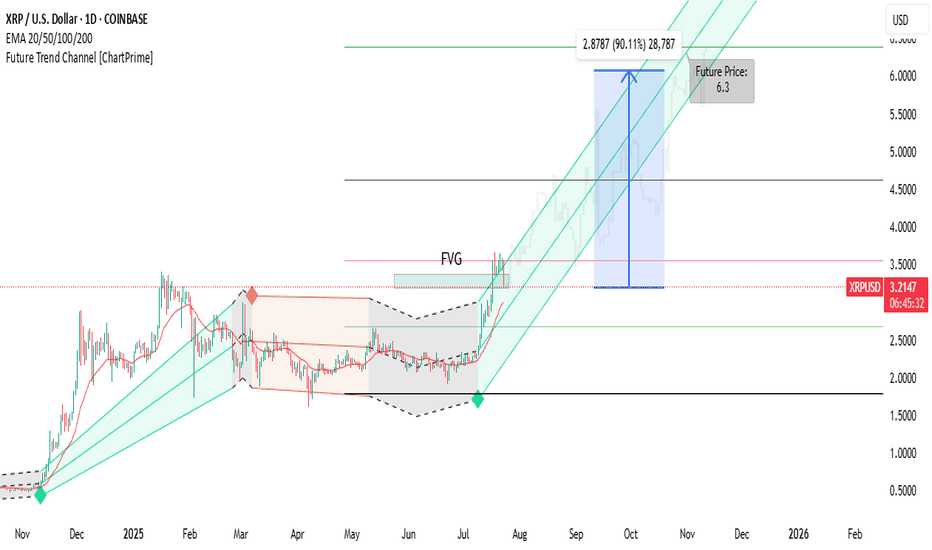

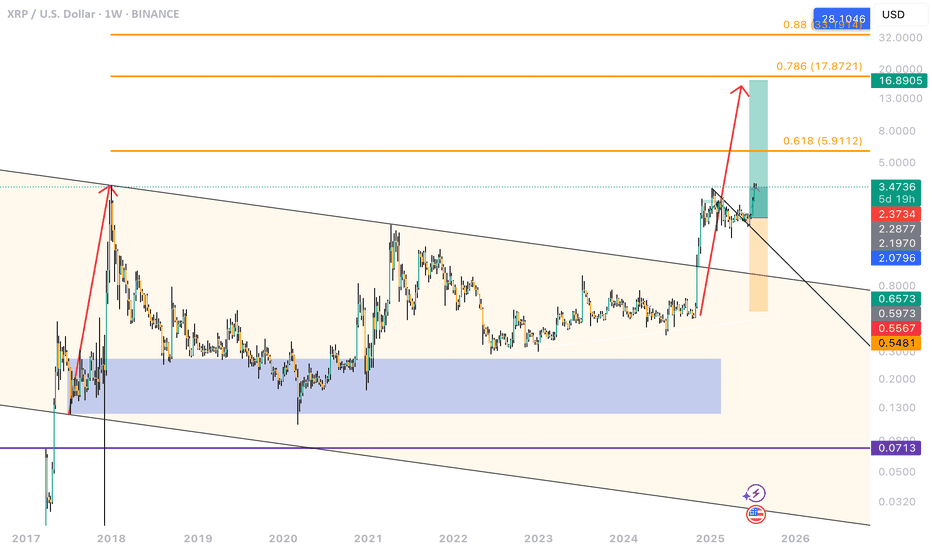

XRPUSD Massive break-out that can Top at $12.500XRP (XRPUSD) got out of its Accumulation Triangle (December 2024 - June 2025) making an aggressive break-out similar to the December 2017 one, which was after an identical Triangle pattern.

The fractals are so comparable that both mostly traded within the 1W MA50 (blue trend-line) and the Mayer Multiple (MM) 2 Stdev Above (orang trend-line).

As you can see, that MM trend-line was where the Top of the previous Cycle (April 2021) was priced and the one before was above the 3 Stdev Above (red trend-line).

