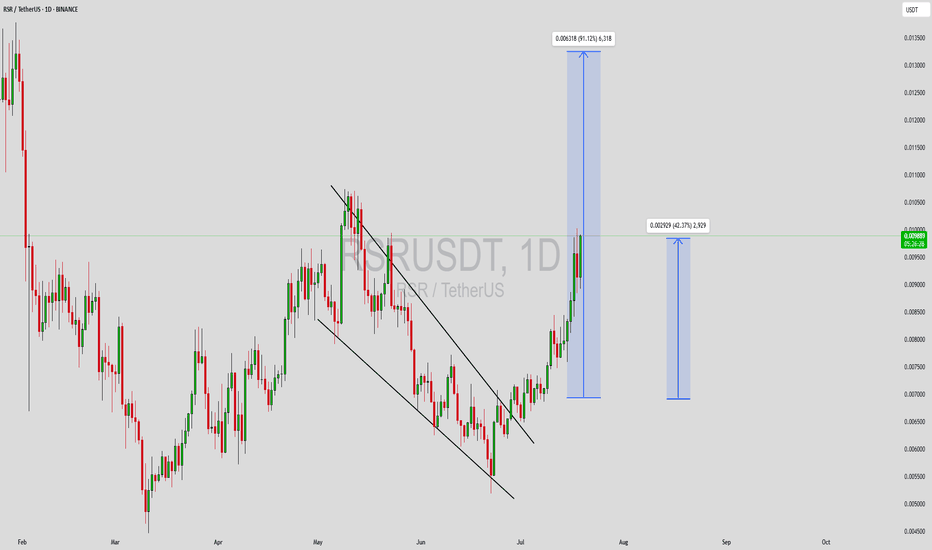

RSRUSDT Forming Bullish WaveRSRUSDT is exhibiting a clear bullish wave pattern on the daily chart, breaking out of its previous downtrend channel with strong momentum. This kind of technical setup often precedes a continuation rally, especially when paired with rising volume. The current breakout is supported by a steady increase in trading activity, indicating strong market interest and confidence from buyers. Based on this chart, there is potential for an 80% to 90% gain if the bullish structure continues to unfold as expected.

Reserve Rights (RSR) is a token with a unique use case, focused on stabilizing digital economies and supporting low-volatility assets. As crypto adoption grows in emerging markets, utility tokens like RSR are becoming increasingly relevant. This could be one of the reasons why investor sentiment is turning positive again, especially after a period of price consolidation and accumulation. If RSR can maintain its momentum, it may retest its previous highs or even reach new local peaks.

Traders and investors should watch key resistance levels closely while considering support re-tests for potential entries. The risk-to-reward ratio in setups like this tends to be favorable if volume remains elevated and broader market sentiment supports the move. Technical indicators such as RSI and MACD may also confirm the bullish bias in the coming sessions, further strengthening this setup’s credibility.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

