RNDR: Pullback in UptrendTrade setup : Price is in an Uptrend. It broke out of a Channel Down pattern and reached $12.00 for +50% gain. Now we look for an entry in Uptrend. Pullback to $10 support could be a swing trade entry with +20% upside potential to $12.00 again. Stop Loss (SL) level at $9.20.

Pattern : Pullback in Uptrend. Price remains in an Uptrend but has pulled back, which could present a 'buying dip' opportunity. Traders should look for the nearest support level where price could stabilize and resume its Uptrend. This support level could be a level where price bounced off of in the past, or a level that was previously resistance. (concept known as polarity).Learn to trade key levels in Lesson 3.

Trend : Short-term trend is Up, Medium-term trend is Strong Up and Long-term trend is Strong Up.

Momentum is Bearish (MACD Line crossed below MACD Signal Line). Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance : Nearest Support Zone is $10.00, then $8.00. Nearest Resistance Zone is $12.00, then $13.80.

RNDRUSDT trade ideas

RNDRUSDTi'm bullish for rndr.

NVDIA bullish strong forescast.

reflecting AI momentum.

AI sector will be bullish.

WWCD Apple 10 june..

RNDR will be sky rocket..

Bottom should be inmy two previous posts were also about RNDR. In here we caught the move up from 9,5$ to 11$, and after that the pullback to the 50ma. I placed my new orders from 10,5 to 10,3$, almost all got hit. I think that the bottom is likely in, NVDA showed strong results so this dump is only created to make you scared and f*** up your longs. Well, are you scared? Good, i just bought your coins ;) The parabolic run to $25 will resume from here imo, stops still right below the 0,5 ($9,5) where I initially bought my RNDR back. I'll update the idea from here! NFA ofc

0,5 is keyWe're entering wave 5 for RNDR, bullish consolidation above the previous range like we saw numerous times before during this run. Big accounts calling for lower, this could be if bitcoin is gonna make a lower low. I assume the bottom is actually in and like to think the same for RNDR. Up from here, I've put some stops just below the 0,5 in case we retrace deeper (scenario B) Either way 35$ per RNDR is inevitable imo.

#RNDR Up 15% what's next?#RNDR: Played out perfectly! Up 15% from the average entry.

Target 1: ✅

Approaching the second and third targets.

Hope you didn’t miss this one!

Like & RT for more!

Do hit the like button if you want me to post more of these setups!

Thank you

#PEACE

NVIDIA Earnings May 21 - Will Crypto AI RNDR Heat Up?Back in Feb 22, 2024 NVIDIA AI chipmaker reported Q4 2023 earnings per share of $5.16 with a posted revenue of $22.1 billion higher than expected. Biggest crypto AI narratives RNDR rose upto 20%. .

Now the biggest question is: "Will RNDR token will lead the crypto market as NVIDIA is going to report earnings of Q1, 2024?"

YES , there is HIGH probability of greater reporting earnings by NVIDIA for Q1, 2024. The fact that Taiwan Semiconductor (TSMC) AI chipmaker Q1 earnings came in higher ($7.3 billion) suggests Nvidia’s could reveal the same.

Trade Setups with TP, SL and Entry is shown in the chart.

Good Luck!!!

RNDR TARGET PRICE ( ROUNDING BOTTOM PATTERN)I am Hodling RNDR which is NVDA of cryptocurrency for me. Until the target price, I am not selling a penny because we are at the beggining of altcoin bull run. There is this rounding bottom pattern already retested that shows we are now in the way of going to the target price for RNDR.

RNDR consolidationRNDR in a consolidation at a considered a lower high below quarterly open. With previous week's low (PWL) capping the downside, a dip into it and recovery and I could enter longs.

Using also previous Monday's range as the support, if it flips, I could short there targeting $7.00 with stops above Quarterly open deviation

#RNDR Scalp Trade Setups!CRYPTOCAP:RNDR AnalysisRisk/Reward: Looking promising.

The breakout has occurred, and we're currently seeing a retest.

TBH, everything looks good for altcoins unless BTC makes an unexpected move at the Monday open. Keep an eye on it. I've entered the trade, taking the risk.

Accumulation Zone: $9.88 to $10.40

Targets: $10.87, $11.45, $12.22

Stop Loss: $9.75

dyor, nfa

#RNDR

Please hit the like button if you like it and share your views in the comments section.

#PEACE

RNDR TokenThe Render token (RNDR) signifies bullish sentiment and is replicating bull accumulation this week.