Assuming that this Cycle will also go for the 'minimum' 2 Stdev Above test, it can make that contact by the end of the year on the 2.0 Fibonacci extension (Cycle Top-to-bottom) at $12.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

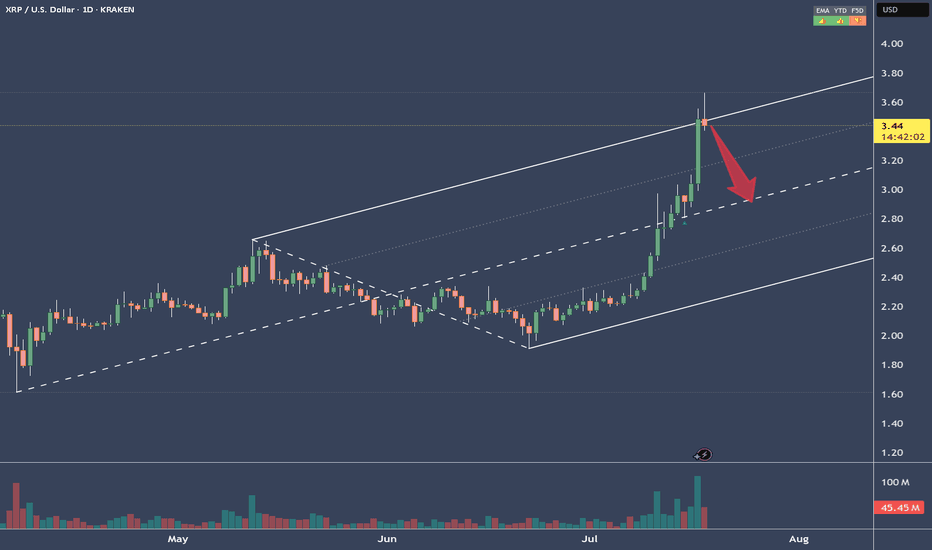

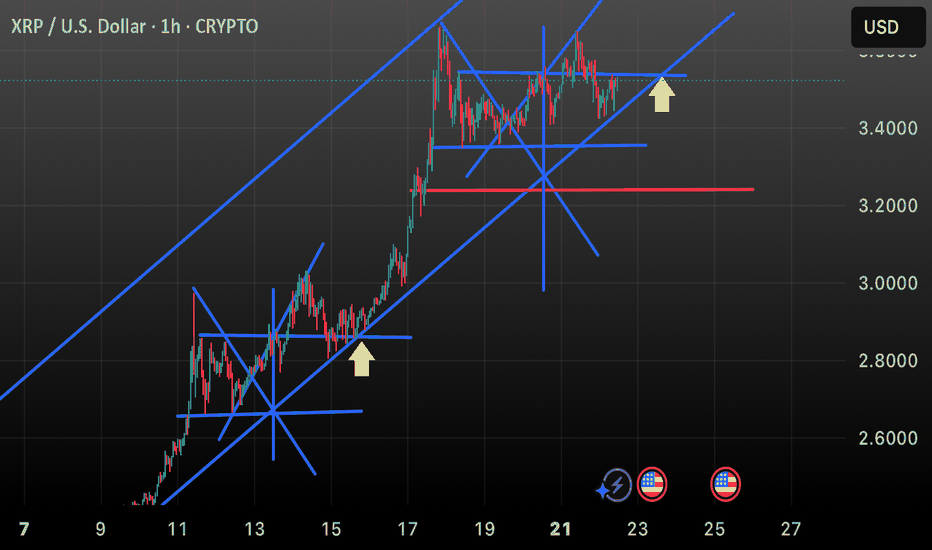

XRPUSD - Target reached. Reversal on the plateSo, that was a nice long trade.

Now price is stretched at the Upper Medianline Parallel (U-MLH).

As of the time of writing, I already see price pulling back into the Fork. A open and close within the Fork would indicate a potential push to the south.

Target would be the Centerline, as it is the level where natural Meanreversion is.