RSRUSDT trade ideas

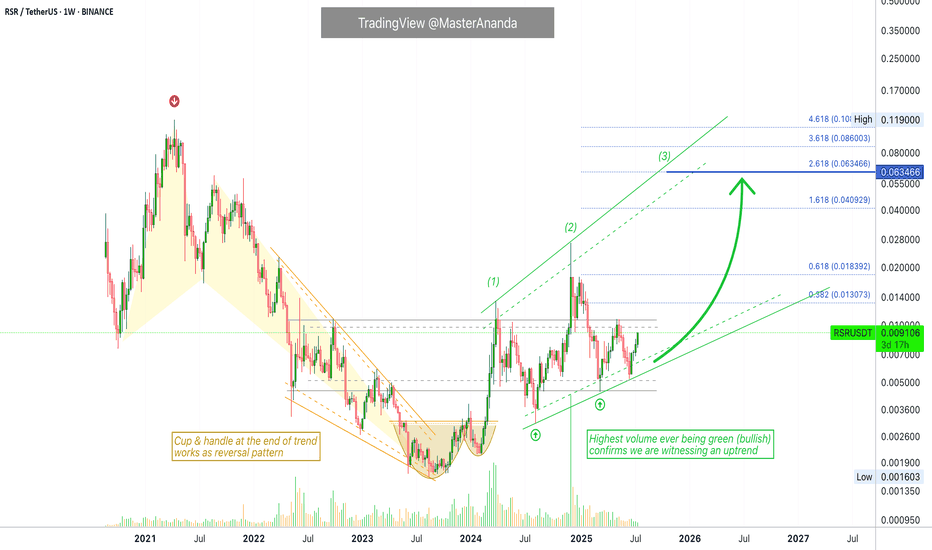

Reserve Rights · A Rising Trend · New ATH Potential in 2025I took my time drawing this chart for you showing all the different stages of the market cycle.

We are looking at Reserve Rights (RSRUSDT) on the weekly timeframe.

Full chart

» A bear market ends with an ending diagonal pattern and final bottom.

» The reversal forms as a classic cup and handle pattern.

» The market transitions from bearish to bullish and turns green.

» Price action changes from lower highs and lower lows to higher highs and higher lows.

» RSR creates a rising channel.

» We are witnessing the start of the next advance.

» Reserve Rights is ready for a higher high and the highest prices in four years, since 2021.

Current price action

» RSRUSDT is on its fourth consecutive green week.

» In early 2024, it produced 7 consecutive weeks closing green as a minor advance.

» The correction that followed was brutal but ended as a higher low in August 2024 than a new advance, this time a total of 17 weeks rising but not all green.

» We are set to experience the last and strongest bullish wave for this RSRUSDT bullish cycle.

» It should be many times stronger compared to last two.

2025 New all-time high

» The final target for this wave can be many times higher than what is shown on the chart.

» On the chart I am showing only a very conservative target.

» I expect higher prices.

» Looks like a good pair based on TA.

Thank you for reading.

Namaste.

RSR/USDT Breakout Play – Approaching a Major Reversal

🧠 Full Technical Analysis (Timeframe: Daily)

RSR/USDT is at a crucial decision point after months of consolidation.

The price action has been forming a classic Descending Triangle pattern, a structure that often precedes major breakouts or breakdowns. As we approach the apex of the triangle, RSR is now testing a descending resistance trendline that has capped prices since December 2024.

🟢 Bullish Scenario: Breakout Toward an Explosive Rally

If the price successfully closes above $0.0083 with strong volume confirmation, it could trigger a trend reversal and unlock a potential multi-phase rally.

🎯 Potential Bullish Targets:

Target 1: $0.0106 – Minor resistance and possible initial take-profit zone.

Target 2: $0.0122 – Last major distribution zone before the previous breakdown.

Target 3: $0.0170 – Strong historical resistance and psychological level.

Max Extension: $0.0259 – $0.0270 – Could be reached if the breakout gains momentum, potentially delivering over +200% upside from the current level.

📈A clean breakout could attract both retail and institutional buyers, leading to significant upside in the short to mid-term.

🔴 Bearish Scenario: Fakeout and Deep Correction Risk

If RSR fails to break out and gets rejected at the trendline resistance, we could see a pullback or bearish continuation. Key support levels to watch include:

🔻 Possible Downside Levels:

Support 1: $0.0072 – Current horizontal base of the triangle.

Support 2: $0.0060 – Previously tested demand zone.

Major Support: $0.0044 – Yearly low and strong bounce zone if panic selling occurs.

📉A rejection at the trendline could open up short-term downside of 30-40%.

🧩 Pattern Highlight: Descending Triangle (Breakout Imminent)

✅ Dynamic Resistance: Downtrend line from December 2024.

✅ Horizontal Support: Around $0.0070 holding firmly.

🚨 Breakout Approaching: Watch for a daily close above resistance.

📌 Confirmation: Breakout should be supported by increased volume to be valid.

🧠 Strategic Notes:

Always confirm breakout with volume and candle close.

Breakout setups like this offer high R:R swing trade opportunities.

Use proper risk management around key levels.