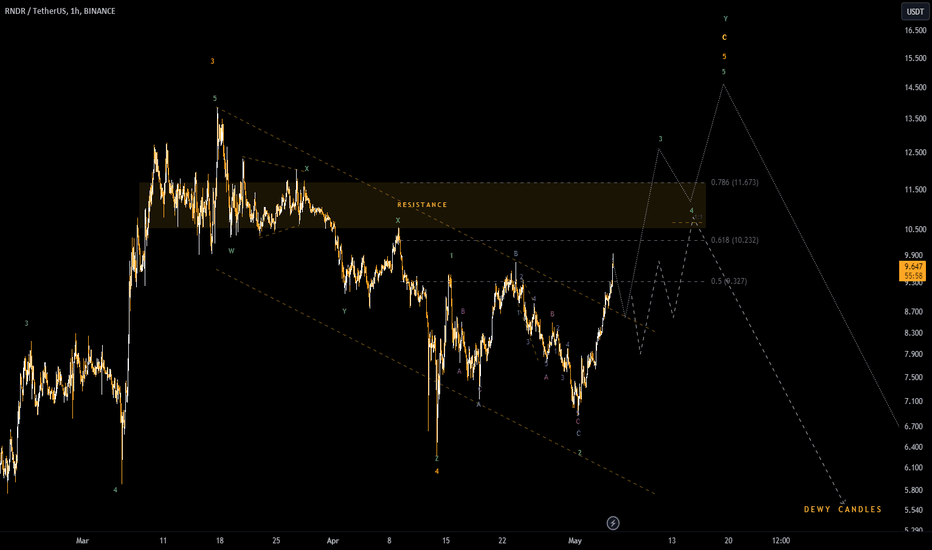

RENDER (RNDR) UPDATE - $10 OR $18 INCOMING AFTER 7RR TRADE SETUP

So following through on the past analysis where I called it bullish for BINANCE:RNDRUSDT at $6.703

which is now over 40% gain just after hitting the 7RR trade setup (see all chart below) I bring you the update in full.

It is very simple. Either we have completed our wave 4-orange and we are heading straight to the wave 5 at around $14-18 right now (dotted line) where we have already completed wave 1 & 2-green or this is just a corrective wave rather than impulsive. Whichever scenario plays out, there are few commons between them and that is the fact that we could get a retracement from this point and both scenario will reach $10.555 being the 1 to 1 level, Golden Zone Fibonacci level and the resistance. So there is a common ground there. It is like a magnet all confluences attracts to there so watch out.

PREVIOUS ANALYSIS

OTHER ANALYSIS

$RNDR LONG | NEW ATH | +40%CRYPTOCAP:RNDR has formed a cup and handle that can potentially breakout to a new all-time high at ~$15.30. This would be +40% from the neckline. Wait for a retest of the neckline at $11, which also happens to be the volume point of control. Once a breakout occurs from the neckline, jumping into a long position is likely to be profitable. Set appropriate SLs and TPs, and good luck!

#RNDR/USDT#RNDR

The price is moving in a bearish channel on a 12-hour frame and is adhering to it to a large extent. It has been penetrated upward and the channel is being retested.

The price rebounded well from the green support area at the 6.70 support level, which is a strong level

We have a trend to hold above the Moving Average 100, which is strong support for the rise

We have very strong oversold resistance on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price is 8.80

First goal 11.26

The second goal is 13.00

The third goal is 15.00

LONG #RNDRUSDTLONG #RNDRUSDT from $10.11 stop loss $9.1

1h TF. The asset bounced off the support zone, I expect a move to the test or move over and move into the liquidity zone. Enter a position from the current price or at the price of 10.11 one averaging at your discretion, cross

RNDR/USD: Bullish Tech & Apple Rumors Fuel Potential RallyTechnical Indicators Flash Bullish Signals:

The RNDR/USD chart boasts a confluence of bullish technical indicators, strengthening the case for a potential upswing.

MACD Crossover: A recent bullish MACD crossover signals increasing buying pressure and potential momentum to the upside.

Stochastic RSI Divergence: A bullish divergence between the Stochastic Oscillator and RSI suggests underlying strength despite recent price weakness.

Apple Integration Rumors Stoke Investor Interest:

Rumors of Apple potentially integrating Octane, a 3D design software powered by the Render Network, have fueled investor interest in the RNDR token, potentially amplifying the bullish technical signals.