Observation Hat ON! §8-)

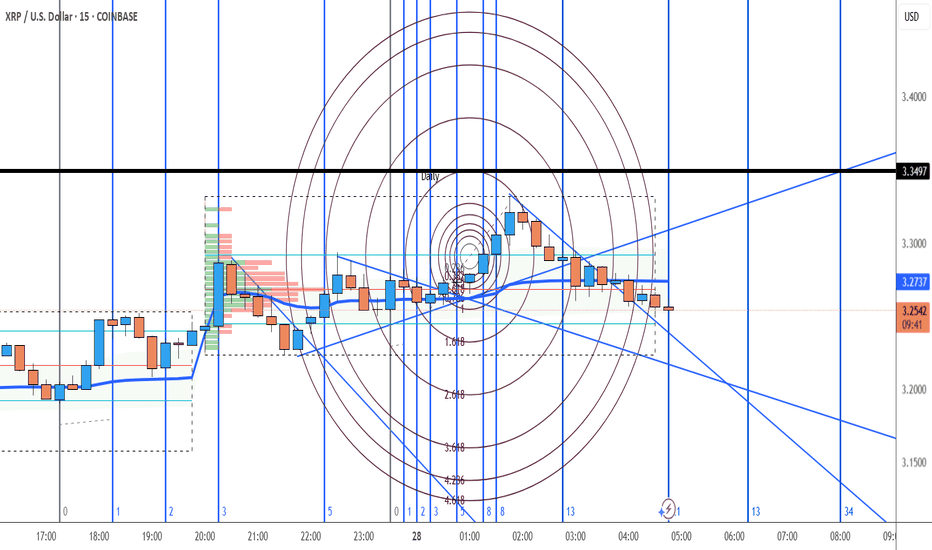

XRP: $10 Breakout? Watch These Algorithmic Windows!This XRP analysis highlights "algorithmic departure windows" (blue circles) where explosive price moves can occur.

Whenever price enters a blue circle, XRP can launch to $10 or higher instantly or within 33 days—no matter the news.

**Key Dates to Watch:

**Possible Departure: July 10, 2025 (fundamentals align)

**Other Windows: May 19 - August 11, 2025; October 22 – November 18, 2025

**Major Target Zone: $8.50–$11.50 (December 25, 2025 – January 26, 2026)

History shows that once price breaks out from these departure windows, XRP can reach its upper targets rapidly—sometimes in a single day, but almost always within 33 days or less.