🔍 Conclusion:

RSR is facing a make-or-break moment after months inside a descending triangle. A breakout above resistance could ignite a powerful rally, while a rejection might trigger another wave of correction.

Breakout or Breakdown? The next few candles may decide everything. Stay ready.

#RSR #RSRUSDT #CryptoBreakout #DescendingTriangle #AltcoinSetup #TradingSignal #CryptoAnalysis #BreakoutPlay #CryptoCharts #CryptoTechnical

RSRUSDT 1D#RSR has broken above the Descending Broadening Wedge resistance on the daily chart.

If a successful retest of the pattern and a breakout above the daily SMA50 occur, the targets are:

🎯 $0.008306

🎯 $0.009042

🎯 $0.010089

🎯 $0.011423

⚠️ As always, use a tight stop-loss and apply proper risk management.

RSR/USDT📊 RSR/USDT Trade Outlook

🟩 Bullish Window:

We're entering a potential bullish range during this period, based on Gann time cycle analysis.

📅 Key Dates to Watch:

🔸 June 1

🔸 June 2

🔸 June 5

🔸 June 9

These dates are likely to act as turning points or triggers for momentum shifts.

🔍 What to Watch:

Pay close attention to key price levels and the trendline breakout. A confirmed close above the trendline could signal the start of a strong move.

✅ Strategy:

Wait for confirmation through price action before entering. We’ll look to go long on a clean break and close above the trendline resistance, ideally during the highlighted time window.

Stay sharp—more updates coming soon.

RSR Bearish Head and Shoulders Pattern Confirmed🚨 SEED_DONKEYDAN_MARKET_CAP:RSR Bearish Head and Shoulders Pattern Confirmed 🚨

SEED_DONKEYDAN_MARKET_CAP:RSR has formed a bearish head and shoulders pattern and has already broken below the purple neckline. This indicates a potential for further downside movement. However, if the price breaks out above the red resistance zone (the right shoulder), the bearish structure could change and become bullish.

📈 Technical Overview:

Pattern: Bearish Head and Shoulders

Neckline: Purple level, already broken.

🔻 Potential Downside: Further downside movement possible.

Bullish Invalidation: If the price breaks out above the red resistance zone (right shoulder), the bearish pattern may be invalidated, and the trend could turn bullish.

Keep an eye on the price action for further developments and confirmation of either continued bearish movement or a bullish reversal.

#RSR/USDT#RSR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.008441.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.008663

First target: 0.008776

Second target: 0.008922

Third target: 0.009093

#RSR/USDT#RSR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.007050.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.007100

First target: 0.007309

Second target: 0.007556

Third target: 0.007816

Reserve Rights Token Ascending Triangle —Advanced Spot TradingHere we have a classic ascending triangle. Notice how the low for this pair happened 11-March. It has been rising for a while. Slowly but surely.

Rising from the base because the triangles upper boundary was working as resistance. It rejected RSRUSDT in late March and also 12-April. Now, this resistance has been broken and this can be great timing to catch a wave in the making.

Looking at other charts, I would show you a bottom without the breakout and tell you to buy and hold. The advantage in this case is having a stop-loss with very low risk and maximum potential for growth. The disadvantage of course is having to wait a long time for the bullish wave to develop. Everything has its pros and cons.

When we consider the current chart, the low was hit more than a month ago. Bottom prices are not available anymore but the resistance of the triangle pattern has already been broken, which means that we can experience sudden growth.

The advantage here is a smaller waiting time, faster profits; the disadvantage is the fact that we have a limited space for profits and if prices drop there is also plenty of space open before prices reach support. So the stop-loss has higher risk and the profits potential can be lower but the waiting time can be shorter. See how that works?

In some instances we can go for the bottom catch with long-term hold. In some other instances, we can wait for breakout confirmation for fast profits. Fast would still require weeks or days.

In the first scenario, the waiting can take months. In the second, RSRUSDT can start growing within days.