Potential Price Target:

Fibonacci retracement levels applied to the recent price movement suggest a possible upswing towards $23, with the 1.618 level acting as a potential target zone.

Important Considerations:

While the technical indicators and rumors are encouraging, remember that technical analysis and speculation don't guarantee future performance.

Conduct thorough research to understand the fundamentals of the Render Network, its tokenomics, and the potential impact of the rumored Apple integration before making any investment decisions.

RNDR/USDTThe Bearish Butterfly is a complex chart pattern used in technical analysis, primarily in trading stocks, futures, and currencies. It's considered a variation of the butterfly pattern, which is itself a type of harmonic pattern.

The Bearish Butterfly pattern is identified by four distinct points on the price chart, forming an M-shaped pattern. These points are labeled X, A, B, and C. The pattern consists of three consecutive legs, with the second leg retracing a significant portion of the first leg, and the third leg completing a move beyond the starting point of the first leg.

Here's a breakdown of the pattern:

1. **Initial Move (X to A)**: The pattern starts with a strong downward move (X to A).

2. **First Retracement (A to B)**: After the initial move, there is a retracement (A to B), which usually retraces a significant portion of the initial move but doesn't exceed it.

3. **Second Move (B to C)**: Following the retracement, the price resumes its downward movement (B to C). This leg typically extends beyond the starting point (X) of the initial move.

4. **Potential Reversal Zone**: The completion of the Bearish Butterfly pattern usually occurs at or near the 127.2% Fibonacci extension of the initial move (X to A). This is where traders anticipate a reversal in the price action, hence the "bearish" designation of the pattern.

Traders who recognize the Bearish Butterfly pattern may use it as a signal to enter short positions, anticipating a downward reversal in the price. However, like all technical analysis tools, it's essential to confirm the pattern with other indicators and factors before making trading decisions.

Rndr/usdt analysis by ict price action Rndr chart after move then completed 70% correction, reaction +OB daily and then move and break wedge pattern and then do a rateracement , finally start main move

First tp: 14.4$

Second tp = 18 $

Finally =24$

RNDR next leg up soon !RNDR / USDT

One of top favorite coins in this cycle

The chart says it all :

– Positive retest of 2nd weekly S/R

– potential breakout of current accumulation range

If no more BTC drama Next leg up should be very soon

RNDR trade idea RNDR just missed order block and created liquidity in form of sell side liquidity which has given us opportunity to take our and form long position here. I will take long position below SSL and will do dca below wick if price comes here.

A very very clean setup. A trader can catch this chart moves easily.

RNDR Long Set-UpA long here with the sessions vwap being the first TP and aiming for the daily level above (purple line) which was the last level relevant untested level before the recent sell off, seems like the best move.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

Render (RNDR) & NVIDIA AI Conference With the rise of Artificial Intelligence , many projects are looking to capitalise on the massive potential that AI promises.

One of those projects is RENDER , the first decentralized GPU rendering platform launched in 2017, the Render network is built to provide a platform for a wide array of computation tasks - from basic rendering to artificial intelligence - which are facilitated swiftly and efficiently in a blockchain-based peer-to-peer network, free from error or delay, while ensuring secure property rights.

Nvidia is a Tech company that focuses on production of high end graphics cards and is a world leader in Artificial Intelligence computing with a Market cap of 2.25 Trillion Dollars. Nvidia are holding an AI conference 17-21 March, one of those talks is a talk on "production rendering on GPU" on the 20th March. I would predict that Render could get a mention as the RNDR network is integrated into Nvidia Omniverse, the VP of Nvidia Omniverse is also an advisor to RNDR, so could we see any further ties between the two companies? If so I think this would propel an already well performing coin that has recently entered into price discovery.

Fib targets after the breakout are shown o the chart and these are the areas to be interested in. I am not ruling out a retest of the break above the previous ATH however with the momentum that we are seeing I think this retest could come a much later stage.

With RNDR's MCap of $3.6B there is no reason why this project shouldn't break into the top 10 at some point this cycle, currently this would mean a 4.85x to displace SHIB at 10th place double that again if you compare to SHIB ATH MCap. This project is just getting started.

All eyes on the Conference, I could see this potentially being a sell the news event as these things often are, however that would just open up a buying opportunity for DCA or long term holding.

RNDRUSDT BUTTERFLY PATTERNHi all,

As you can see butterfly pattern is completing , a red candle can bring price to less than 8

Please trade on your own risk