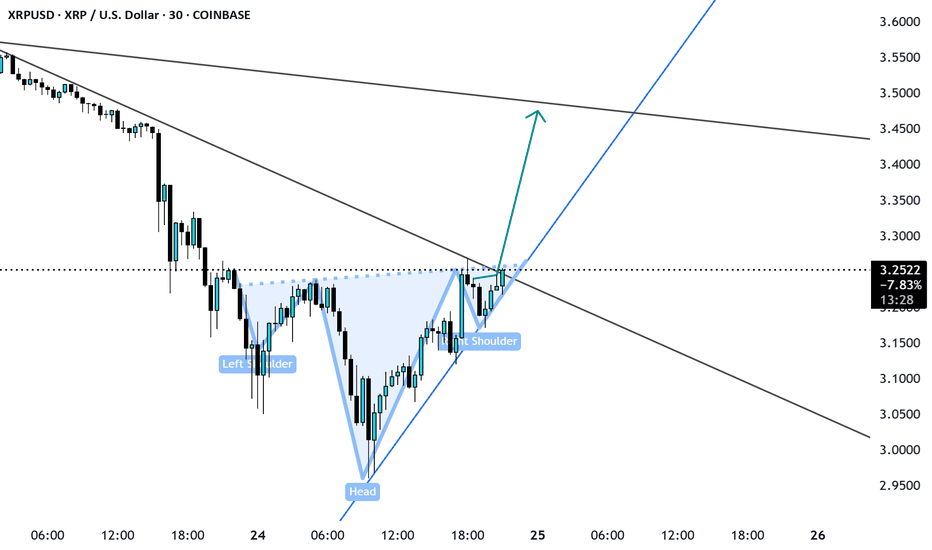

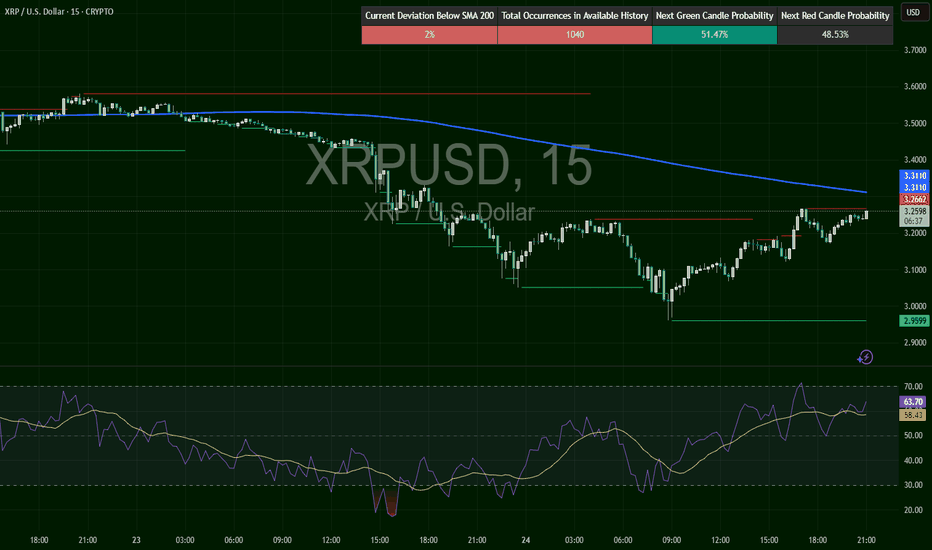

News is the excuse for the moves—algorithms deliver the predetermined price.

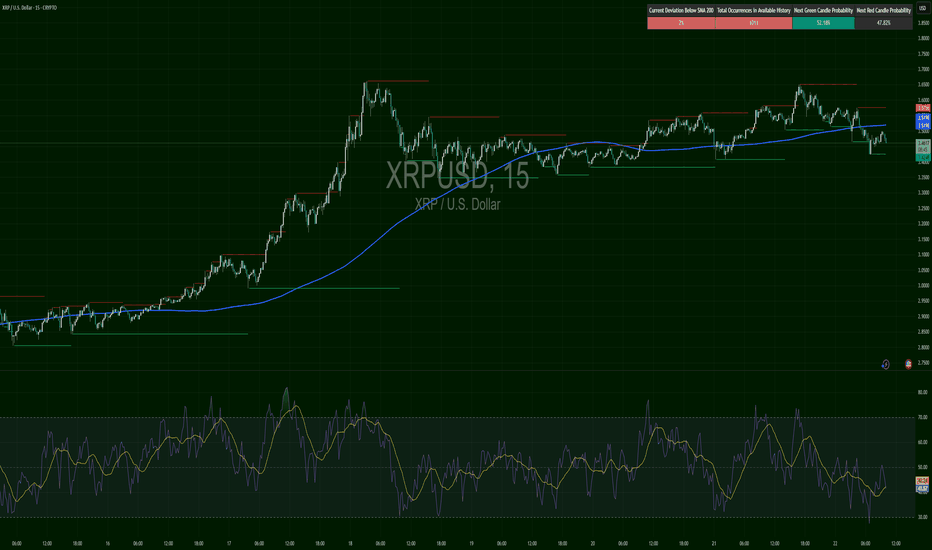

XRPUSD – Reclaim or Reject? Critical TestXRP flushed hard to $2.95, then reversed and is now pressing back into prior breakdown levels at $3.26–$3.31. 200 SMA above is resistance at $3.31. RSI at 63.14, bullish and rising. This is the make-or-break retest zone. Break it, and we could see $3.40+ fast. Rejection = trap.