Market conditions can always change. A short wait can turn into a reversal and instead of profits we get a losing trade. That's ok. We are not meant to win them all. The goal is profit big on the winners and the cut the losers short. When a trade goes bad, just let it go. When a trade is doing good, hold strong.

Namaste.

RSRUSDT | Locking In 80% Profit and Defining Key ZonesPreviously on RSRUSDT

%80 Profit!

We just banked an 80 percent gain from shorting at the red box in RSRUSDT—an incredible outcome that followed our earlier winner. Now it’s clear what really matters on this chart: the red boxes are your go‑to resistance zones and the green box is the support to watch.

🔴 Red Boxes = Resistance

Every time price has reached these red boxes, sellers have stepped in hard. For short setups, wait for lower‑time‑frame breakdowns confirmed by CDV weakness and volume spikes. That’s when you know it’s safe to act.

🟢 Green Box = Support

On any pullback, the green box has reliably attracted buyers. If price dips into this zone, look for clean higher‑lows on a 5‑ or 15‑minute chart plus positive CDV shifts before considering a long entry.

🎯 Trade with Clarity

Enter short at red boxes only after seeing LTF structure breaks and confluence on your indicators.

Enter long at the green box once lower‑time‑frame breakouts and CDV confirmation signal genuine demand.

I will not insist on my short idea. If price breaks above a red box without a downward break on the low time frame, I won’t force a short. If it breaks up with volume and retests, I’ll flip and look long.

You’ve seen these levels work again and again—just like that recent 80 percent profit. Keep watching these zones, stay patient, and let the market validate each move before you pull the trigger.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

RSR/USDT: FALLING WEDGE BREAKOUT! 100%+ PROFIT POTENTIAL!!🚀 Hey Traders! RSR Breakout Alert – 100%+ Rally Incoming? 👀🔥

If you’re hyped for big moves and real alpha, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🚀

RSR has just broken out of a falling wedge structure on the daily timeframe—a powerful bullish pattern. The chart’s signaling a potential 100–150% upside move if momentum picks up from here. 📈

📍 Entry Zone: CMP – Add more on dips down to $0.0066

🎯 Target: 100%–150% upside

🛑 Stop-Loss: $0.0054

📊 Trade Plan:

✅ Buy from current levels

✅ Add on dips near breakout support

✅ Ride the breakout wave with tight risk control!

💬 What’s Your Take?

Are you riding this RSR breakout or waiting on confirmation? Drop your thoughts and targets in the comments—let’s ride this wave together! 💰🔥

RSRUSDT | Resistance Zone Reached – Time to Be CautiousThe price of RSRUSDT is currently testing a key resistance area marked by the blue box. This region has historically shown strong seller presence, and it's a level that shouldn’t be ignored.

🔵 Key Level: The blue box is not just any zone—it’s where the market has often paused or reversed. For those who’ve been following closely, you know these levels aren’t randomly picked. They come from a deep understanding of market behavior and what really moves price.

📉 What to Watch:

If we see rejection here with lower time frame breakdowns, that could set up a short opportunity.

If the level breaks with strong volume and gives a proper retest, we can switch our bias and start thinking long.

No matter what, confirmation is key. Don’t rush. Let price tell its story.

✅ Why This Matters: You’re not just following lines on a chart—you’re aligning yourself with a strategy that has consistently identified high-probability setups. Every zone I share is based on clear logic and consistent results. That’s why so many keep coming back for more.

So stay sharp, stay patient, and never forget: we react, we don’t predict.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