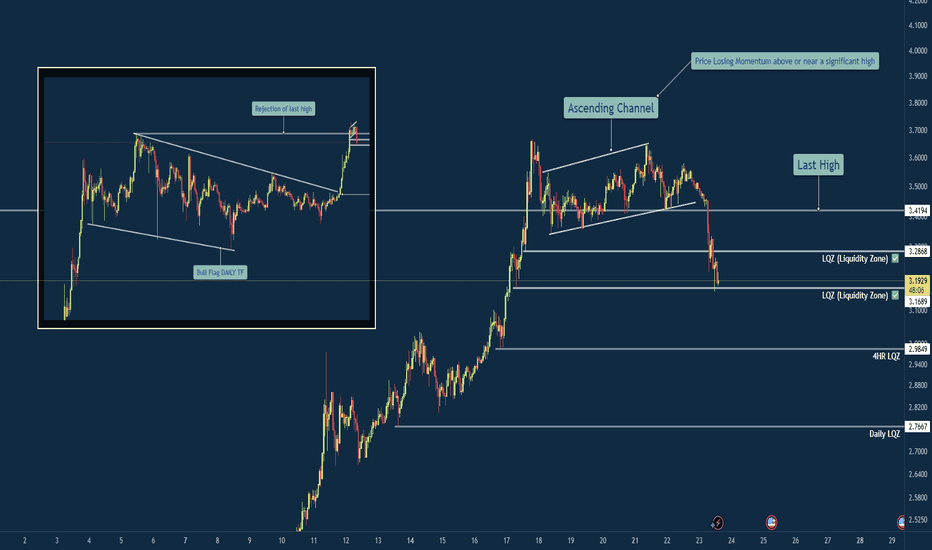

XRP/USD – Bearish Shift After Momentum Exhaustion🧠 Summary:

XRP/USD has shown clear signs of exhaustion after sweeping the previous high. Following a breakout from a daily bull flag, price struggled to hold momentum near the key level of 3.4194, forming an ascending channel that eventually broke down. Liquidity zones below current price are now in focus.

🔍 Technical Breakdown:

✅ Daily Bull Flag → Broke out with strength

⚠️ Rejection near Previous High (3.4194) → No follow-through

🔼 Ascending Channel → Formed post-impulse, now broken

📉 Momentum Shift → Structure flipped bearish

💧 Liquidity Zones (LQZ) below price acting as magnets

📌 Key Levels:

🔹 Last High: 3.4194 (Rejection Point)

🔹 Broken LQZ: 3.2868

🔹 Current Support: 3.1689 (LQZ - being tested)

🔹 Target 1: 2.9849 (4HR Liquidity Zone)

🔹 Target 2: 2.7667 (Daily Liquidity Zone)

🧩 Confluences:

Liquidity sweep of prior high

Momentum loss near key resistance

Break of ascending structure

Retesting broken zones with room below

⚠️ Final Thoughts:

This trade is playing out just as we described in the post before this on XRP. We discussed watching how price would react to this area before making any type of "Late Entries". XRP is still a huge and vital part of the Crypto Eco System so long term i am holding my Long position. The areas on the chart are still great areas to buy in at "Dollar Cost Average". This will be one of those positions that though it may be bearish on the lower time frame you need to zoom out and always keep an eye on the weekly and daily chart before making any drastic moves.

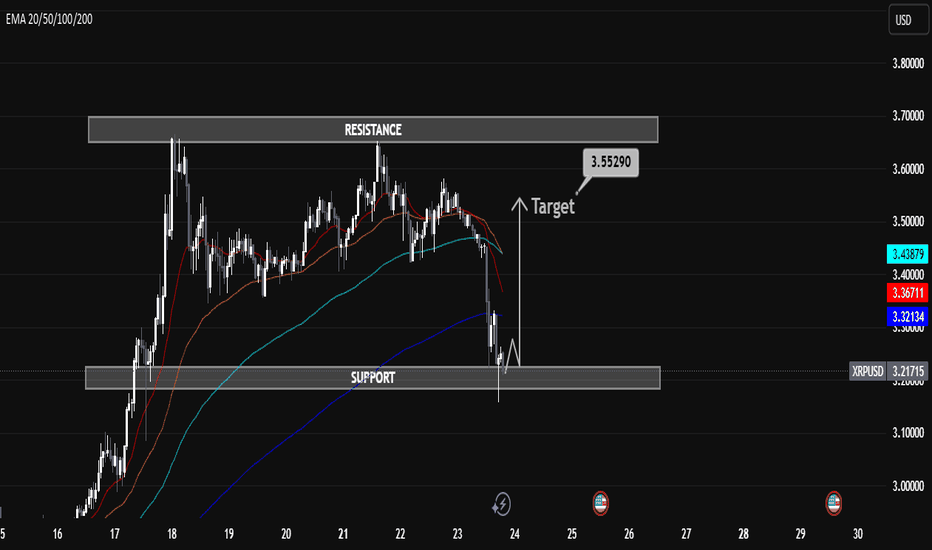

XRP/USD H1 Educational Market Analysis – Support-Based XRP/USD H1 Educational Market Analysis – Support-Based Long Opportunity

🔍 Structure Overview:

• Support Zone: $3.21 – $3.23

This level has acted as a strong liquidity pool and base for past bullish moves. Price has tapped into it, showing signs of potential demand returning.

• Resistance Zone: $3.65 – $3.70

Acts as a key supply zone, where previous bullish attempts failed. Targeting this area after a rebound is technically sound if structure confirms.

⸻

🔄 Price Action Insights (H1):

• Price broke down through EMAs (20/50/100/200), confirming short-term bearish pressure.

• A rejection wick from support hints at possible absorption of selling pressure.

• If price forms a higher low structure above $3.25 and reclaims EMAs, a potential bullish reversal may unfold.

⸻

🧠 Educational Note:

• H1 charts are ideal for intraday strategies, and this structure provides a clear example of:

• Support-resistance dynamics

• The use of EMAs as trend confirmation tools

• Reversal vs. continuation setups

⸻

🎯 Intraday Bullish Scenario:

• If price holds above $3.21 and breaks above the $3.40 (EMA cluster), bulls may push toward the $3.55290 target.

• This level aligns with the mid-range of the resistance zone, offering scalp-to-swing potential.

⸻

🚫 Bearish Risk:

• Failure to hold $3.21 could lead to a deeper correction toward $3.10 or even $3.00.

• Confirmation of bearish continuation would be a lower high rejection from EMAs without reclaiming them.

⸻

📌 Summary:

On the H1 chart, XRP is at a critical support. Watch for a clean bounce and break above EMAs for a move toward $3.55. However, losing $3.21 could attract further downside. Use price action confirmation before entries.