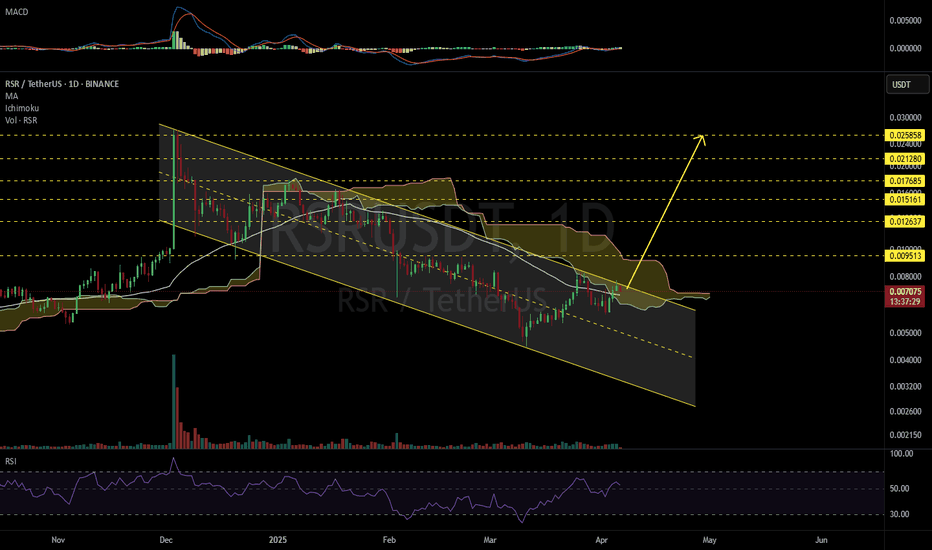

RSRUSDT 1D#RSR is moving inside a descending channel on the daily chart. It has broken above the daily MA50 and is now moving inside the Ichimoku cloud — which is a great sign. In case of a breakout above the channel resistance, the targets are:

🎯 $0.009513

🎯 $0.012637

🎯 $0.015161

🎯 $0.017685

🎯 $0.021280

🎯 $0.025858

Use a tight stop-loss.

#RSR Buy Trade: Fundamental Strength & Rebound Potential**Description:**

**RSR (Reserve Rights)** presents a compelling buy opportunity driven by strong fundamentals and ecosystem growth. As the native token of the Reserve Protocol, RSR is designed to stabilize the decentralized stablecoin **RTokens**, offering utility in collateralization and governance.

**Key Fundamentals:**

- **Adoption Growth:** Reserve’s hybrid stablecoins (e.g., eUSD) are gaining traction in emerging markets, particularly in inflation-hit regions like Latin America.

- **Strategic Backing:** RSR’s value is tied to demand for RTokens, which are overcollateralized and decentralized—a critical advantage amid regulatory scrutiny on centralized stablecoins.

- **Tokenomics:** RSR’s supply is capped at **100B**, with active burning mechanisms as RTokens scale, creating long-term scarcity potential.

**Market Context:**

RSR’s price often reacts to macroeconomic shifts impacting stablecoin demand. Recent partnerships (e.g., payment integrations in Venezuela) and protocol upgrades could catalyze upward momentum.

**Disclaimer:**

Cryptocurrency trading carries substantial risk. This is **not financial advice**. Conduct your own research (DYOR). Past performance ≠ future results. RSR is highly volatile; only invest what you can afford to lose. The Reserve Protocol’s success is not guaranteed, and regulatory changes may impact RSR’s utility.

RSRUSDTAt the 2 white circles we see almost a identical pattern.

Now we're looking if RSR really is bottomed out at the 4h chart or not.

If yes, you know what to do..

If not.. then short it!

We need to keep seeing higher lows and higher highs on this chart to go up again after this significant drop. But we also need to watch what Bitcoin is doing these days.

Orange move = lost move, don't watch.

Green move = Long at retest AFTER the breakout. (Recistance at the grey lines)

Red move = Short at retest AFTER the loss of the yellow trendline.

RSR AMALYSIS (1D)RSR has approached a valuable zone after heavy drops.

This support zone is quite large, so we have divided it into two entries.

This position is suitable for spot trading, and risk and position sizing must be managed carefully.

We will enter one entry at Entry 1 and another at Entry 2.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Seller shakeoutCould be a "Real direction, fake move. Fake direction, fake move. Real direction, Real move."

It doesn't look great for altcoins.

I take a look at a mid-cap coin because it tells you a lot about the market. Where there is less liquidity, the situation can be more clear. This has helped me aid my decision.