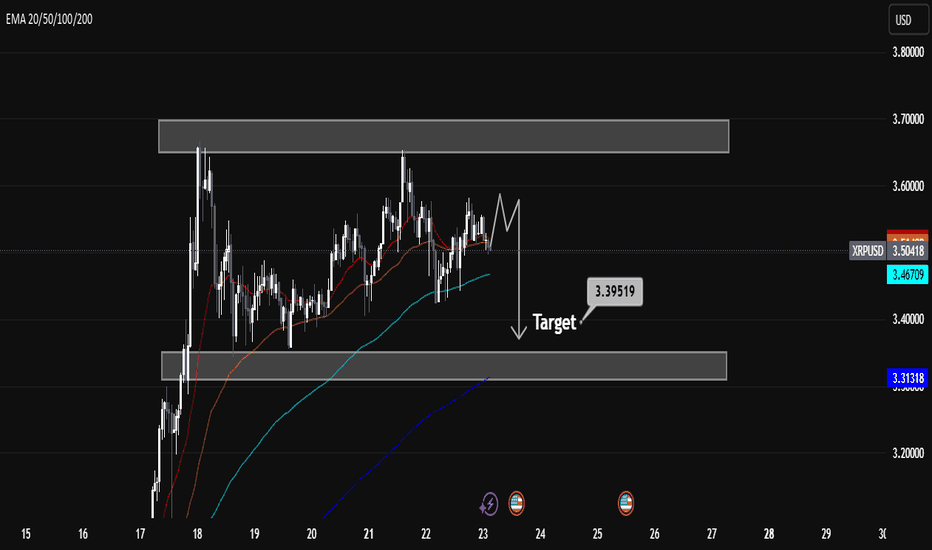

XRPUSD Technical Analysis — Bearish Retracement in PlayXRPUSD Technical Analysis — Bearish Retracement in Play

Overview:

XRPUSD is currently exhibiting signs of bearish momentum after failing to break through a key resistance zone. Price action suggests a potential retracement towards the marked target level of 3.39519, supported by multiple technical indicators and price structure.

Key Technical Levels:

Immediate Resistance: 3.70 – 3.75 (strong supply zone; price rejected here multiple times).

Support Zone: 3.30 – 3.39 (prior demand zone and EMA confluence).

Target: 3.39519 (short-term bearish target as marked on chart).

Current Price: 3.50 (as of chart time).

Indicators & Price Action:

EMA Analysis:

EMA 20/50 (red/orange) are flattening out, indicating weakening short-term momentum.

EMA 100 (cyan) acts as current dynamic support.

EMA 200 (blue) is far below, suggesting room for deeper retracement if sentiment weakens.

Price Structure:

XRPUSD formed a double top near resistance, followed by lower highs.

Recent candle patterns show indecision and possible distribution.

Projected bearish leg toward 3.39519 suggests sellers are in short-term control.

Conclusion:

XRPUSD is likely to retest the 3.395 support level after rejecting the upper resistance zone. The bearish structure is supported by EMA alignment, price action, and repeated failure to break resistance. A break below 3.395 could open further downside towards 3.31. However, a strong bounce from support could invalidate this setup.

Trade Bias: Short-term bearish toward 3.395, watching for reaction at support.

You Are Getting Ripped Off On XRP Contd.... Once again for all the hype on xrp it still can not break the all time high.

Like I said 2 weeks ago when the price was at 3.60, I will see you at $3.00 by August 1st..

Its fading and the death nail will come 5-8 days from now.

The whole crypto market will crash. The slide starts in August.

I will be buying XRP for 55 cents in 2027.

Also Silver will outgain XRP in the next 2 years by 400 percent.

Laugh and mock all you want.

Come see me August 1st.

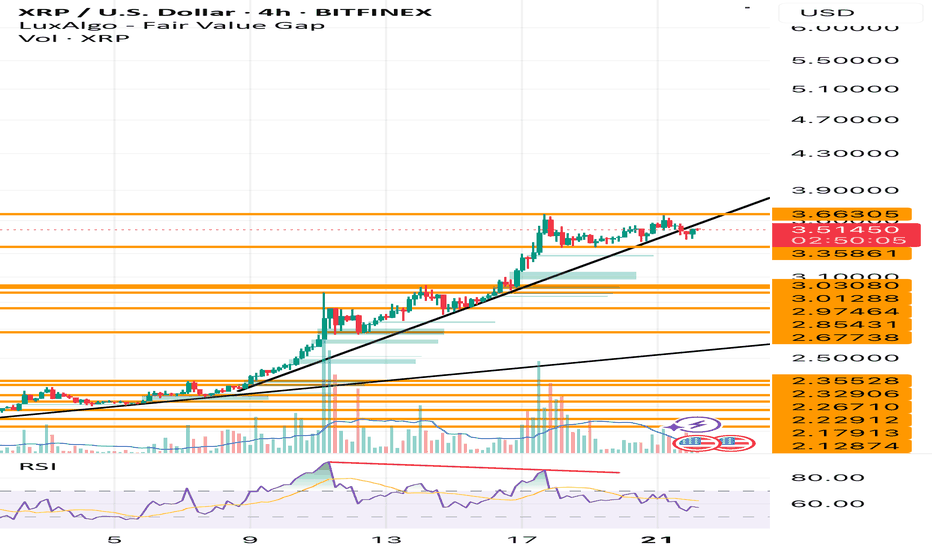

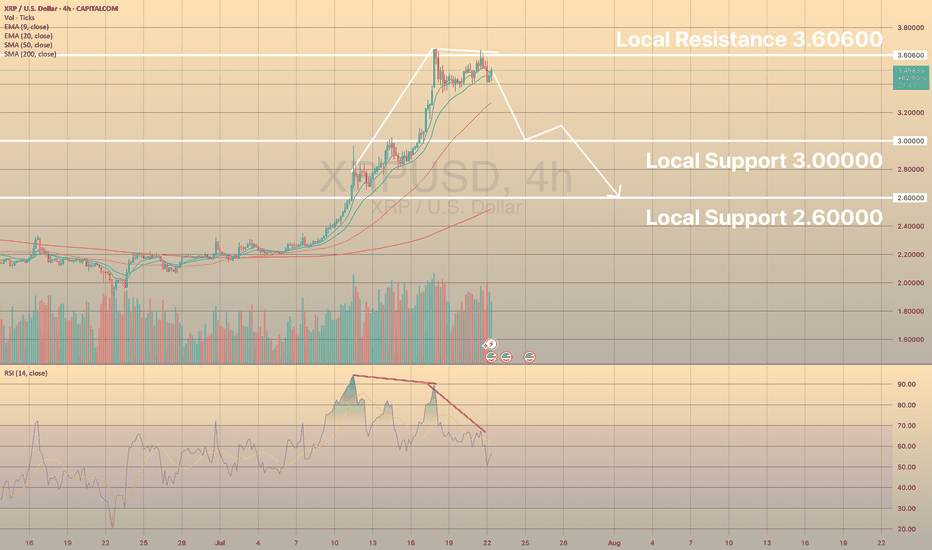

XRPUSD - BEARISH DIVERGENCE DESPITE STRONG BULLISH PRESSUREXRPUSD SIGNALS BEARISH DIVERGENCE DESPITE STRONG BULLISH PRESSURE. WHAT TO EXPECT?👀

Ripple has been moving bullish since July 9, the same as the ETHUSD, reaching the 3.60600 resistance level. Strong bearish divergence on RSI is observed.

What is the bearish divergence?

Bearish divergence is a technical analysis pattern where the price makes higher highs in an uptrend, but a momentum indicator (e.g., RSI, MACD) forms lower highs, signaling weakening bullish momentum and a potential downward reversal. To trade, identify the divergence in a clear uptrend with the indicator showing lower highs (e.g., RSI above 70). Sell or short when the price confirms a reversal (e.g., breaks below a support level or trendline) with increased volume. Set a stop-loss above the recent high. Target the next support level.

Here the closest support level is local support 3.00000. is the price drops below the EMA20 on 4-h chart, there are high chances of reaching this level.

XRPUSD – Trend Bent, Bias BearXRP broke structure on the downside after failing to hold $3.59, slicing through the 200 SMA. Momentum flipped bearish with RSI stuck under 50, signaling distribution phase. Support rests at $3.42. Bulls need a fast reclaim of $3.50 to regain control — until then, lower highs dominate.

$XRPBullish Bias: The chart suggests a bullish outlook with a breakout from a multi-year wedge and Fibonacci targets as high as ~$16.8.

Current Pullback: The price is pulling back after breakout (possibly retesting previous resistance as support).

Risk Area: Orange box shows a potential invalidation or pullback zone before another rally.

Descending Broadening Wedge (Pattern)

A large wedge spans from 2017–2025, marked by two converging black trendlines.

XRP has broken above the wedge (bullish breakout).

Fibonacci Levels (Orange horizontal lines on the right)

0.618: ~$5.91

0.786: ~$17.87

0.88: ~$32.06

These levels are likely drawn from the ATH (All-Time High) to a major low.